Tax Deduction For Children S Education Expenses Malaysia For each child aged 18 and above in full time education A levels foundation etc you can claim RM2 000 annually 18 and above in higher education For each child studying

18 rowsFees paid to childcare centre and kindergarten for child For each child aged 18 and above in full time education A levels foundation etc employees can claim RM2 000 annually c 18 and above in higher education For each

Tax Deduction For Children S Education Expenses Malaysia

Tax Deduction For Children S Education Expenses Malaysia

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

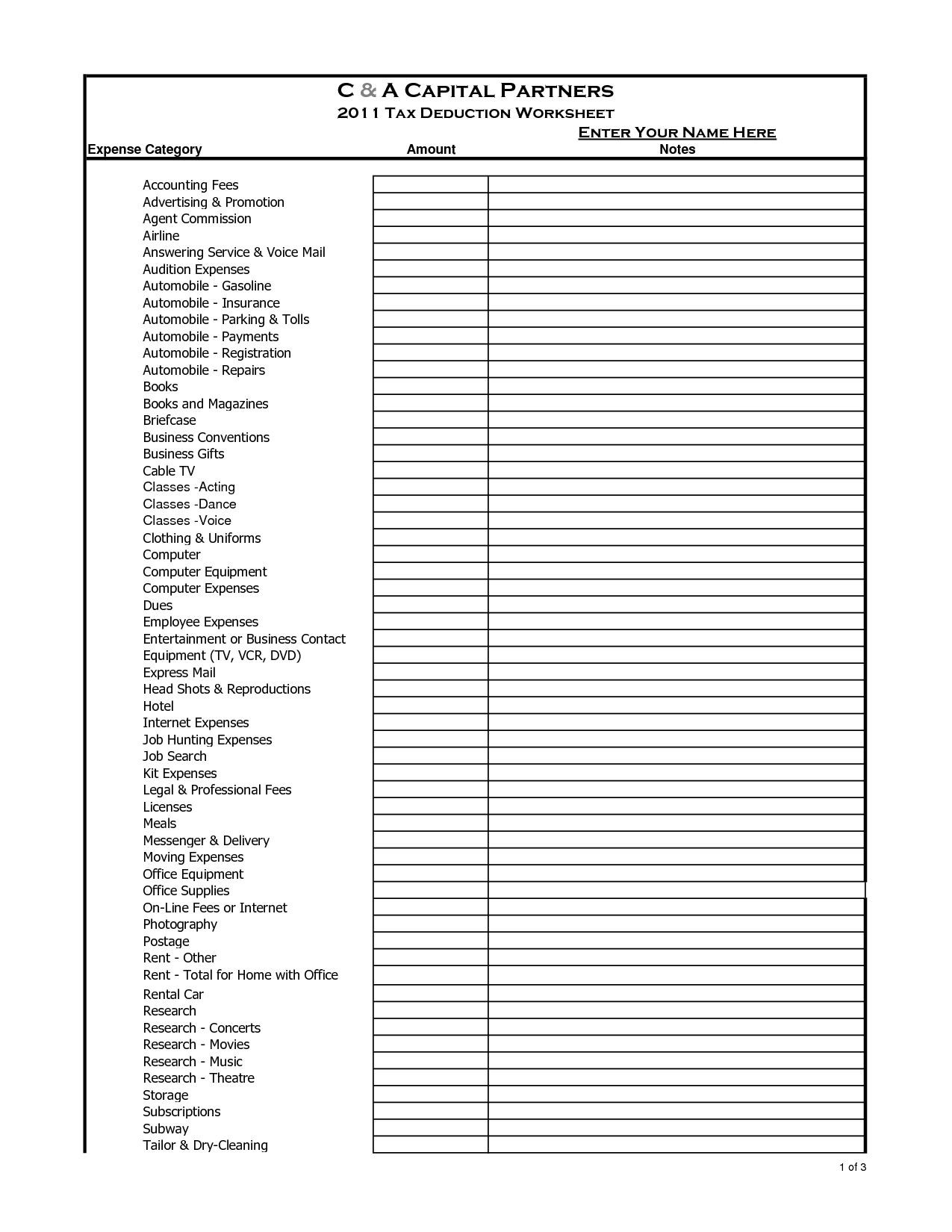

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

How Some Parents Can Get 3 600 When They File Their Taxes

https://dailynationtoday.com/wp-content/uploads/2022/02/SC-Child-Tax-Credit-Comp-copy.jpg

Ordinary Child Relief for Children Aged Below 18 Years Claim up to RM2 000 per child Full Time Education for Children Aged 18 Years and Above Claim Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said the tax relief would be applicable for children enrolled in registered preschools and

Amount deposited in SSPN by an individual taxpayer for his her children s education is deductible up to a maximum of RM8 000 The allowable deduction is limited to the net Facilities Health Communication Developments Colleges Universities Agriculture Industries Income is assessed on a current year basis The YA is the year coinciding

Download Tax Deduction For Children S Education Expenses Malaysia

More picture related to Tax Deduction For Children S Education Expenses Malaysia

Education In Malaysia

https://wenr.wes.org/wp-content/uploads/2023/01/0822-WENR-Malaysia-Infographic-v4-1.png

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Guide To Filing Taxes In Malaysia Tax Deduction For Children

https://static.wixstatic.com/media/34b1e8_1a9e28bde9b14f68a05af9b9a5096b99~mv2.jpg/v1/fill/w_1000,h_717,al_c,q_85,usm_0.66_1.00_0.01/34b1e8_1a9e28bde9b14f68a05af9b9a5096b99~mv2.jpg

For each child aged 18 years old and above in full time education A levels foundation and etc you can claim RM2 000 annually c 18 and above in higher education For each Children aged 18 and above doing A levels matriculation or other preparatory courses full time result in a lower tax relief limit that those doing their diploma or degree Lifestyle Lifestyle tax covers a wide

Employment Income Corporate Income Tax Capital Allowances Tax Incentives Income Exempt From Tax This publication is a quick reference guide outlining Malaysian tax information which is based on taxation As always Malaysia s tax season has rolled around with the arrival of March and if you re like most taxpayers your immediate priority is to start looking for

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

What Kind Of Insurance Policies Can Be Sold For Higher Value REPs

https://www.repsholdings.com.sg/wp-content/uploads/2022/01/types-of-policies-that-can-be-sold-to-REPs-for-higher-value-endowment-savings-plan-2048x2048.png

https://help.payrollpanda.my/malaysian-tax/what...

For each child aged 18 and above in full time education A levels foundation etc you can claim RM2 000 annually 18 and above in higher education For each child studying

https://taxsummaries.pwc.com/Malaysia/Individual/Deductions

18 rowsFees paid to childcare centre and kindergarten for child

Personal Tax Relief 2021 L Co Accountants

Tax Deductions For Businesses BUCHBINDER TUNICK CO

The 6 Best Tax Deductions For 2020 The Motley Fool

8 Tax Itemized Deduction Worksheet Worksheeto

Plan Your Money

More Help For Families And Less Taxes Expat Care

More Help For Families And Less Taxes Expat Care

Printable Itemized Deductions Worksheet

How To Find Average Income Tax Rate Parks Anderem66

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Tax Deduction For Children S Education Expenses Malaysia - Amount deposited in SSPN by an individual taxpayer for his her children s education is deductible up to a maximum of RM8 000 The allowable deduction is limited to the net