Tax Deduction For Daycare 2023 If the care provider is your household employee you may owe employment taxes For details see the Instructions for Schedule H Form 1040 If you incurred care expenses in 2023 but didn t

Yes daycare expenses may be tax deductible through the Child and Dependent Care Tax Credit This credit allows eligible parents to claim a percentage of qualifying child care expenses reducing their tax liability Learn how this credit can offset your care costs and reduce your tax bill by hundreds or even thousands of dollars If you paid someone to care for a child who was under age 13 when the

Tax Deduction For Daycare 2023

Tax Deduction For Daycare 2023

https://i.pinimg.com/736x/66/c9/92/66c992efc2736986383bbb9bcea348d5.jpg

Hassan Measure Would Restore Mortgage Insurance Deduction For

https://wpcdn.us-east-1.vip.tn-cloud.net/www.nhbr.com/content/uploads/2023/06/m/y/taxes-home-2048x1410.jpg

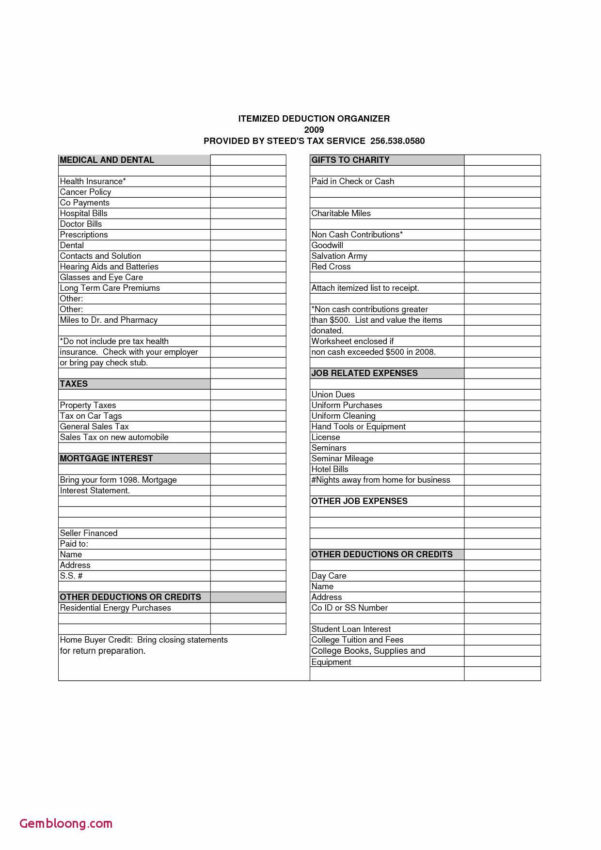

Itemized Deductions Examples Editable Template AirSlate SignNow

https://www.signnow.com/preview/100/302/100302714/large.png

Here are the standout points of the daycare tax deduction rules for 2023 2024 Deduction Limits Depending on the taxpayer s income bracket there are set limits on the The Internal Revenue Service IRS has announced that daycare expenses will be tax deductible for the years 2023 and 2024

In a significant development for families the tax landscape for 2023 and 2024 includes a provision that allows for tax deductions on childcare and daycare expenses This In operating a daycare or childcare center certain business expenses are tax deductible that you can claim when filing your taxes Some daycare business expenses that childcare providers are allowed to deduct

Download Tax Deduction For Daycare 2023

More picture related to Tax Deduction For Daycare 2023

Self Employed Tax Deduction Worksheet

https://i.pinimg.com/originals/74/a4/dd/74a4dd8b0181fa2746d635bd76a42e98.jpg

Daycare Tax Statement Daycare Tax Form Illustration Par Watercolortheme

https://www.creativefabrica.com/wp-content/uploads/2023/02/09/Daycare-Tax-StatementDaycare-Tax-Form-Graphics-60564329-2.jpg

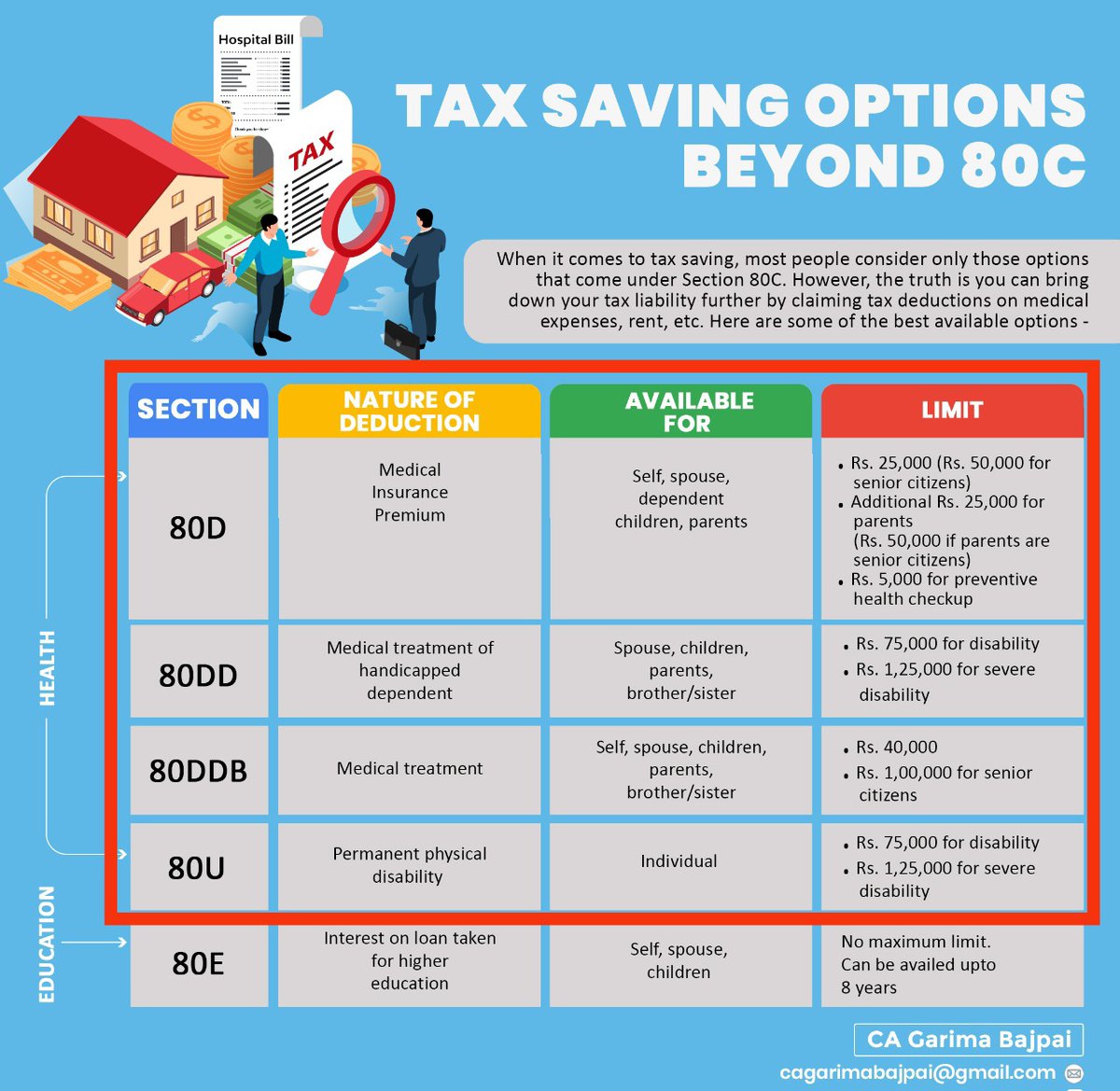

Income Tax Deductions Related To Health Deduction For Medical

https://pbs.twimg.com/media/Fq1e6leWIAE3ioW.jpg

Can you claim daycare on your 2023 taxes Meanwhile the Dependent Care Tax Credit allows you to deduct up to 35 percent of eligible childcare expenses paid during the year All the above items are included in your daycare gross income Grants made directly to your business are general ly included in business income If you spend the grant money in your

Aside from traditional business deductions home daycare operators can take advantage of an expanded deduction for business use of homes even if no rooms are used The IRS allows you to deduct certain childcare expenses on your 2024 and 2025 tax return If you paid for a babysitter a summer camp or any care provider for a disabled

In Home Daycare Tax Deduction Worksheet

https://www.worksheeto.com/postpic/2009/10/list-itemized-tax-deductions-worksheet_449386.png

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/559i57L2mTIwb0IA9pbpog/7fd2ce773008246da36a27d2552b2643/Schedule_A.png

https://www.irs.gov › pub › irs-prior

If the care provider is your household employee you may owe employment taxes For details see the Instructions for Schedule H Form 1040 If you incurred care expenses in 2023 but didn t

https://www.care.com › daycare-tax-credi…

Yes daycare expenses may be tax deductible through the Child and Dependent Care Tax Credit This credit allows eligible parents to claim a percentage of qualifying child care expenses reducing their tax liability

List Of Tax Deductions Examples And Forms

In Home Daycare Tax Deduction Worksheet

Small Business Tax Deductions Worksheet

Free Daycare Provider Tax Deduction Checklist Smartcare YouTube

Budget 2023 Expectations Rs 5 Lakh Income Tax Deduction On Home Loan

Home Daycare Tax Worksheet Personal Budget Spreadsheet Budgeting

Home Daycare Tax Worksheet Personal Budget Spreadsheet Budgeting

Tax Deduction For Spray Foam Planet Home Solution

Old Vs New Tax Regime Make Sure Which One To Opt For With These 4 Tips

Family Day Care Tax Spreadsheet With 75 Daycare Payment Receipt

Tax Deduction For Daycare 2023 - In a significant development for families the tax landscape for 2023 and 2024 includes a provision that allows for tax deductions on childcare and daycare expenses This