Tax Credits 2023 Irs A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax

A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a Earned income credit The earned income tax credit could be worth between 600 and 7 430 for the 2023 tax year depending on your filing status and the number of

Tax Credits 2023 Irs

Tax Credits 2023 Irs

https://i.ytimg.com/vi/2fcIiqyn8Wk/maxresdefault.jpg

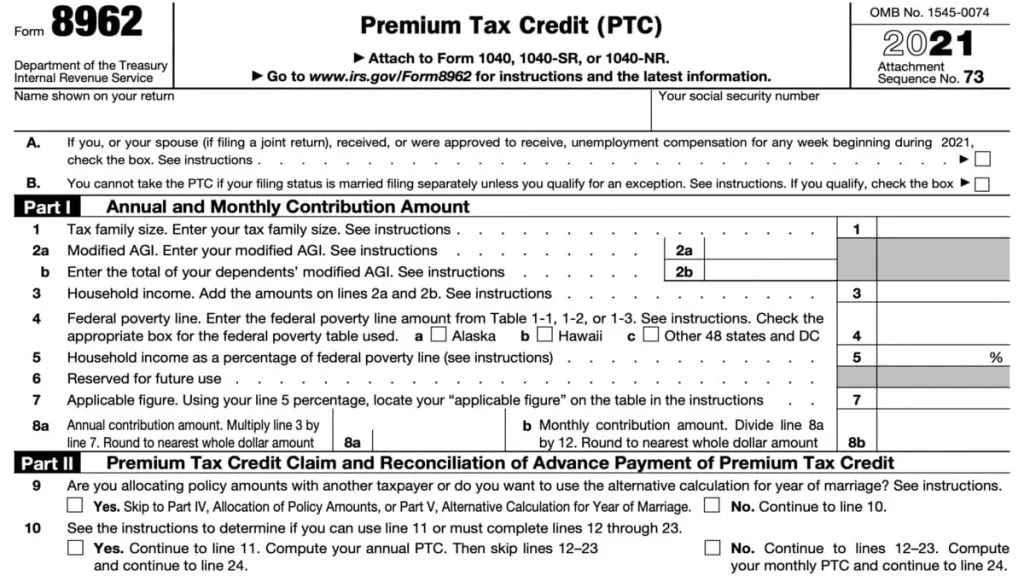

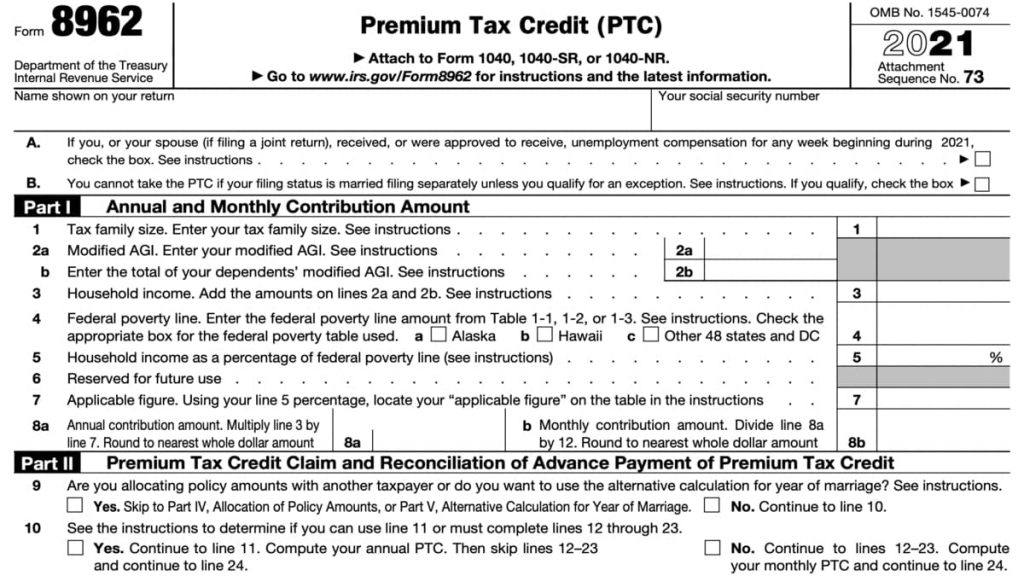

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

https://www.taxuni.com/wp-content/uploads/2022/03/8962-Form-Premium-Tax-Credit-1024x576.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Below you ll find an overview of some of the most common and popular tax credits for the 2023 tax year If you are eligible these credits can be applied when you file your taxes in The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify Answer a few quick questions about

