Tax Credits 2023 California 2023 California Tax Rates Exemptions and Credits The rate of inflation in California for the period from June 1 2022 through June 30 2023 was 3 1 The 2023 personal income tax

Partnership of tax agencies including Board of Equalization California Department of Tax and Fee Administration Employment Development Department Franchise Tax Board and Internal Put money back in your pocket You may qualify for cash back tax credits and a bigger refund when you file your taxes File early to put money in your pocket sooner The California Earned Income Tax Credit CalEITC is a refundable

Tax Credits 2023 California

Tax Credits 2023 California

https://www.myfreetaxes.org/wp-content/uploads/2022/01/iStock-Tax-Credit-word-scaled.jpg

5 Restaurant Tax Credits For 2023 You NEED To Know About U Nique

https://u-niqueaccounting.com/wp-content/uploads/2023/01/Best-Restaurant-Tax-Credits-2023.jpeg

What Will Change With EV Tax Credits In 2023

https://assets-global.website-files.com/60ce1b7dd21cd5b42639ff42/63079f0f1d82de0d8bd6f54d_Used EV Tax Credits Are Here v2.jpg

107 56 plus 2 of the amount over 10 756 If you paid rent for six months or more on your main home located in California you may qualify to claim the credit on your tax return See the California instructions for the worksheet to

Use our income tax calculator to find out what your take home pay will be in California for the tax year Enter your details to estimate your salary after tax Select Region Want to reduce your California income tax bill Check out this list of California state tax credits for families child care costs renters and more

Download Tax Credits 2023 California

More picture related to Tax Credits 2023 California

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

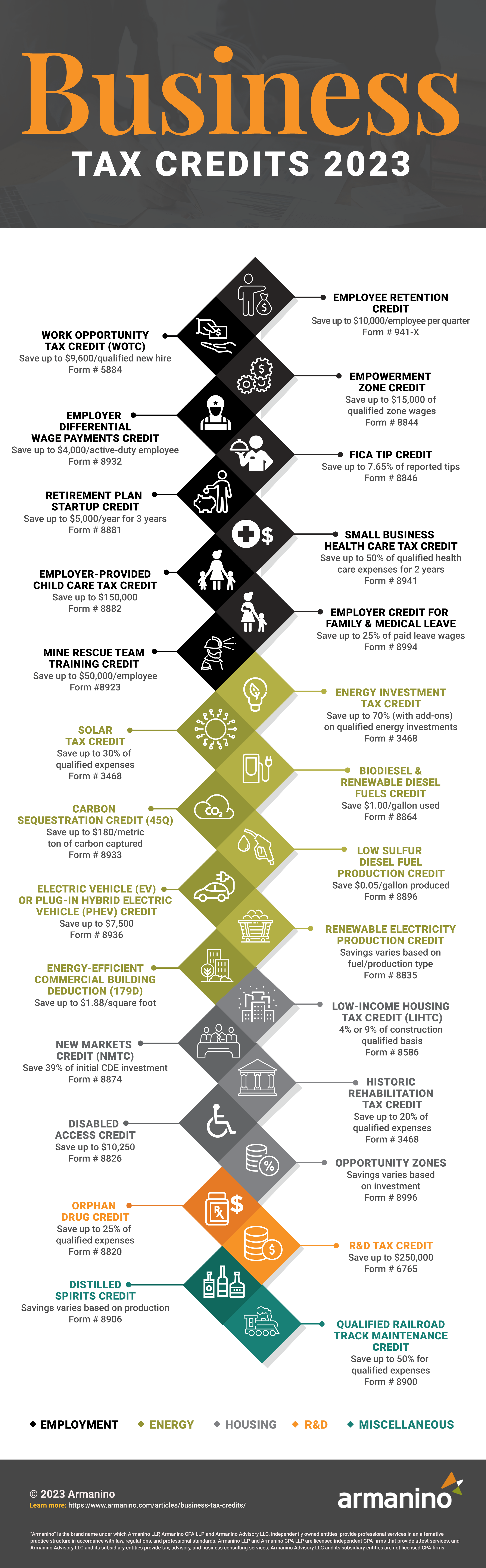

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax METHOD A WAGE BRACKET TABLE METHOD METHOD B See if you qualify for the Earned Income Tax Credit This is a refundable credit so you can get back more than you pay in taxes If you qualify you can claim it even if you

For the 2033 tax year it drops to a 26 credit and for 2034 it decreases again to 22 After that the tax credit will go away unless the federal government extends it California EV tax credit in 2022 2023 explained Learn which cars qualify how it works and more

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/deck-resources/business-tax-credits-2023.jpg

