Tax Credits And Low Income There are a wide range of tax credits and the amount and types available can vary by tax year Taxpayers should carefully review current tax credits when preparing their federal tax return Earned Income Tax Credit One refundable tax credit for moderate and low income taxpayers is the Earned Income Tax Credit

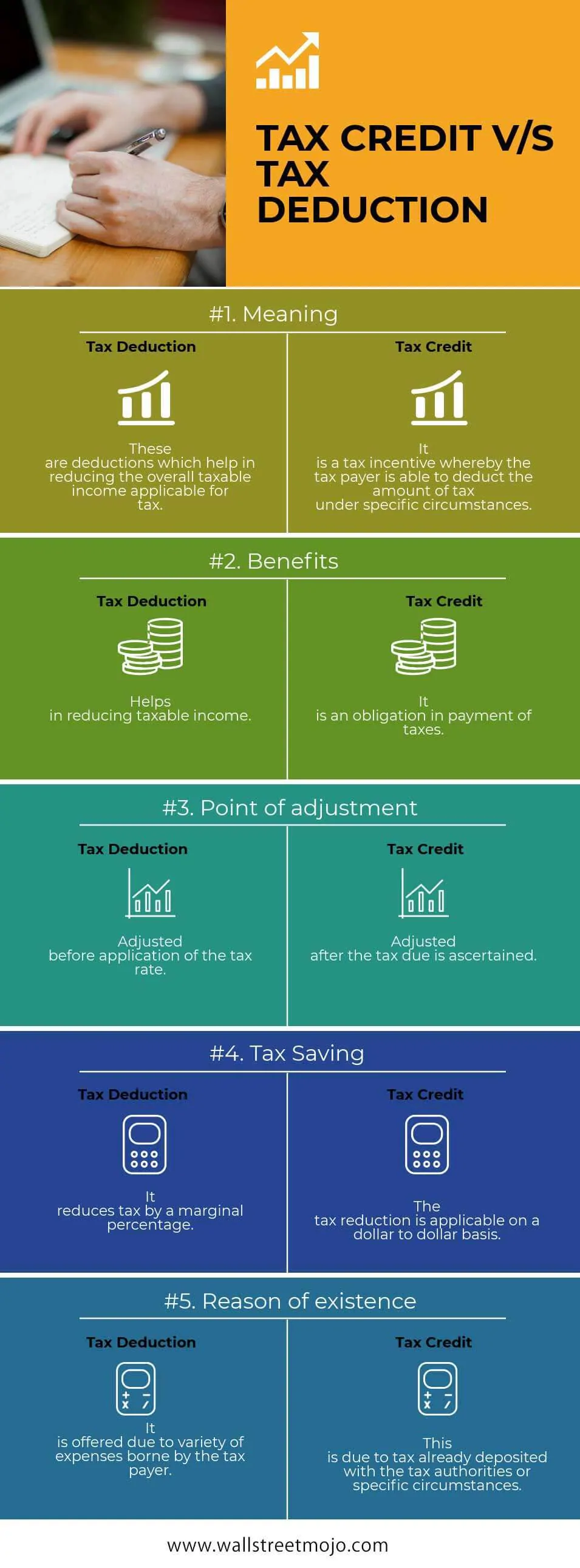

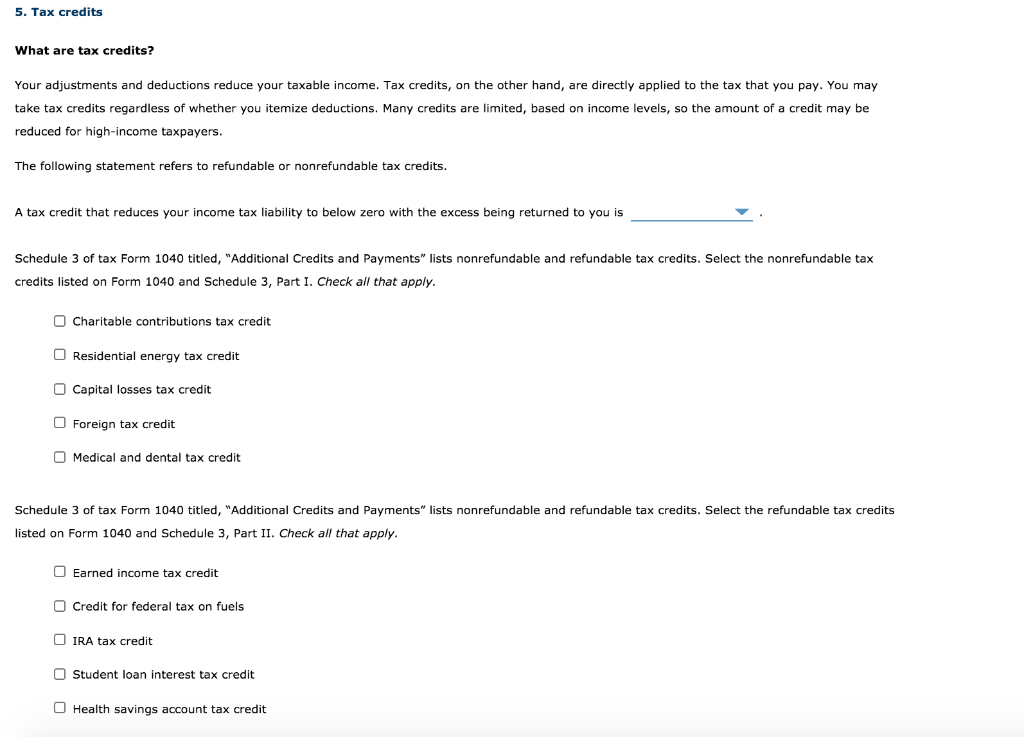

Tax Tip 2024 19 March 21 2024 The Earned Income Tax Credit is the federal government s largest refundable tax credit for low to moderate income workers The Low Income Housing Tax CreditA tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly

Tax Credits And Low Income

Tax Credits And Low Income

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

Discover Tax Credits And You Can Exemptions That Have Homeownership

https://bridgehunter.com/photos/26/04/260497-L.jpg

What Happens To Tax Credits Now That Our Home Is In A Trust

https://www.lehighvalleylive.com/resizer/GEcueSrSmkWojcr44Sw4GfrvNkw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/CXSXVBO37NDY7CPTYTHWSIOIDM.jpg

The Low Income Housing Tax Credit LIHTC is a tax incentive for housing developers to construct purchase or renovate rental housing for low income individuals and families The LIHTC A tax credit property is a housing project owned by a developer or landlord who participates in the federal low income housing tax credit LIHTC program The property owners can claim tax

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund Did you receive a letter from the IRS about the EITC Find out what to do Who Qualifies A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable

Download Tax Credits And Low Income

More picture related to Tax Credits And Low Income

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Building The Case Low Income Housing Tax Credits And Health

https://bipartisanpolicy.org/wp-content/uploads/2019/03/Low-Income-Housing-Tax-Credit-Economic-Impacts.png

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

The Low Income Housing Tax Credit LIHTC has been a key policy tool for preserving and expanding the supply of affordable rental housing It was authorized through the Tax Reform Act of 1986 P L 99 514 to give private investors a federal income tax credit as an incentive to make equity investments in affordable rental housing Mcclure As a low income filer you might be entitled to various credits and deductions for which other taxpayers don t qualify Certain situations in particular such as having children or making retirement plan contributions are considered when

