Tax Credits Meaning And Examples A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

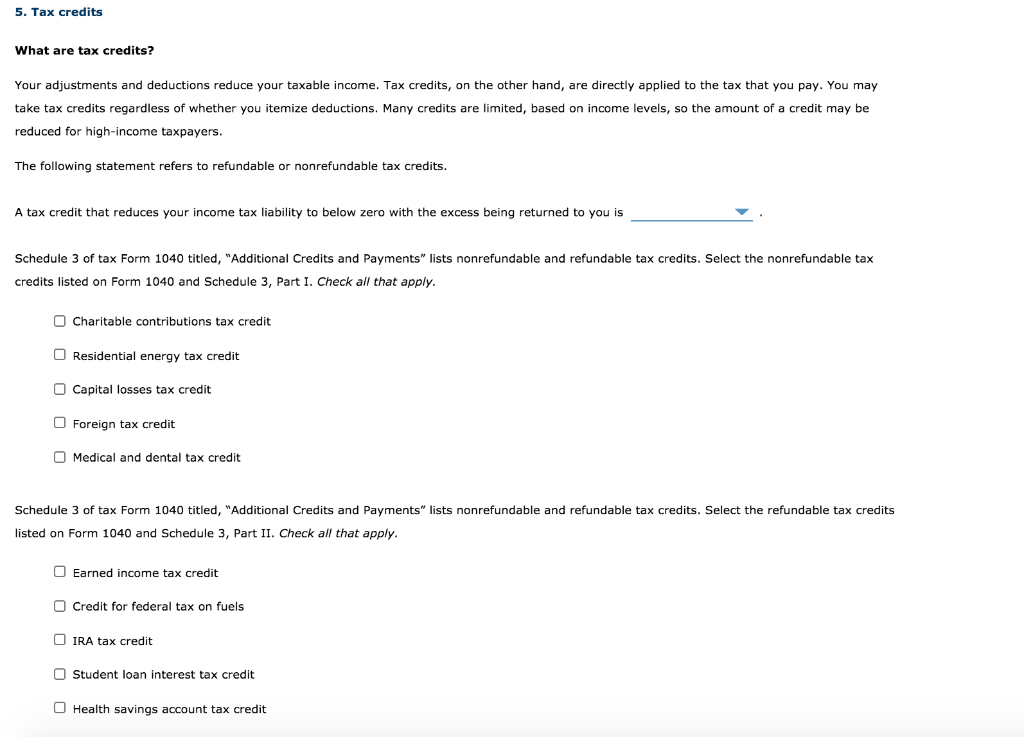

Definition of Tax Credits Tax credits are a type of financial incentive offered by the government to reduce an individual s or a company s tax liability They directly reduce the amount of tax owed dollar for dollar as opposed to tax deductions which lower the amount of taxable income A few tax credits can greatly increase the amount of money you get back on your return Here s more about what they are and how you can qualify for these tax breaks

Tax Credits Meaning And Examples

Tax Credits Meaning And Examples

https://www.taxback.com/resources/blogimages/20200507122215.1588843335429.2ea42cc2d6c8d92d7a9d6d79f87.jpg

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

https://www.thescottishsun.co.uk/wp-content/uploads/sites/2/2018/04/nintchdbpict000379813847.jpg?strip=all&quality=100&w=1200&h=800&crop=1

Tax Credits Definition Types Qualifications And Limitations

https://www.financestrategists.com/uploads/Types_of_Tax_Credits.png

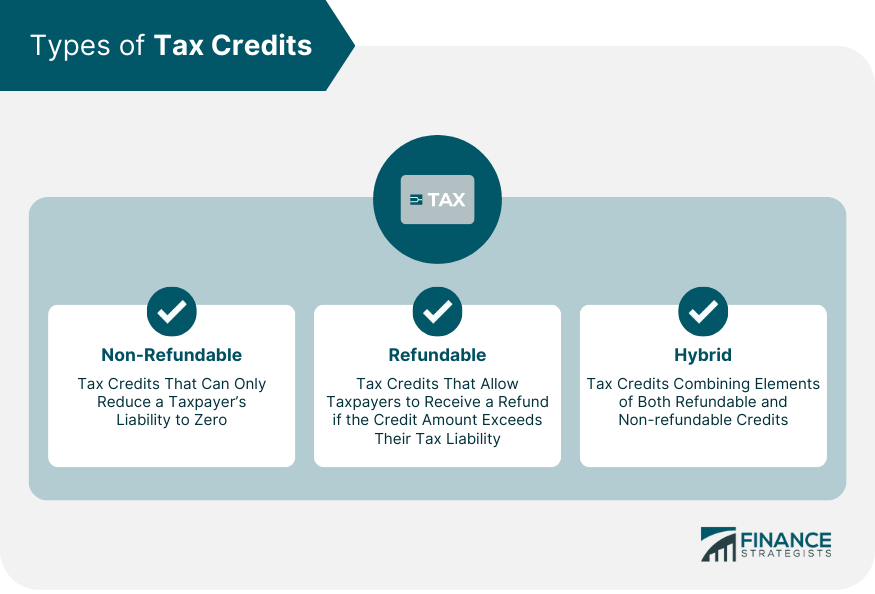

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the taxes you actually owe a tax credit is a benefit that directly reduces your tax burden Tax Credits The word tax credit refers to a sum of money that taxpayers can deduct directly from their taxes This is distinct from tax deductions which reduce an individual s taxable income The worth of a tax credit is dependent on its type

A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are nonrefundable that is they cannot reduce a

Download Tax Credits Meaning And Examples

More picture related to Tax Credits Meaning And Examples

Employee Retention Credit The Basics FRSCPA PLLC

https://www.frscpa.com/wp-content/uploads/2021/01/Tax-Credits-scaled-1.jpeg

What Are Tax Credits And How Do They Work MOMCUTE

https://www.wallstreetmojo.com/wp-content/uploads/2022/07/Tax-Credit-Working.jpg

Tax Credits Vs Tax Deductions Garden State Home Loans NJ

https://gardenstateloans.com/wp-content/uploads/2017/09/Tax-credits-vs-tax-deductions-1-1024x630.jpg

How do tax credits work Learn about the two types of tax credits refundable and nonrefundable and how they can impact you this tax season Tax credits are tax breaks that lower how much you owe to the government They can be nonrefundable refundable and partially refundable

A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a refundable credit they can get the difference back in their refund To claim a tax credit people should Keep Tax credits and tax deductions are two different things While they re both tax breaks that can reduce your tax liability they work in different ways

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

https://media.cheggcdn.com/media/4db/4db8bd1d-6102-4a72-a48f-72d1533edb22/phpsxAAGW

The Complete List Of Tax Credits For Individuals

https://1.bp.blogspot.com/-B5mx7WwZLfU/XkNu_a2Yc3I/AAAAAAAAAVI/92Bi9aK3Zck3yvveRPIUlVsZCGZHNQNlgCEwYBhgL/s1600/TaX%2BCredits%2B%25281%2529.png

https://www.irs.gov › newsroom › tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

https://www.financestrategists.com › tax › tax-planning › tax-credits

Definition of Tax Credits Tax credits are a type of financial incentive offered by the government to reduce an individual s or a company s tax liability They directly reduce the amount of tax owed dollar for dollar as opposed to tax deductions which lower the amount of taxable income

Common Tax Deductions And Credits For Small Business

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Tax Credits Vs Tax Deductions

Business Tax Credits Types Of Credits Available How To Claim

Best Tax Credits And Deductions Everyone Should Know About CBS Minnesota

Client Alert Employer Benefits And Tax Credits Part Of Families First

Client Alert Employer Benefits And Tax Credits Part Of Families First

Two Types Of Tax Credit Types Of Taxes Tax Credits Accounting Services

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Debits And Credits credits debits Accounting And Finance

Tax Credits Meaning And Examples - A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly