Tax Deduction Daycare 2022 Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent

Learn how this credit can offset your care costs and reduce your tax bill by hundreds or even thousands of dollars If you paid someone to care for a child who was under Grants made directly to your business are general ly included in business income If you spend the grant money in your daycare business you can deduct those expenditures Most tax

Tax Deduction Daycare 2022

Tax Deduction Daycare 2022

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

HOME DAYCARE TAX DEDUCTIONS TOY TAX DEDUCTION CHILDCARE PROVIDER

https://i.ytimg.com/vi/CPKTAxbWrHY/maxresdefault.jpg

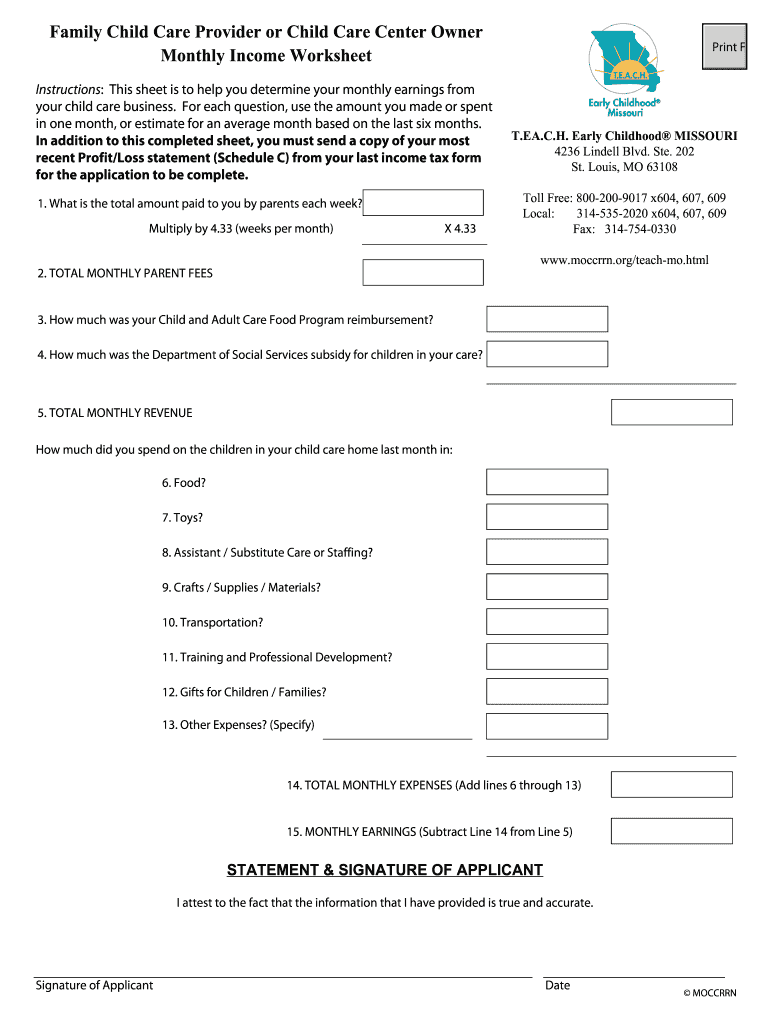

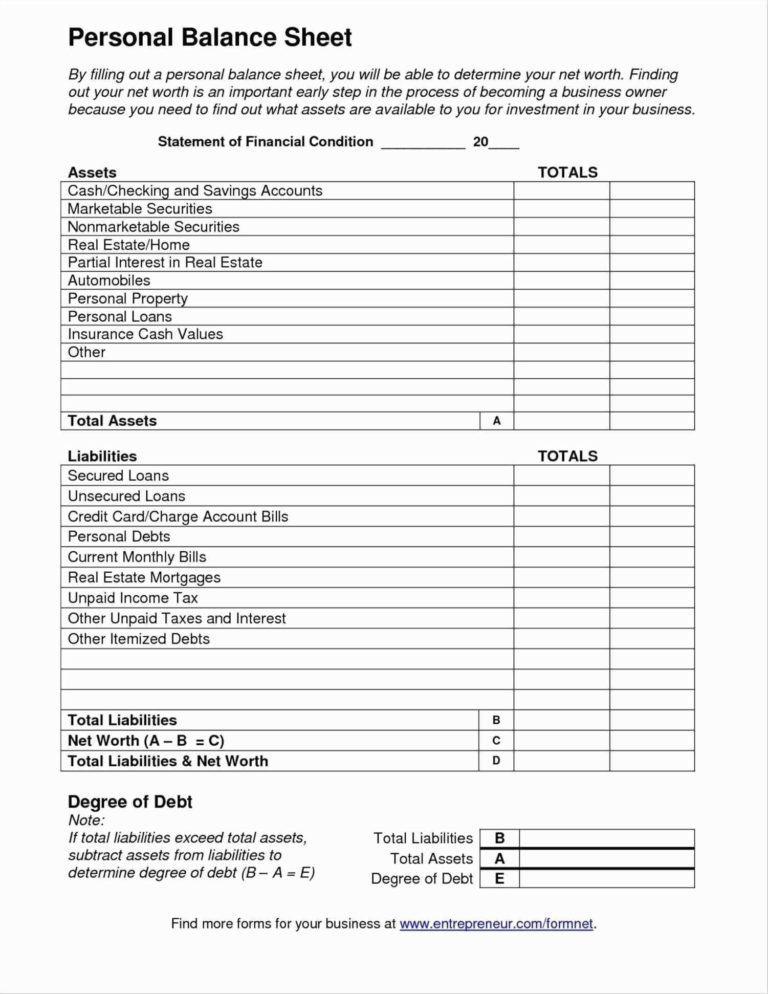

Home Daycare Tax Worksheet

https://www.pdffiller.com/preview/100/112/100112118/large.png

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services This article looks at the various tax deductions daycare providers may use and the childcare tax credit that the For the tax year 2022 filing in April 2023 taxpayers earning less than 43 000 can claim the Child and Dependent Care Credit There is a slab for determining the child dependent care credit threshold based on the Modified

Can you take a child care tax deduction No there are no tax deductions available for child care for individuals just a credit However you might qualify for other credits or deductions To learn more read about the top common tax Is daycare tax deductible Find out how you can claim a tax credit for daycare expenses including payments made to daycare centers babysitters summer camps and other care providers for a child under 13 or a disabled

Download Tax Deduction Daycare 2022

More picture related to Tax Deduction Daycare 2022

Home Daycare Tax Worksheet

https://www.irs.gov/pub/xml_bc/15004m01.gif

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

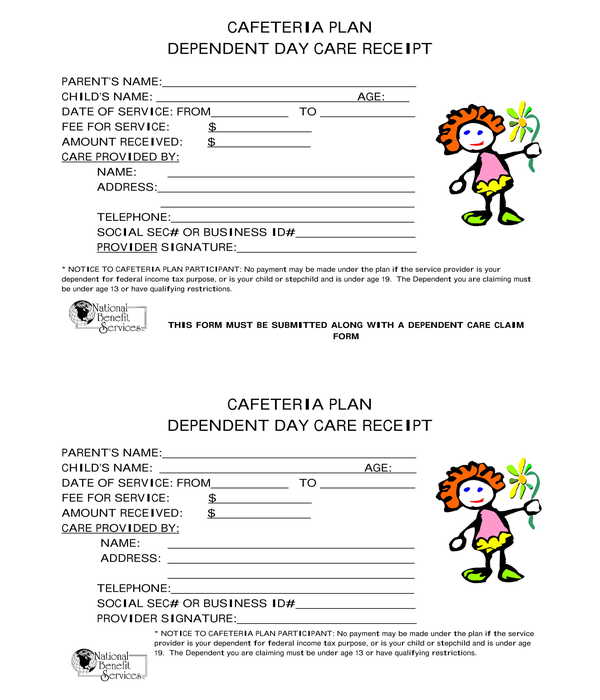

Daycare Tax Receipt Template Master Template

https://images.sampleforms.com/wp-content/uploads/2019/07/Cafeteria-Plan-Dependent-Daycare-Receipt-Form.jpg

Once you enter your income and are qualified to deduct childcare expenses please follow these steps in TurboTax While signed in to your return search for child care Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more

Did you spend any money on childcare expenses this year You can get some of that back by claiming the Child and Dependent Care Tax Credit You can also use the child Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

