Tax Deduction Codes 94 Deduction of Tax from Yarn Traders u s 153 1 a 6406081 95 Deduction of Tax from Yarn Traders u s 153 1 b 6406082 Sr Description Code Receipts Value Tax Collected 1 Deducted Paid A 8 1 Adjustable Tax Sum of 2 to 61 640000 2 Import u s 148 1 64010002

Applicable Withholding Tax Rates Updated up to June 30 2023 Stay Connected Facebook Twitter YouTube Official Email FBR Employees Government Links Government of Pakistan Under the Income Tax Ordinance 2001 all Income are broadly divided into following five heads of Income Salary Income from property Income from business Capital gains and Income from Other Sources

Tax Deduction Codes

Tax Deduction Codes

https://s3.studylib.net/store/data/007136445_1-c474023fbe19a6392d6d8eb6c7aa8d19-768x994.png

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

What Are Pay Stub Deduction Codes Realty Today

https://data.realtytoday.com/data/images/full/98831/what-are-pay-stub-deduction-codes.jpg

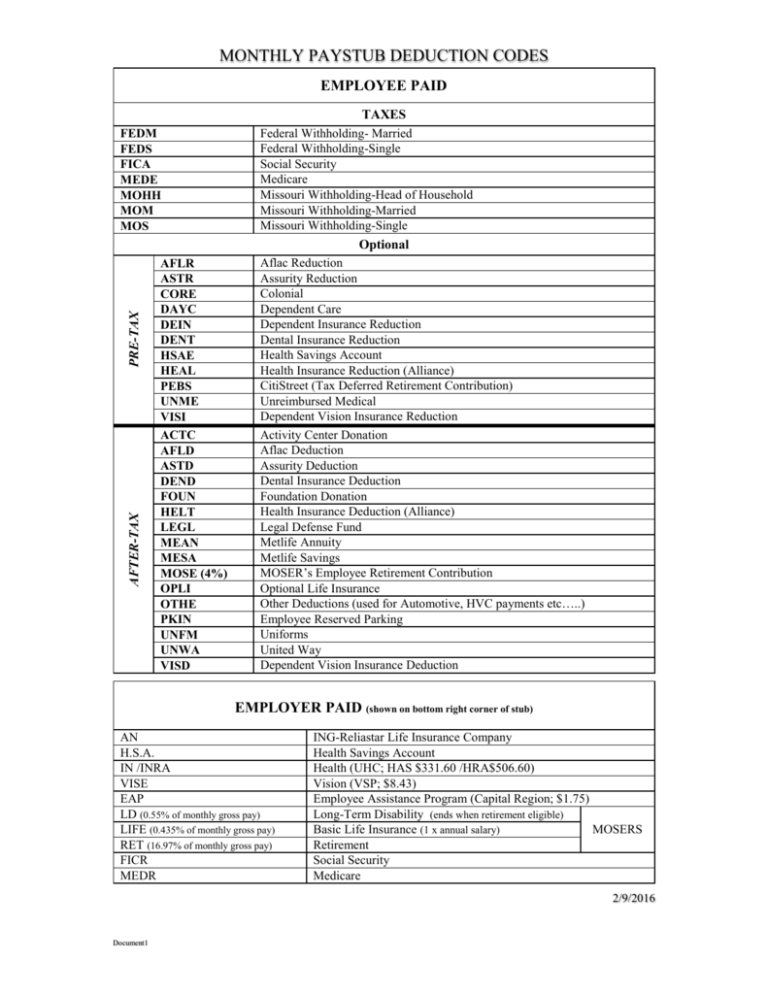

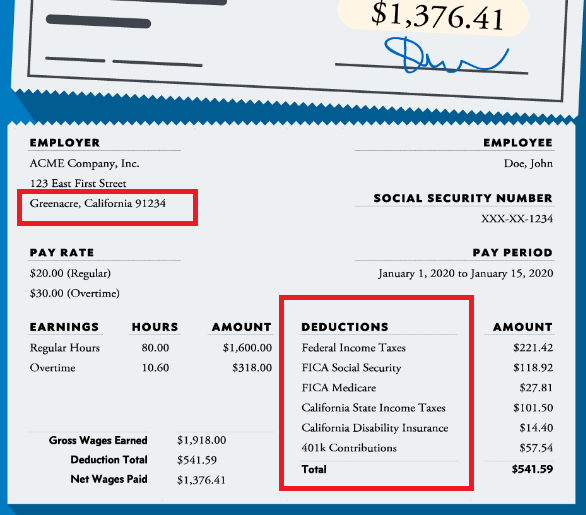

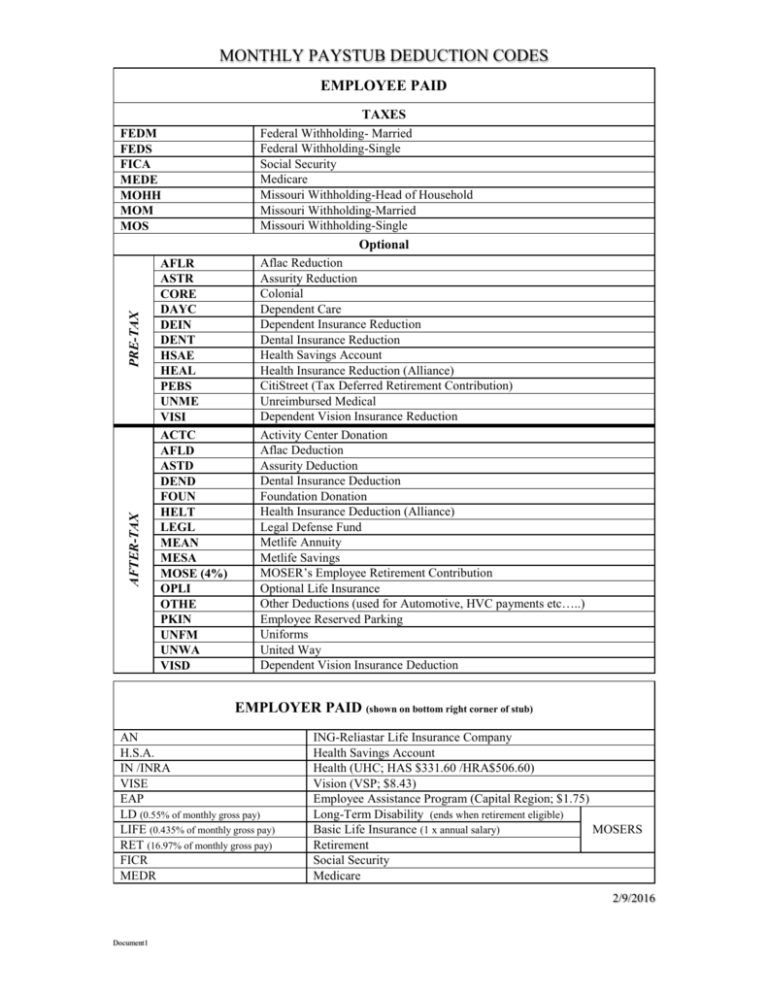

Payroll is required to deduct all federal and state income taxes listed in the following table from every employee s taxable earnings each pay period Registered degree seeking students working part time Pay Group STU are only subject to Federal and California State withholding taxes Time of deduction of tax Section 158 A person is required to deduct tax from an amount paid by the person at the time the amount is actually paid In case of payment of profit on debt earlier of the time it is paid or credited to the account of the recipient

In Pakistan taxation or non taxation of foreign remittances has historically been in the spotlight both from the tax policy and tax law enforcement perspectives more so since early 1970s Transaction privilege tax deduction codes are used in Schedule A of Forms TPT 2 and TPT EZ to deduct income exempt or excluded from tax as authorized by Arizona statute and or the Model City Tax Code

Download Tax Deduction Codes

More picture related to Tax Deduction Codes

Deduction Codes Explained Guide SupplierWiki

https://media.graphassets.com/lLkTFc4mR9iwDs0Jhk2k

How Much Are Paycheck Tax Deductions In California Unemployment Gov

https://unemployment-gov.us/wp-content/uploads/2022/02/paycheck-deductions-in-california.png

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

We have built the tax credits and tax deductions for CPP contributions and EI premiums into the federal and provincial tax deductions tables in this guide However certain types of income such as pension income are not subject to CPP contributions and EI premiums You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions

[desc-10] [desc-11]

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

https://download1.fbr.gov.pk/Docs/2021816218852519...

