Tax Deductible Employment Expenses Employment expenses are expenses that are wholly and exclusively incurred in the production of your employment income in Singapore Allowable employment expenses may be deducted from your employment income Allowable expenses Allowable employment expenses must satisfy all the following conditions

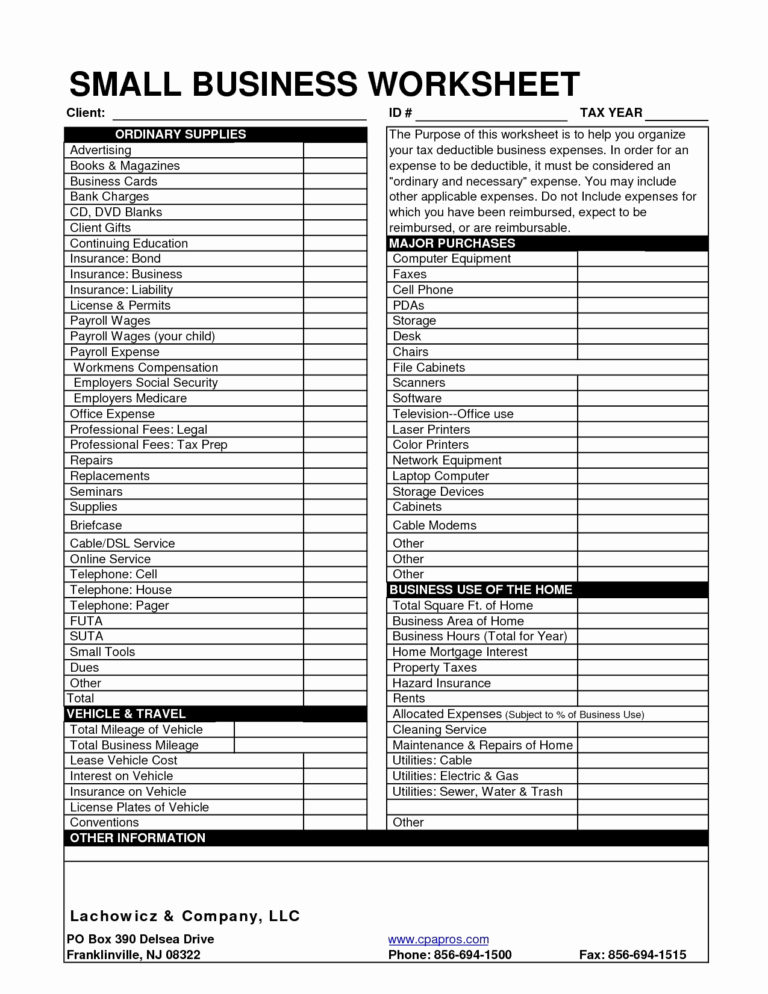

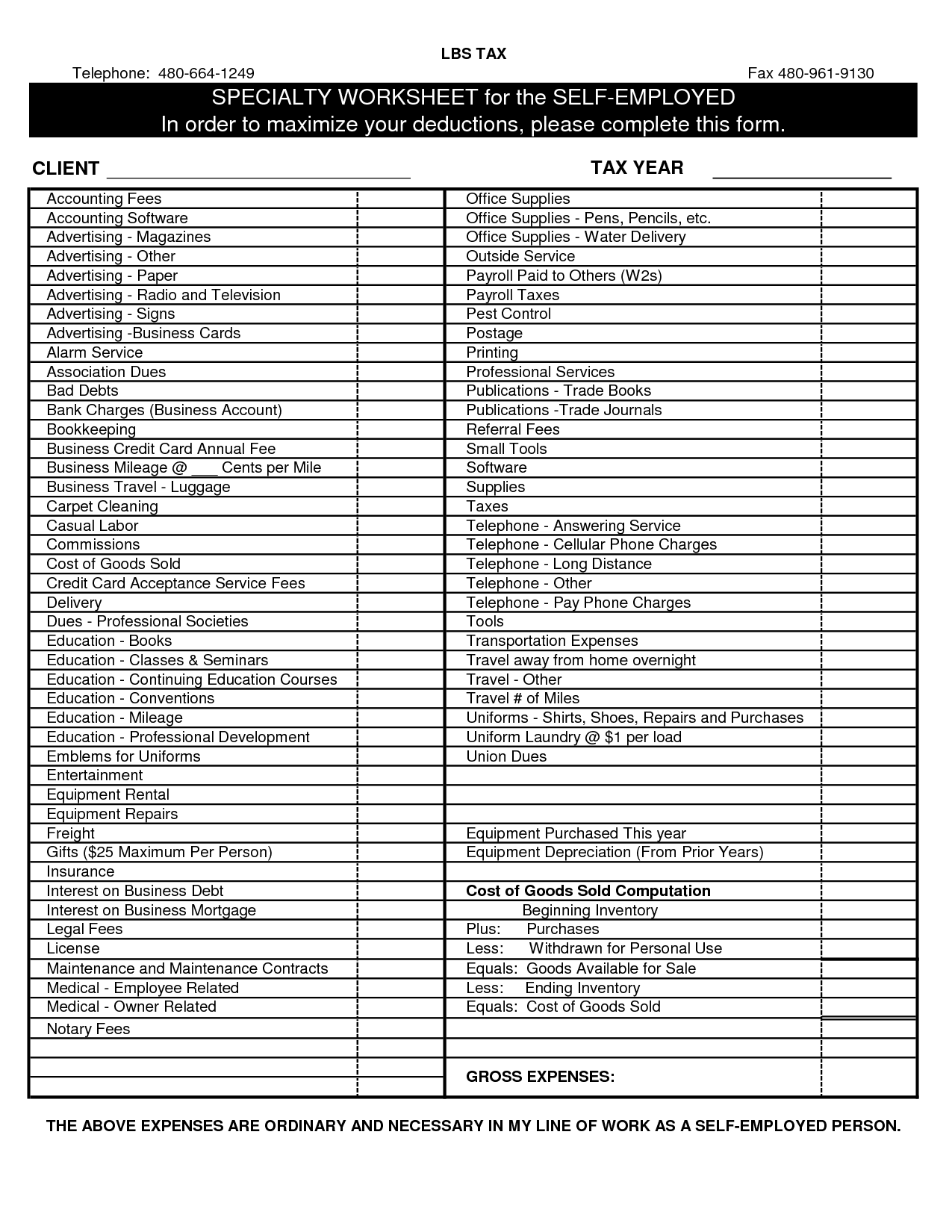

Jul 28 2023 4 minutes Table of Contents No matter whether a company is big or small every business incurs costs and expenses that may reduce the business taxable income Sometimes employees not just employers are the ones who incur business expenses That s where employee expense reimbursement comes in Salaries and wages are only deductible in the tax year you make them but this can depend on your method of accounting The payments must be considered reasonable and necessary in the course of your business These and other rules also apply to bonuses awards vacation pay and sick leave

Tax Deductible Employment Expenses

Tax Deductible Employment Expenses

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

17 Self employed Tax Deductions To Lower Your Tax Bill In 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/top-self-employed-tax-deductions.png

Home Office Deduction Worksheet HMDCRTN

https://i0.wp.com/i.pinimg.com/originals/fb/04/64/fb046437592342cbcd33fc4e7c06451d.jpg?w=640&is-pending-load=1#038;ssl=1

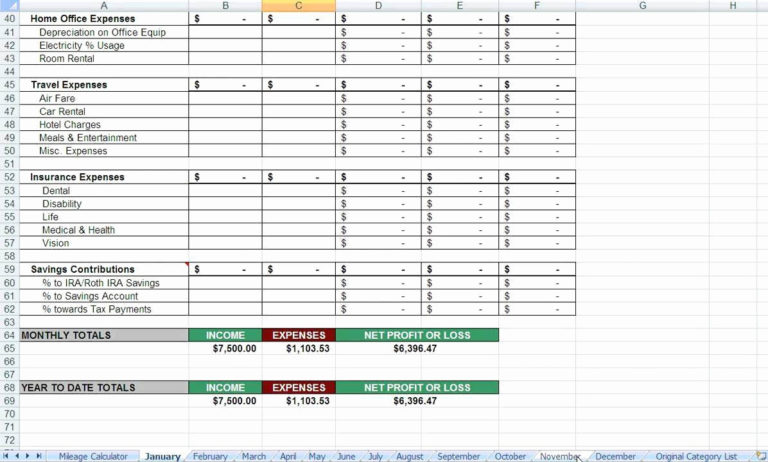

Line 22900 Other employment expenses You can deduct certain expenses including any GST HST you paid to earn employment income You can do this only if your employment contract required you to pay the expenses and you did not receive an allowance for them or the allowance you received is included in your income 1 Home office deduction The home office deduction may be the largest deduction available if you re self employed If you work 100 remotely as a W 2 employee you do not qualify for

The deductible expenses include any GST HST you incur on these expenses minus the amount of any input tax credit claimed Also since you cannot deduct personal expenses enter only the business part of expenses on Form T2125 T2042 or T2121 Note Expenses that are paid to earn employment income are sometimes deductible including any GST HST that was paid on them This can only be done if your employer requires you to pay the expenses and either you didn t receive reimbursement for the expenses or the amount you did receive is included in your income

Download Tax Deductible Employment Expenses

More picture related to Tax Deductible Employment Expenses

Resources

http://tax29.com/wp-content/uploads/2016/11/Tax29-Self-Employed-Deduction-List.png

Sales Tax Worksheet Or Financial Statement Worksheet Template And Sch n

https://www.semesprit.com/wp-content/uploads/2018/08/sales-tax-worksheet-along-with-57-beautiful-gallery-tax-deduction-spreadsheet-template-excel-of-sales-tax-worksheet.jpg

Cleaning Business Expenses Spreadsheet Db excel

https://db-excel.com/wp-content/uploads/2018/11/sample-spreadsheet-of-business-expenses-yaruki-up-for-cleaning-intended-for-cleaning-business-expenses-spreadsheet-752x970.jpg

You may be able to claim expenses you paid to earn employment income under these two conditions Your employment contract requires you to incur these expenses as part of your employment Your employer did not reimburse you Eligible expenses you can claim under the T2200 form include To get started what is a deductible unreimbursed employee business expense Per Sec 162 a there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the tax year in

Updated on October 12 2022 Fact checked by Sarah Fisher In This Article View All Photo katleho Seisa Getty Images Was this page helpful Although most employees won t be able to deduct job related expenses on their federal tax returns again until at least 2026 there are some exceptions Can employees deduct any job related expenses SOLVED by TurboTax 5121 Updated December 11 2023 Job related expenses for employees are no longer deductible on most people s federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress passed and the President signed into law

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Tax Worksheettax Deductible Expense Logtax Deductions Etsy In 2022

https://i.pinimg.com/736x/82/5f/2f/825f2fe72ee96f4d836e19fa9a2df8fe.jpg

https://www.iras.gov.sg/.../employment-expenses

Employment expenses are expenses that are wholly and exclusively incurred in the production of your employment income in Singapore Allowable employment expenses may be deducted from your employment income Allowable expenses Allowable employment expenses must satisfy all the following conditions

https://www.justworks.com/blog/expenses-101...

Jul 28 2023 4 minutes Table of Contents No matter whether a company is big or small every business incurs costs and expenses that may reduce the business taxable income Sometimes employees not just employers are the ones who incur business expenses That s where employee expense reimbursement comes in

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

Tax Deduction Spreadsheet Excel As Spreadsheet Software House With Tax

Best Tax Deductions Form Fill Out And Sign Printable Pdf Template

Business Expense Deductions Spreadsheet Db excel

Farm Expenses Spreadsheet Charlotte Clergy Coalition

Farm Expenses Spreadsheet Charlotte Clergy Coalition

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

Solved Please Note That This Is Based On Philippine Tax System Please

A Singaporean s Guide How To Claim Income Tax Deduction For Work

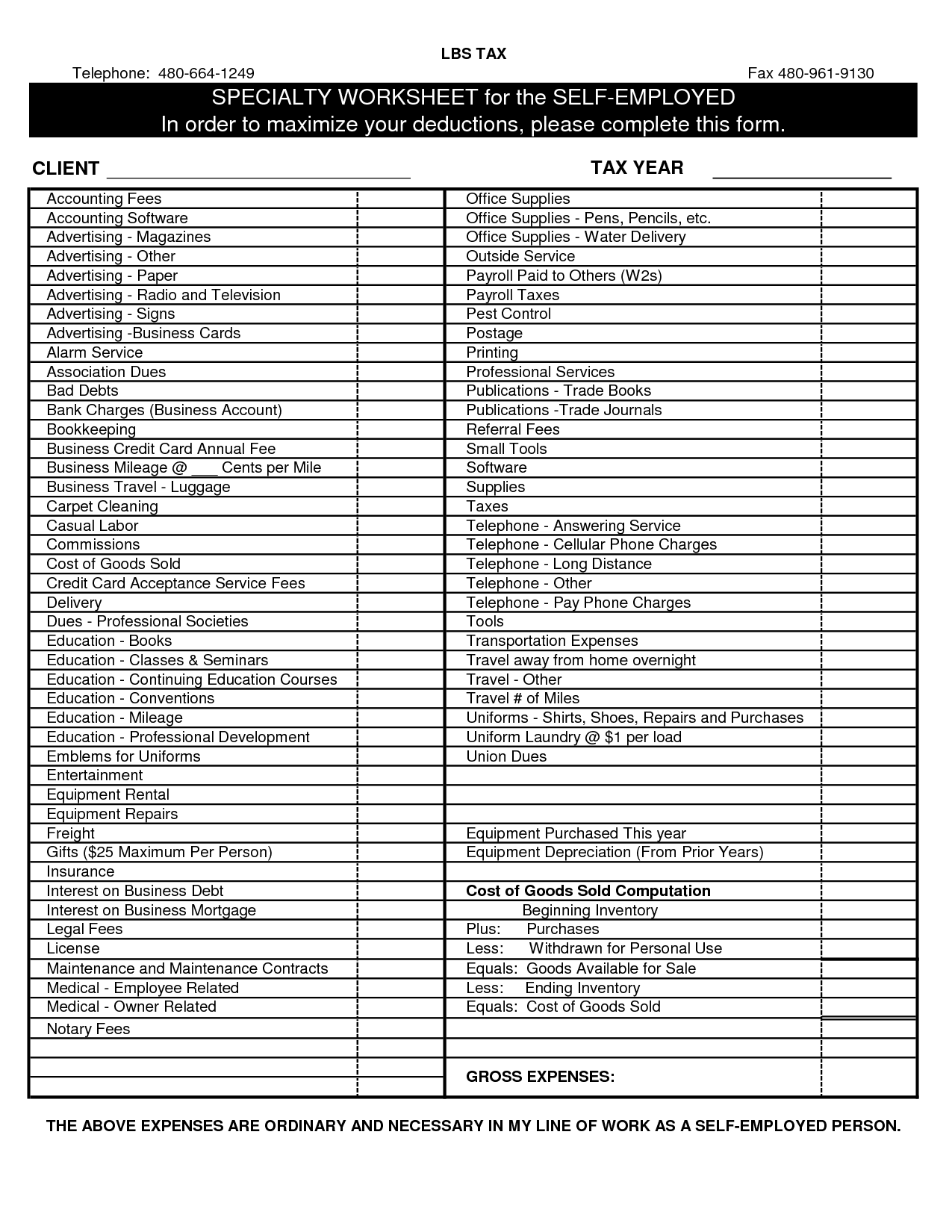

Tax Deductible Employment Expenses - Tax deductible business expenses If you re self employed your business will have various running costs You can deduct some of these as part of your annual tax return to work out