Tax Deduction Definition Economics Quizlet Verkko a tax for which the percentage of income paid in taxes increases as income increases progressive tax a tax for which the percentage of income paid in taxes increases as

Verkko Study with Quizlet and memorize flashcards containing terms like Tax Benefits Received Principle Ability to Pay Principle and more Verkko Production of Income FROM investment expenses tax planning and preparation expenses deductible if 1 for production or collection of income 2 management

Tax Deduction Definition Economics Quizlet

Tax Deduction Definition Economics Quizlet

https://i.pinimg.com/originals/ff/c2/2c/ffc22c3cacdd92bd70a97183067c7a7a.jpg

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

Verkko Define Individual Income Taxes A tax levied on personal income earned from wages and returns on investments What is the structure of the individual income taxes Verkko Direct Taxes on income profits and gains Income tax Corporate tax Social security tax Wealth and inheritance tax Rates flat progressive and regressive Subjects

Verkko system requiring employers to deduct income taxes from employee s paychecks and send them directly to the IRS Indexing upward revision of the tax brackets to Verkko Terms in this set 15 What are tax expenditures aka targeted tax cuts tax preferences deductions credits tax expenditures lower tax rates or bases Congressional Budget

Download Tax Deduction Definition Economics Quizlet

More picture related to Tax Deduction Definition Economics Quizlet

How To Get Your Biggest Tax Deduction The Motley Fool

https://g.foolcdn.com/editorial/images/437194/tax-deduction_gettyimages-515708887.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

What Is TAX DEDUCTION In This Video We Simply Define tax Deduction

https://i.pinimg.com/originals/71/76/73/71767344456a9586f89f91c95c615ae9.jpg

Verkko Study with Quizlet and memorize flashcards containing terms like Progressive tax Regressive tax Proportional tax and more Fresh features from the 1 AI enhanced Verkko The amount of income that is used to calculate an individual s or company s income tax due Standard Deduction A dollar amount that a taxpayer must exceed in income to

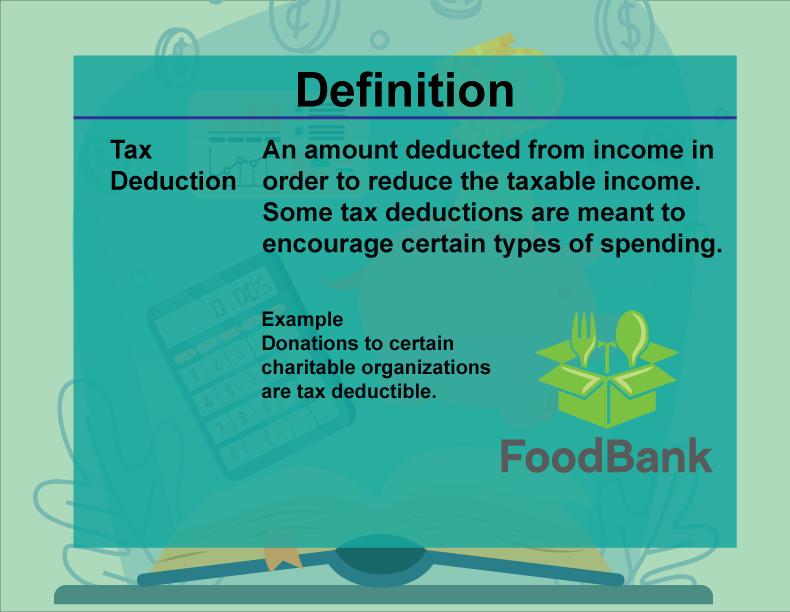

Verkko 30 huhtik 2023 nbsp 0183 32 Fact checked by Suzanne Kvilhaug Investopedia Theresa Chiechi What Is a Tax Deduction A tax deduction is an amount that you can deduct from your taxable income to lower the Verkko a deduction is allowed inly for an expenditure that is made for some business or economic purpose that exceeds any tax avoidance motive economic substance

Tax Deduction Definition Types And Benefits

https://www.mudranidhi.com/wp-content/uploads/2023/05/Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

Tax Deduction Taxable Income Deduction Viva Business Consulting

https://www.vivabcs.com.vn/assets/uploads/2017/03/Tips-on-taxable-income-deduction-1.jpg

https://quizlet.com/18121814/economics-chapter-14-flash-cards

Verkko a tax for which the percentage of income paid in taxes increases as income increases progressive tax a tax for which the percentage of income paid in taxes increases as

https://quizlet.com/129676810/economics-taxes-flash-cards

Verkko Study with Quizlet and memorize flashcards containing terms like Tax Benefits Received Principle Ability to Pay Principle and more

What Is A Tax Deduction Definition Examples Calculation

Tax Deduction Definition Types And Benefits

What Is Tax Deduction Definition Types And Benefits

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

Definition Financial Literacy Tax Deduction Media4Math

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

Section 80GG Deduction In 2023 24 Claim Tax Deduction For Rent Paid

Deduction Form Self Employed Tax Employment Form

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Tax Deduction Definition Economics Quizlet - Verkko A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher