Tax Deductible Business Expenses India Corporate Deductions Last reviewed 15 May 2024 Expenses that are revenue in nature are by and large allowed as a deduction to businesses and professionals if they are incurred wholly and exclusively for the purpose of the business or profession not in the nature of a personal expense and

Income Tax Deductions for Business Last updated February 5th 2020 04 55 pm The Income Tax Act levies tax on income after allowing deductions to be claimed for expenses which were incurred exclusively to earn the income While calculating the income tax payable by a company Limited Liability Partnership LLP partnership or Understanding Allowability of Business Expenditure under section 37 of the Income Tax Act 1961 with latest case laws Section 37 of the Income tax Act 1961 is a residuary section for allowability of business expenditure and the same is given below 37 1 Any expenditure not being expenditure of the nature described in sections 30 to 36

Tax Deductible Business Expenses India

Tax Deductible Business Expenses India

https://businessfirstfamily.com/wp-content/uploads/2016/08/tax-deductible-expenses-for-business.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

List Of Tax Deductions Here s What You Can Deduct

https://s.yimg.com/uu/api/res/1.2/PZHKfKkv5p.BgGeZMfyACA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/gobankingrates_644/d87a23f0b34a2e279043d0f64d549859

Updated on May 6th 2024 21 min read The Income Tax Act of 1961 allows various deductions for taxpayers to help them manage their tax liability better Section 36 of the Income Tax Act illustrates various expenses that are allowed as a deduction from the income earned from business and profession Section 37 General Deductions Allowed for Business Profession Updated on 16 Jan 2024 05 49 PM This section provides an overview of the general deductions allowed for income tax purposes under section 37 of the Income Tax Act

Business Related Travel Expenses are Tax Deductible According to the Internal Revenue Service IRS you can deduct ordinary and necessary expenses for travel away from The following are some of the business utility expenses that are claimable for deductions Preliminary expenses All expenses made prior to the establishment of

Download Tax Deductible Business Expenses India

More picture related to Tax Deductible Business Expenses India

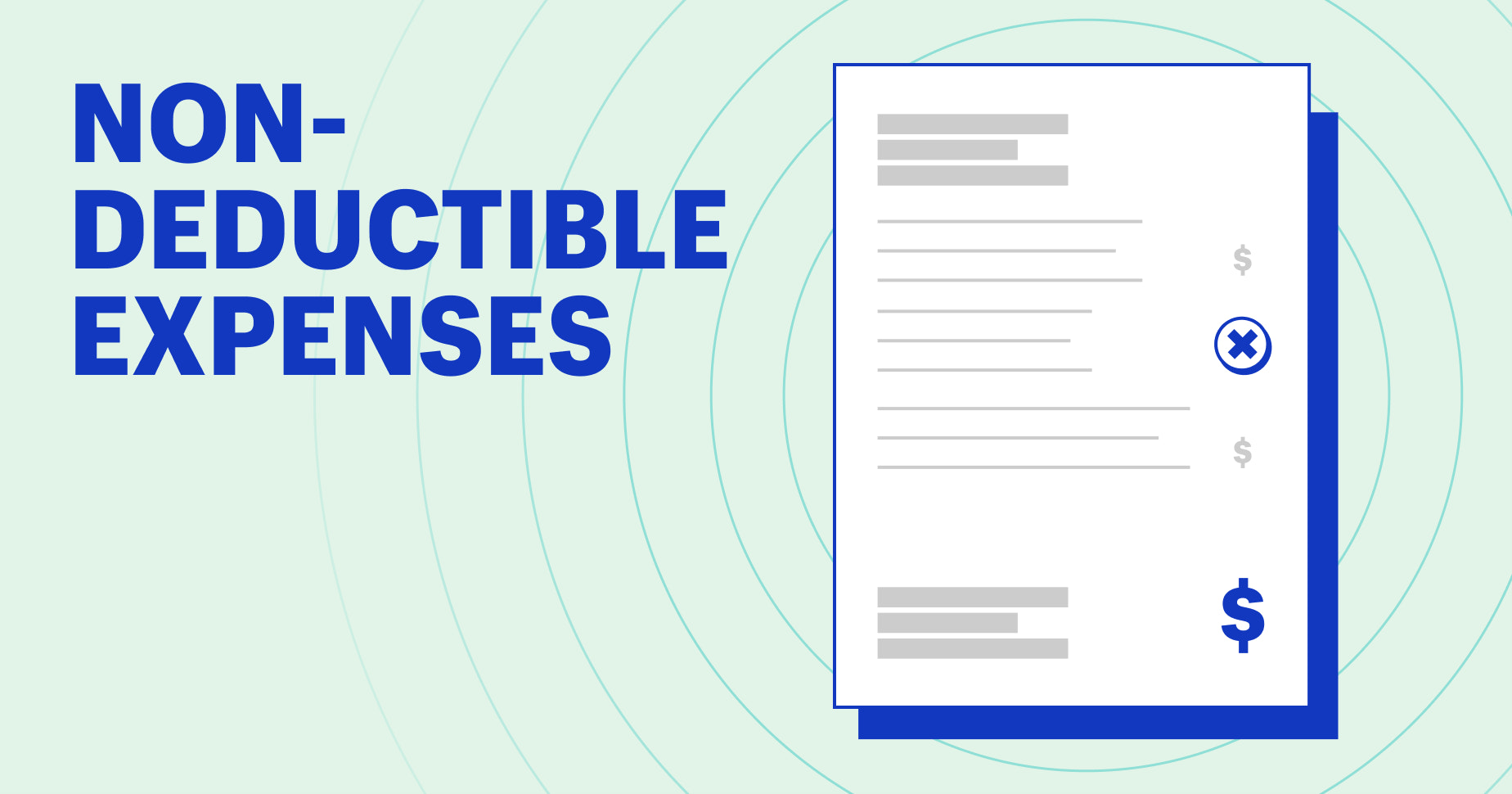

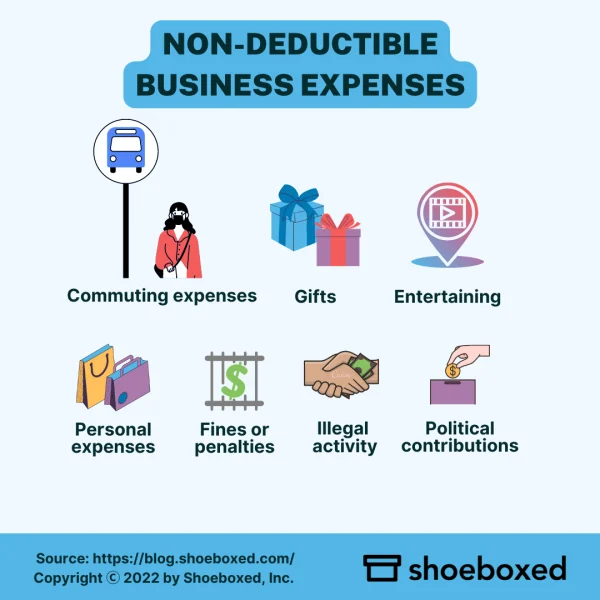

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Tax Deductions Credits Business Expenses Reviewed by Anjaneyulu Updated on Apr 02 2024 Introduction Businesses and professionals have to incur Sections 30 to 36 of the Act deal with deductions for computing profits and gains of business or profession and also prescribes certain conditions to avail of such deductions The amount of interest paid with respect to capital borrowed for the purposes of business or profession is one among them

Most of the business expenses are deductible under the income tax act the deduction of expenses reduces the tax liability How many types of Business A tax deduction is an expense allowance or exemption that lowers a person s or a company s taxable income It assists people and organizations in

Have Fun Without Worries It s Tax Deductible

https://www.yycadvisors.com/images/entertainmenttaxcompressed.jpg

Tax Deductible Business Expenses For Doulas

https://www.inspiredbirthpro.com/wp-content/uploads/2010/03/Business-Expenses.jpg

https://taxsummaries.pwc.com/india/corporate/deductions

Corporate Deductions Last reviewed 15 May 2024 Expenses that are revenue in nature are by and large allowed as a deduction to businesses and professionals if they are incurred wholly and exclusively for the purpose of the business or profession not in the nature of a personal expense and

https://www.indiafilings.com/learn/income-tax-deductions-business

Income Tax Deductions for Business Last updated February 5th 2020 04 55 pm The Income Tax Act levies tax on income after allowing deductions to be claimed for expenses which were incurred exclusively to earn the income While calculating the income tax payable by a company Limited Liability Partnership LLP partnership or

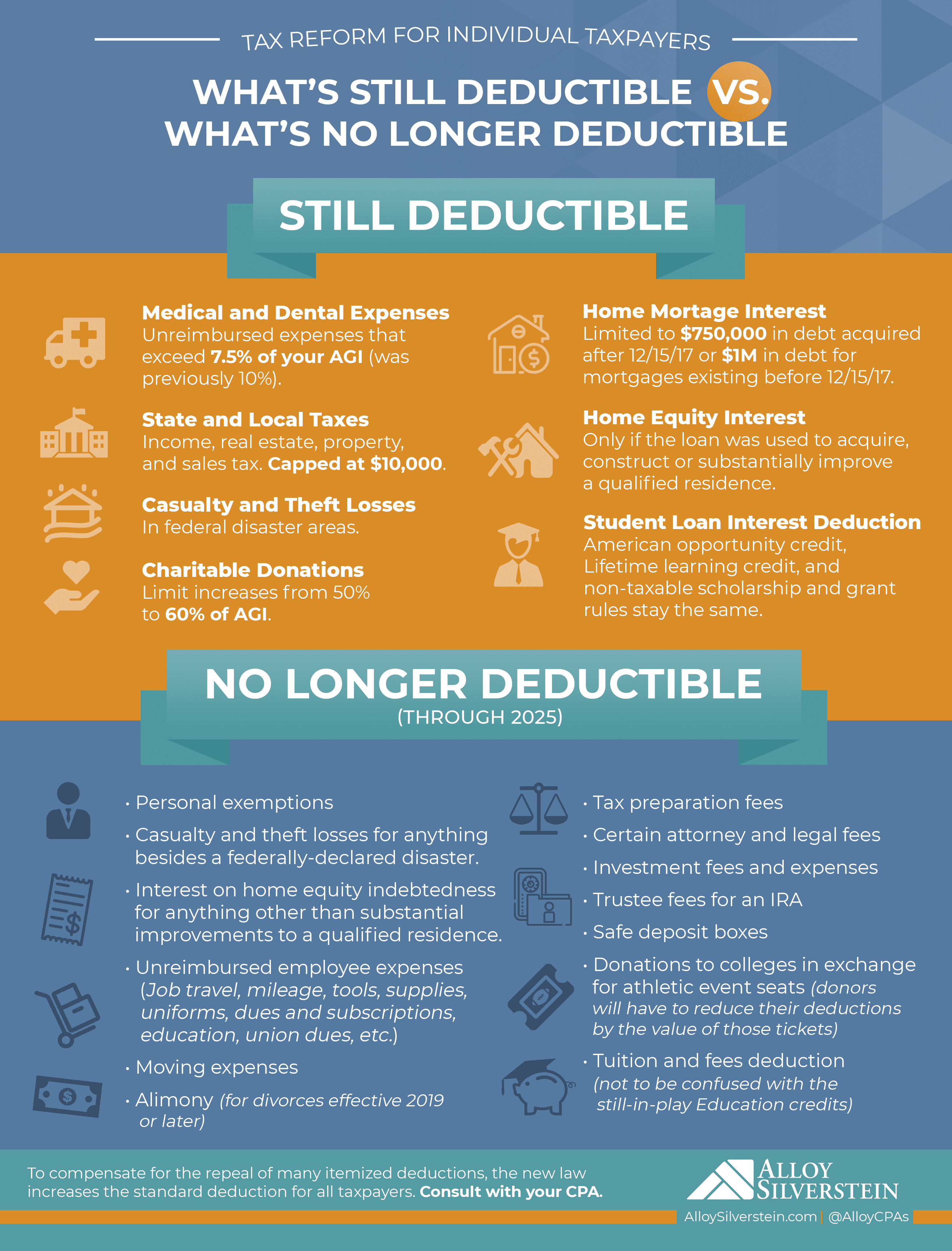

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Have Fun Without Worries It s Tax Deductible

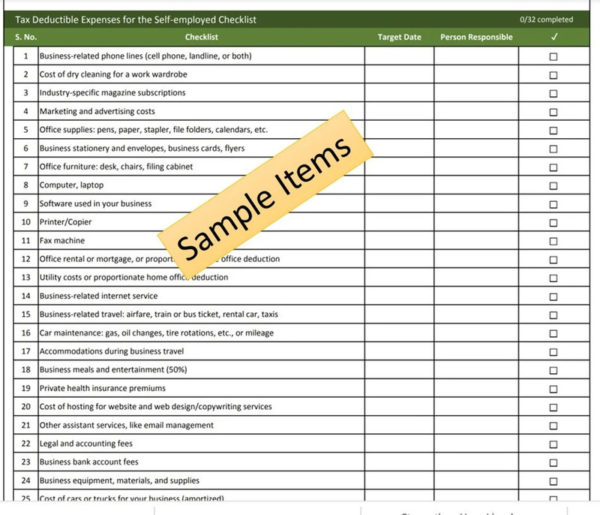

Tax Deductible Expenses For The Self employed Checklist

What Are Tax Deductible Business Expenses Compass Accounting

Do I Have To Have An LLC To Deduct Business Expenses

A Guide To Tax Deductible Business Expenses BDC ca

A Guide To Tax Deductible Business Expenses BDC ca

Complete Must Have List Of Rental Property Expenses The Profit Property

Nondeductible Expenses Meaning List FAQs Shoeboxed

Have Fun Without Worries It s Tax Deductible

Tax Deductible Business Expenses India - Business Related Travel Expenses are Tax Deductible According to the Internal Revenue Service IRS you can deduct ordinary and necessary expenses for travel away from