Tax Deduction Alabama Alabama provides a standard Personal Exemption tax deduction of 1 500 00 in 2024 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduce the amount

Amendment No 225 to the Constitution of Alabama of 1901 proclaimed ratified December 13 1965 provided deduction for federal income taxes paid by individual taxpayers SmartAsset s Alabama paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Tax Deduction Alabama

Tax Deduction Alabama

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

What Is The Alabama Standard Deduction For 2023 Support

https://support.taxslayer.com/hc/article_attachments/11587771249677

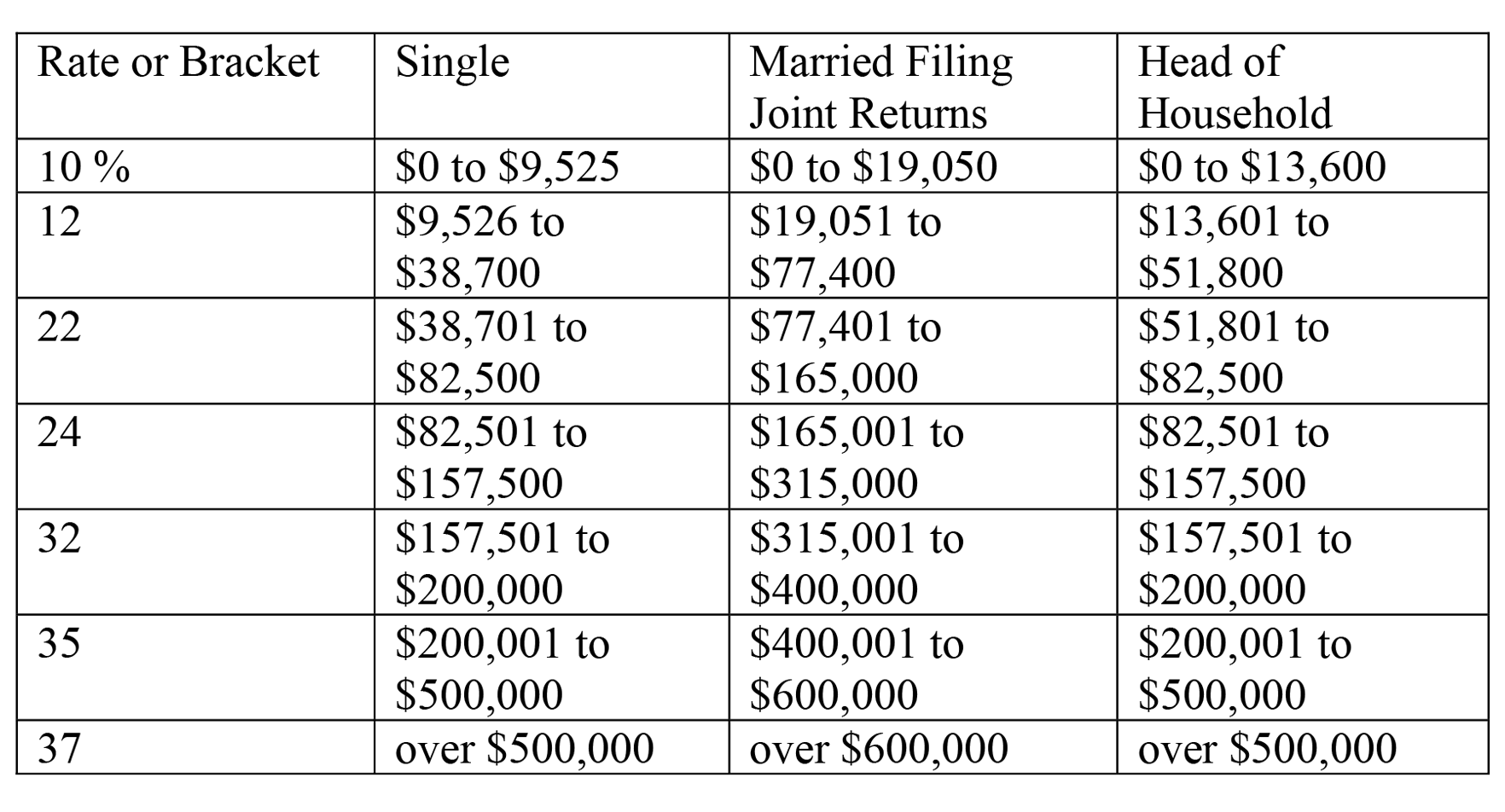

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Does Alabama provide for a federal income tax deduction Yes Federal income tax may be deducted for the taxable year in which paid or accrued according to the method of accounting Alabama provides a standard Personal Exemption tax deduction of 1 500 00 in 2023 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2023

For single filers the rates are 2 on the first 500 of taxable income 4 on income between 501 and 3 000 and 5 on income over 3 000 Updated on Jul 23 2024 169 rowsCalculate your total Alabama state income tax Derive your Alabama local income tax liability Gross income minus taxes deductions and withholdings Divide your net pay by your pay frequency

Download Tax Deduction Alabama

More picture related to Tax Deduction Alabama

How Much Is The Alabama Standard Deduction Ozark

https://oaraka.ozarkalabama.org/what-is-the-current-alabama-income-tax-rate-.jpg

Removing The FIT Deduction Would Allow Alabama To Untax Groceries

https://www.alarise.org/wp-content/uploads/2019/04/Alabama-FIT-Deduction-Grocery-Tax-Cut-May-2019-768x768.png

What Crowdfunding Means And How Tax Deductions Are Related

https://www.ketto.org/wp-content/uploads/2020/09/Crowdfunding-and-Tax-Deduction.jpg

Alabama s 2024 income tax ranges from 2 to 5 This page has the latest Alabama brackets and tax rates plus a Alabama income tax calculator Income tax tables and other tax information is sourced from the Alabama Department How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we

Calculate your total tax due using the AL tax calculator update to include the 2024 25 tax brackets Deduct the amount of tax paid from the tax calculation to provide an example of your 2024 25 tax refund Alabama has three income tax brackets but most people pay the highest rate of 5 since it applies to income over 6 000 for married couples filing jointly and income over

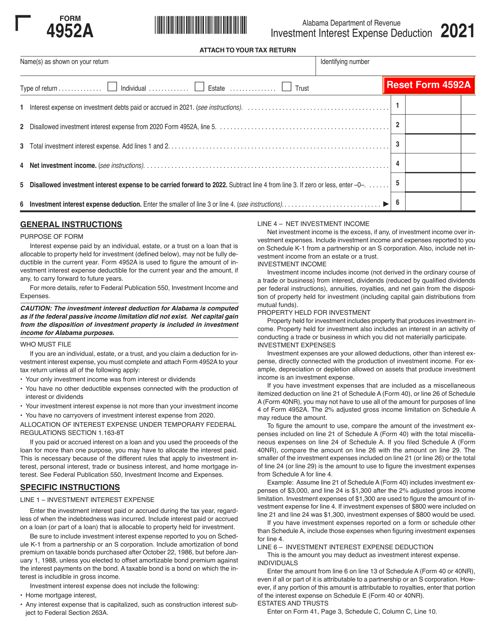

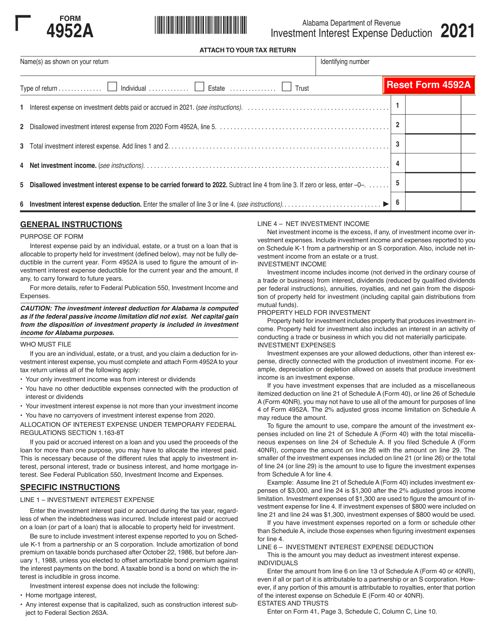

Form 4952A Download Fillable PDF Or Fill Online Investment Interest

https://data.templateroller.com/pdf_docs_html/2433/24331/2433167/form-4952a-investment-interest-expense-deduction-alabama_big.png

Federal Tax Deductions Worksheet

http://www.worksheeto.com/postpic/2014/06/federal-income-tax-deduction-worksheet_449368.jpg

https://al-us.icalculator.com/income-tax-rates/2024.html

Alabama provides a standard Personal Exemption tax deduction of 1 500 00 in 2024 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduce the amount

https://www.revenue.alabama.gov/tax-types/individual-income-tax

Amendment No 225 to the Constitution of Alabama of 1901 proclaimed ratified December 13 1965 provided deduction for federal income taxes paid by individual taxpayers

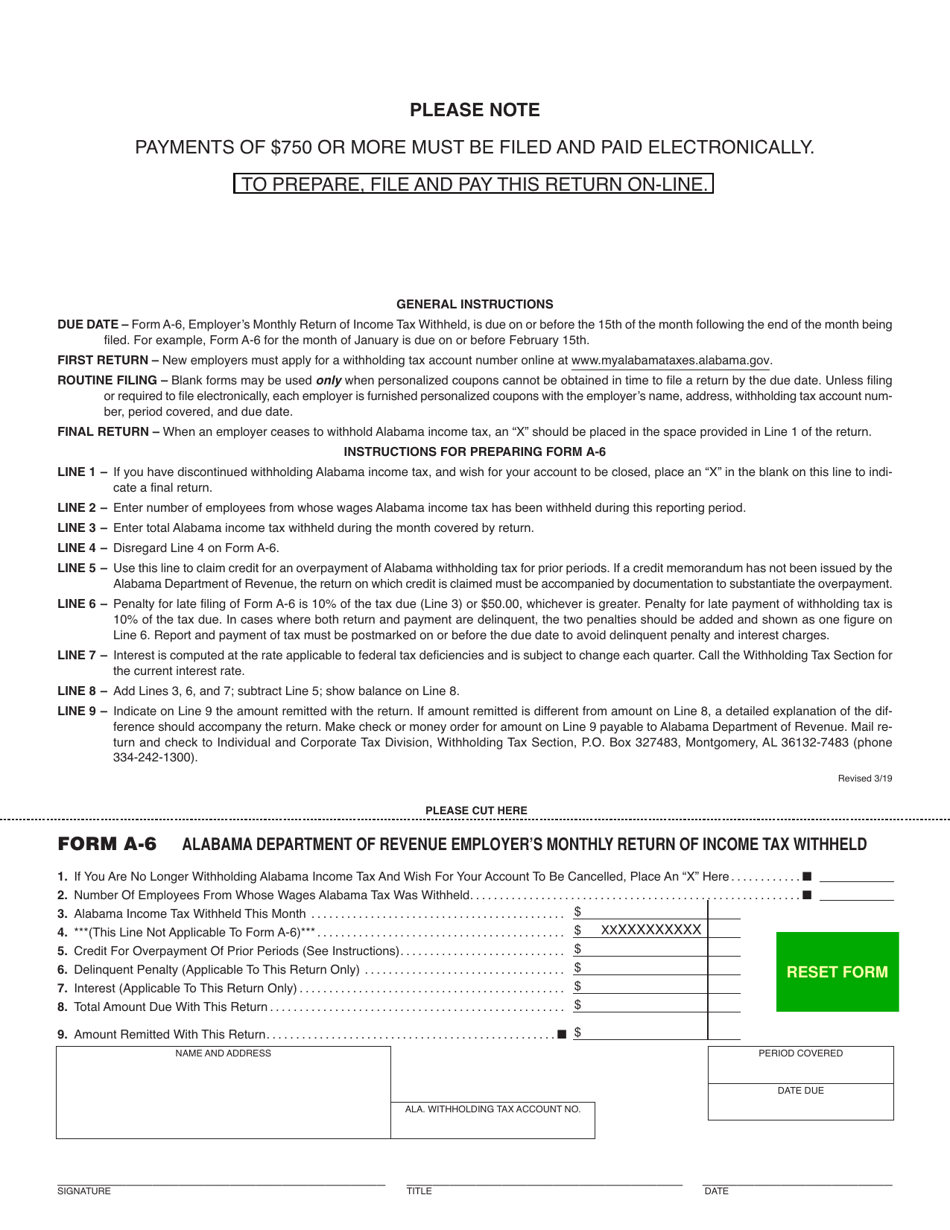

Form A 6 Fill Out Sign Online And Download Fillable PDF Alabama

Form 4952A Download Fillable PDF Or Fill Online Investment Interest

Alabama Deduction For Self Employment Tax Cook Co News

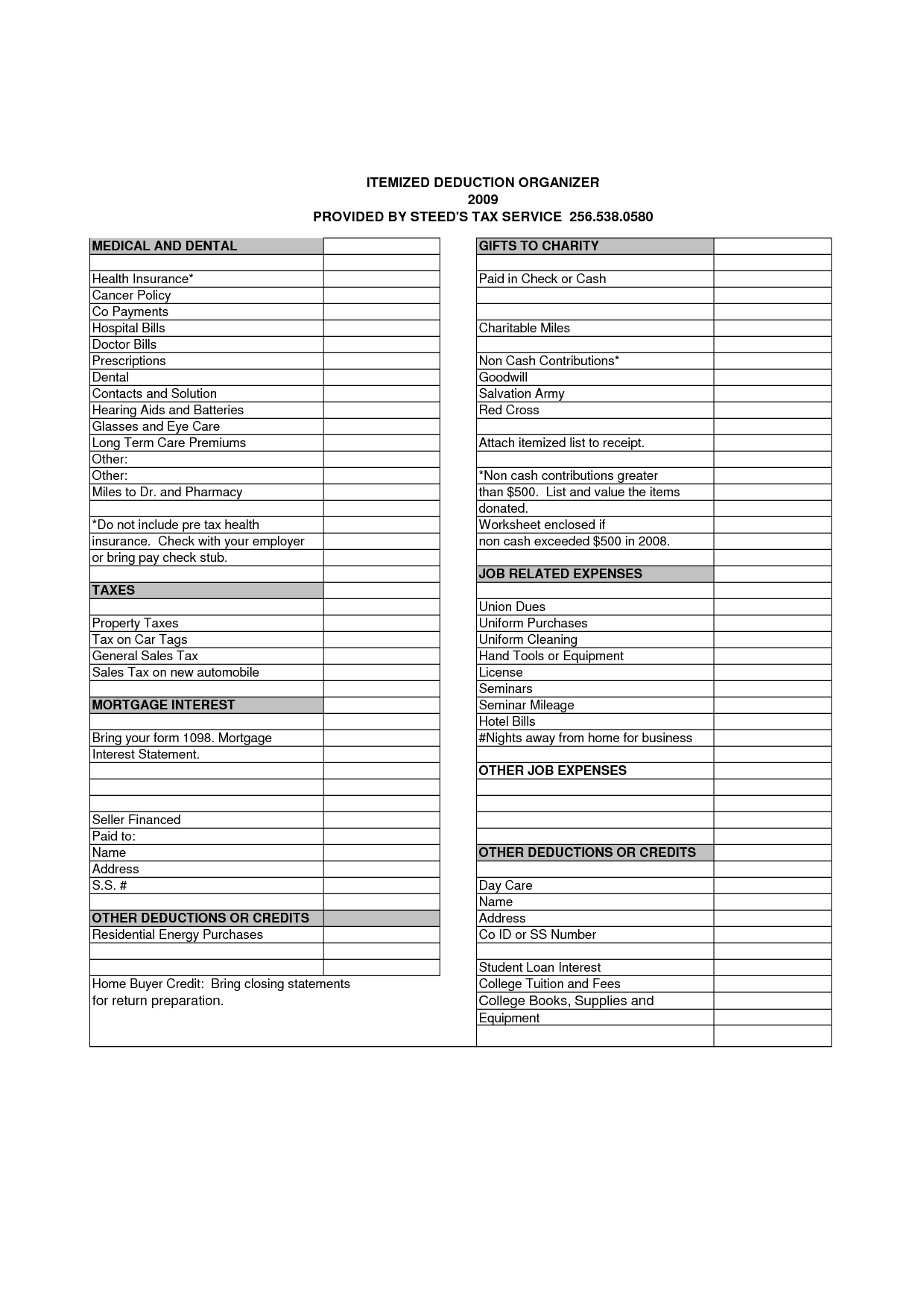

Printable Itemized Deductions Worksheet

State Of Alabama Withholding Tax Tables 2021 Federal Withholding

Cattlemen Get A New Income Tax Deduction Alabama Cooperative

Cattlemen Get A New Income Tax Deduction Alabama Cooperative

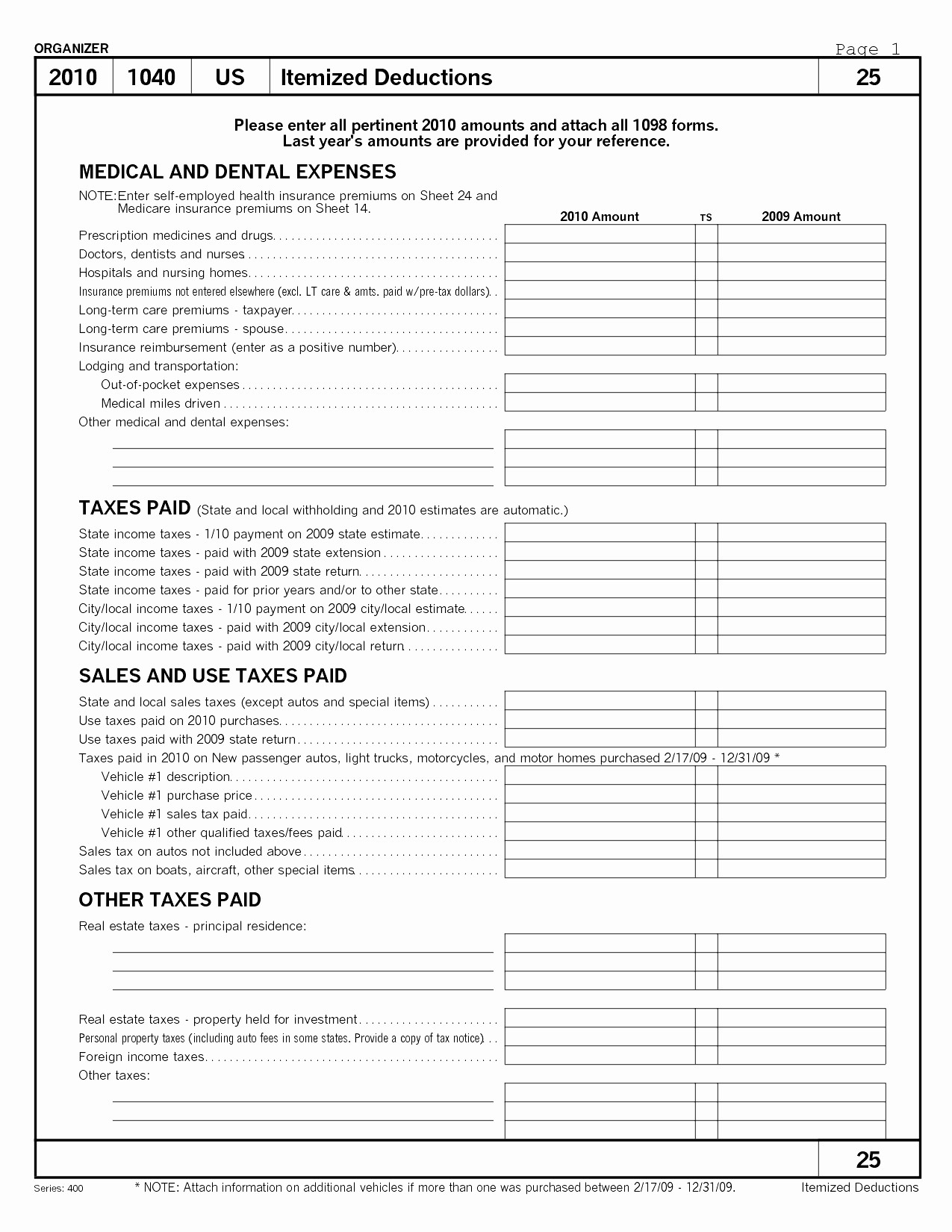

Printable Tax Organizer Template

Federal Judge Halts Ban On Payroll Deduction To Alabama Education

Removing The FIT Deduction Would Allow Alabama To Untax Groceries

Tax Deduction Alabama - The Alabama standard deduction is based on the filing status used by the taxpayer For tax years ending 12 31 2007 and forward the Standard Deduction Chart is used to determine the