Tax Deduction Daycare Expenses If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2024 or 2025 taxes of up to 35 of up to

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will break down what the daycare tax credit is how to qualify and how

Tax Deduction Daycare Expenses

Tax Deduction Daycare Expenses

https://c8.alamy.com/comp/2J04NMK/childcare-expenses-abstract-concept-vector-illustration-child-care-tax-credit-family-budget-childcare-money-daycare-expenses-calculation-and-deduction-financial-plan-abstract-metaphor-2J04NMK.jpg

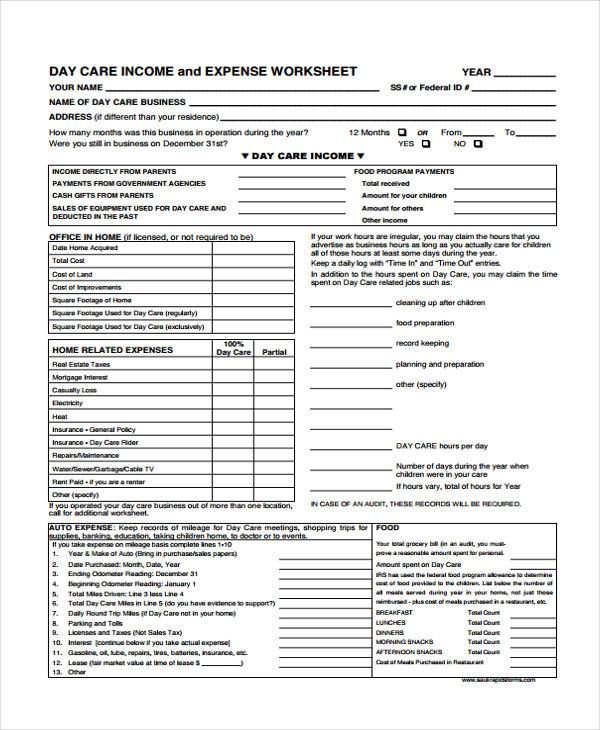

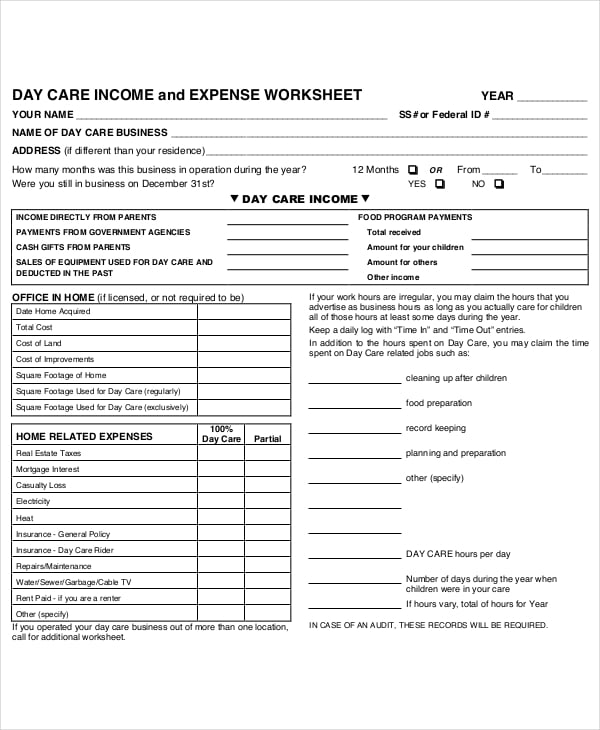

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/5b/3b/21/5b3b21e30091d2391c9664101cf13515.jpg

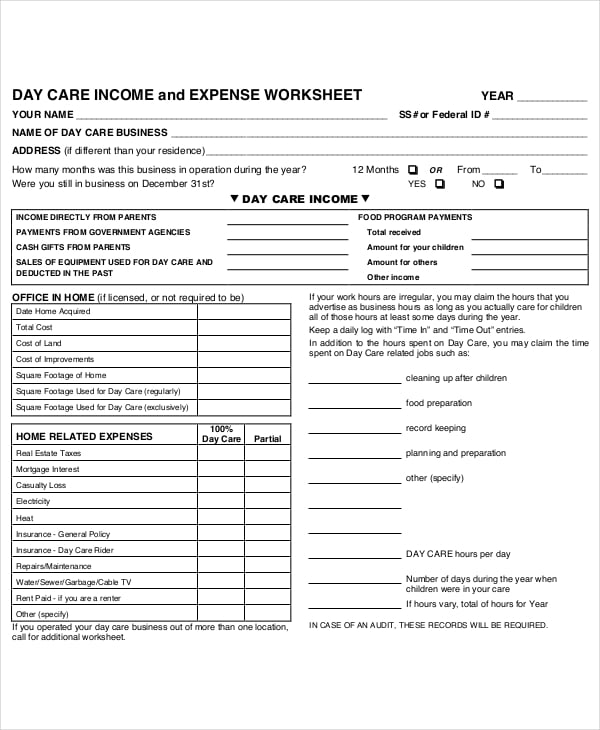

Printable Daycare Income And Expense Worksheet

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

The IRS allows you to deduct certain childcare expenses on your 2024 and 2025 tax return If you paid for a babysitter a summer camp or any care provider for a disabled The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to school or carry on research For tax year 2021 only the exclusion for employer provided dependent care assistance has increased from 5 000 to 10 500 Note If the qualifying child turned 13 during the tax year

Download Tax Deduction Daycare Expenses

More picture related to Tax Deduction Daycare Expenses

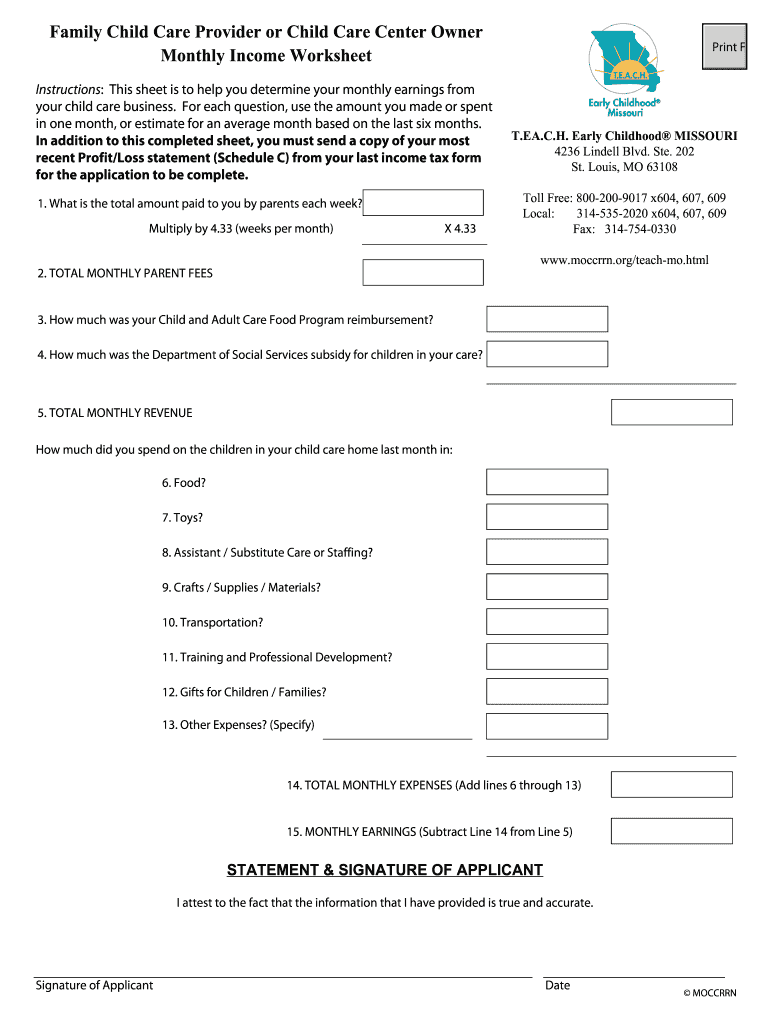

Home Daycare Tax Worksheet

https://www.pdffiller.com/preview/100/112/100112118/large.png

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/ce/ba/ae/cebaaec98a00c8228bd61d4ea2eba3d2.jpg

Home Daycare Tax Worksheet

https://images.sampleforms.com/wp-content/uploads/2017/03/Day-Care-Income-and-Expenses-Form.jpg

Can you take a child care tax deduction No there are no tax deductions available for child care for individuals just a credit However you might qualify for other credits or deductions You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2024 Benefits of the tax credit

Here s how the FSA compares to the tax credit for dependent care when determining which one could benefit you the most come tax time Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one

Free Printable Daycare Tax Forms Printable Forms Free Online

https://images.template.net/wp-content/uploads/2017/06/Daycare-Blank-Expense-Sheet.jpg

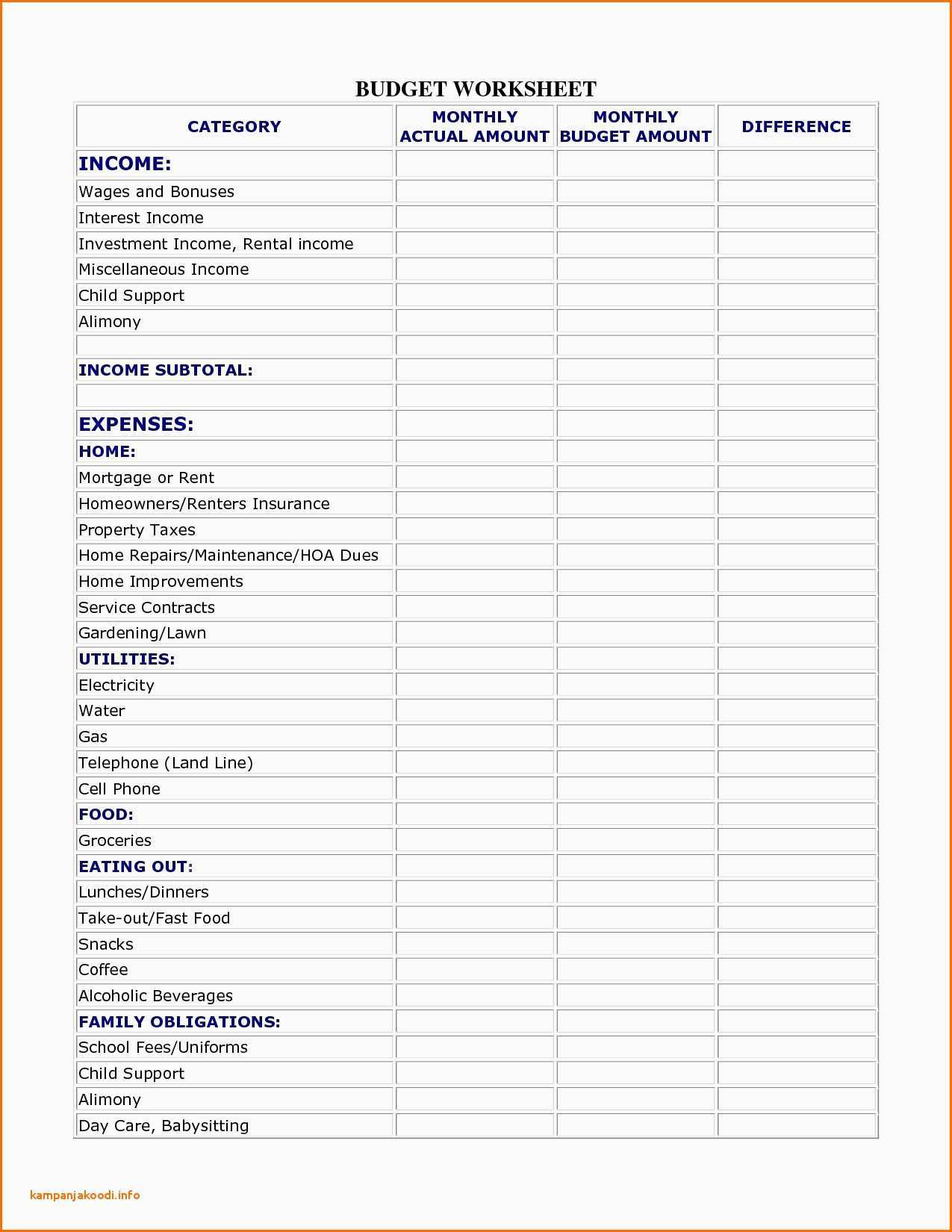

Home Expense Spreadsheet Daycare Personal Spending Db excel

https://db-excel.com/wp-content/uploads/2019/09/home-expense-spreadsheet-daycare-personal-spending.jpg

https://turbotax.intuit.com › tax-tips › fa…

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2024 or 2025 taxes of up to 35 of up to

https://www.irs.gov › newsroom › child-and-dependent...

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and

Home Daycare Tax Worksheet

Free Printable Daycare Tax Forms Printable Forms Free Online

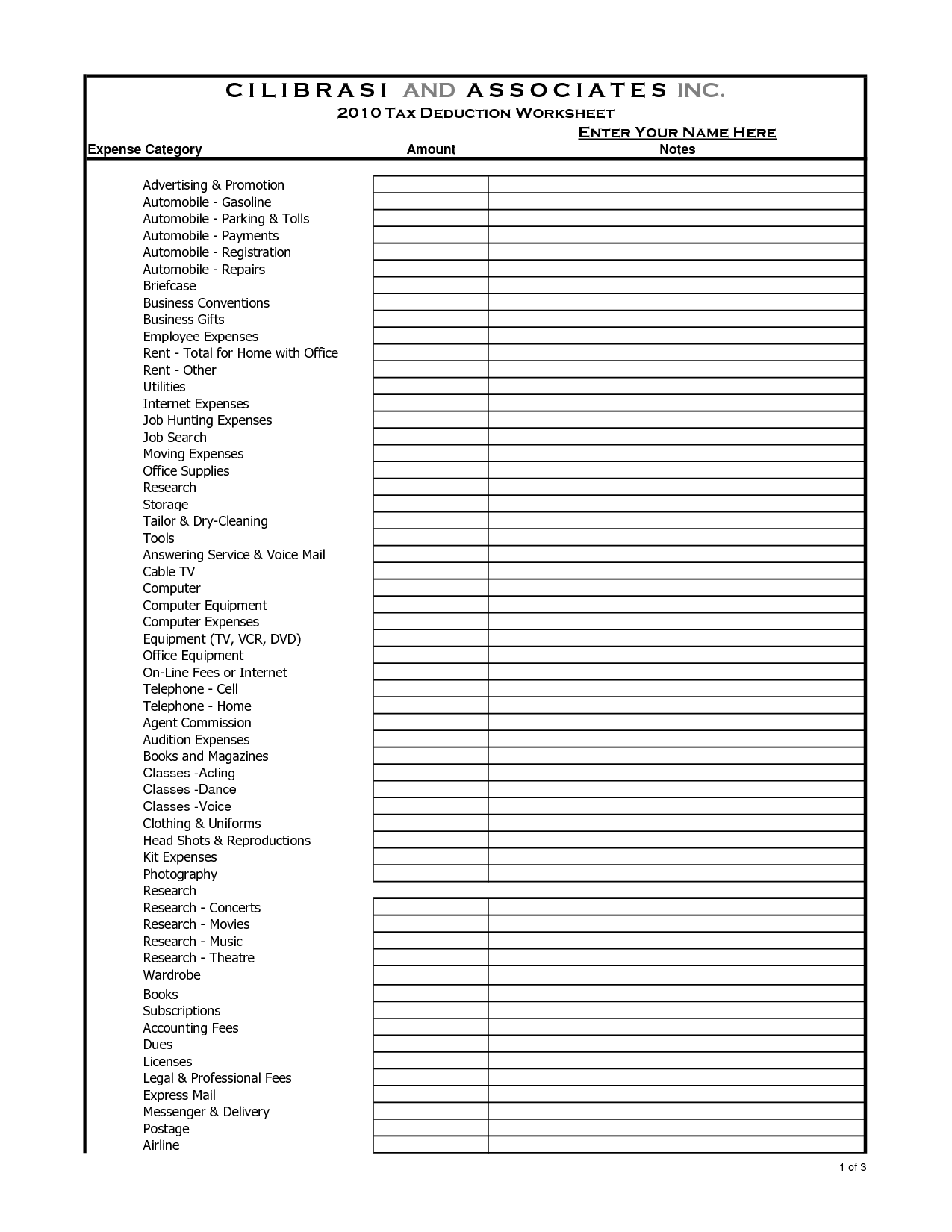

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign

List Of Tax Deductions Examples And Forms

Itemized Deductions Worksheet 2017 Printable Worksheets And

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

16 Best Images Of Tax Organizer Worksheet Tax Deduction Worksheet

10 2014 Itemized Deductions Worksheet Worksheeto

17 Best Images Of Money Expenses Worksheet Fillable Monthly Expenses

Tax Deduction Daycare Expenses - The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to