Tax Credits For Unemployed With a decreased income there may be refundable tax credits or additional deductions for which you are now eligible and the only way to get them is by filing a tax return Further itemizing your deductions may even allow you to recover certain expenses you

The American Opportunity Tax Credit is for qualified education expenses paid by or on behalf of an eligible student for the first four years of higher education It is partially refundable If the credit reduces the amount of tax a taxpayer owes to zero they can get a refund of 40 of any remaining amount of the credit up to 1 000 Taxpayers A claim for unemployment repayment can be made immediately if emergency tax was applied in your last employment immediately if you are leaving Ireland permanently four weeks after becoming unemployed if you are not receiving any other taxable income

Tax Credits For Unemployed

Tax Credits For Unemployed

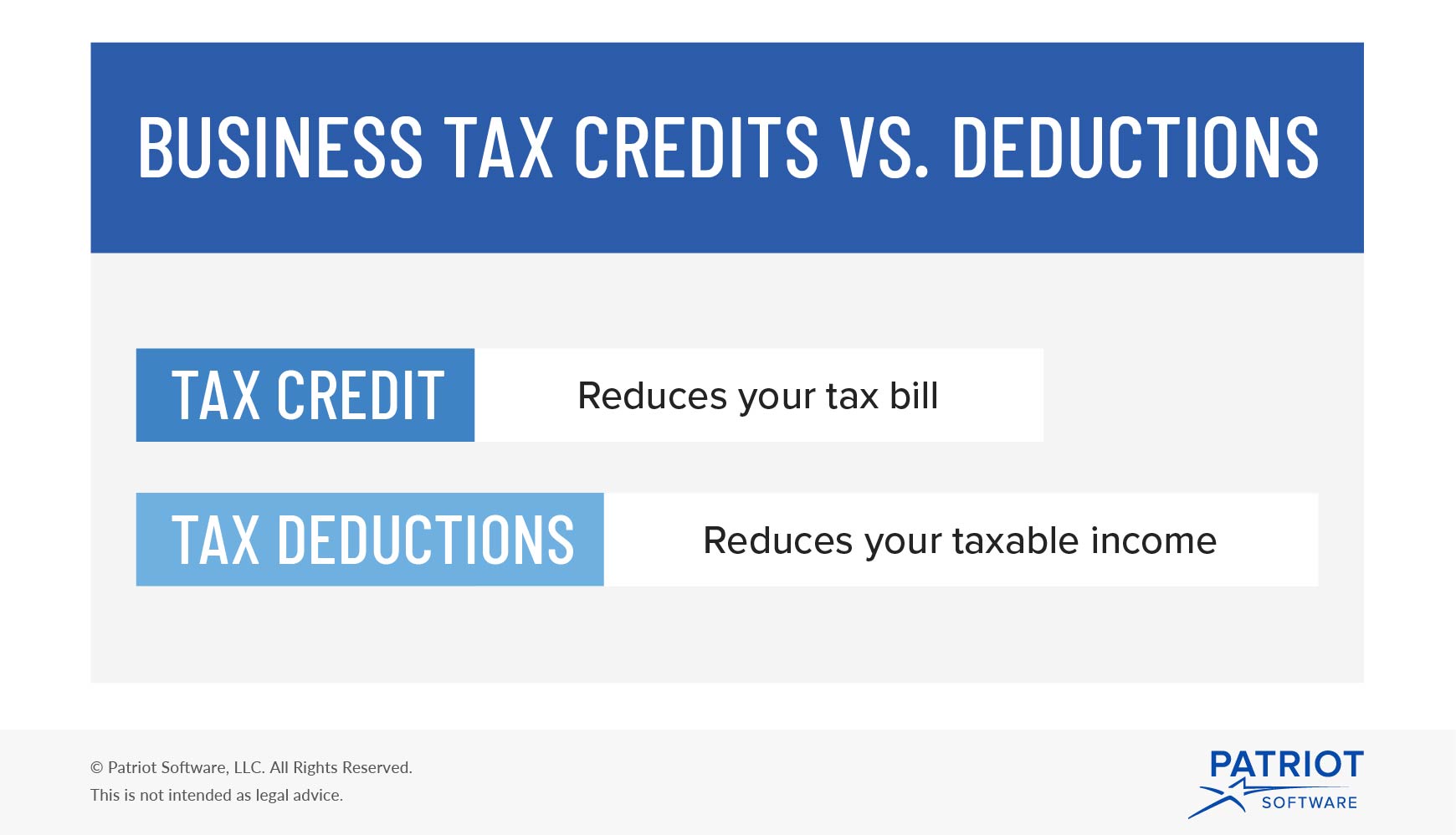

https://www.e-file.com/help/popular-tax-credits.png

Americans Who Became Unemployed In 2020 May Qualify For New Tax Credits

https://www.pennlive.com/resizer/JjBMnkbBvHKOCJViV1mGkObyobA=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/SFZ5F23SSREZ3JSRTU5AGQDQTY.jpg

5 Valuable Tax Credits For 2020 Individual Returns Mize CPAs Inc

https://www.mizecpas.com/wp-content/uploads/2020/07/Files-with-Taxes-Refund-and-Medical-Expenses-highlighted.jpg

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced significant barriers to employment WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers You may be eligible to claim the Earned Income Credit if you earned income from a job or self employment for at least part of the tax year You can only receive the Earned Income Credit if your adjusted gross income AGI is below the applicable maximum for the tax year

The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10 200 tax break Unemployment benefits count toward your income and are taxed by the federal government at rates according to the IRS tax brackets It s a bit more complicated when it comes to state taxes

Download Tax Credits For Unemployed

More picture related to Tax Credits For Unemployed

Tax Credits For Hiring The Unemployed Expire This Week Mlive

https://www.mlive.com/resizer/WHF_zwYMppqe3XpLPbZJAG_GQnQ=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.mlive.com/home/mlive-media/width2048/img/michigan-job-search/photo/122810expired-meterjpg-e80a0ccae7e0b9f5.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Business Tax Credits Credit Vs Deduction Types Of Credits More

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credits-visual.jpg

You must have earned income in the year to claim either of these credits the Earned Income Credit EIC and the Child and Dependent Care Credit Help with the Child Tax Credit and unemployment income Key Points President Joe Biden signed the American Rescue Plan Act of 2021 on Thursday The 1 9 trillion Covid relief bill gives a tax break on unemployment benefits received last year The

The legislation allows taxpayers who earned less than 150 000 in adjusted gross income to exclude unemployment compensation up to 20 400 if married filing jointly or 10 200 for all other Though you ll owe federal income tax on unemployment benefits you won t have to pay Social Security or Medicare taxes known as payroll taxes on your benefits Note that if you previously

WOTC s Newest Category Long Term Unemployed Cost Management Services

https://www.cmswotc.com/wp-content/uploads/2014/10/20130521_133524-e1461859054281.jpg

Credits Vs Deductions Carpenter Tax And Accounting

http://www.carpentertaxaccounting.com/wp-content/uploads/2017/02/Credit-Vs-Deductions-Blog-.png

https:// jonestaxhelp.com /tax-deductions-credits...

With a decreased income there may be refundable tax credits or additional deductions for which you are now eligible and the only way to get them is by filing a tax return Further itemizing your deductions may even allow you to recover certain expenses you

https://www. irs.gov /newsroom/tax-credits-for...

The American Opportunity Tax Credit is for qualified education expenses paid by or on behalf of an eligible student for the first four years of higher education It is partially refundable If the credit reduces the amount of tax a taxpayer owes to zero they can get a refund of 40 of any remaining amount of the credit up to 1 000 Taxpayers

