Tax Credits For Heat Pumps Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30

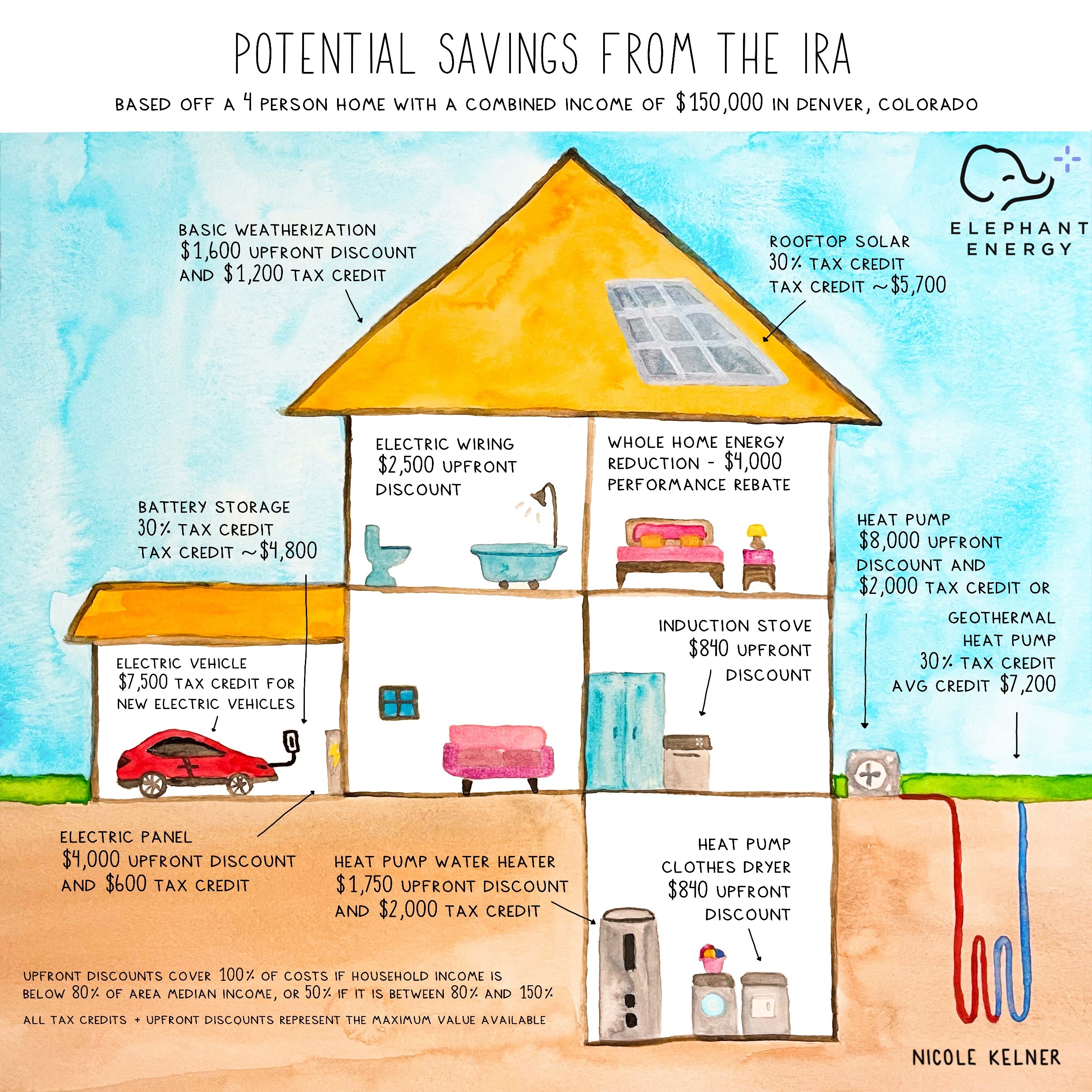

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

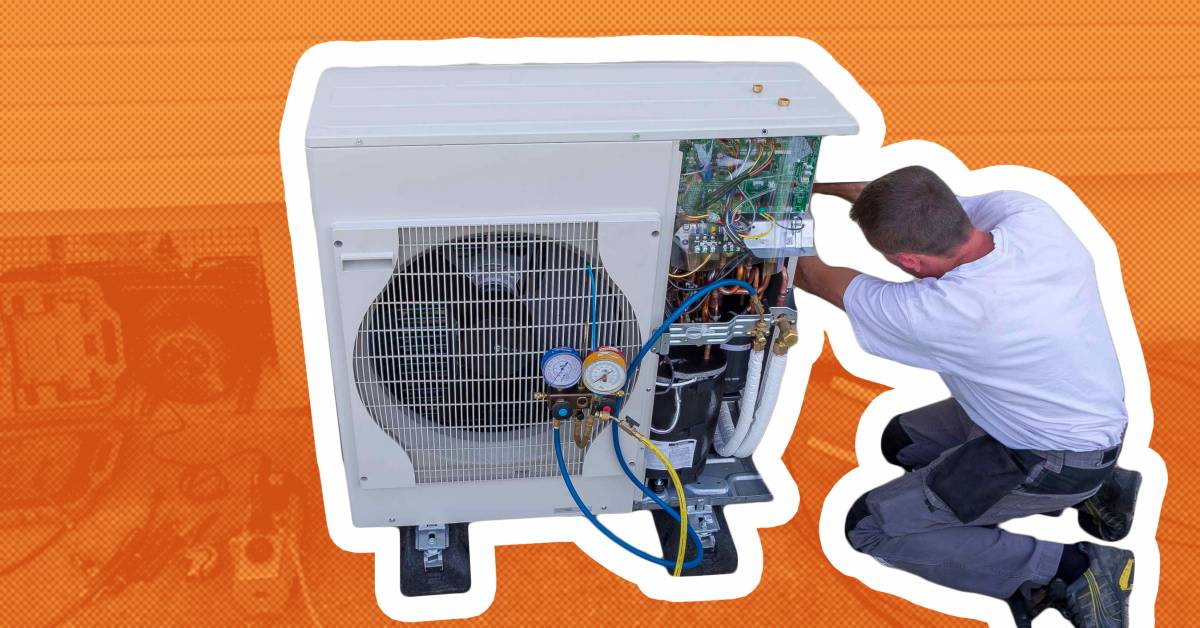

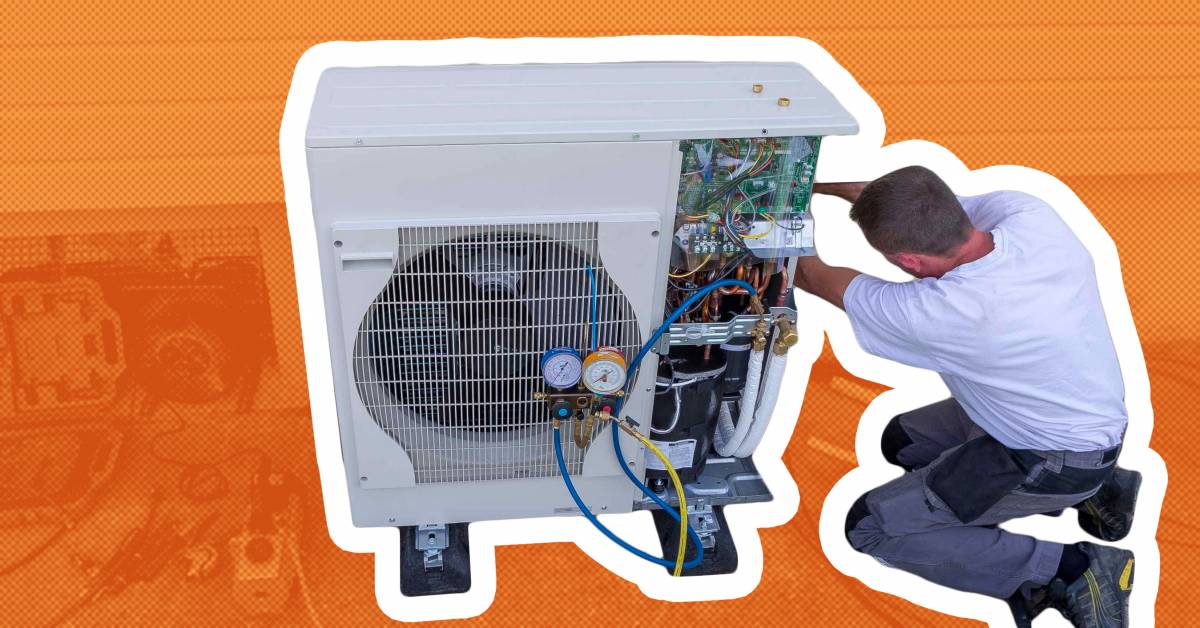

Tax Credits For Heat Pumps

Tax Credits For Heat Pumps

https://cdnassets.hw.net/3e/77/2a11f7a34801b97570b9a6e865c9/tmp7ece-2etmp-tcm17-231699.jpg

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

Consumer Reports explains the tax credits and rebates available through the Inflation Reduction Act for the purchase of a heat pump Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000 If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit through the Inflation Reduction Act is available through 2032 and is