Several key credits are also adjusted for inflation For example the maximum earned income tax credit for qualifying taxpayers with three or more children will be 7 430 in 2023 up from The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum

Download Tax Credits 2023 Irs

More picture related to Tax Credits 2023 Irs

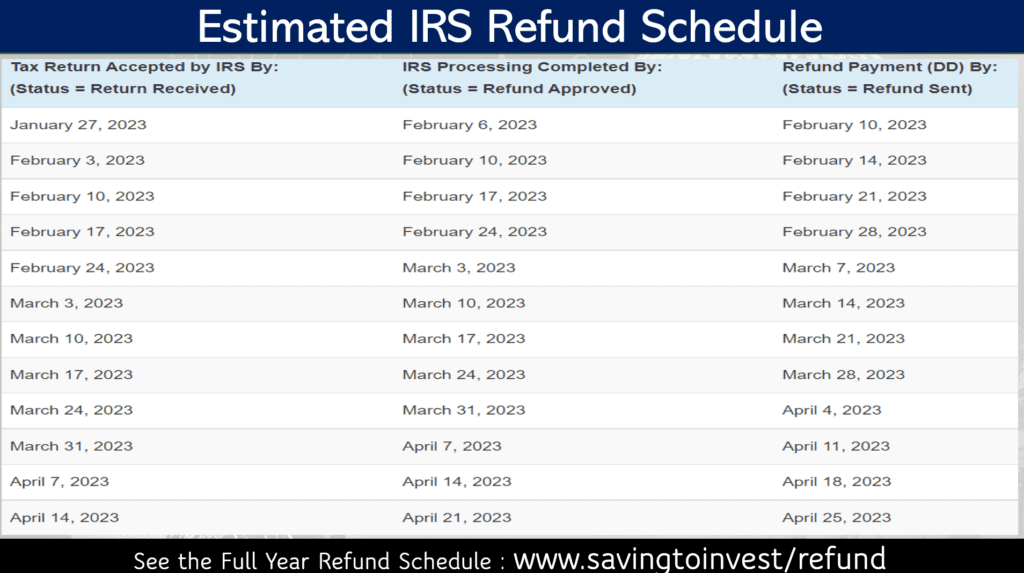

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

https://cdn.cheapism.com/images/2023-eitc.width-1000.png

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

The most noteworthy increases are about 7 for standard deduction amounts income tax brackets and the Earned Income Tax Credit EITC for tax year 2023 Understand how these increases impact your clients To help taxpayers prepare for the 2023 filing season the agency has updated its Get Ready page on IRS gov Some tax credits will return to 2019 levels This means that

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

IRS Extends Tax Filing Deadline To October 16 2023

https://static.wixstatic.com/media/805a63_04bf88a5cdd7455eb554b8c1d1d79e57~mv2.png/v1/fill/w_1000,h_1000,al_c,q_90,usm_0.66_1.00_0.01/805a63_04bf88a5cdd7455eb554b8c1d1d79e57~mv2.png

https://www.irs.gov › ... › refundable-tax-credits

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax

https://www.irs.gov › newsroom › tax-credi…

A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

2023 Irs Tax Chart Printable Forms Free Online

IRS Is NOW Accepting 2022 Tax Returns 2023 IRS TAX REFUND UPDATE

IRS Is NOW Accepting 2022 Tax Returns 2023 IRS TAX REFUND UPDATE

2023 IRS W 4 Form HRdirect Fillable Form 2023

Tax Credits Save You More Than Deductions Here Are The Best Ones

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

Tax Credits 2023 Irs - Below you ll find an overview of some of the most common and popular tax credits for the 2023 tax year If you are eligible these credits can be applied when you file your taxes in