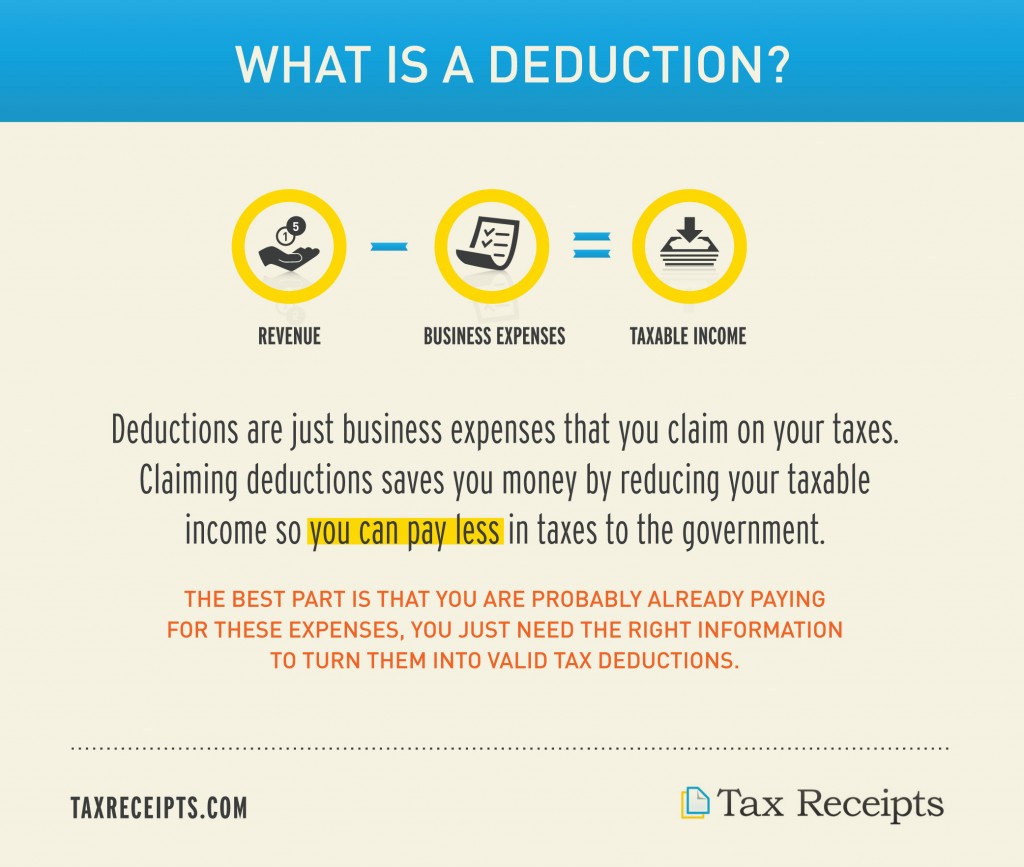

Tax Deduction Definition And Example What Is a Deduction A deduction is an expense that can be subtracted from a taxpayer s gross income in order to reduce the amount of income that is

What is a tax deduction A tax deduction reduces the amount of income that is subject to tax There are hundreds of different types of tax deductions A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher income taxpayers who often have significant deductible expenses

Tax Deduction Definition And Example

Tax Deduction Definition And Example

https://i.pinimg.com/originals/71/76/73/71767344456a9586f89f91c95c615ae9.jpg

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Copy-of-Copy-of-Copy-of-Copy-of-Untitled-Design-5.jpg?w=1000&ssl=1

Standard Deduction Definition Example InvestingAnswers

https://investinganswers.com/sites/www/files/definition-featured-image/jason-briscoe-amLfrL8LGls-unsplash.jpg

What Is a Tax Deductible A tax deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI The deductible This article will cover the basics of tax deductions how they work how they differ from credits and an example of how they might work in the real world

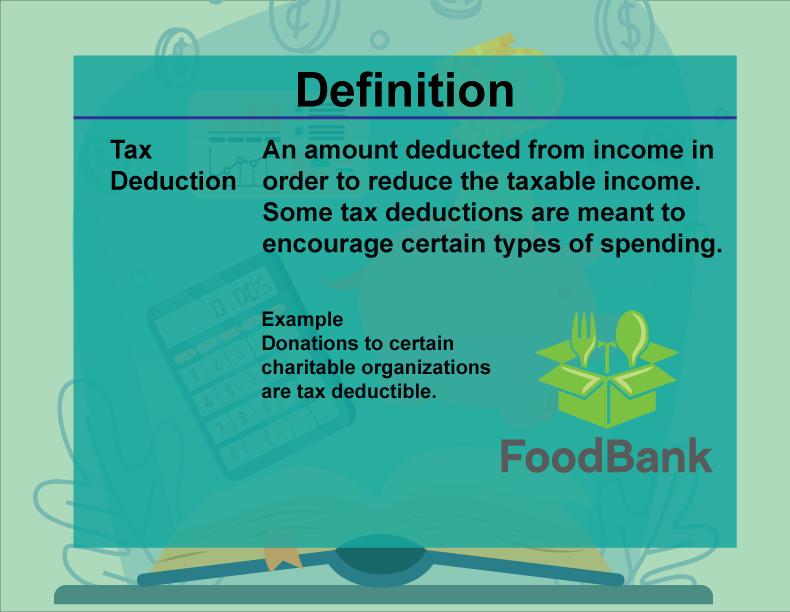

A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of Tax deductions reduce your taxable income by allowing you to write off certain expenses Learn more about this tax incentive and how you can leverage it

Download Tax Deduction Definition And Example

More picture related to Tax Deduction Definition And Example

Tax Deduction Definition Types And Benefits

https://www.mudranidhi.com/wp-content/uploads/2023/05/Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

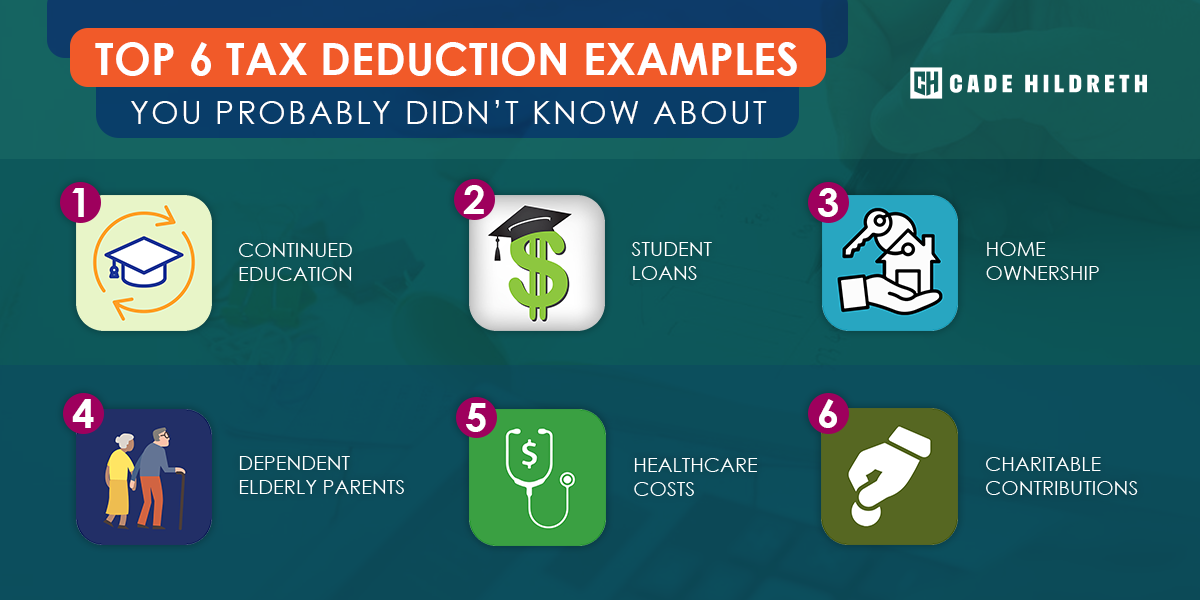

Top 6 Tax Deduction Examples You Probably Didn t Know About

https://cadehildreth.com/wp-content/uploads/2020/01/tax-deduction-examples.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

A tax deduction is an amount subtracted from an individual s or entity s total income thereby reducing the taxable income for that year In the United States the tax code A tax deduction is a sum that you can deduct from your taxable income in order to reduce the amount of taxes you owe You can take the standard deduction a single fixed amount

A tax deduction is a result of a tax deductible expense or exemption which reduces your taxable income A common deduction on your federal income tax return is the Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Itemized Deductions Definition Who Should Itemize NerdWallet

https://i.pinimg.com/originals/99/76/2e/99762eef7a875a1ad03c082295cce86d.png

https://www.investopedia.com/terms/d/…

What Is a Deduction A deduction is an expense that can be subtracted from a taxpayer s gross income in order to reduce the amount of income that is

https://investinganswers.com/dictionary/t/tax-deduction

What is a tax deduction A tax deduction reduces the amount of income that is subject to tax There are hundreds of different types of tax deductions

Tax Deduction Taxable Income Deduction Viva Business Consulting

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Definition Financial Literacy Tax Deduction Media4Math

Tax Deduction Definition Standard Or Itemized Crixeo

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

What Is A Tax Deduction Definition Examples Calculation

What Is A Tax Deduction Definition Examples Calculation

What Is A Tax Deduction Definition Examples Calculation

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Is A Tax Deduction

Tax Deduction Definition And Example - Tax deductions reduce your taxable income by allowing you to write off certain expenses Learn more about this tax incentive and how you can leverage it