The federal low income housing tax credit LIHTC is one of the most effective tools ever created for financing the development of affordable housing The Low Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low and moderate income tenants The LIHTC was enacted What is the Low Income Housing Tax Credit and how does it work Tax Policy Center

The Complete List Of Tax Credits For Individuals

https://1.bp.blogspot.com/-B5mx7WwZLfU/XkNu_a2Yc3I/AAAAAAAAAVI/92Bi9aK3Zck3yvveRPIUlVsZCGZHNQNlgCEwYBhgL/s1600/TaX%2BCredits%2B%25281%2529.png

A Novel Strategy For Increasing Utilization Of Earned Income Tax

https://i1.rgstatic.net/publication/361654836_A_Novel_Strategy_for_Increasing_Utilization_of_Earned_Income_Tax_Credits_and_Reducing_Adverse_Childhood_Experiences_The_EITC_Access_Project/links/62be5de1f10dfc7b53f090e8/largepreview.png

https://www.irs.gov/newsroom/tax-credits-for...

There are a wide range of tax credits and the amount and types available can vary by tax year Taxpayers should carefully review current tax credits when preparing their federal tax return Earned Income Tax Credit One refundable tax credit for moderate and low income taxpayers is the Earned Income Tax Credit

https://www.irs.gov/newsroom/low-to-moderate...

Tax Tip 2024 19 March 21 2024 The Earned Income Tax Credit is the federal government s largest refundable tax credit for low to moderate income workers

Working To Bring Home Extra Income For Low income Working Families

The Complete List Of Tax Credits For Individuals

Tax Credits Vs Tax Deductions Garden State Home Loans NJ

The Low Income Housing Tax Credit Explained Greater Greater Washington

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

The Complete List Of Tax Credits MAJORITY

The Complete List Of Tax Credits MAJORITY

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Need Tax Help Tax Aid

Personal Income Tax Has Untapped Potential In Poorer Countries

Tax Credits And Low Income - Low Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families August 28 2018 By Will Fischer 1 As the nation s largest affordable housing development program the Low Income Housing Tax Credit LIHTC has substantial influence on where low income families are able to live