Tax Credits For Energy Efficiency Home Improvements 2022 Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of

Tax Credits For Energy Efficiency Home Improvements 2022

Tax Credits For Energy Efficiency Home Improvements 2022

http://www.theenergytrail.com/wp-content/uploads/2017/03/tax-credits-1-945x630.jpeg

Easy ERTC Application How Businesses Claim Employee Tax Credits For

https://www.dailymoss.com/wp-content/uploads/2022/08/easy-ertc-application-how-businesses-claim-employee-tax-credits-for-2020-amp-202-62f607d891d65.png

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving How To Did You Know Innovation Tech The Tax Credits for Energy Efficient Upgrades are Back Here s some good news The federal tax credits for energy efficiency were extended as part of the Inflation

Save More with Tax Credits for Energy Efficient Home Improvements Tax credits for energy efficient home improvements are extended and expanded What are energy tax credits targeting home improvements In August 2022 the Inflation Reduction Act amended two credits available for energy efficient

Download Tax Credits For Energy Efficiency Home Improvements 2022

More picture related to Tax Credits For Energy Efficiency Home Improvements 2022

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

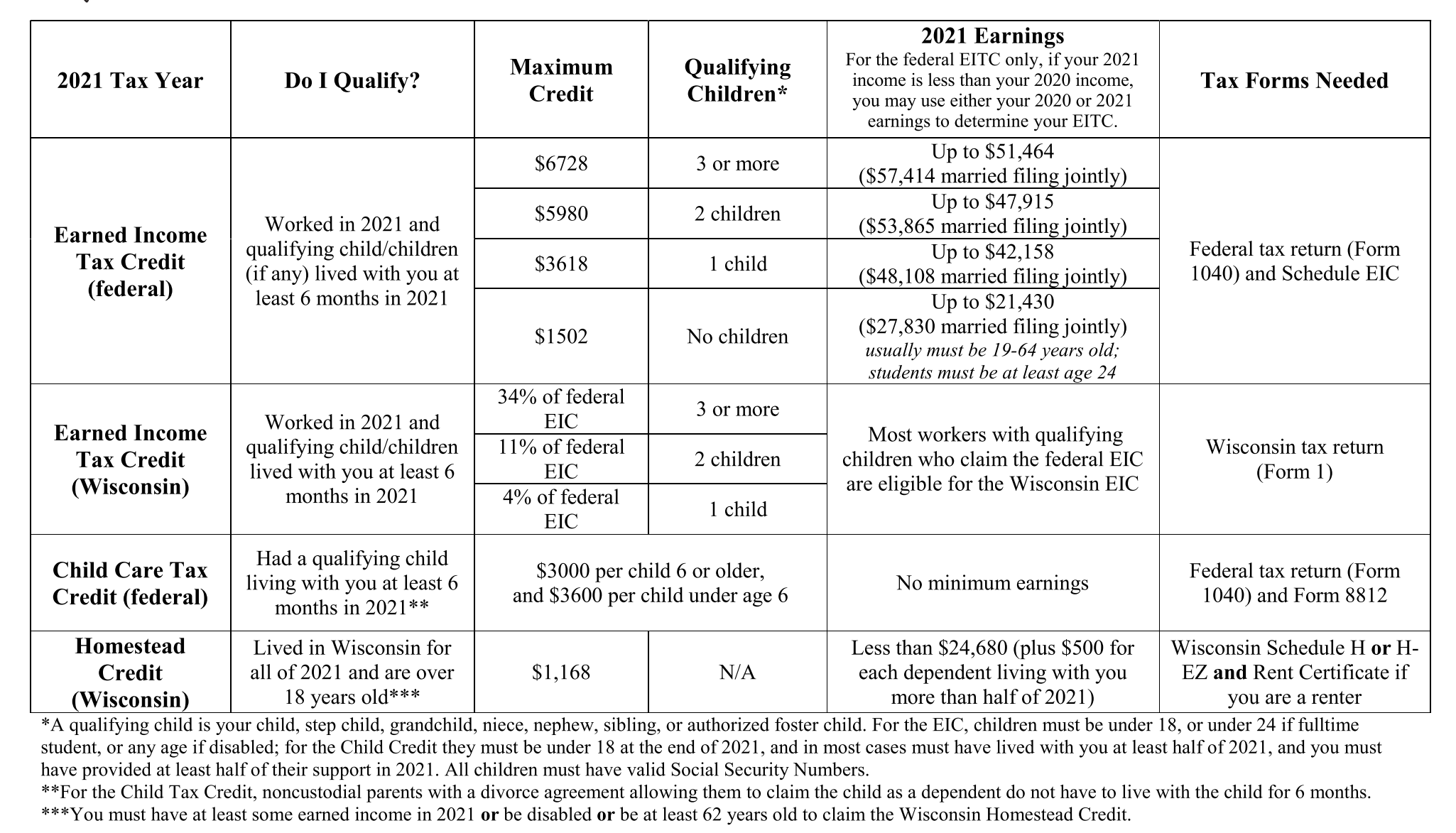

2021 Tax Credits Get The Credit You Deserve Financial Education

https://finances.extension.wisc.edu/files/2021/09/2021-tax-credits-e1643336436945.png

The credit is worth 10 of the cost of certain energy efficient windows doors and skylights and 100 of the cost of certain air conditioning and water heater systems According to the IRS Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection

The Inflation Reduction Act of 2022 H R 5376 will lower health care prescription drug and energy costs invest in energy security and make our tax code fairer all while fighting According to the IRS Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Tax Credits For Energy Efficient Home Improvements Kiplinger

https://cdn.mos.cms.futurecdn.net/jL8hKibD7YHkjQxA6muNGM-1920-80.jpg

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit

Get The Power Of Tax Credits For Your Businesses

Federal Solar Tax Credit What It Is How To Claim It For 2024

New Tax Credits For Energy Efficiency Home Improvements In Georgia

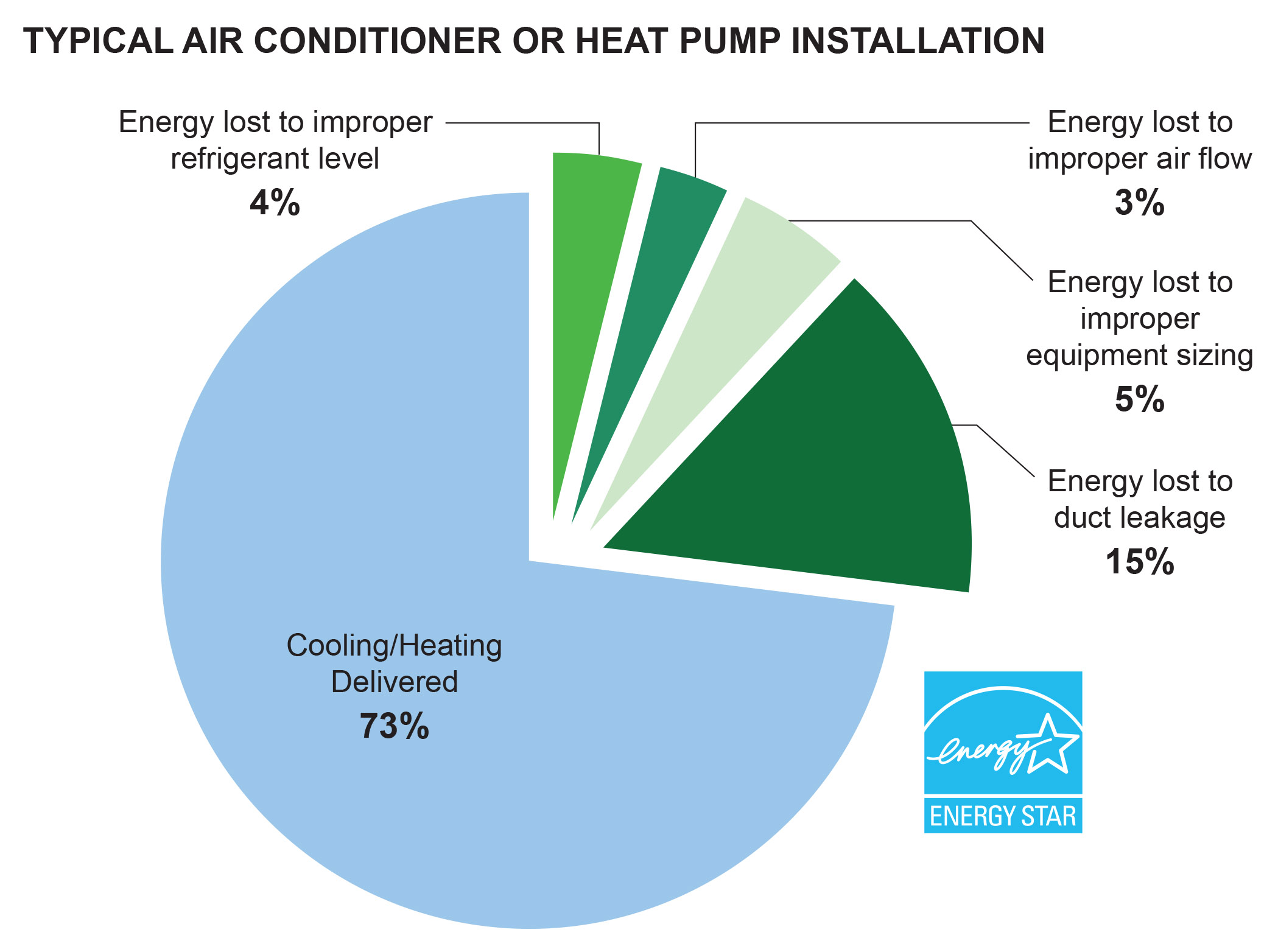

About The Smart Tools For Efficient HVAC Performance Campaign

8 Energy Efficient Home Improvements To Increase Your Property Value

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Colorado Tax Credits For Alternative fuel Vehicles Head To Senate

Canada To Set Up Tax Credits For Clean Tech Launch Growth Fund

Tax Credits For Energy Efficiency Home Improvements 2022 - What are energy tax credits targeting home improvements In August 2022 the Inflation Reduction Act amended two credits available for energy efficient