Tax Deductible Expenses Thailand PwC Thailand I Thai Tax 2023 24 Booklet 7 Deductible expenses The amount of personal expenses that may be deducted depends on the category of assessable

For residents of Thailand including foreign residents of Thailand Thai personal income tax law permits the following deductions against assessable income Deductions for Welcome to our guide on tax rates allowances and deductions for expats in Thailand Here we break down the income tax system for expatriates showing tax rates and brackets based on

Tax Deductible Expenses Thailand

Tax Deductible Expenses Thailand

https://i.etsystatic.com/23545555/r/il/f49ff7/3754474129/il_1080xN.3754474129_gsw3.jpg

Hair Salon Monthly Expenses Google Search Tax Deductions Tax

https://i.pinimg.com/originals/59/a8/f5/59a8f5c21289277936f1e4c5ed2b0d42.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions-1024x631.png

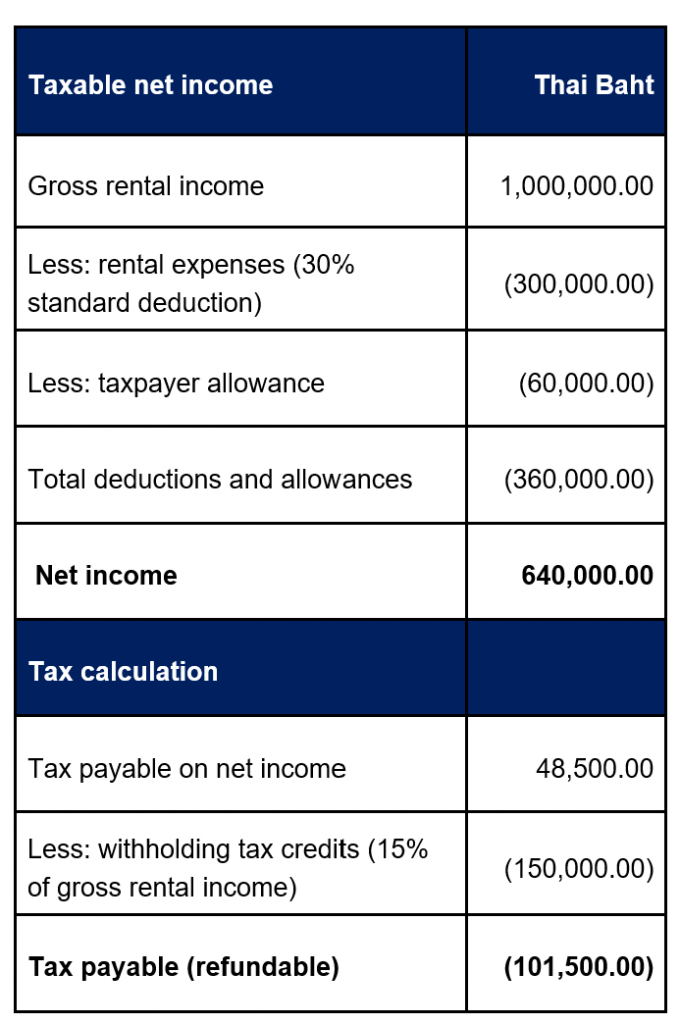

PwC Thailand I Thai Tax 2020 21 Booklet 6 Deductible expenses The amount of personal expenses that may be deducted depends on the category of assessable income as Taxpayer shall make deductions from assessable income before the allowances are granted Therefore taxable income is calculated by TAXABLE

Expenses for your own or your dependents education in Thailand are deductible Donations to approved charities and religious institutions in Thailand are tax deductible Contributions to approved retirement Find out how much Thailand income tax you ll pay when working or retiring here and the deductions and allowances you can claim back

Download Tax Deductible Expenses Thailand

More picture related to Tax Deductible Expenses Thailand

Three Factors In Determining Tax Deductible Expenses

https://media.nationthailand.com/images/news/2011/12/19/30172200/ori_30172200-01.jpg

Malaysia Rental Income Tax Deductible Expenses Brian Blake

https://www.hlbthai.com/wp-content/uploads/2022/04/Screenshot-2021-05-29-160904-680x1024-1.png

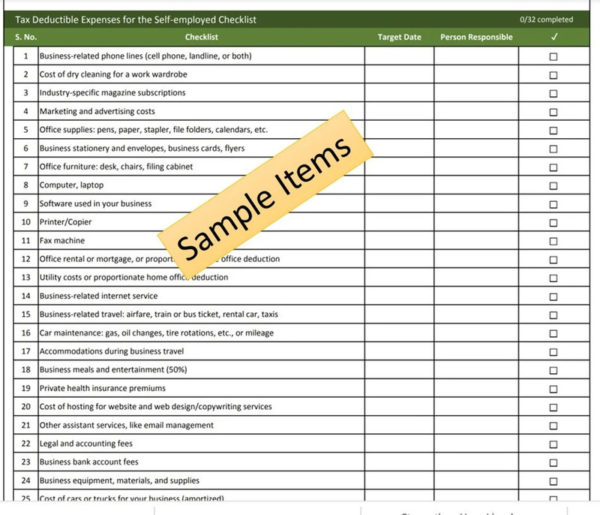

Tax Deductible Expenses For The Self employed Checklist

https://www.checklisted.us/wp-content/uploads/2022/05/Tax-Deductible-Expenses-for-the-Self-employed-Checklist-1-600x515.jpg

The Thailand Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Thailand This includes calculations for Employees in Thailand to The formula for calculating tax in Thailand Net Income Assessable income Deduction Allowances x Tax rate PIT The use of deduction allowances will help to reduce tax

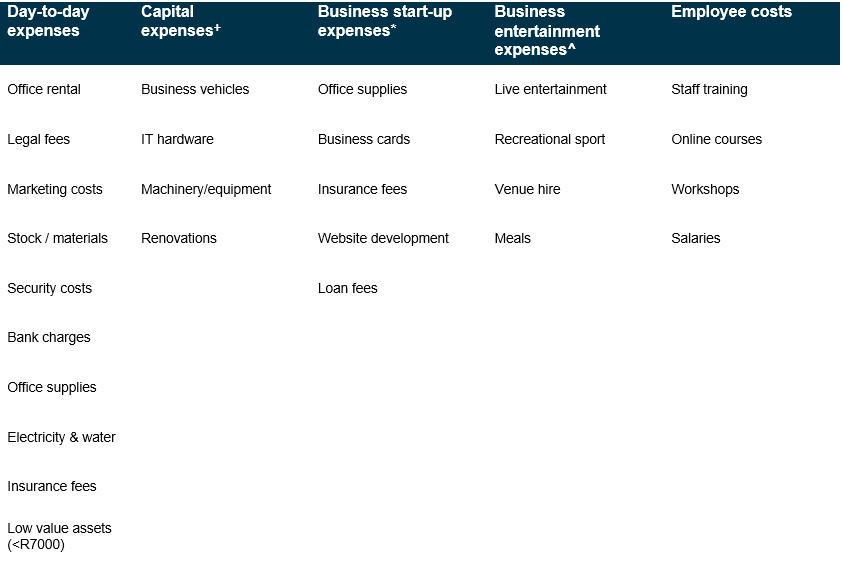

Liquidation proceeds is allowed as a deductible expense once the process of liquidation officially finished Conditions for credits Only dividend withholding tax is allowed as tax 5 Deductible Expenses and Allowance Generally expenses incurred exclusively for the purpose of generating income or for the purpose of business other than certain

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

Income Tax Deductible Expenses Timenews

https://capitalist.com.br/wp-content/uploads/2023/05/IRPF-1000x600.png

https://www.pwc.com/th/en/tax/assets/thai-tax/thai...

PwC Thailand I Thai Tax 2023 24 Booklet 7 Deductible expenses The amount of personal expenses that may be deducted depends on the category of assessable

https://sherrings.com/personal-tax-deductions-allowances-thailand.html

For residents of Thailand including foreign residents of Thailand Thai personal income tax law permits the following deductions against assessable income Deductions for

The Tax Deductions And Credits You Can Claim In Australia

Understanding Nondeductible Expenses For Business Owners

Tax Of Myanmar Q A Yangon

10 Deductible Expenses In The Philippines To Lower Your Dues

Tax deductible Expenses For Small Businesses On Accounting

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

Investment Expenses What s Tax Deductible Charles Schwab

Your Separation Agreement Impacts Whether Spousal Support Payments Are

Tax Deductions Top 15 For Rental Income Www taxkenya

Tax Deductible Expenses Thailand - Taxpayer shall make deductions from assessable income before the allowances are granted Therefore taxable income is calculated by TAXABLE