Tax Deduction For Donations Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are limited to 60 of the

Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of contribution and the type of charity Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

Tax Deduction For Donations

Tax Deduction For Donations

https://images.prismic.io/wealthfit-staging/5a24d2af02c0d250c371601bf4063747e9901677_03-maximize-charitable-deductions.jpg?auto=compress,format&w=1772

Tax Deductible Donation Receipt Template Analysis Template

http://www.analysistemplate.com/wp-content/uploads/2015/02/tax-deductible-donation-receipt-template.png

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more than 250 You must have written appraisals for noncash donations of Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

Tax law requires that deductions are allowed only for contributions that serve a charitable purpose A recipient organization must qualify for tax exempt status as required by the tax code Enjoy tax deductions of up to 2 5 times the qualifying donation amount during the next tax season when you donate to Community Chest or any approved Institution of a Public Character IPC before the year ends On this page What are tax deductible donations What are non tax deductible donations

Download Tax Deduction For Donations

More picture related to Tax Deduction For Donations

This Year Only Tax Deductible Donations Aren t Just For Itemizers

https://static01.nyt.com/images/2020/11/21/business/21Adviser-illo/20Adviser-illo-superJumbo.jpg?quality=75&auto=webp

Get 300 Tax Deduction For Cash Donations In 2020 2021

https://cdn.aarp.net/content/dam/aarp/money/taxes/2020/12/1140-online-donation-screen.imgcache.rev9aad3c0f802258a825bf512a713d6041.jpg

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

The tax deduction you receive for donations to charities is based on the fair market values of the items donated Here s a guide to check the values These contributions may be deducted on your tax return if you itemize to lower your taxable income for the tax year A charitable contribution is voluntary and is made without getting or expecting to get anything of equal value in return

What Is A Tax Deductible Donation A tax deductible donation allows you to deduct cash or property you transfer to a qualified organization such as clothing or household items To receive a charitable donation tax deduction your donations and other itemized deductions must exceed the standard deduction Here are the standard deductions for 2023 to give you an idea of how much you might have to give Single 13 850 Married filing jointly 27 700 Married filing separately 13 850 Head of household 20 800

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

https://www.thebalance.com/thmb/WTZF3eXFhZ0fX5VLuL9VwzDfneY=/1500x1000/filters:fill(auto,1)/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg

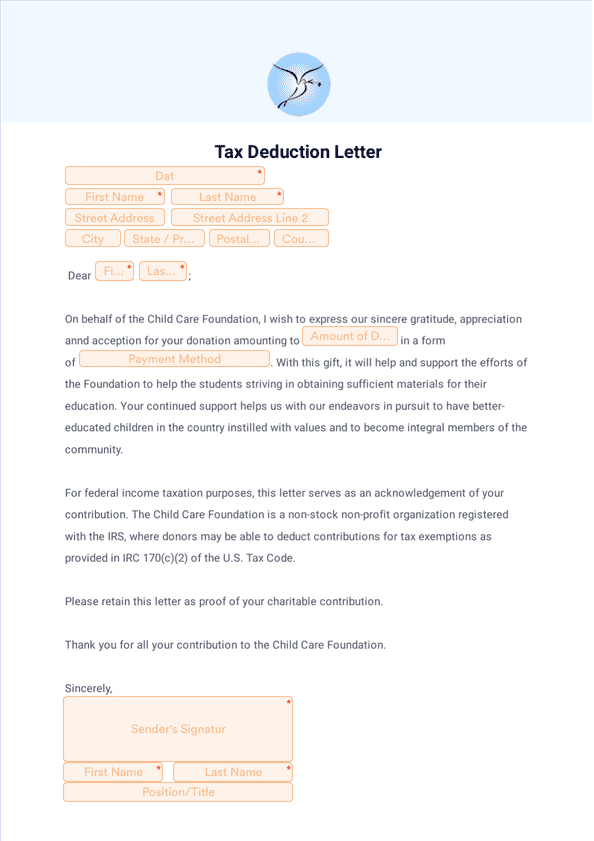

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

https://www.investopedia.com › terms › charitable...

Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are limited to 60 of the

https://www.irs.gov › newsroom › expanded-tax-benefits...

Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of contribution and the type of charity

Section 80G Tax Deduction For Donations And Exemption Limit Meteorio

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

5 Itemized Tax Deduction Worksheet Worksheeto

The Complete Charitable Deductions Tax Guide 2023 2024

2021 Taxes For Retirees Explained Cardinal Guide

How To Get Tax Deductions On Goodwill Donations 15 Steps

How To Get Tax Deductions On Goodwill Donations 15 Steps

Printable Itemized Deductions Worksheet

9 End of Year Tax Deduction Tips

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

Tax Deduction For Donations - With your Giving Account at Fidelity Charitable you can become eligible for a charitable tax deduction and improve the world 7 charitable tax deduction questions are answered in our basic guide to help you understand the potential tax