Tax Credits Income Thresholds And Determination Of Rates Regulations 2002 Section 7 1 of the Tax Credits Act 2002 c 21 the Act provides that the entitlement of a person or persons to a tax credit is dependent on the relevant income defined in

In particular the family element is not reduced where the relevant income is 50 000 or less Regulation 9 provides that in cases where the rate of a tax credit would be less than The Act This regulation prescribes the manner in which amounts are to be determined for the purposes of section 7 1 a of In the case of a person or persons entitled to working

Tax Credits Income Thresholds And Determination Of Rates Regulations 2002

Tax Credits Income Thresholds And Determination Of Rates Regulations 2002

https://kozlaw.com/wp-json/social-image-generator/v1/image/10132

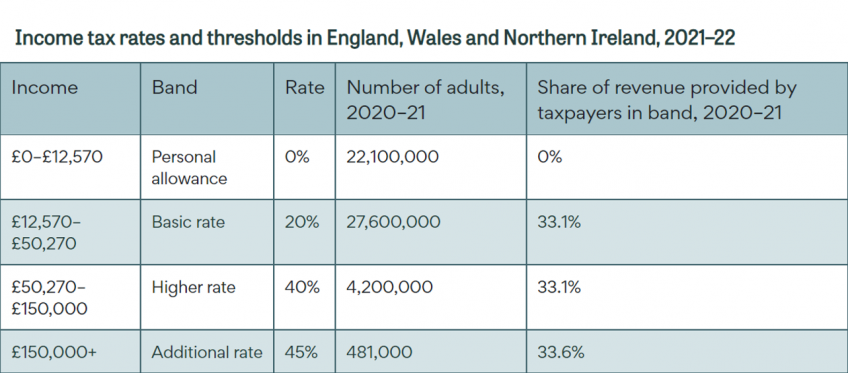

Income Tax Explained IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

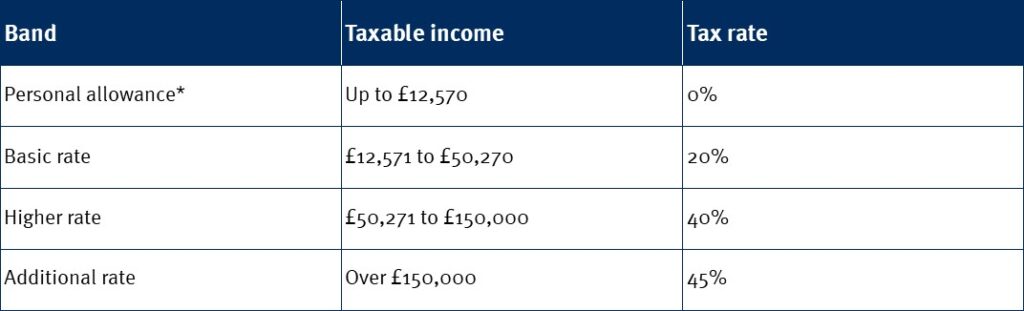

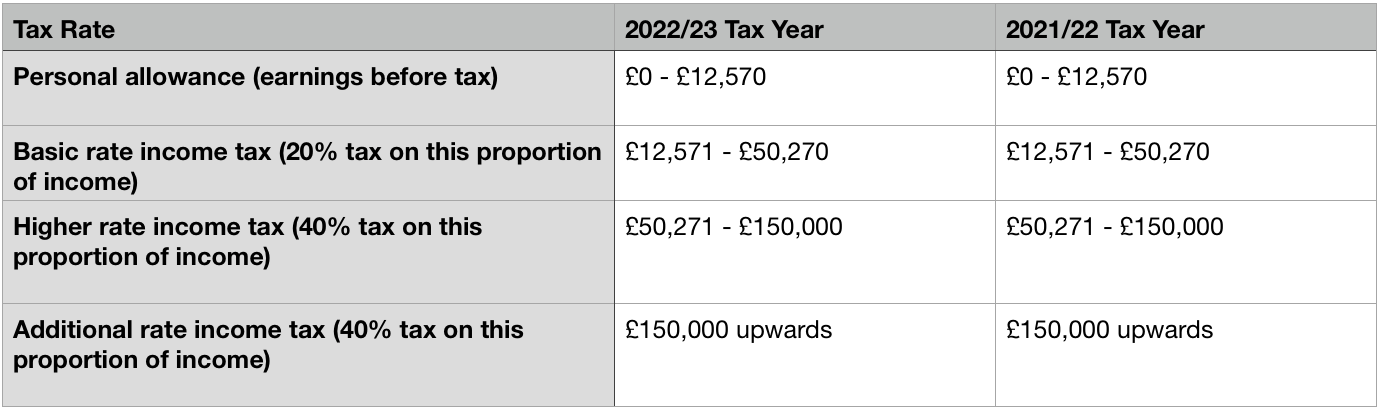

Latest UK Tax Rates And Thresholds For Business Owners

https://osome.com/content/images/size/w1200h800/2022/11/UK-tax-rates-thresholds-allowances.png

The Tax Credits Income Thresholds and Determination of Rates Regulation 2002 Regs 7 WTC When calculating a person s entitlement to WTC the rate for each relevant Income thresholds and taper rates The Tax Credit Income Thresholds and Determination of Rates Regulations 2002 Regs 3 7 Steps 3 5 and 8 Steps 3 5

The Tax Credits Income Thresholds and Determinations of Rates Regulations 2002 Reg 3 2 For people entitled to WTC the threshold is 7 455 a year People with annual The Tax Credits Income Thresholds and Determination of Rates Regulations 2002 UK Statutory Instruments 2002 No 2008 Regulation 7 Table of Contents Content More

Download Tax Credits Income Thresholds And Determination Of Rates Regulations 2002

More picture related to Tax Credits Income Thresholds And Determination Of Rates Regulations 2002

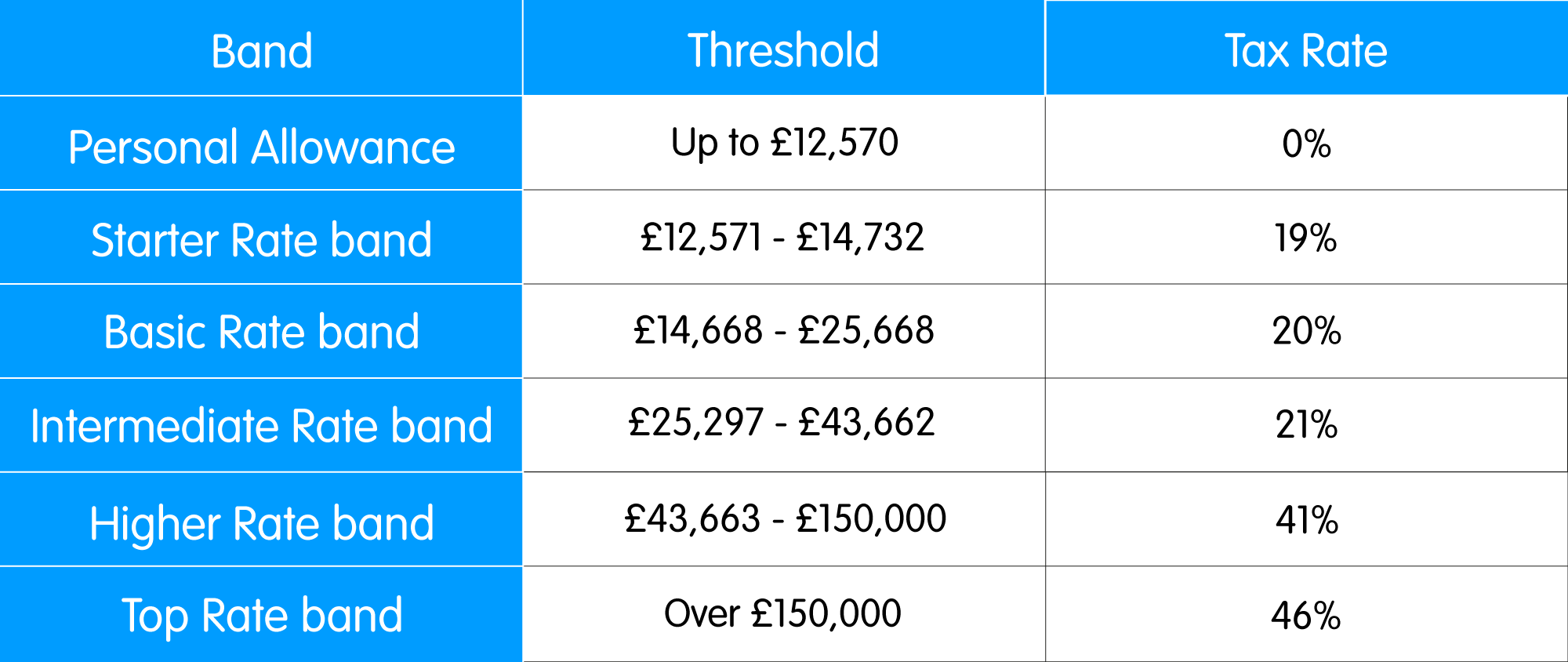

Preparing For The Tax Year 2022 23 PayStream

https://static.paystream.co.uk/media/3848/tax-rates-and-thresholds-for-scotland.png

Not Everyone Has To File A Tax Return Learn The Minimum Income

https://i.pinimg.com/originals/8b/ce/8f/8bce8fae11ba92ef79516f7faa2320e3.png

Budget Commentary 2021

https://www.wealthatwork.co.uk/affinityadvise/wp-content/uploads/sites/22/2021/03/Income-tax-rate-v2-1024x311.jpg

1 These Regulations may be cited as the Tax Credits Income Thresholds and Determination of Rates Regulations 2002 and shall come into force a for the Lancashire PR1 4AT Table of Amendments The Tax Credit Income Thresholds and Determination of Rates STATUTORY INSTRUMENTS 2002 No 2008 TAX CREDITS

File The Tax Credits Income Thresholds and Determination of Rates Regulations 2002 UKSI 2002 2008 pdf 2002 2008 Tax Credits Income Thresholds and Determination of Rates Regulations 2002 TC Income Thresholds Determination of Rates Made by the Treasury under

