Tax Credits For Home Improvements 2021 OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to Canada Revenue Agency If you bought built sold or renovated a home in 2021 we re here to help you with your tax affairs Here are some helpful tips and

Tax Credits For Home Improvements 2021

Tax Credits For Home Improvements 2021

https://752460.smushcdn.com/1591278/wp-content/uploads/2021/07/renew-tax-credits-1084x1446.jpg?lossy=0&strip=1&webp=1

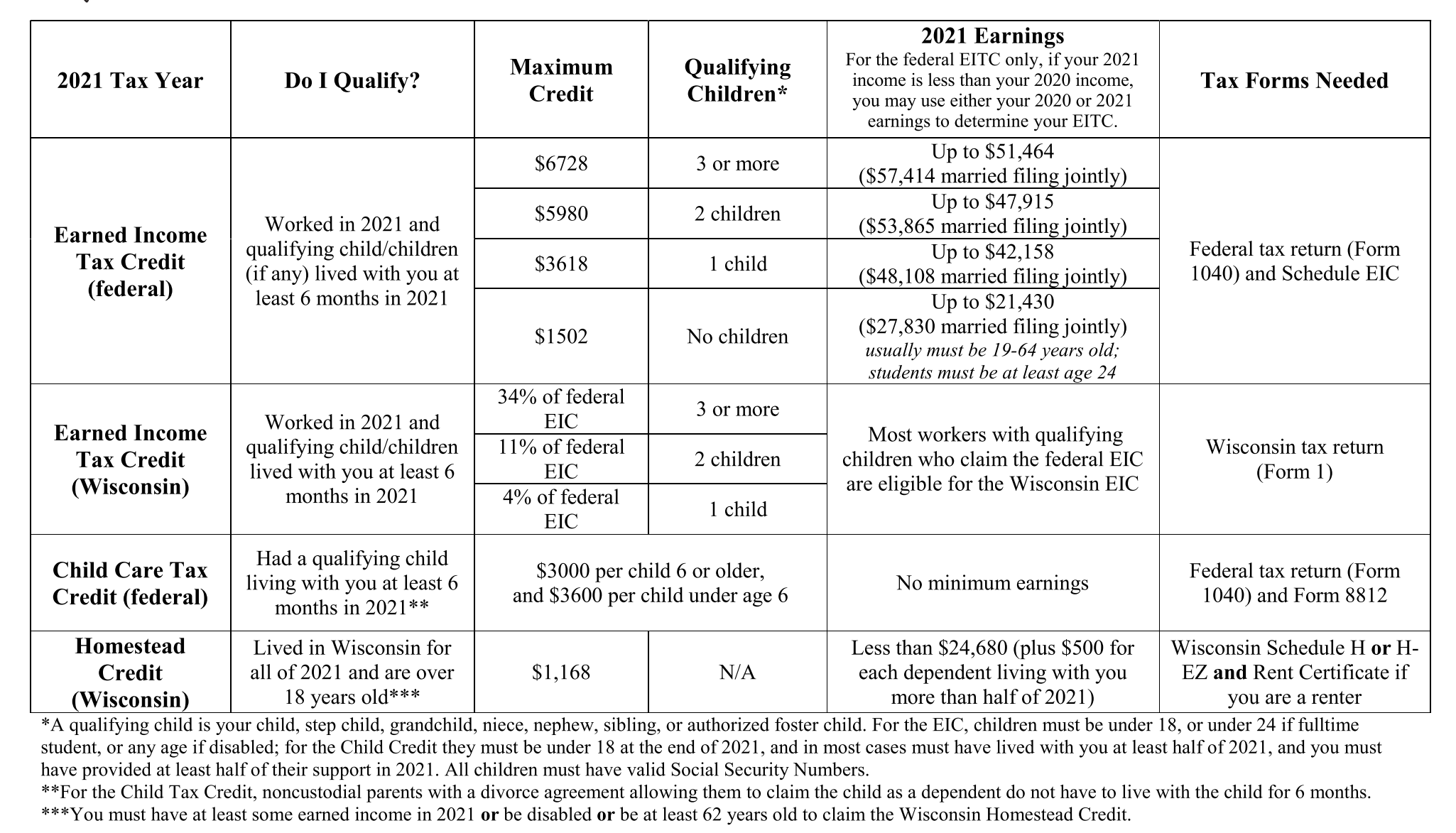

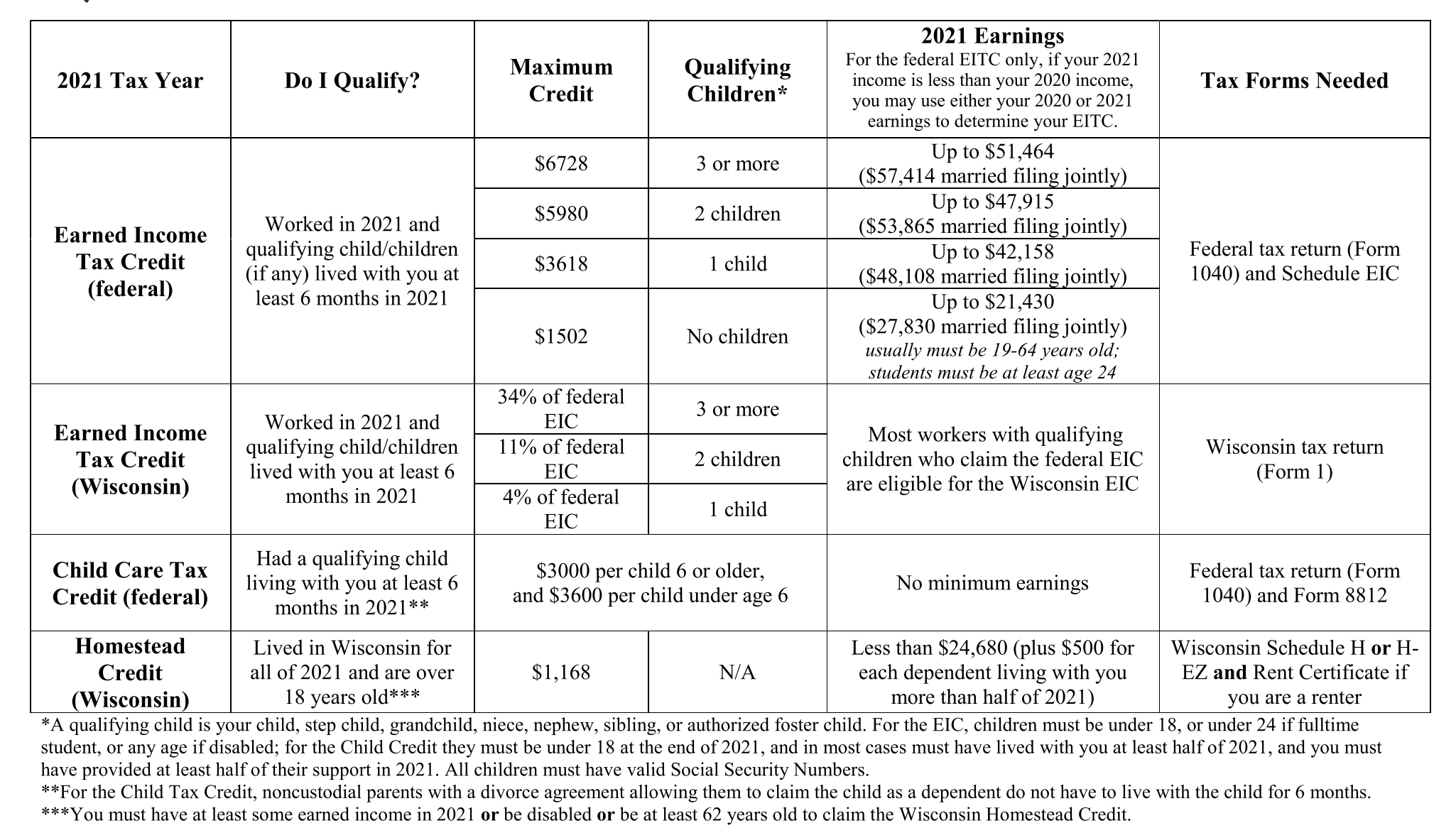

2021 Tax Credits Get The Credit You Deserve Financial Education

https://finances.extension.wisc.edu/files/2021/09/2021-tax-credits-e1643336436945.png

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving money The Nonbusiness Energy Property Credit expired at the end of 2021 However the Inflation Reduction Act revives enhances and renames the credit now the Energy Efficient Home Improvement

Credits for renovating your home Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Published on Mar 8 2021 7 minute read By Rebecca Henderson Reviewed by Expert Riley Adams CPA Tax credits reduce your tax bill on a dollar for dollar basis However deductions are what lower your

Download Tax Credits For Home Improvements 2021

More picture related to Tax Credits For Home Improvements 2021

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Tax Credits For Energy Efficient Homes

https://assets.site-static.com/blogphotos/4757/25032-tax-credits-for-energy-efficient-homes.jpg

Federal Tax Credits To Support Affordable Housing In Detroit Friedman

https://friedmanrealestate.com/wp-content/uploads/2019/06/federal-tax-credits-to-support-affordable-housing.jpg

The maximum credit amount is 1 200 for home improvements and 2 000 for heat pumps and biomass stoves or boilers Previously the credit was capped at a Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

Claim the credit on your 2021 and or 2022 personal income tax returns Total qualified expenses incurred between October 1 2020 and December 31 2021 in excess of Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Complete List Of Tax Credits For Individuals Tax Credits Federal

https://i.pinimg.com/originals/5b/16/4b/5b164bd7e067ddaa9caa8fdc87288ecb.png

https://turbotax.intuit.com/tax-tips/home...

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

https://www.energystar.gov/products/ask-the...

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to

Canada To Set Up Tax Credits For Clean Tech Launch Growth Fund

Federal Solar Tax Credit What It Is How To Claim It For 2024

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

The Value Of Investment Tax Credits For Your Business

When Are Tax Credits Ending How To Apply For Universal Credit

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

How To Get Tax Credits For Home Improvements

Tax Credits For Energy Efficient Home Improvements 2022 YouTube

Tax Credits For Giving Ozarks Food Harvest

Tax Credits For Home Improvements 2021 - Credits for renovating your home Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032