Tax Credits Made Easy

WOTC s Newest Category Long Term Unemployed Cost Management Services

Pin On All Things Real Estate Group Board

S Corp Tax Deductions Everything You Need To Know

Business Owner Don t Forget Tax Credits TaxAssist Accountants

Can I Qualify For The Hope Credit When Receiving A Pell Grant Pell

Can I Qualify For The Hope Credit When Receiving A Pell Grant Pell

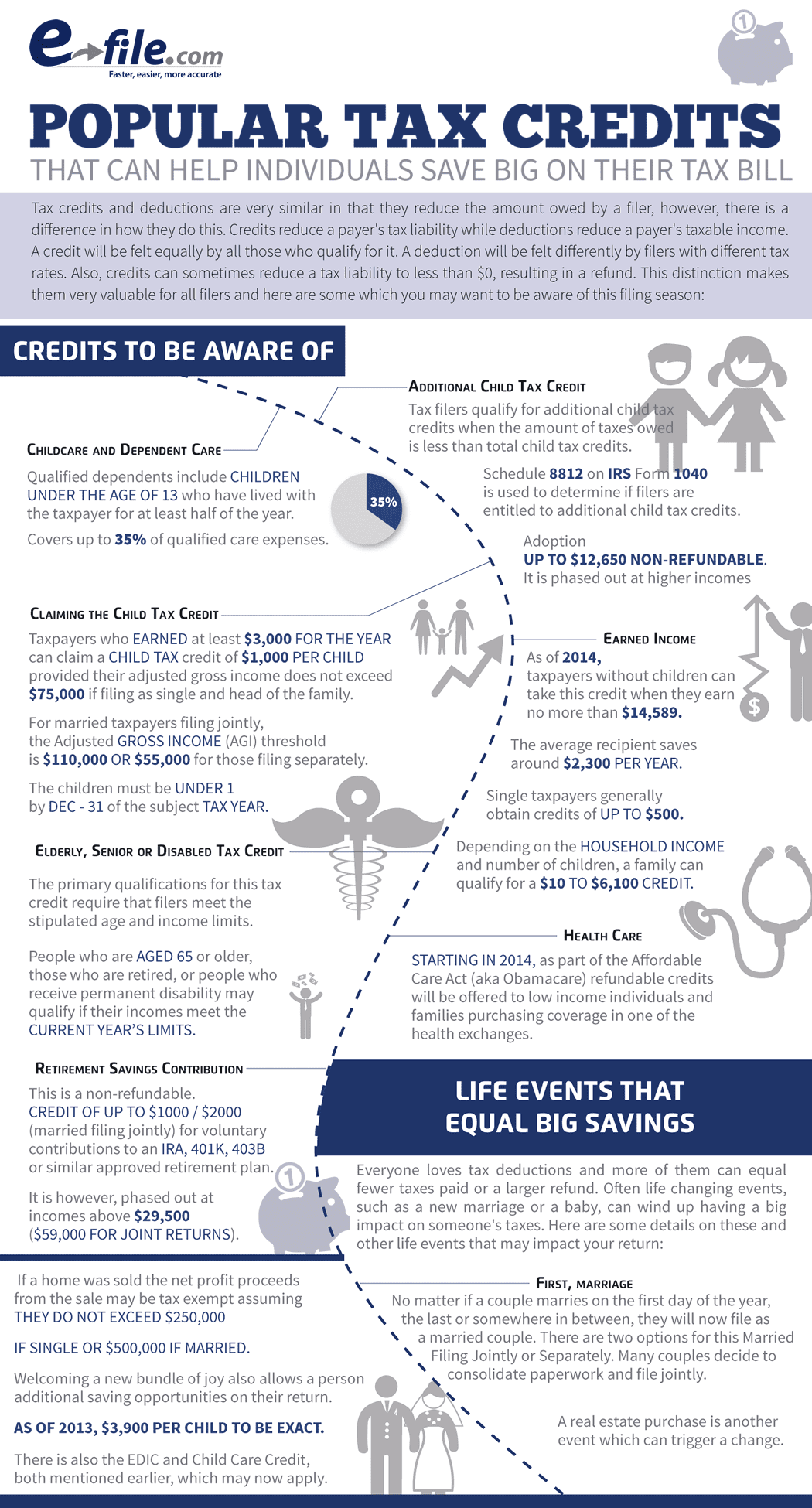

As Unemployment Skyrockets KFF Estimates More Than 20 Million People

Instant Loans For Unemployed Finance Management Simple Ideas

I Understand That Subsidies Come In The Form Of Tax Credits But I m

Tax Credits For Unemployed - Taxes How To How To Claim the Tax Credit for Hiring Unemployed Workers Published April 26 2023 REVIEWED BY Tim Yoder Ph D CPA WRITTEN BY Lea Uradu J D Employers can get a tax credit called the Work Opportunity Tax Credit WOTC of up to 2 400 per employee if they hire people who have been out of work for