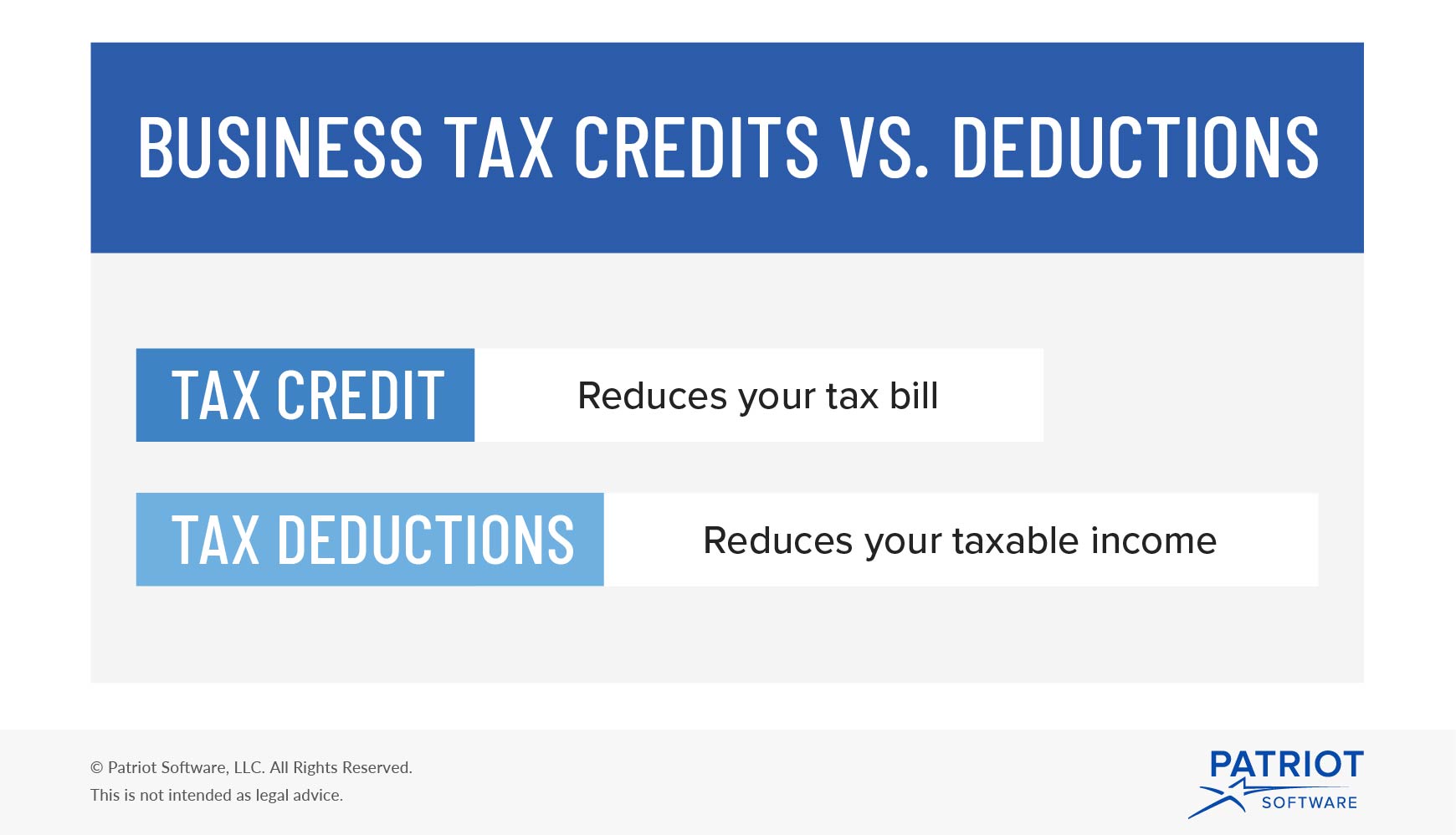

Tax Credits Corporations A business tax credit is an amount of money that companies can subtract from their federal and or state taxes owed It reduces a business tax bill on a dollar for dollar basis

A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease Credits A corporation s tax liability is reduced by allowable credits The following list includes some of the credits available to corporations

Tax Credits Corporations

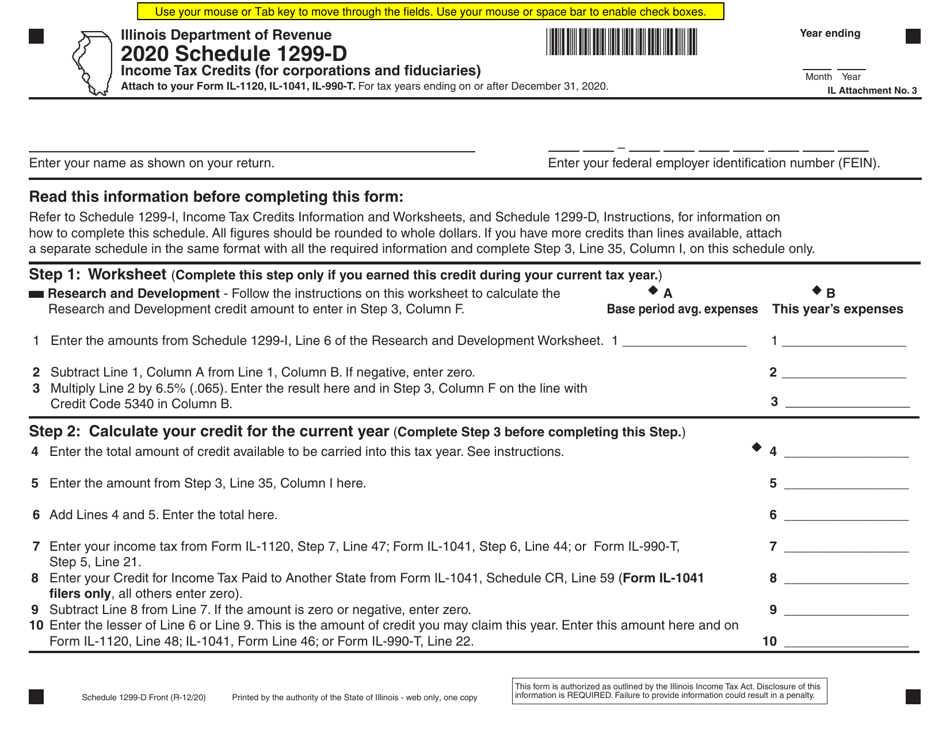

Tax Credits Corporations

https://data.templateroller.com/pdf_docs_html/2130/21307/2130781/schedule-1299-d-income-tax-credits-for-corporations-and-fiduciaries-illinois_print_big.png

Chart Of The Day Corporate Tax Payments 1952 2017 Mother Jones

https://www.motherjones.com/wp-content/uploads/2017/08/blog_individual_corporate_taxes_1952_2017.gif

Business Tax Credits Credit Vs Deduction Types Of Credits More

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credits-visual.jpg

The credit itself is taxable and so taking a 25 corporation tax rate into account the net benefit to the company of the credit is 15 The net benefit was Small business tax credits for insurance family and medical leave work opportunities research access childcare motor vehicles tips pensions and more

In this article we break down the new foreign tax credit limitations requirements and related international tax planning considerations for U S As part of this plan Pillar Two establishes a global minimum effective corporate tax rate of 15 for large multinational enterprises MNEs which has important implications for the use of tax incentives around the world

Download Tax Credits Corporations

More picture related to Tax Credits Corporations

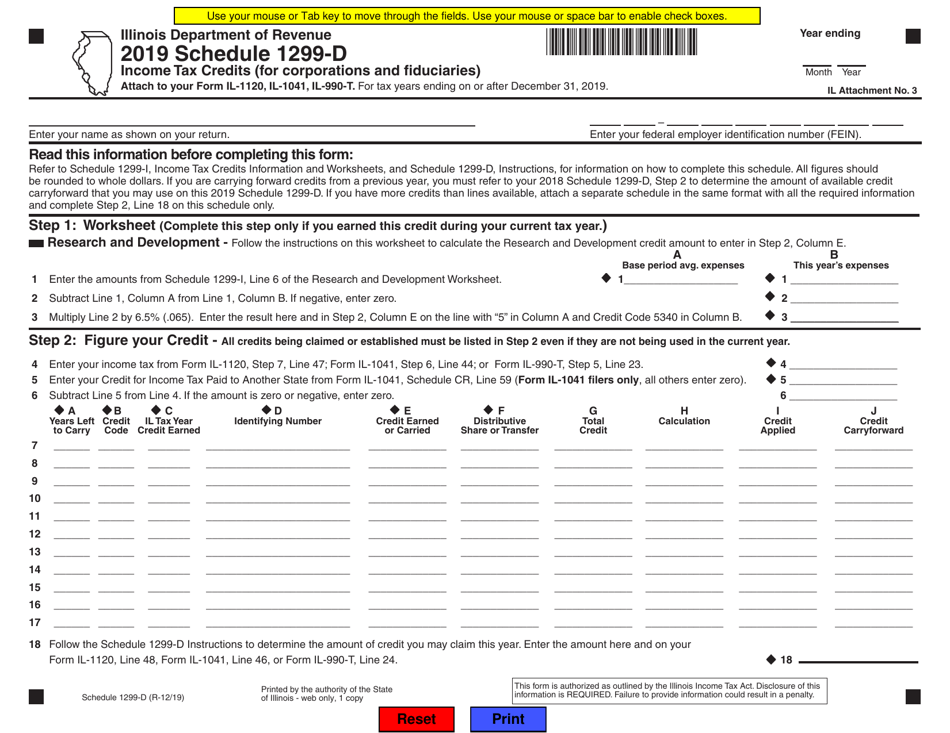

2019 Illinois Income Tax Credits For Corporations And Fiduciaries

https://data.templateroller.com/pdf_docs_html/2024/20243/2024360/schedule-1299-d-income-tax-credits-for-corporations-and-fiduciaries-illinois_print_big.png