Contact Us Tax O Bill

https://www.taxobill.com/wp-content/uploads/2021/04/1.png

https://www.caltax.com/.../cat/1023-tax-rates-2023.pdf

2023 California Tax Rates Exemptions and Credits The rate of inflation in California for the period from June 1 2022 through June 30 2023 was 3 1 The 2023 personal income tax

http://www.taxes.ca.gov/Income_Tax/CreditsDeductions.html

Partnership of tax agencies including Board of Equalization California Department of Tax and Fee Administration Employment Development Department Franchise Tax Board and Internal

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Business Tax Credits 2023 Armanino

Minnesota Tax Credits For Workers And Families

Sept 30th At 1pm Business Tax Credits In Your Favor Don t Miss Out

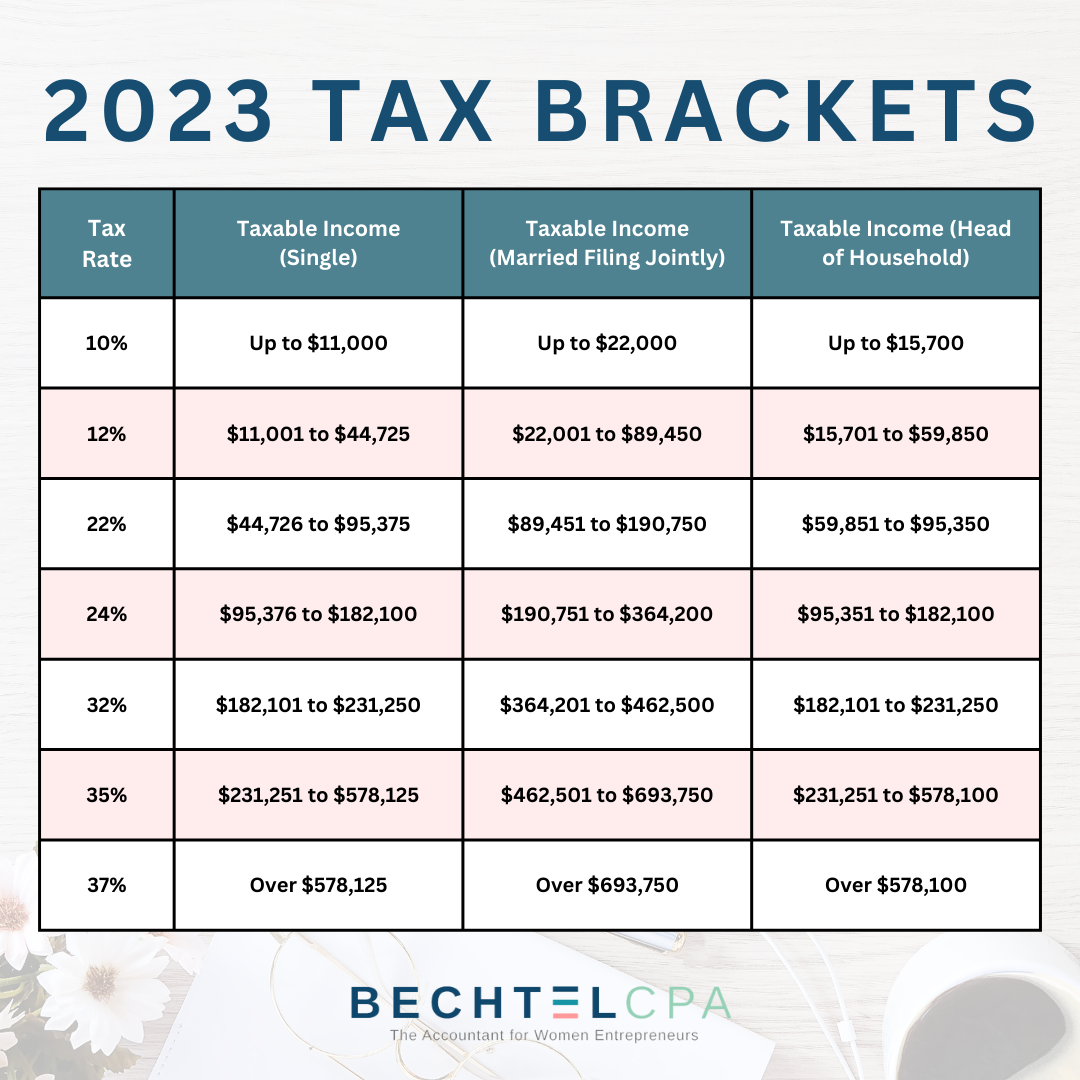

Tax Changes For The 2023 Tax Year Bechtel CPA LLC

What Tax Credits Can I Expect In 2023

What Tax Credits Can I Expect In 2023

Tax Credits Spsgz

Upcoming Changes To R D Tax Credits Introducing The Additional

Tax Credits Are Hidden Benefit For Homeowners

Tax Credits 2023 California - 107 56 plus 2 of the amount over 10 756