Income Tax Rates 2022 23 Scotland Ozella Runyon

https://downloads.thesaurussoftware.com/images/2223-R1.png

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

https://www.legislation.gov.uk/uksi/2002/2008/contents/made

Section 7 1 of the Tax Credits Act 2002 c 21 the Act provides that the entitlement of a person or persons to a tax credit is dependent on the relevant income defined in

https://www.hmrc.gov.uk/gds/tctm/attachments/tctm...

In particular the family element is not reduced where the relevant income is 50 000 or less Regulation 9 provides that in cases where the rate of a tax credit would be less than

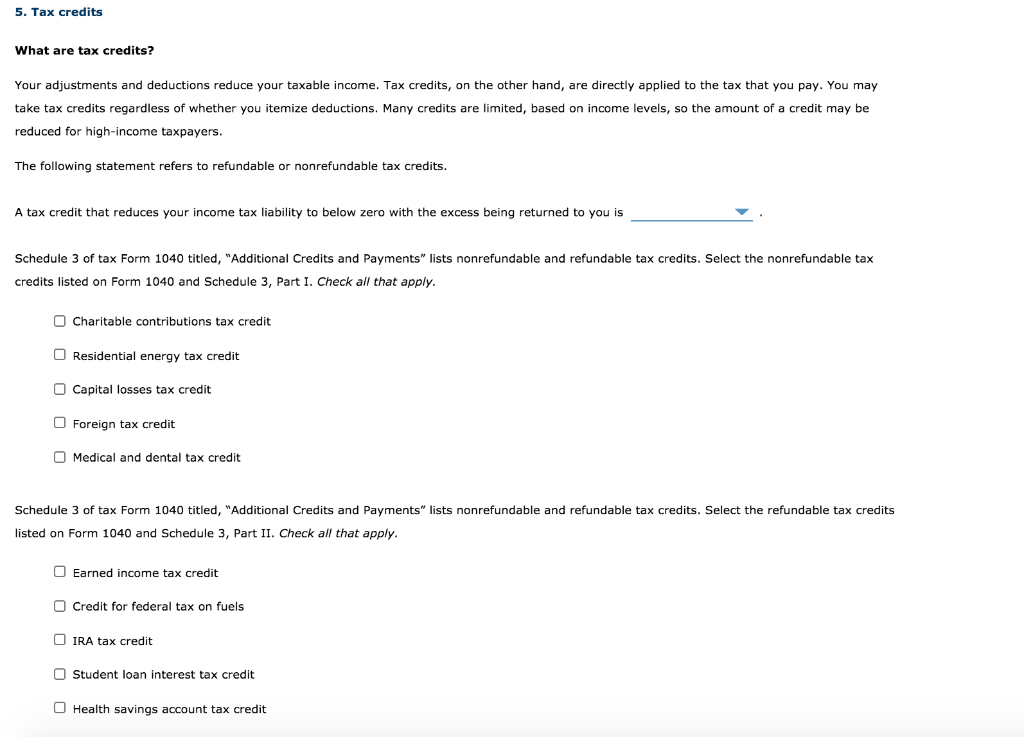

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Income Tax Rates 2022 23 Scotland Ozella Runyon

Income Tax Thresholds 2022 23 Latest News Update

Rates Allowances Thresholds UK Changes For Tax Year 2022 23

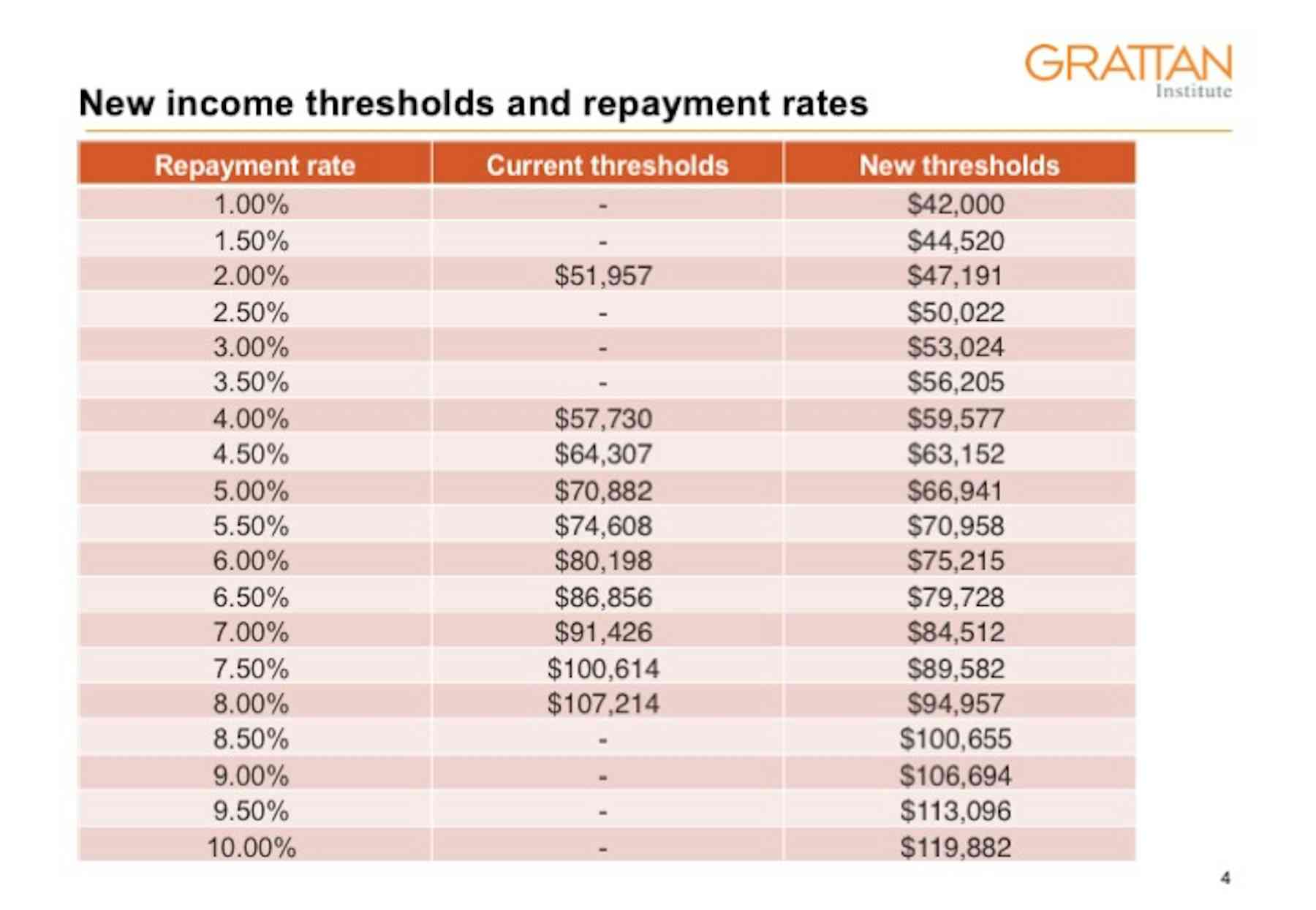

Explainer How Will The Changes To HELP Student Loans Affect You

Tax Rates And Thresholds For 2021 22 Tax Tips Galley Tindle

Tax Rates And Thresholds For 2021 22 Tax Tips Galley Tindle

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