94 Deduction of Tax from Yarn Traders u s 153 1 a 6406081 95 Deduction of Tax from Yarn Traders u s 153 1 b 6406082 Sr Description Code Receipts Value Tax Collected 1 Deducted Paid A 8 1 Adjustable Tax Sum of 2 to 61 640000 2 Import u s 148 1 64010002

https://www.fbr.gov.pk/withholding-tax-rates/51147/81155

Applicable Withholding Tax Rates Updated up to June 30 2023 Stay Connected Facebook Twitter YouTube Official Email FBR Employees Government Links Government of Pakistan

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

Example Tax Deduction System For A Single Gluten free GF Item And

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

New Tax Laws Business Deduction Changes You Need To Know About

Creating A Roth Deduction Code Community

Creating A Roth Deduction Code Community

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

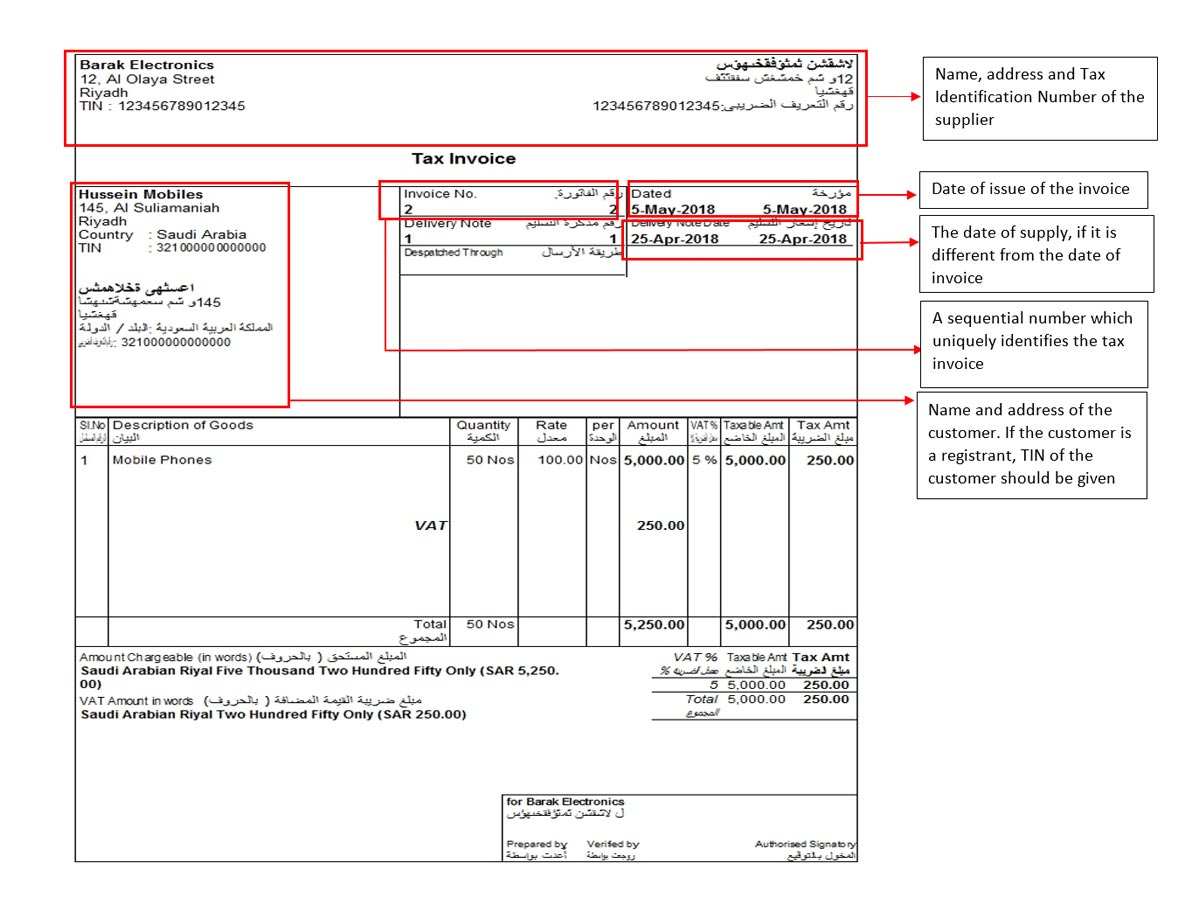

Uae Vat Invoice Format Fta Cards Design Templates SexiezPicz Web Porn

Tax Deduction Codes - In Pakistan taxation or non taxation of foreign remittances has historically been in the spotlight both from the tax policy and tax law enforcement perspectives more so since early 1970s