Tax Deduction For Buying A Hybrid Vehicle The tax credit for EVs provides up to 7 500 toward a purchase of a qualifying Tesla Ford or other plug in car

According to the U S Department of Energy you can receive a tax credit of up to 7 500 for each electric vehicle you purchase on or after To be eligible for a tax deduction on a hybrid car purchase the vehicle must meet certain criteria set by the Internal Revenue Service IRS Currently the federal government does not offer a specific tax deduction for

Tax Deduction For Buying A Hybrid Vehicle

Tax Deduction For Buying A Hybrid Vehicle

https://aposhiangarage.com/wp-content/uploads/2021/08/Buying-a-Hybrid-Car-What-To-Know-Before-You-Go.jpg

Things You Need To Know Before Buying A Hybrid Car Best Trend Car

https://www.besttrendcar.com/wp-content/uploads/2021/11/Things-You-Need-to-Know-Before-Buying-a-Hybrid-Car1-1024x621.jpg

Buying A Hybrid Vehicle Key Considerations Noobie

https://noobie.com/wp-content/uploads/2022/01/hybrid-vehicle-768x512.jpg

Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of either Did you know that purchasing a hybrid car could potentially save you money on your federal taxes That s right the purchase of a hybrid car may be eligible for a tax

2025 state by state list of all current PHEV hybrid Fuel Cell FCEV electric vehicle EV tax credits rebates incentives Claim a federal tax credit of up to 7 500 for purchasing a new hybrid or electric vehicle EV Electric vehicle and hybrid sales have been steadily increasing since their

Download Tax Deduction For Buying A Hybrid Vehicle

More picture related to Tax Deduction For Buying A Hybrid Vehicle

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

Tax Deductions For Job Seekers

https://www.kbic.com/blog/wp-content/uploads/tax-deduction.jpg

5 Things To Look For When Buying A Used Hybrid Car Buying A Car

https://img.autotrader.co.za/2417724

To claim the tax credit the buyer must file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with their tax return If you re thinking about buying an electric car or a plug in hybrid you should be aware that the Trump administration is considering eliminating a federal EV tax credit of up to 7 500 It s

A tax credit for hybrid cars is a financial incentive to encourage the purchase of environmentally friendly vehicles Unlike tax deductions which reduce your taxable income Starting on Jan 1 2023 people who purchase eligible electric vehicles can receive 2 500 to 7 500 in tax credits The value of the credit can be directly subtracted from

5 Things To Know Before Buying A Hybrid Camera

https://www.gannett-cdn.com/-mm-/e340e82bf6404892c12b9d47cccf0d12cb033c77/c=0-156-3000-1848/local/-/media/USATODAY/GenericImages/2013/11/12/1384283299000-GTY-179551220.jpg?width=3200&height=1680&fit=crop

Deduct The Batmobile Vehicle Tax Deduction For Real Estate Agents

http://dmaccountingfirm.com/wp-content/uploads/2015/01/76729758-e1422044421314.jpg

https://insideevs.com › news

The tax credit for EVs provides up to 7 500 toward a purchase of a qualifying Tesla Ford or other plug in car

https://www.caranddriver.com › ... › hybri…

According to the U S Department of Energy you can receive a tax credit of up to 7 500 for each electric vehicle you purchase on or after

Tax Deductions You Can Deduct What Napkin Finance

5 Things To Know Before Buying A Hybrid Camera

10 Most Common Small Business Tax Deductions Infographic

Benefits Of Buying A Hybrid Hybrid Car Infographic Logistics

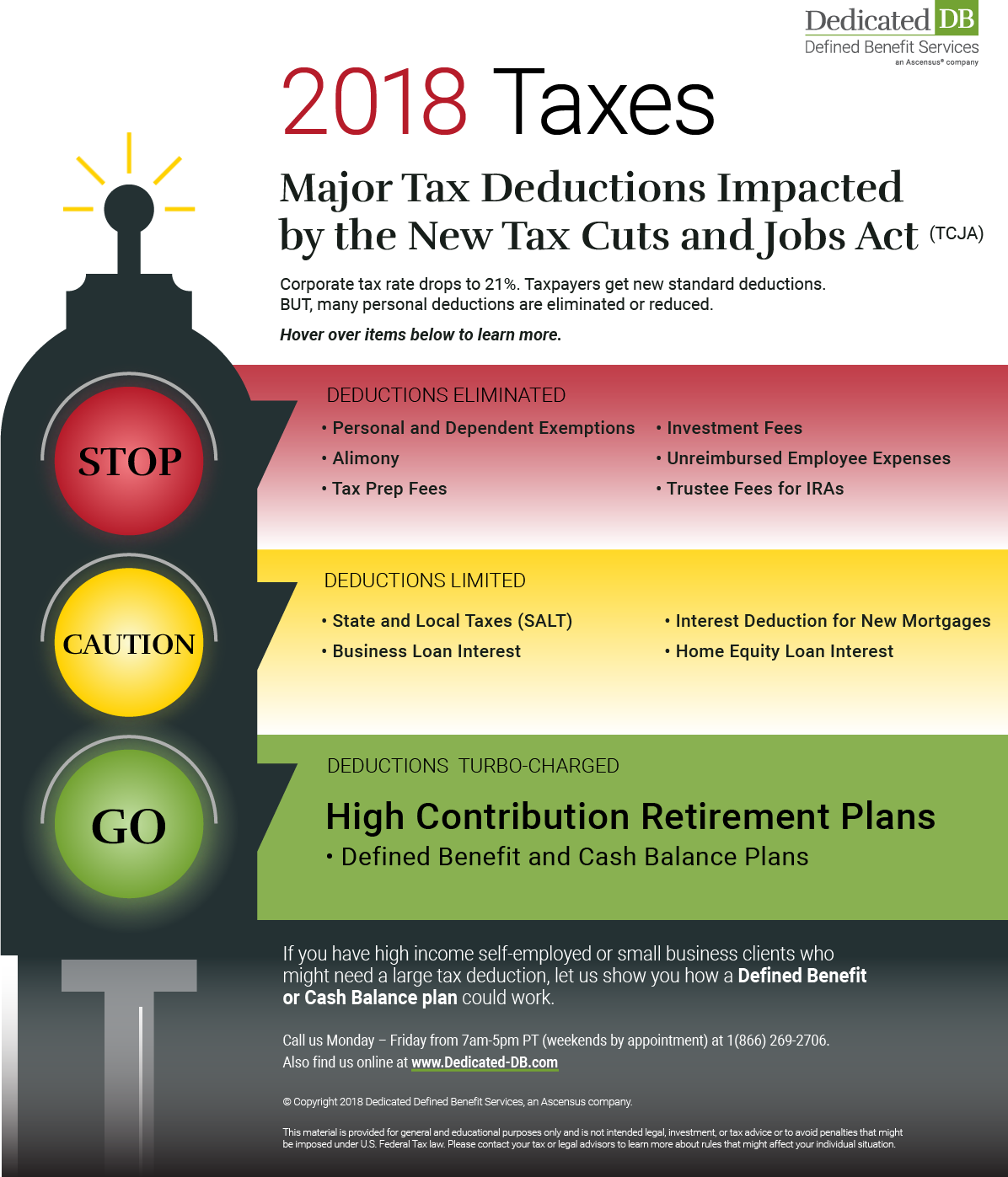

Tax Deduction Changes For 2018

5 Helpful Hybrid Car Maintenance Tips Christian s Automotive

5 Helpful Hybrid Car Maintenance Tips Christian s Automotive

What Is The Difference Between A Hybrid Car And An Electric Car News

NickolasropMays

Throw A Company Picnic This Summer And Enjoy Larger Tax Deduction

Tax Deduction For Buying A Hybrid Vehicle - Buyers of hybrid vehicles may benefit from tax reductions lower car insurance premiums and reduced vehicle inspection fees These incentives aim to make hybrid cars