Tax Credits Entitlement Uk Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

The Tax Credits Act 2002 s 10 states that entitlement for WTC is dependent on the claimant or both or either claimants being engaged in qualifying remunerative work It is the basic Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to receive payments and how to calculate how much

Tax Credits Entitlement Uk

Tax Credits Entitlement Uk

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/110769/TC_Entitlement_Graph.png

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Entitlements To Tax Credits UK 2002 2003 Download Table

https://www.researchgate.net/publication/237314718/figure/tbl1/AS:669509568446469@1536634928436/Entitlements-to-tax-credits-UK-2002-2003.png

Tax Credits can be worth 1 000s each year but unlike many other benefits need to be renewed annually Your Tax Credits can also go up or down or stop altogether if there are changes in your family or work life This guide takes Information about tax credits child tax credits and working tax credits Who is eligible to claim and how to make a claim guide

Working Tax Credit eligibility 2022 depends most on whether You are between 16 and 24 with a child or have a qualifying disability You are at least 25 either with or without any children You must be working a minimum number of hours Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and reporting changes

Download Tax Credits Entitlement Uk

More picture related to Tax Credits Entitlement Uk

Tax Credits Entitlement QuickCalc

https://www.quickcalc.co.uk/images/tccalc.gif

Tax Credits To Help Cover The Costs Of Higher Education Lahrmer Company

https://lahrmercpa.files.wordpress.com/2022/04/tax-credits-to-help-cover-the-cost-of-higher-education.jpg

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Working Tax Credit is usually paid every four weeks but you can choose to have it paid weekly by asking HMRC to change your payments Working Tax Credit and other benefits Working Tax The Tax Credits Act 2002 section 3 1 states that entitlement to a tax credit for the whole or part of a tax year is dependent on the making of a claim HMRC state that it is no longer possible to

Information and advice from Age UK on claiming benefits and entitlements including pension credit attendance allowance council tax benefit and many more Child Tax Credits if you re responsible for one child or more how much you get eligibility claim tax credits

Upcoming Changes To R D Tax Credits Introducing The Additional

https://www.zest.tax/wp-content/uploads/2023/06/pexels-thisisengineering-3912480-scaled.webp

State Tax Credits Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

https://www.gov.uk/working-tax-credit/what-youll-get

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

https://revenuebenefits.org.uk/tax-credits/...

The Tax Credits Act 2002 s 10 states that entitlement for WTC is dependent on the claimant or both or either claimants being engaged in qualifying remunerative work It is the basic

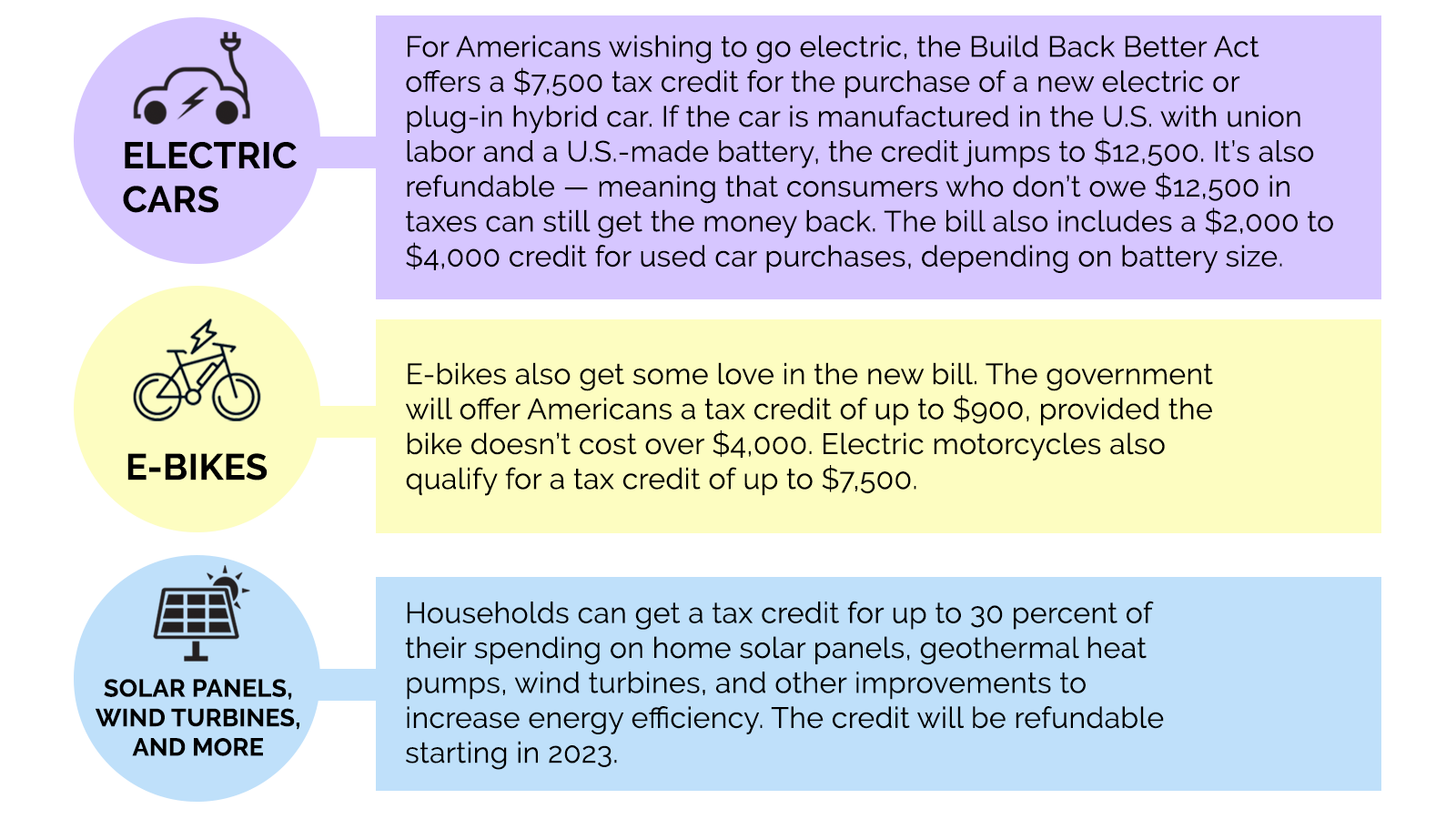

Green Incentives Usually Help The Rich Here s How The Build Back

Upcoming Changes To R D Tax Credits Introducing The Additional

Details From IRS About Enhanced Child Tax Credits

Geothermal Tax Credits Incentives

Guidance On Examining Identity Documents accessible GOV UK

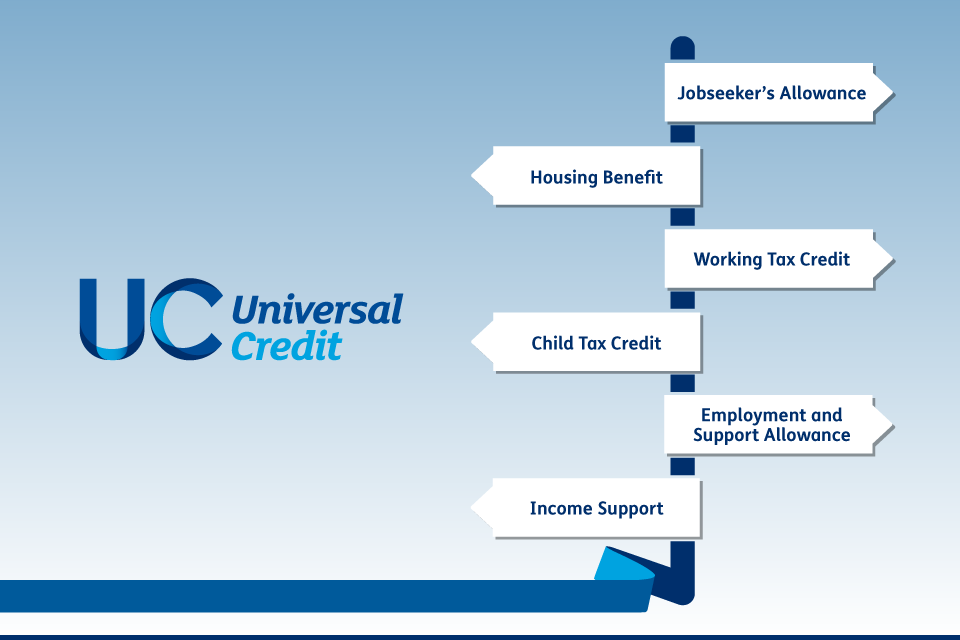

DWP Letters Telling People To Call The Universal Credit Helpline Are

DWP Letters Telling People To Call The Universal Credit Helpline Are

Universal Credit Expands To All Claimants In 5 Areas GOV UK

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Tax Credits Entitlement Uk - For tax credits the savings limit of 16 000 doesn t exist Instead your tax credits are affected by how much income usually interest you receive from those savings If you receive less than