Trends In New Business Entities 30 Years Of Data Legal Entity

https://www.berkmansolutions.com/images/blog/Corporations-v-Partnerships-1980-2012.png

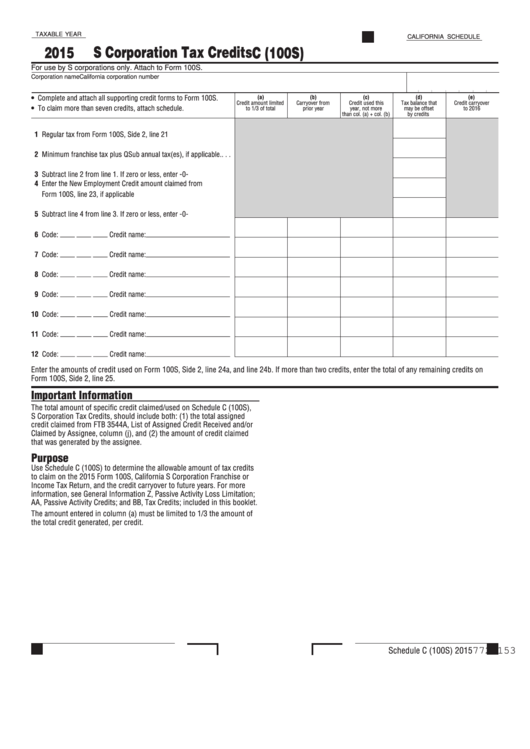

Fillable Schedule C 100s S Corporation Tax Credits Form

https://data.formsbank.com/pdf_docs_html/184/1840/184001/page_1_thumb_big.png

A qualifying CCPC can qualify for a 35 refundable tax credit annually on its first CAD 3 million in expenditures This enhanced credit is subject to certain capital Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit

General business credits can provide significant tax benefits in the form of a dollar for dollar reduction to tax liability for individuals and corporate taxpayers alike Significant changes to credit eligibility requirements including enhanced and extended existing credits And new options for credit monetization that will impact the project

How Are Multinational Corporations Foreign Profits Treated Around The

https://files.taxfoundation.org/20170113144446/Foreign-Income-Tax-System-by-Country2-13.png

2013 Business Tax Changes And Credits In Fiscal Cliff Deal Extend Small

http://www.savingtoinvest.com/wp-content/uploads/2011/01/2011-Corporate-Tax-Rates.png

https://www.investopedia.com/terms/b/…

A business tax credit is an amount of money that companies can subtract from their federal and or state taxes owed It reduces a business tax bill on a dollar for dollar basis

https://www.irs.gov/.../business-tax-credits

A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease

Corporate Top Tax Rate And Bracket Tax Policy Center

How Are Multinational Corporations Foreign Profits Treated Around The

Employee Retention Tax Credits And Your Business Scott Company

A Simplified Way To Tax Multinational Corporations Crooks And Liars

How Smart Are You About Tax Credits Wealth Management

How A Global Minimum Tax Would Deter Profit Shifting And One Way It

How A Global Minimum Tax Would Deter Profit Shifting And One Way It

Business Owner Don t Forget Tax Credits TaxAssist Accountants

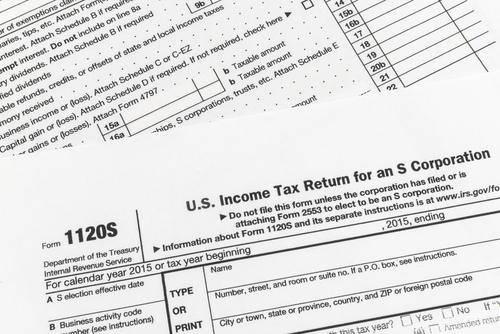

Proven Strategies To Lower S Corporation Taxes Dutton Legal Group

Rejects Federal Grant Money And Gives Corporations Tax Credits Uses

Tax Credits Corporations - Companies can claim a refundable tax credit of up to 50 of 10 000 in qualifying wages for each full time employee who you kept on your payroll in 2020 up to a 5 000 credit