Tax Credits For Hvac Units You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

An HVAC tax credit can help you save money on your tax dues and energy bills Learn if you qualify with our 2023 guide to HVAC tax credits The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners

Tax Credits For Hvac Units

Tax Credits For Hvac Units

https://www.sunheating.com/media/hvac-tax-credits.jpg

How To Find Federal Tax Credits Rebates For HVAC Upgrades

https://www.blueheatingandcooling.com/wp-content/uploads/2016/10/BHC-taxcredits.jpg

Take Advantage Of Federal Tax Credits For HVAC Systems In 2023

https://www.fullerhvac.com/wahelper/GetImage?id=567239

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work In one taxable year a taxpayer purchases and installs the following two exterior doors at a cost of 1 000 each windows and skylights at a total cost of 2 200 and one central air conditioner at a cost of 5 000

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems

Download Tax Credits For Hvac Units

More picture related to Tax Credits For Hvac Units

Federal Tax Credits For HVAC Upgrades In 2021

https://www.signaturehvac.com/wp-content/uploads/2021/12/pexels-mikhail-nilov-6964107-1024x683.jpg

SAVE MONEY With HVAC Tax Credits Ernst Heating Cooling

https://www.ernstheating.com/wp-content/uploads/2021/03/hvac-tax-credits.jpg

Taking Advantage Of HVAC Tax Credits Ace Plumbing Heating And Air

https://www.aceplumbing.com/wp-content/uploads/2018/05/air-conditioning-repair-742x494.jpg

Learn about the federal government s tax credit program for high efficiency heating and cooling equipment and review regional programs for qualifying HVAC systems Starting in 2023 and extended to December 2032 homeowners can qualify for a tax credit equal to 30 of their installation costs for air source heat pumps and up to 2 000 for qualifying heat pumps They must meet the following criteria to qualify

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Some of the biggest credits available are HVAC tax credits to help you heat and cool your home more efficiently You can qualify for these credits as long as the products you install are qualified through ENERGY STAR and meet certain energy efficiency and performance requirements

HVAC Equipment Tax Credits For Homeowners

https://www.airtro.com/wp-content/uploads/2020/04/tax-credits.jpg

Georgia And Federal Tax Credits For HVAC 2023 Reliable Heating Air

https://octanecdn.com/reliableairnew/reliableairnew_782044049.png

https://airconditionerlab.com/what-hvac-systems...

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

An HVAC tax credit can help you save money on your tax dues and energy bills Learn if you qualify with our 2023 guide to HVAC tax credits

HVAC Tax Credits 2018 2019 Magic Touch Mechanical

HVAC Equipment Tax Credits For Homeowners

Tax Credits Available For HVAC Units Lower Bucks Times

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

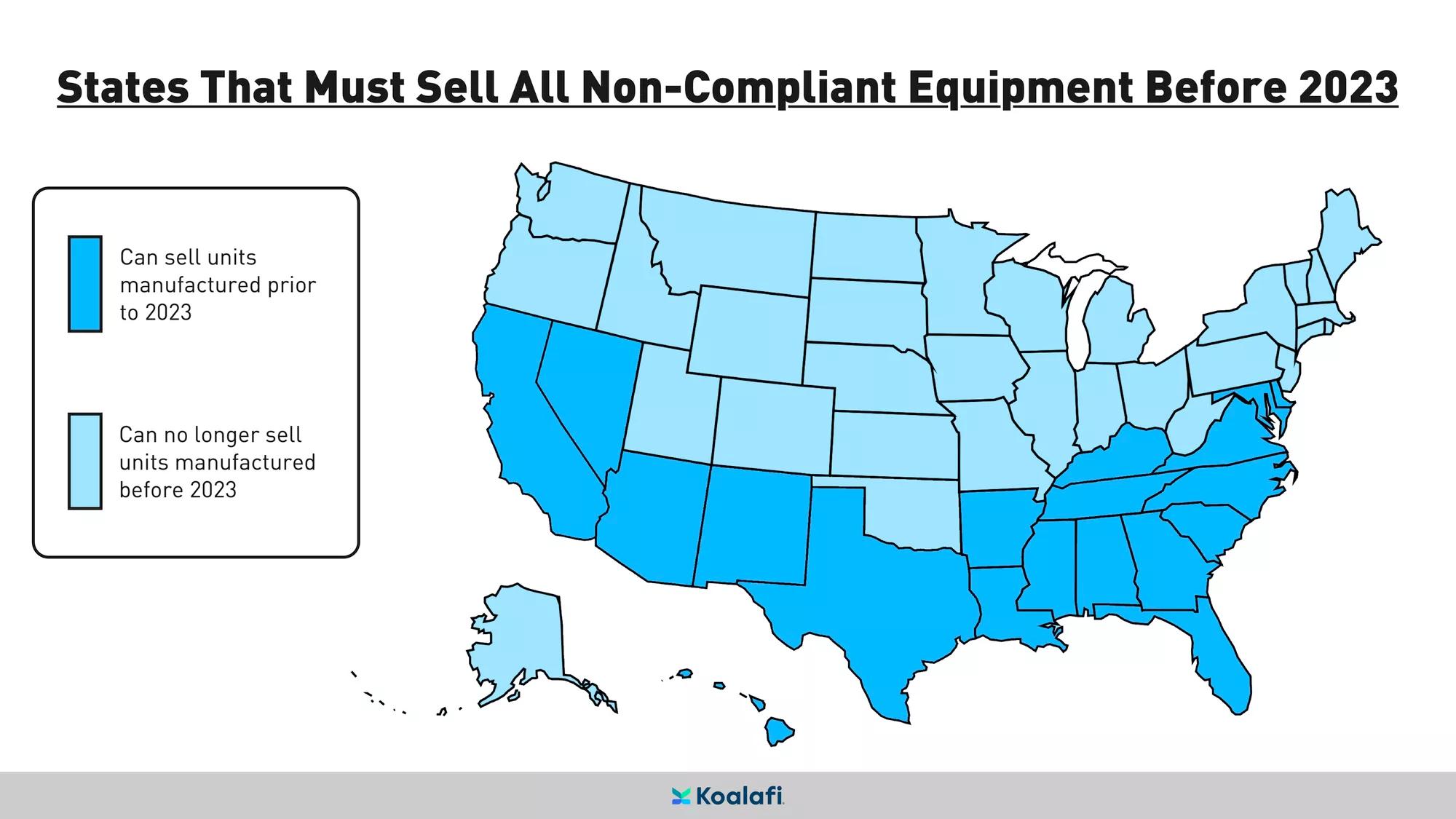

New HVAC Regulations In 2023 SEER Requirements Tax Credits And

Tax Credit 25C HVAC Tax Credits

Tax Credit 25C HVAC Tax Credits

How To Find Your Federal Tax Credits HVAC Rebates

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

Federal Energy Tax Credits For HVAC Systems In 2023

Tax Credits For Hvac Units - Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses