Tax Deduction For Disabled Person Tax breaks for the disabled include tax deductions income exemptions and tax advantaged accounts A number of tax deductions and exclusions benefit people who are on

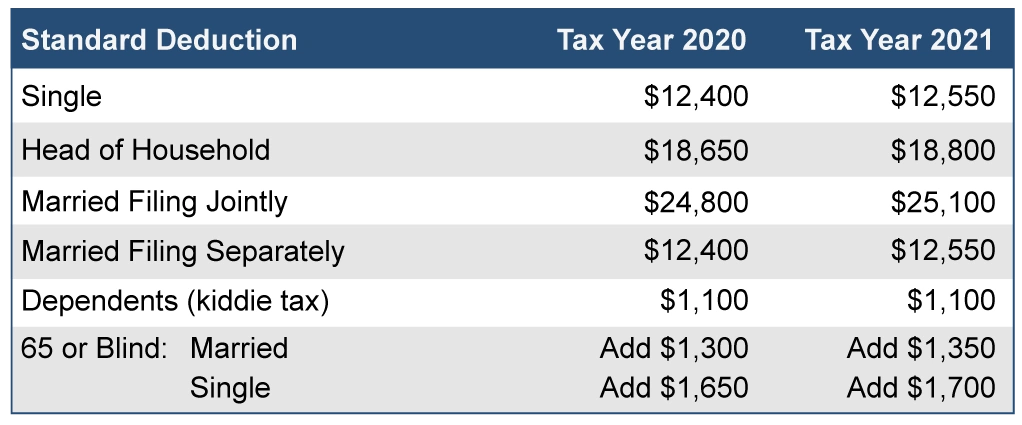

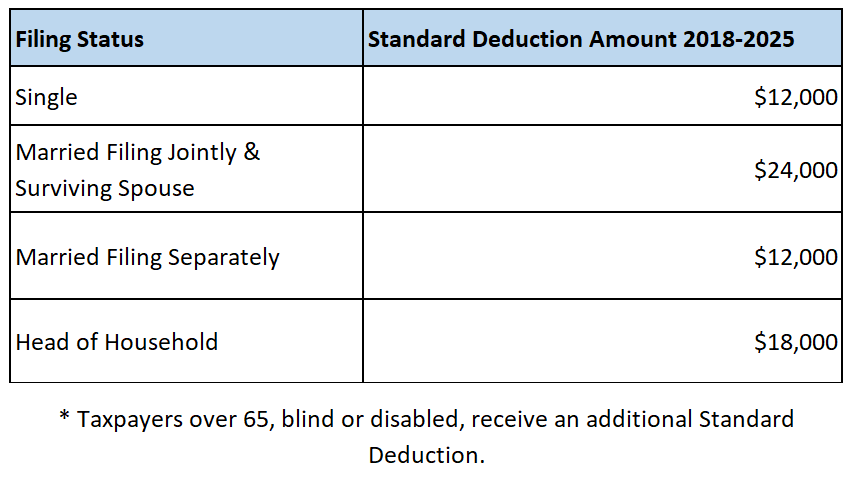

Learn about the tax deductions credits and exclusions that may be available to persons with disabilities their parents and businesses Find out how to claim the standard deduction Use Deductions to Reduce Taxes Increased standard tax deduction A higher standard tax deduction may be available to you if you are blind or visually impaired Medical

Tax Deduction For Disabled Person

Tax Deduction For Disabled Person

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/181/209/487053261.jpg

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

https://www.autismfinancialplanning.com/wp-content/uploads/2022/06/tax-deduction-under-income-tax-section-80u.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Major tax benefits for the disabled include If you are legally blind you may be entitled to a higher standard deduction on your tax return The standard deduction amount depends on your filing People with disabilities in the United States may be eligible for various tax deductions and credits to help offset the costs associated with their condition First the following tax tips and resources may be helpful for some

Tax credits for those with disabilities include the child and dependent care credit credit for the elderly and the disabled and earned income tax credit Unlike a tax deduction For the disabled person who is working part time or full time either inside or outside the home impairment related work expenses IRWE are an often overlooked source for major tax breaks

Download Tax Deduction For Disabled Person

More picture related to Tax Deduction For Disabled Person

Income Tax Deduction For Disabled Persons Section 80U And 80DD YouTube

https://i.ytimg.com/vi/xJw5OfOVseE/maxresdefault.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

Tax breaks for people with disabilities Here are the most common tax relief options for people with disabilities Disability tax credit Work expenses Medical expenses Home modifications Care expenses ABLE Accounts Tax free The federal tax code includes a number of provisions that can ease the tax burden on people living with a disability Some disability payments and benefits are free of income tax

If you are a person living with a disability you are eligible for a variety of tax breaks and credits you may or may not be aware of Some disability payments are free of income tax A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross

How Do Tax Deductions For Donating A Car Actually Work

https://i0.wp.com/automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png?w=1000&ssl=1

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

https://onecargroup.com.au/wp-content/uploads/2018/08/Files-1200x938.jpg

https://www.disabilitysecrets.com › resources › tax...

Tax breaks for the disabled include tax deductions income exemptions and tax advantaged accounts A number of tax deductions and exclusions benefit people who are on

https://www.irs.gov › pub › irs-pdf

Learn about the tax deductions credits and exclusions that may be available to persons with disabilities their parents and businesses Find out how to claim the standard deduction

Disabled Person Can Claim Up To Rs 1 25 000 Tax Deduction

How Do Tax Deductions For Donating A Car Actually Work

What Is The Standard Deduction For 2021

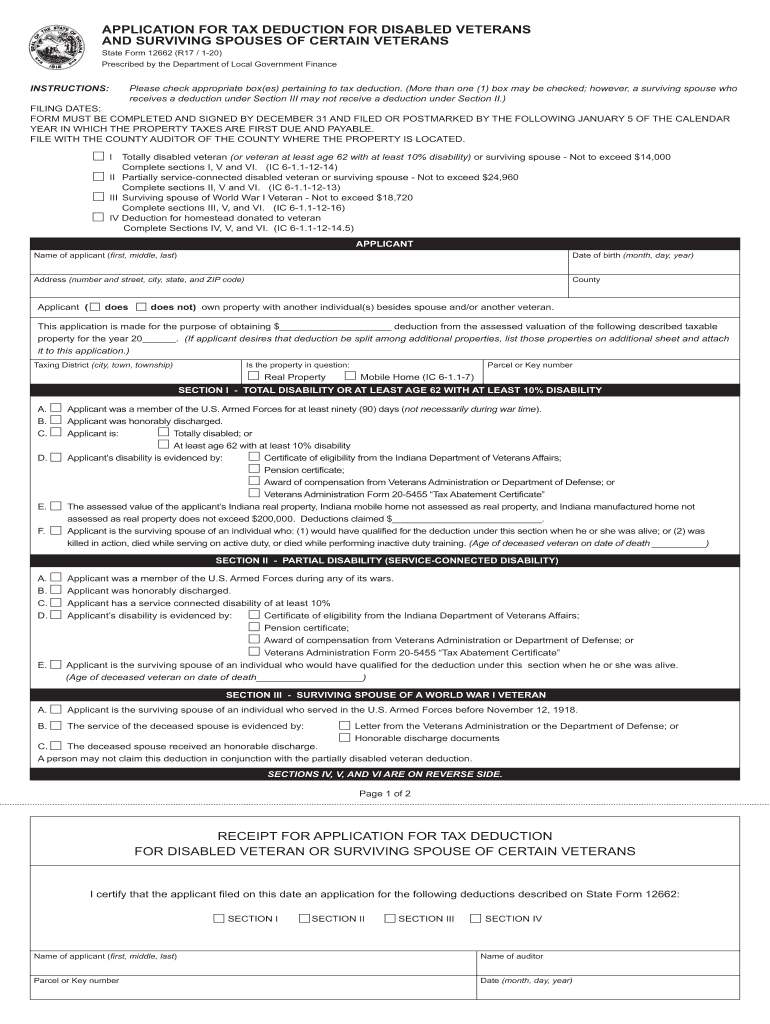

Indiana State Form 12662 Fill Out And Sign Printable PDF Template

Know Tax Deduction For Disabled Individuals Under Section 80U Future

How Does Tax Deduction Work In India Tax Walls

How Does Tax Deduction Work In India Tax Walls

Superannuation Tax Deduction Are You Eligible

Health Reimbursement Arrangement Employers Are Allowed To Say A Tax

Standard Deduction Vs Itemizing YR TAX COMPLIANCE LLC

Tax Deduction For Disabled Person - Amidst the myriad challenges that individuals with disabilities encounter there are certain tax benefits for their empowerment and assistance Income Tax Act offers special