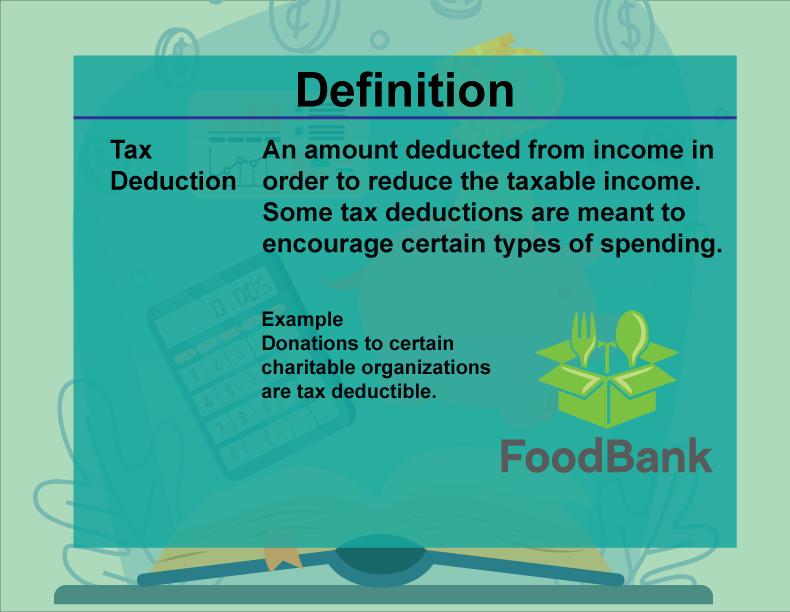

Tax Deduction Definition Economics A deduction is an expense that can be subtracted from taxable income to reduce the amount owed Most taxpayers who take the standard deduction only need to file Form 1040

A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher income taxpayers who often have significant deductible What is the purpose of tax deductions A common view among tax law scholars is that tax deductions are required to properly measure income In this paper I present an alternative

Tax Deduction Definition Economics

Tax Deduction Definition Economics

https://i.pinimg.com/originals/71/76/73/71767344456a9586f89f91c95c615ae9.jpg

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

A tax deduction reduces the amount of gross income that is subject to taxes How Tax Breaks Work The government provides tax breaks to individual and corporate taxpayers A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of

See all Economics Reading language arts Up to 2nd grade Khan Kids 2nd grade 3rd grade 4th grade 5th grade 6th grade reading and vocab NEW 7th grade reading and vocab NEW Most countries impose taxes on both income and consumption While income taxes are levied on net income i e from labour and capital over an annual tax period consumption taxes

Download Tax Deduction Definition Economics

More picture related to Tax Deduction Definition Economics

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

https://i.pinimg.com/474x/a4/c8/51/a4c85197b9f35d1d483da88c3145d8a2--business-accounting-tax-deductions.jpg

What Is Tax Deduction Definition Types And Benefits

https://www.askbankifsccode.com/blog/wp-content/uploads/2023/04/What-is-Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

Tax Credit Or Tax Deduction Which Is More Helpful For Tax Savings And

https://i.pinimg.com/originals/ff/c2/2c/ffc22c3cacdd92bd70a97183067c7a7a.jpg

Reduced tax rates Reduction in a tax rate typically the corporate income tax rate Exemptions from various taxes Exemption from certain taxes often those collected at the border such as Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax

A tax deduction is an amount subtracted from an individual s or entity s total income thereby reducing the taxable income for that year In the United States the tax code Tax deductibility is a critical aspect of the tax system allowing taxpayers to reduce their taxable income through the standard deduction or itemized deductions This

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

Tax Deduction Definition Types And Benefits

https://www.mudranidhi.com/wp-content/uploads/2023/05/Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

https://www.investopedia.com/terms/d/…

A deduction is an expense that can be subtracted from taxable income to reduce the amount owed Most taxpayers who take the standard deduction only need to file Form 1040

https://taxfoundation.org/.../glossary/ta…

A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher income taxpayers who often have significant deductible

Tax Deduction Taxable Income Deduction Viva Business Consulting

What Is A Tax Deduction

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Definition Financial Literacy Tax Deduction Media4Math

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Will My Tax Deduction Savings Look Like The Motley Fool

What Will My Tax Deduction Savings Look Like The Motley Fool

What Is A Tax Deduction Definition Examples Calculation

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

Tax Deduction Definition Economics - A tax deduction is a deduction taxpayers can take to reduce their taxable income amounts therefore reducing the amount of taxes owed In the post we ll explain