Tax Deductible Donations Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

Taxpayers may deduct charitable donations of up to 60 of their adjusted gross incomes Charitable donations to individuals no matter how worthy are not deductible Rules for Charitable You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more than 250 You must have written appraisals for noncash donations

Tax Deductible Donations

Tax Deductible Donations

https://4.bp.blogspot.com/-nR3ri3XCT_U/VvYsA2vOfkI/AAAAAAAAFZM/Pbve44ORGNAQIWGzQaQgsknZ5LMc9cygw/s1600/Tax%2BBenefit%2Bof%2BNRI%2Baccounts.jpg

Tax Deductible Donations Wealth How

https://pixfeeds.com/images/47/513215/1280-913705116-tax-deductible-donations.jpg

Explainer Why Are Donations To Some Charities Tax deductible

https://images.theconversation.com/files/160105/original/image-20170309-21047-1tidnuj.jpg?ixlib=rb-1.1.0&rect=0%2C366%2C4018%2C1948&q=45&auto=format&w=1356&h=668&fit=crop

Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are limited to 60 of the If donating to a charity is part of your tax plan here are a couple of tips so you can maximize your tax deductible donation before year end Featured Partner Offers Federal Filing Fee 69

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search Generally you can deduct contributions up to 60 of your adjusted gross income AGI depending on the nature and tax exempt status of the charity to which you re giving You can deduct contributions of appreciated assets up to 20 of your AGI

Download Tax Deductible Donations

More picture related to Tax Deductible Donations

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://images.prismic.io/wealthfit-staging/5a24d2af02c0d250c371601bf4063747e9901677_03-maximize-charitable-deductions.jpg?auto=compress,format&w=1772

A Guide To Tax Deductible Donations Best Charities To Donate To

https://www.sbg.org.au/wp-content/uploads/2014/08/Tax-deductible-donations.jpg

Tax Deductible Donations

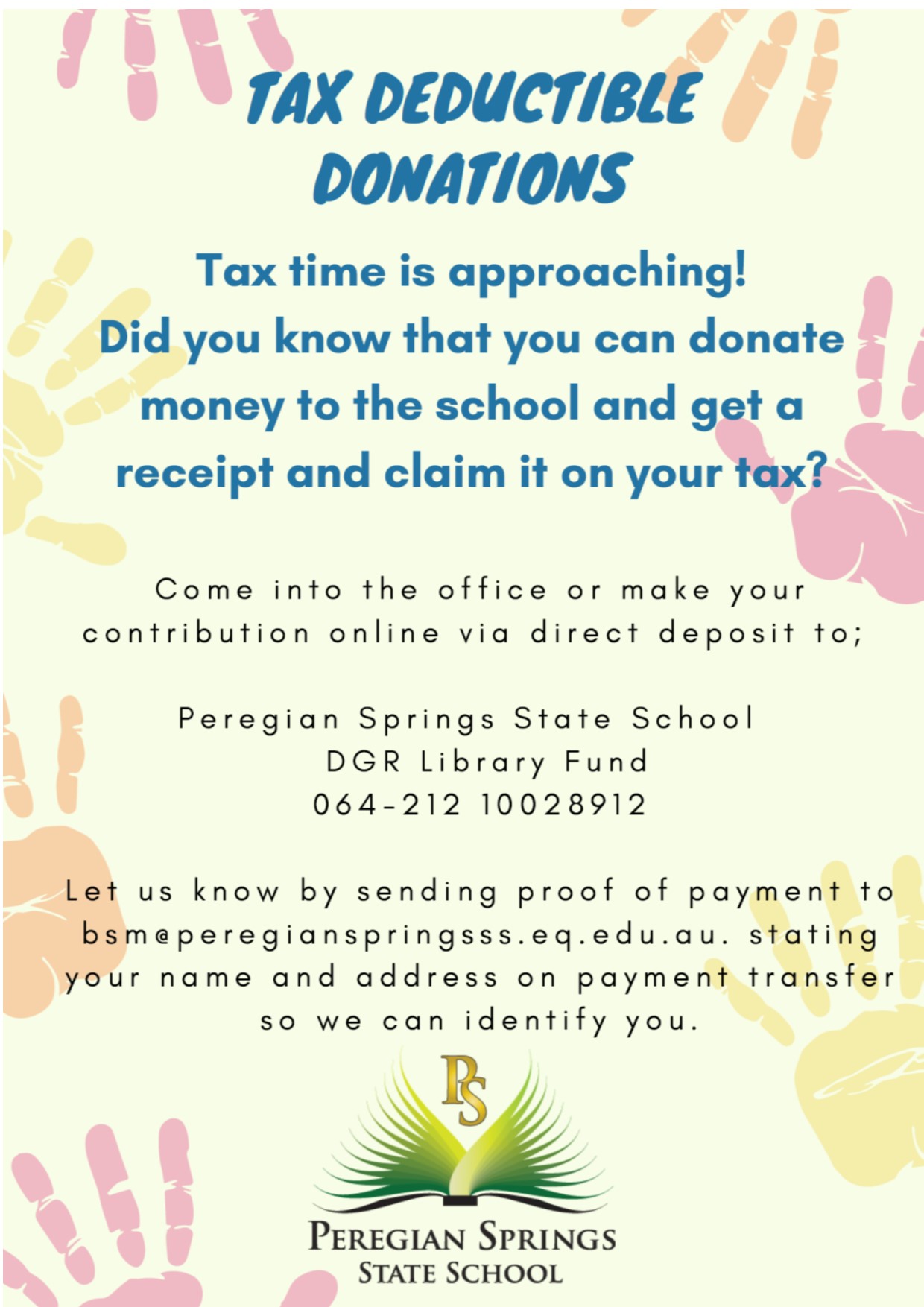

https://peregianspringsss.eq.edu.au/SiteCollectionImages/Tax dedcuctale donations.jpg

Understanding Tax Deductible Donations It is important to note that a charitable donation is a gift of money or goods to a tax exempt organization such as a charity that can reduce your taxable income Donating to a qualifying nonprofit allows you to claim deductions ultimately reducing the amount of income subject to taxes Tax law requires that deductions are allowed only for contributions that serve a charitable purpose A recipient organization must qualify for tax exempt status as required by the tax code

[desc-10] [desc-11]

Guide To Tax Deduction For Charitable Donations Backpacks USA

https://cdn.shopify.com/s/files/1/0533/2241/6308/files/guide-to-tax-deductions-for-charitable-donations-infographic.jpg

Tax Deductible Donations Reduce Your Income Tax Charity Tax Calculator

https://www.thesmithfamily.com.au/-/media/images/campaigns/tax-steps-infov2/Tax-page-infographicv2.png?h=2160&w=3840&la=en&hash=CD10B58E7976DC39CC2E07D255B005E2

https://www.nerdwallet.com/article/taxes/tax...

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

https://www.investopedia.com/terms/c/charitabledonation.asp

Taxpayers may deduct charitable donations of up to 60 of their adjusted gross incomes Charitable donations to individuals no matter how worthy are not deductible Rules for Charitable

Tax Deductible Donation Form SEE Foundation

Guide To Tax Deduction For Charitable Donations Backpacks USA

Save More Money With Tax Deductible Donations C D LLP

Donations Tax Deductible

How To Make Sure Your Charitable Donation Is Tax Deductible Tax

Tax Deductible Donation Receipt Printable Addictionary

Tax Deductible Donation Receipt Printable Addictionary

Tax Deductible Receipt Template

Tips Tax Deductible Donations For Charity Medeiros Souza

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

Tax Deductible Donations - [desc-13]