Tax Credits For Building Low Income Housing The Low Income Housing Tax Credit LIHTC is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent restricted units for lower income households

The Low Income Housing Tax Credit LIHTC offers developers nonrefundable and transferable tax credits to subsidize the construction and rehabilitation of housing developments that have strict income limits Created by the Tax Reform Act of 1986 the LIHTC program gives State and local LIHTC allocating agencies the equivalent of approximately 10 billion in annual budget authority to issue tax credits for the acquisition rehabilitation or new construction of rental housing targeted to lower income households

Tax Credits For Building Low Income Housing

Tax Credits For Building Low Income Housing

https://houstoncasemanagers.com/wp-content/uploads/2022/03/get-low-income-housing-fast.png

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Tax Credits MJA Associates

https://mja-associates.com/wp-content/uploads/2023/12/AdobeStock_124656824.jpg

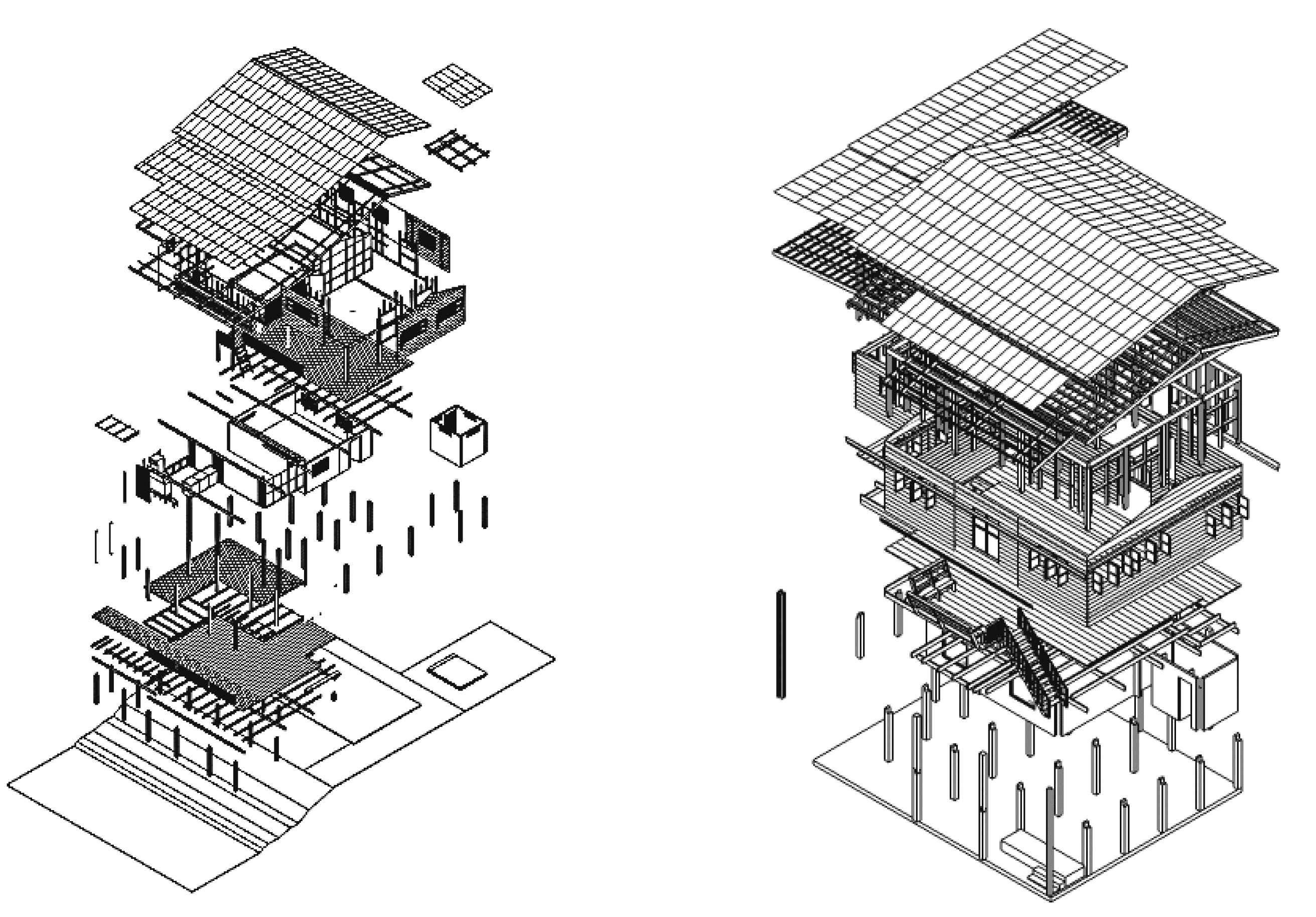

The Low Income Housing Tax Credit LIHTC is a tax incentive for housing developers to construct purchase or renovate rental housing for low income individuals and families The LIHTC was The low income housing tax credit LIHTC program which was created by the Tax Reform Act of 1986 P L 99 514 is the federal government s primary policy tool for the development of affordable rental housing

Under the program a developer receives federal income tax credits over a 10 year period in exchange for i acquiring rehabbing or newly constructing rental housing for low income households and then ii operating the project under LIHTC guidelines for a certain compliance period The primary source of development funding is the Low Income Housing Tax Credit LIHTC a federal tax credit administered by state agencies Most affordable housing that gets built receives an allocation of tax credits

Download Tax Credits For Building Low Income Housing

More picture related to Tax Credits For Building Low Income Housing

Find Low Income Housing In Every State Tidewater VIP Portal

https://vip.tidewatermg.com/wp-content/uploads/2018/02/find-low-income-housing-feature3.jpg

Characteristics Of Low income Housing At Rangsit Area In Pathum Thani

https://so02.tci-thaijo.org/public/journals/124/submission_191177_16489_coverImage_en_US.png

LOW INCOME HOUSING TAX CREDIT BASICS

https://s3.studylib.net/store/data/009236048_1-a0f0eadc475963f967f6838150b1e2e8-768x994.png

The Low Income Housing Tax Credit LIHTC is a tax incentive for rental owners and developers who provide affordable housing for low income residents That means the rent they charge is considered affordable by those whose income falls below the median household income of the area The low income housing tax credit LIHTC program which was created by the Tax Reform Act of 1986 P L 99 514 is the federal government s primary policy tool for the development of affordable rental housing

The Low Income Housing Tax Credit LIHTC program was enacted as part of the Tax Reform Act of 1986 It is administered by the Treasury Department and State Housing Finance Agencies HFAs The Low Income Housing Tax Credit Housing Credit stimulates investment in affordable housing in underserved urban and rural communities and in higher cost suburban communities across the nation It provides low income families with a safe and decent place to live and by lessening their rent burdens frees up additional income that can be

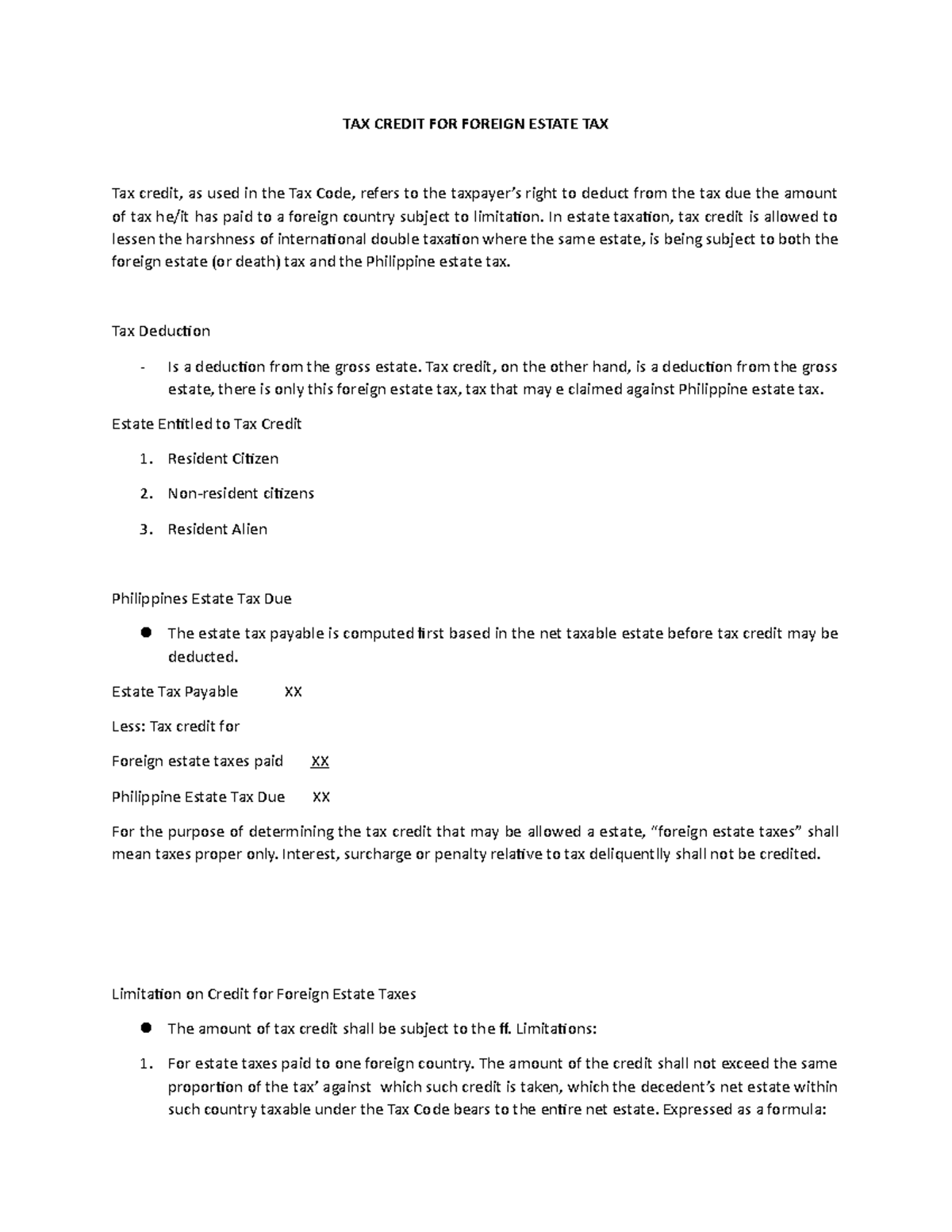

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/13670d83508fce97953b9582fddf4f67/thumb_1200_1553.png

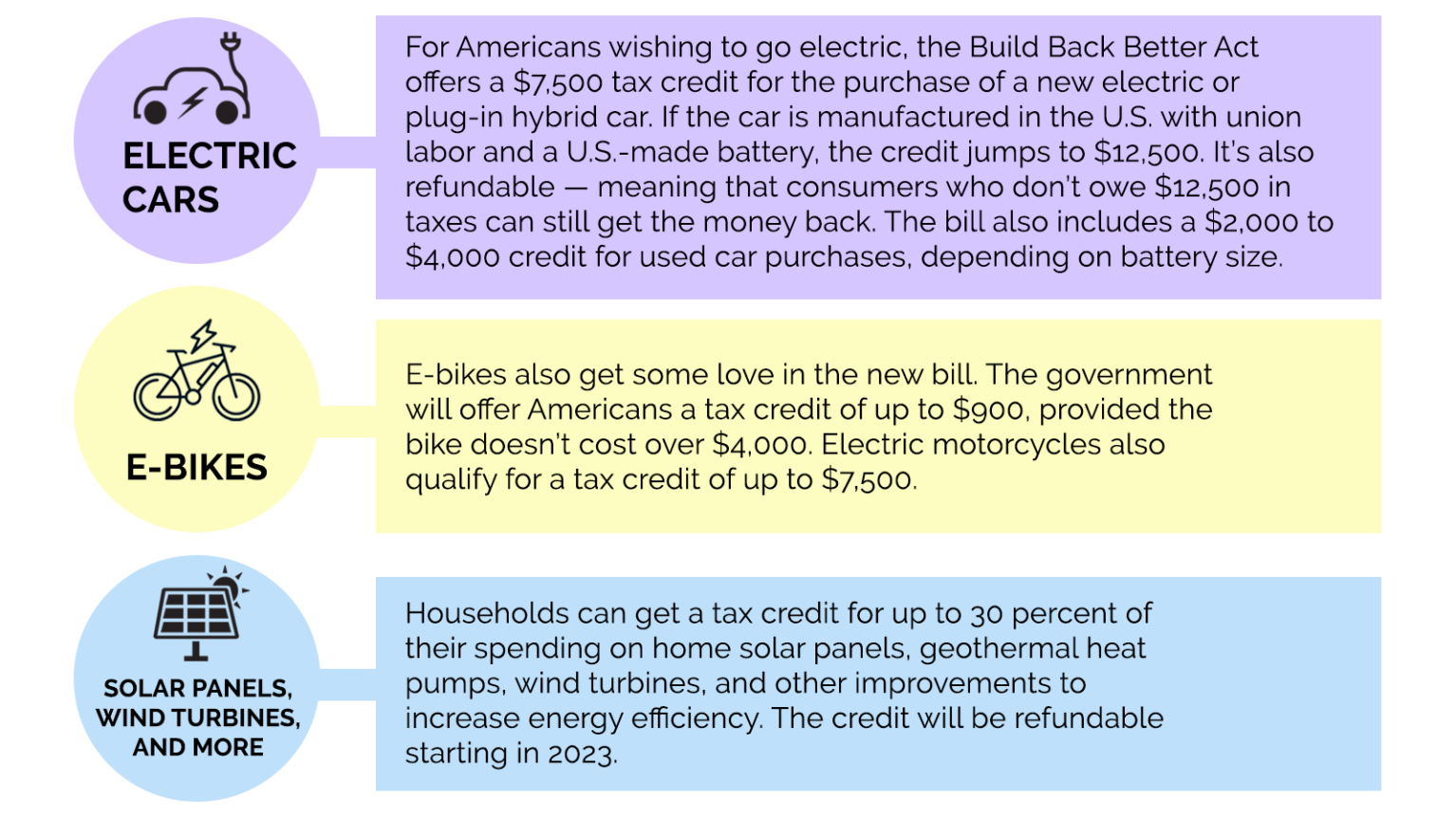

Green Incentives Usually Help The Rich Here s How The Build Back

https://grist.org/wp-content/uploads/2021/12/tax-credits-chart.png?w=1536

https://en.wikipedia.org/wiki/Low-Income_Housing_Tax_Credit

The Low Income Housing Tax Credit LIHTC is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent restricted units for lower income households

https://taxfoundation.org/research/all/federal/low...

The Low Income Housing Tax Credit LIHTC offers developers nonrefundable and transferable tax credits to subsidize the construction and rehabilitation of housing developments that have strict income limits

When Are Tax Credits Ending How To Apply For Universal Credit

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

Introduction To The Low Income Housing Tax Credit LIHTC Program

Free Tax Assistance Earns 105K In Refunds Credits For Families

Low Income Housing Tax Credit

Low Income Housing With No Waiting List 7 Ways To Find Housing

Low Income Housing With No Waiting List 7 Ways To Find Housing

Low Income Housing Tax Credit Services VIHFA

Georgia Tax Credits For Workers And Families

Building The Case Low Income Housing Tax Credits And Health

Tax Credits For Building Low Income Housing - The Low Income Housing Tax Credit program LIHTC finances the construction rehabilitation and preservation of housing affordable to lower income households The LIHTC program encourages private investment by providing a tax credit a dollar for dollar reduction in federal taxes owed on other income Although the