An Explanation Of 2016 Federal Income Tax Rates

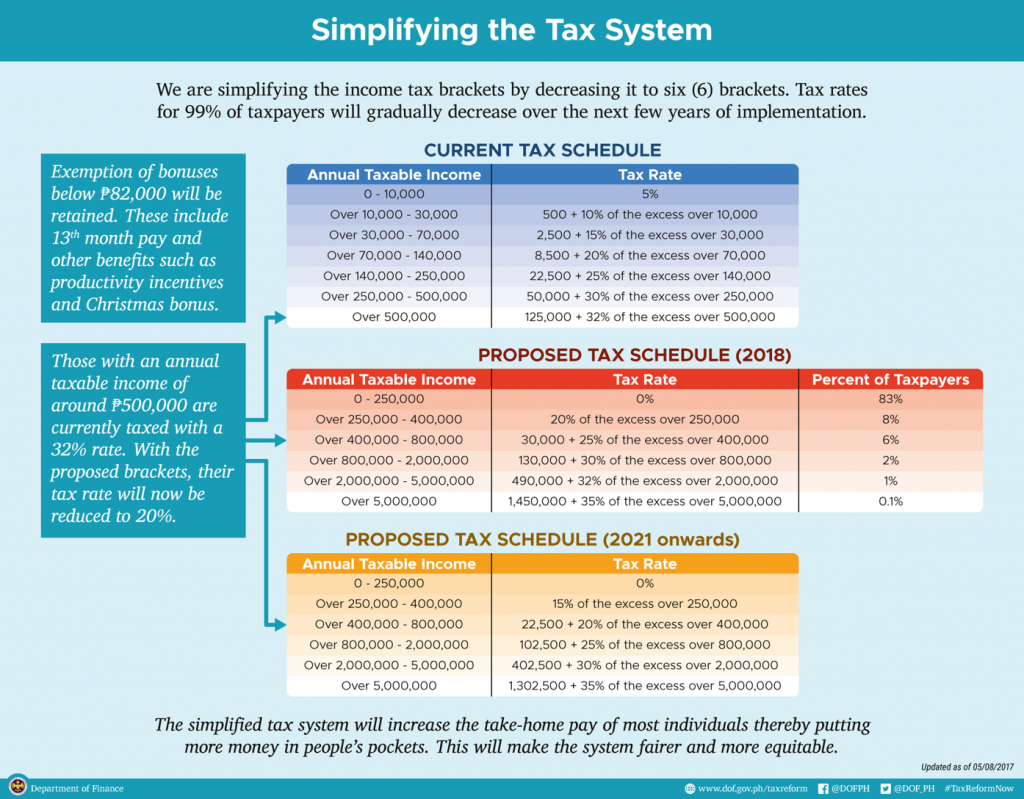

Proposed Tax Schedule Blogwatch

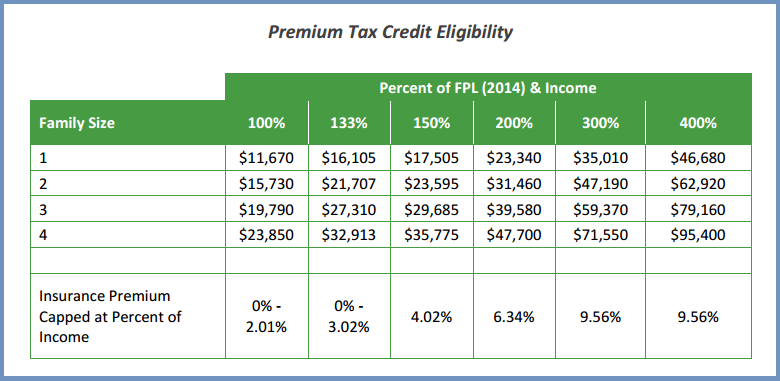

FAQs Health Insurance Premium Tax Credits

Tax Credits Income Thresholds And Determination Of Rates Regulations 2002 - What does the law mean How do tax credits work Tax credits and coronavirus Forms notices and checklists Real Time Information and tax credits