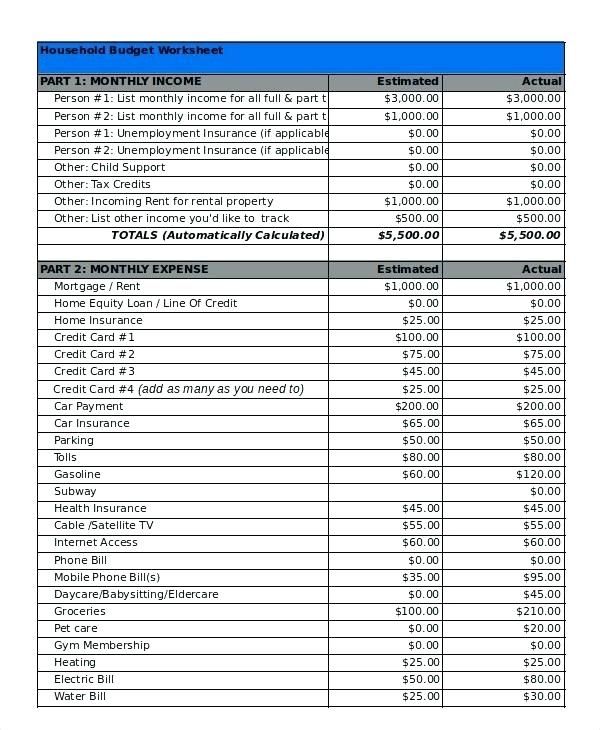

General Sales Tax Deduction Worksheet 2022

https://i.pinimg.com/originals/80/f5/2d/80f52dac2182daa554539d9580ab22d3.png

Deductions Worksheet Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/391/382/391382225/large.png

https://www.irs.gov › newsroom › understanding-the...

Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent

https://turbotax.intuit.com › tax-tips › family › the...

Learn how this credit can offset your care costs and reduce your tax bill by hundreds or even thousands of dollars If you paid someone to care for a child who was under

Home Daycare Tax Worksheet

General Sales Tax Deduction Worksheet 2022

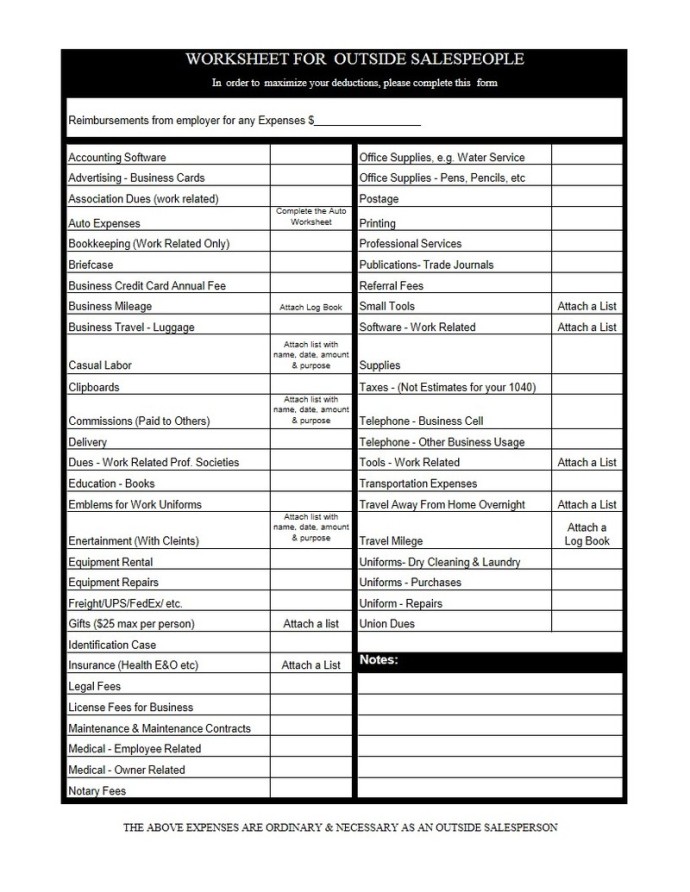

List Of Tax Deductions Examples And Forms

Home Daycare Tax Worksheet Ivuyteq

Tax Deduction Worksheet 2023

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

Small Business Tax Deductions Worksheet 2022

10 Tax Deduction Worksheet

Tax Deduction Worksheet Template

Tax Deduction Daycare 2022 - Below find a listing of key tax breaks and credits along with a brief description that families and or child care providers may be able to take advantage of Child and Dependent Care Tax