Download Tax Credits For Heat Pumps

More picture related to Tax Credits For Heat Pumps

Tax Credits On Electric Cars Heat Pumps Will Help Low Income

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/tax-credits-on-electric-cars-heat-pumps-will-help-low-income.jpeg?fit=2048%2C1361&ssl=1

New Tax Credits Increase Appeal Of Heat Pumps For Homeowners

https://hvparent.com/_content/articles/tax-credits-and-heat-pumps-40021.JPG

So Why Are Heat Pumps So Important

https://www.sjbmechanical.com/wp-content/uploads/2021/04/SJB-GSHP.jpg

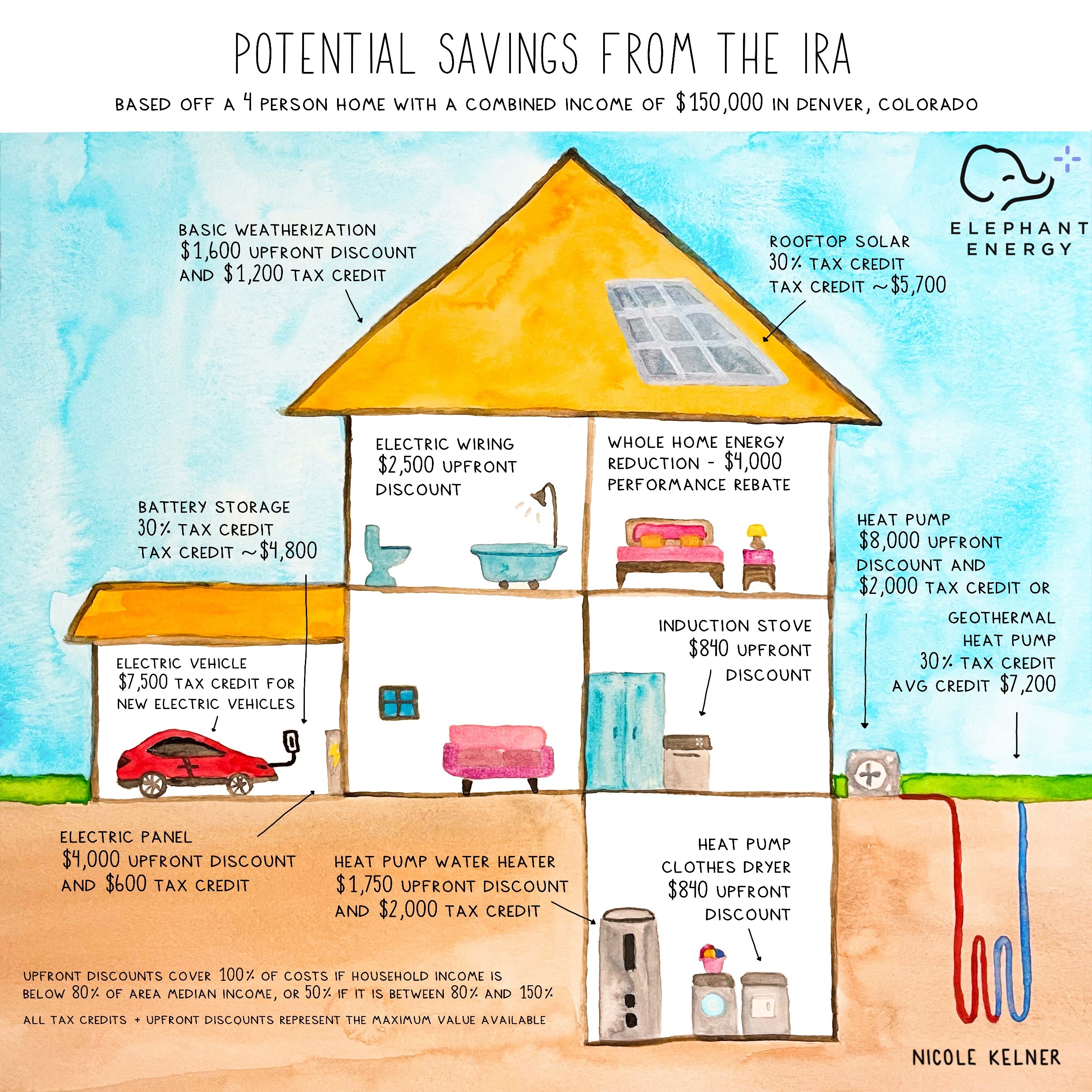

It includes tax credits for heat pumps heat pump water heaters weatherization electric panel upgrades solar and battery storage How to claim a tax credit Make your upgrade See all eligible appliance and home improvements in the list below Claim your tax credit Submit IRS Form 5695 when filing your taxes You can download it here or search for

The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

Lucrative Tax Credits Pledged For Heat Pumps REMI Network

https://www.reminetwork.com/wp-content/uploads/tax-credit2-1.jpg

https://www.energystar.gov/.../air-source-heat-pumps

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Heat Pump Tax Credits Get Rewarded For Sustainable Heating And Cooling

Inflation Reduction Act IRA The Ultimate Guide To Saving

Heat Pumps Can Help Oregonians Achieve Clean Cooling Oregon Capital

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

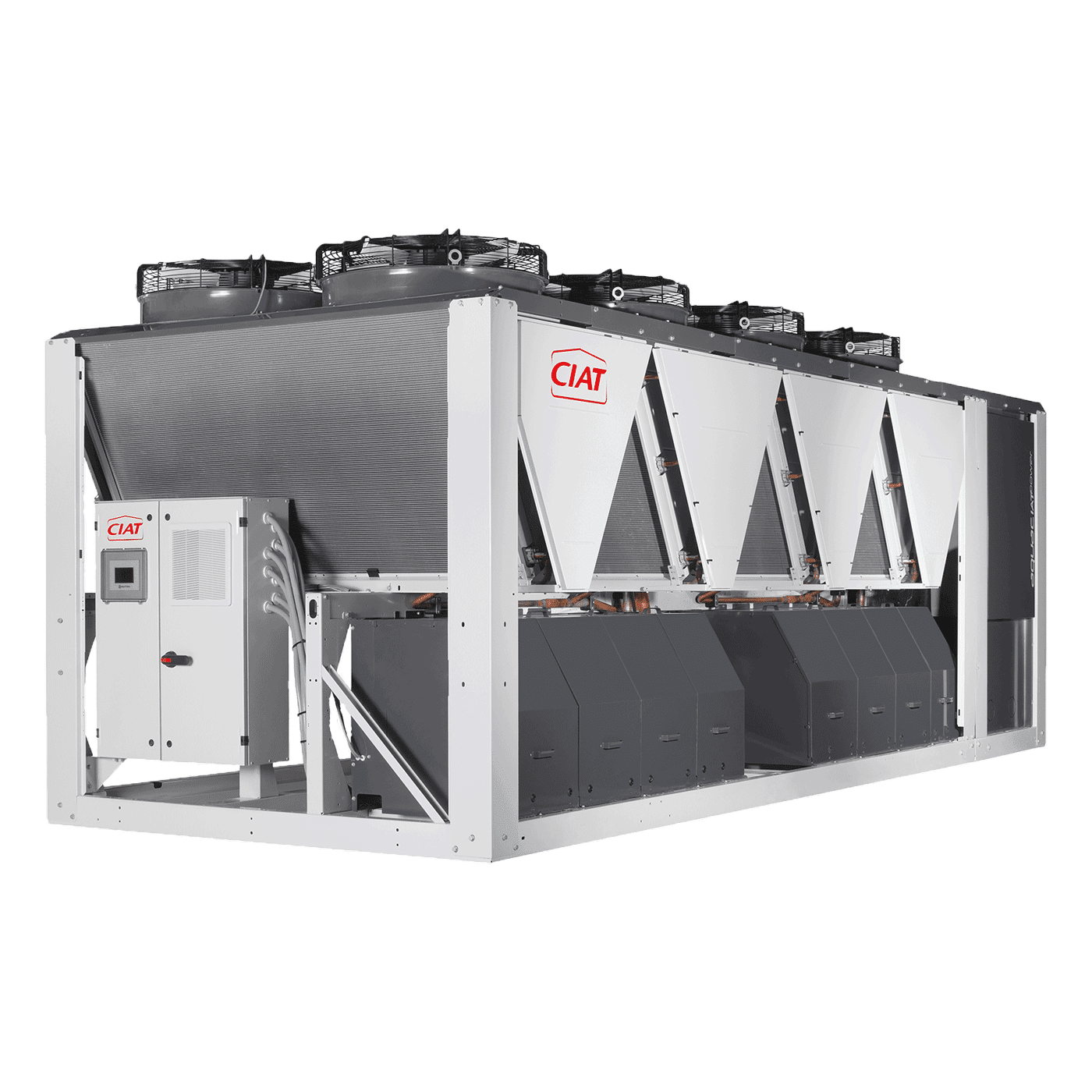

Heat Pumps Chillers CIAT United Kingdom

Nashville Heat Pump Tax Credit Rebates Incentives Savings Guide

Nashville Heat Pump Tax Credit Rebates Incentives Savings Guide

Heat Pumps Wattsmart Savings

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

Tax Credits For Geothermal Extended To 2023 ECS Geothermal Inc

Tax Credits For Heat Pumps - Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000