Tax Credits For Energy Efficient Home Improvements 2021 Frequently asked questions about energy efficient home improvements and residential clean energy property The Department of Energy s Tax Credit Product Lookup

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements A More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals building contractors and others See

Tax Credits For Energy Efficient Home Improvements 2021

Tax Credits For Energy Efficient Home Improvements 2021

http://www.sagebuilders.com/wp-content/uploads/2015/01/energy-efficient-home.jpg

Tax Credits For Energy Efficient Home Improvements Kiplinger

https://cdn.mos.cms.futurecdn.net/jL8hKibD7YHkjQxA6muNGM-1920-80.jpg

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

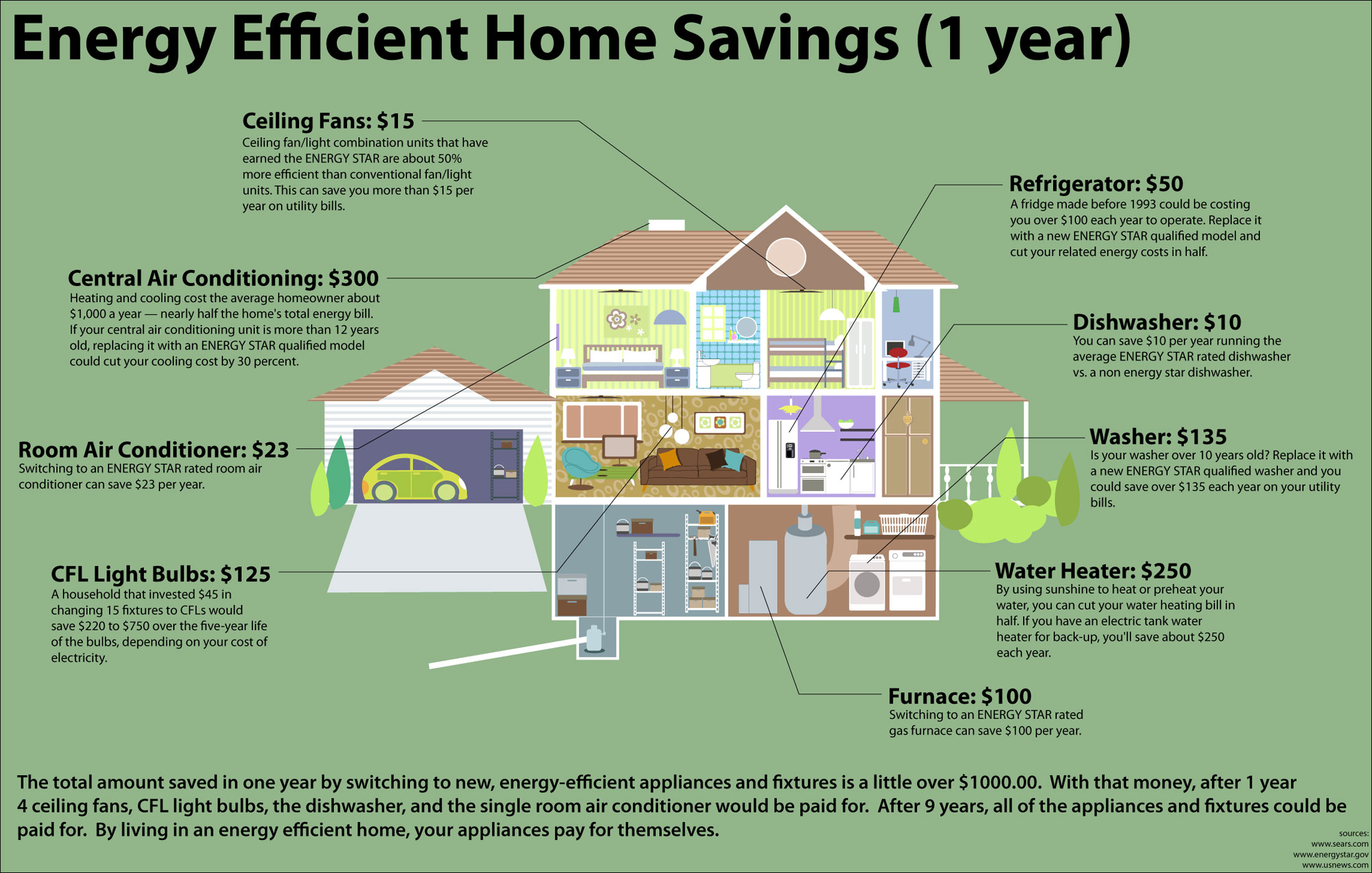

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy

Provides a tax credit for energy efficiency improvements of residential homes New Energy Efficient Homes Credit Provides a tax credit for construction of new energy efficient homes The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may

Download Tax Credits For Energy Efficient Home Improvements 2021

More picture related to Tax Credits For Energy Efficient Home Improvements 2021

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Residential Home Energy Credits

https://www.muacllp.com/wp-content/uploads/2022/06/Houses-Money-Stacks-Photo.jpg

Tax Credits For Energy Efficient Home Improvements 2022 YouTube

https://i.ytimg.com/vi/8qjHkvy5UZg/maxresdefault.jpg

The Energy Efficient Home Improvement EEHI covers up to 30 of the costs of installing certain energy efficient upgrades The credit is available from 2023 through 2032 The EEHI s credit limits have increased from the If you are planning a few home improvements that will boost the energy efficiency of your house you may save some money on your projects under the Inflation Reduction Act IRA a law

The I nflation Reduction Act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property Here are some tips to help The inflation Reduction Act of 2022 which Congress passed in August amended the tax credits for energy efficient home improvements and residential energy property in line

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Federal Tax Credits For Energy Efficient Home Improvements

https://activerain.com/image_store/uploads/1/0/7/4/5/ar12686175554701.jpg

https://www.irs.gov › credits-deductions › frequently...

Frequently asked questions about energy efficient home improvements and residential clean energy property The Department of Energy s Tax Credit Product Lookup

https://www.irs.gov › credits-deductions › home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements

2023 Energy Efficient Home Credits Tax Benefits Tips

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Credits For Energy Efficient Home Improvements

Tax Credits For Energy Efficient Replacement Windows What You Should

Energy Efficient Home Improvements That Save Money Carbon Valley Home

.png)

Inflation Reduction Act Energy Cost Savings

.png)

Inflation Reduction Act Energy Cost Savings

Tax Credits For Energy Efficient Homes

Where To Find Rebates Tax Credits And Rewards For Energy efficient

Federal Solar Tax Credit What It Is How To Claim It For 2024

Tax Credits For Energy Efficient Home Improvements 2021 - If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed