Tax Credits For Renewable Energy The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the

Taking advantage of Inflation Reduction Act incentives such as tax credits is key to lowering GHG emission footprints and accelerating the clean energy transition The Investment Tax Credit ITC and Production Tax Credit PTC allow taxpayers to deduct a percentage of the cost of renewable energy systems from their federal taxes The renewable electricity production tax credit PTC is a per kilowatt hour kWh federal tax credit included under Section 45 of the U S tax code for electricity generated by qualified renewable energy resources

Tax Credits For Renewable Energy

Tax Credits For Renewable Energy

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Tax Credits For Energy Efficient Homes

https://assets.site-static.com/blogphotos/4757/25032-tax-credits-for-energy-efficient-homes.jpg

Who Will Actually Be Able To Use The Renewable Tax Credits

https://imageio.forbes.com/specials-images/imageserve/5fe4d47aa4ae08af76e141a7/0x0.jpg?format=jpg&crop=7050,3304,x0,y247,safe&width=1200

Provides a tax credit for construction of new energy eficient homes Credit Amount 2 500 for new homes meeting Energy Star standards 5 000 for certified zeroenergy ready homes For multifamily base amounts are 500 per unit for Energy Star and 1000 per unit for zero energy The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion of

Download Tax Credits For Renewable Energy

More picture related to Tax Credits For Renewable Energy

HMRC Issue Tax Credits Claim Reminder Adapt Accountancy

https://752460.smushcdn.com/1591278/wp-content/uploads/2021/07/renew-tax-credits-1084x1446.jpg?lossy=0&strip=1&webp=1

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

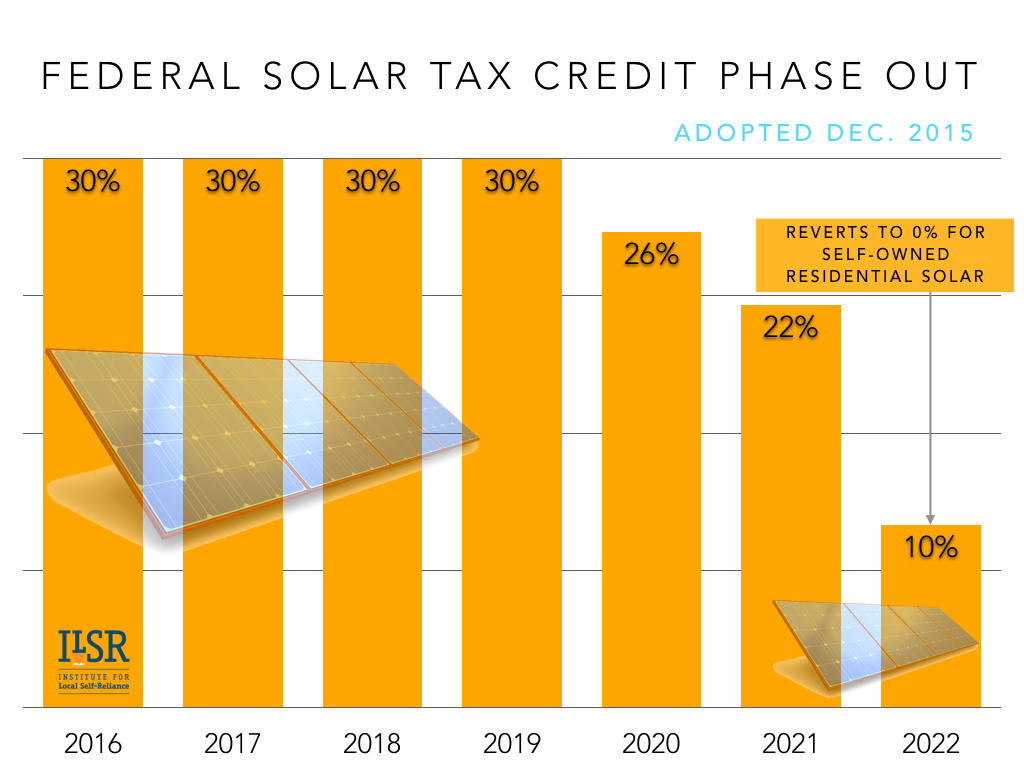

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015.jpeg

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032 The ITC is a dollar for dollar credit for expenses invested in renewable energy properties most often solar developments Inflation Reduction Act extended the ITC from 2022 through 2032 as a 30 percent credit for qualified expenditures

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more energy efficient utilize clean energy sources and lower greenhouse gas emissions that contribute to climate change and global warming By allowing taxpayers to subtract a certain percentage of their qualified expenditures on renewable energy systems from their federal income taxes renewable energy tax credits result in a reduction of tax liability thus making sustainable choices more financially appealing to individuals and businesses

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

https://www.eia.gov › energyexplained › renewable...

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the

https://www.epa.gov › green-power-markets › summary...

Taking advantage of Inflation Reduction Act incentives such as tax credits is key to lowering GHG emission footprints and accelerating the clean energy transition The Investment Tax Credit ITC and Production Tax Credit PTC allow taxpayers to deduct a percentage of the cost of renewable energy systems from their federal taxes

Solar Tax Credit Calculator NikiZsombor

Get The Power Of Tax Credits For Your Businesses

Federal Solar Tax Credits For Businesses Department Of Energy

Capital Account Implications For Renewable Energy Tax Credits Global

What Are Clean Energy Tax Credits And How Do They Work Evergreen Action

Progressive Charlestown Republicans Plan To Chop Tax Credits For Green

Progressive Charlestown Republicans Plan To Chop Tax Credits For Green

Federal Income Tax Credits And Incentives For Energy Efficiency

Earn Tax Credits For Making EnergyEfficient Home Improvements Learn

When Are Tax Credits Ending How To Apply For Universal Credit

Tax Credits For Renewable Energy - If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022