Tax Credits In Ireland 2023 Revenue will give you a Personal Tax Credit if you are resident in Ireland You may be able to claim additional tax credits depending on your personal

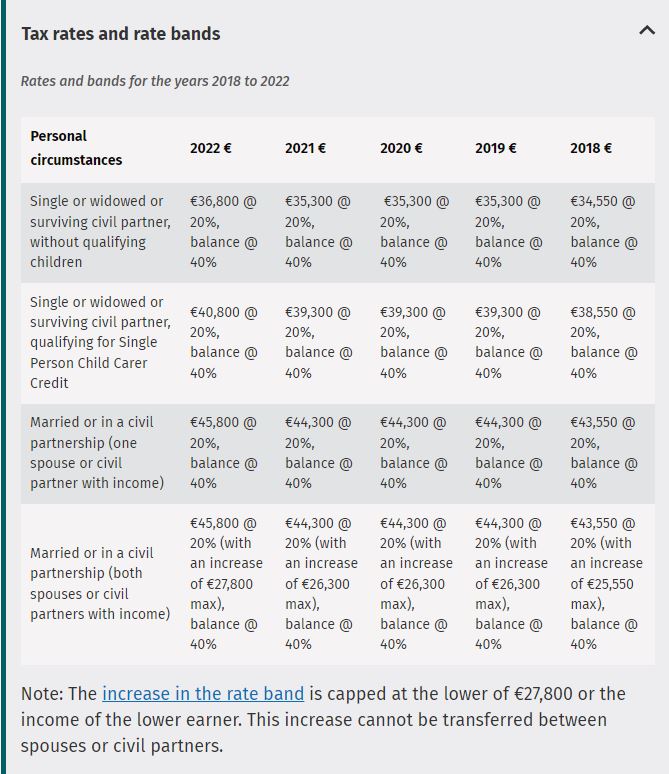

What is an increased rate band How tax credits work What is a Tax Credit Certificate View your pay and tax details How tax credits work Tax credits reduce the The following tax credits will increase by 75 to 1 775 Personal Tax Credit Employee Tax Credit Earned Income Tax Credit The ceiling for the 2

Tax Credits In Ireland 2023

Tax Credits In Ireland 2023

https://irelandaccountant.ie/wp-content/uploads/What-Tax-Credits-Are-Available-in-Ireland.jpg

Employee Retention Tax Credit Florida Business Consulting

https://devotedenterprises.com/wp-content/uploads/2022/01/ERTC-scaled.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

For those earning 40 000 this change will mean a reduction of over 800 in income tax paid in 2023 The main tax credits personal employee and earned Income Tax Budget 2023 Sep 27 2022 In an effort to ease the cost of living pressures brought about by rising prices and inflation the Minister for Finance

The 2023 tax rates and credits can be found here and the changes are summarised below There were a number of changes to both the Irish standard rate Income Tax Credits Tax Year 2022 Tax Year 2023 Single Person 1 700 1 770 Married Couple Civil Partnership 3 400 3 550 Widowed Person Surviving Civil Partner in year

Download Tax Credits In Ireland 2023

More picture related to Tax Credits In Ireland 2023

How To Claim R D Tax Credits In Ireland

https://www.myriadassociates.ie/media/eivjnltg/the-irish-rd-tax-credits-update-giving-a-huge-cash-boost-to-businesses-sooner-than-expected.jpg?anchor=center&mode=crop&width=500&height=500&rnd=132612429153900000

Income Tax Rates 2022 Ireland Been Nice Webcast Photo Galery

https://techlifeireland.com/wp-content/uploads/2016/05/table-revenue.jpg

PAYE Explained A Guide To Understanding Irish Tax Credits And Reliefs

https://www.taxback.com/resources/blogimages/20200507122215.1588843335429.2ea42cc2d6c8d92d7a9d6d79f87.jpg

4 4 The reduced 9 rate of VAT is due to expire on 01 March 2023 The calendar year 2022 2023 at the standard rate of income tax 20 capped at 1 250 per property Help to Buy Scheme changed scope of Irish taxation Research

Overview Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply Report on Tax Expenditures 2022 Report on Tax Expenditures 2022 incorporating outcomes of certain tax expenditure and tax related reviews completed

100 OFF Tax Credits Family Dependent Tax Credits With

https://www.tutorialbar.com/wp-content/uploads/2234172_e3c9-749x421-1-788x442.jpg

List Of Tax Credits In Ireland 2020 AccountsIreland

https://accountsireland.com/wp-content/uploads/2020/05/woman-4783150_1920.jpg

https://www.revenue.ie/en/jobs-and-pensions/tax-credits/index.aspx

Revenue will give you a Personal Tax Credit if you are resident in Ireland You may be able to claim additional tax credits depending on your personal

https://www.revenue.ie/.../tax-credits.aspx

What is an increased rate band How tax credits work What is a Tax Credit Certificate View your pay and tax details How tax credits work Tax credits reduce the

Tax Credits Save You More Than Deductions Here Are The Best Ones

100 OFF Tax Credits Family Dependent Tax Credits With

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

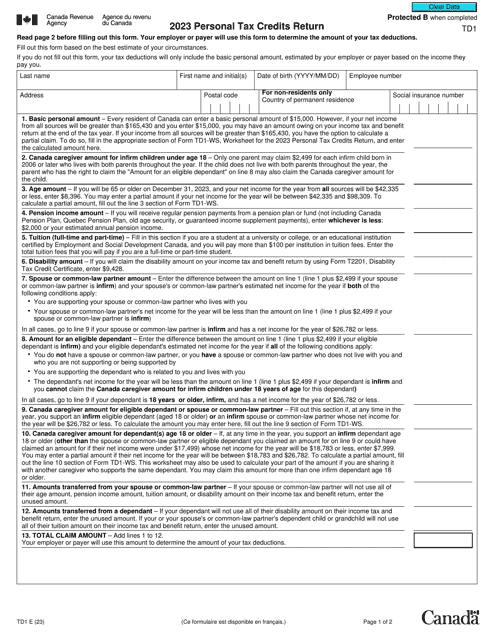

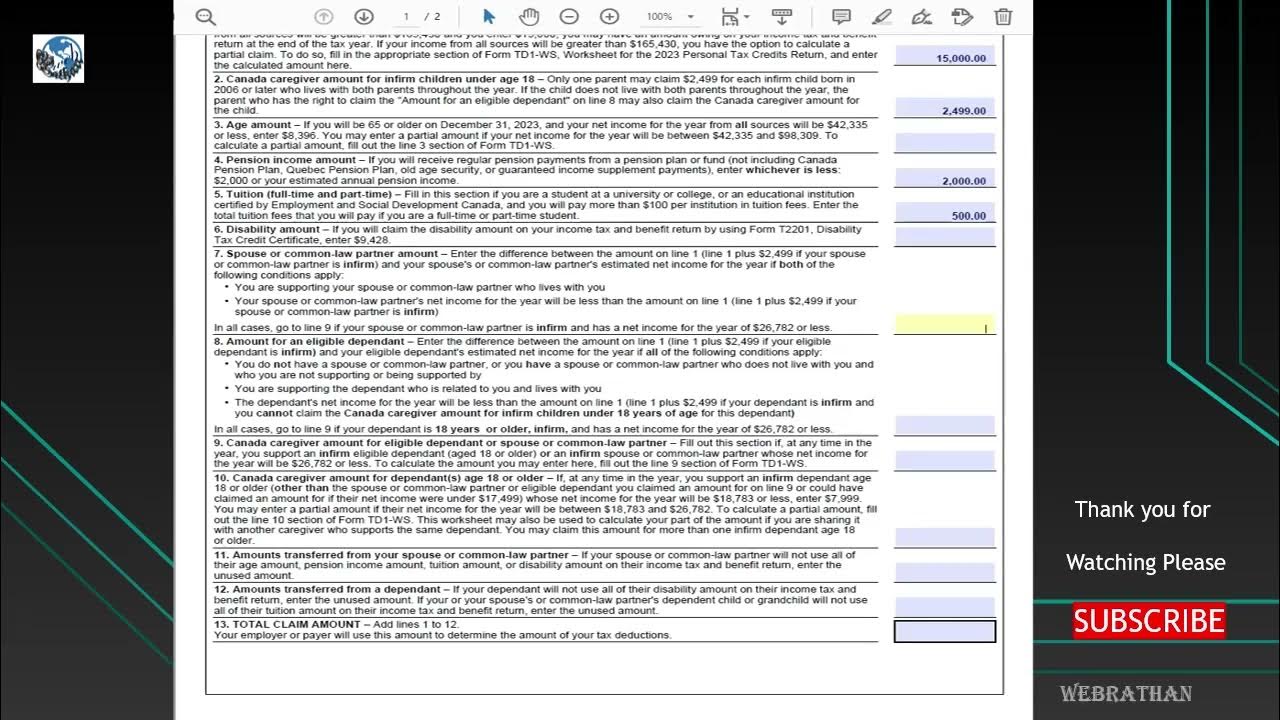

Form TD1 2023 Fill Out Sign Online And Download Fillable PDF

R D Tax Credits In Care Homes Green Jellyfish

5 Tax Credits In Biden s New Law

5 Tax Credits In Biden s New Law

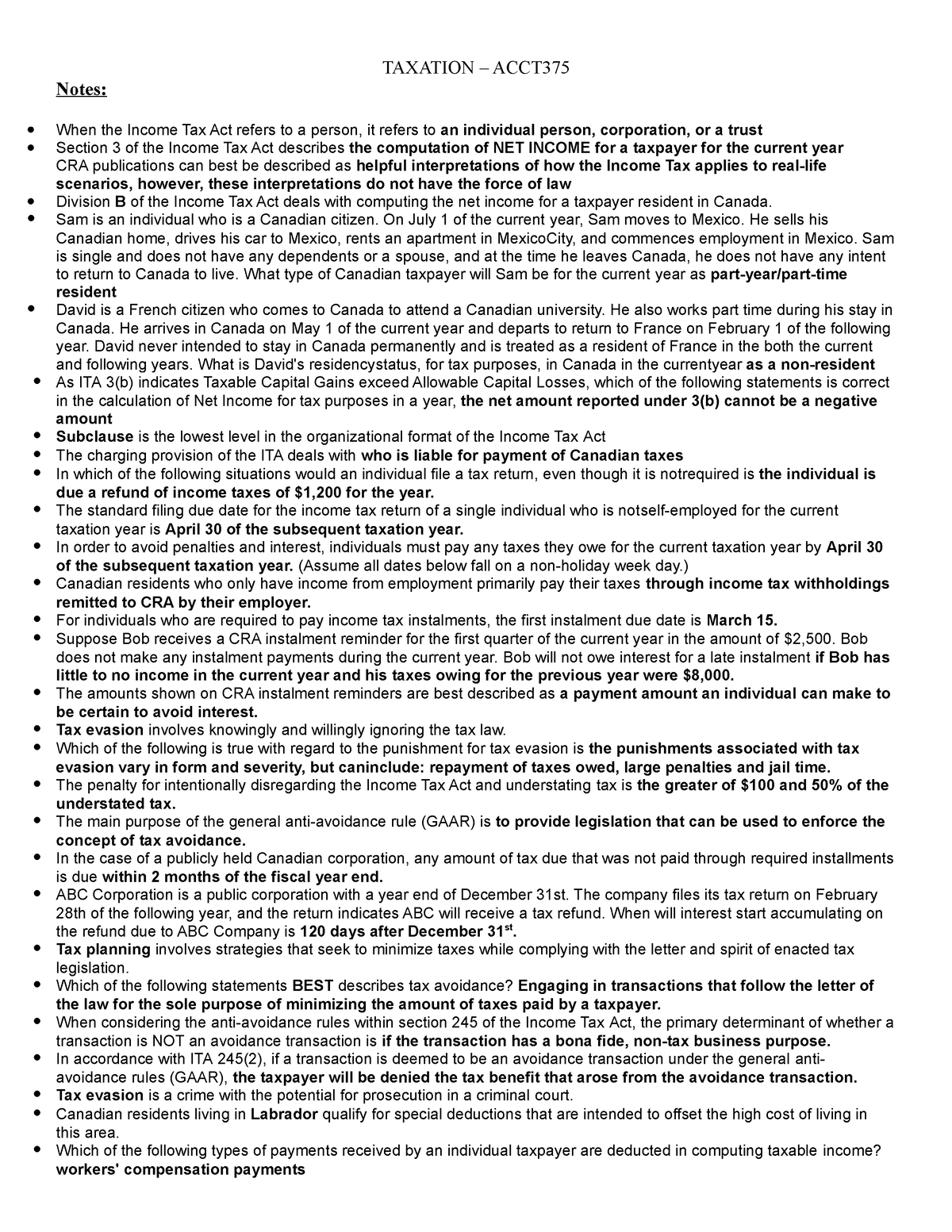

Taxation Reviewer 2021 TAXATION ACCT Notes When The Income Tax Act

2023 Ontario Tax Form Printable Forms Free Online

List Of Tax Credits In Ireland 2020 AccountsIreland

Tax Credits In Ireland 2023 - Under the new rules the tax credit will now be paid out to all claimants regardless of the corporation tax position in three instalments over three years For