Tax Deduction For Equipment Purchase Deduct Supplies Expense Since supplies are supposedly used up within the year of purchase the cost of supplies as current assets is listed as an expense on your

2021 Spending Cap on equipment purchases 2 620 000 This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your Section 179 is a tax deduction that allows businesses to write off all or part of the cost of qualified property and equipment up to

Tax Deduction For Equipment Purchase

Tax Deduction For Equipment Purchase

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

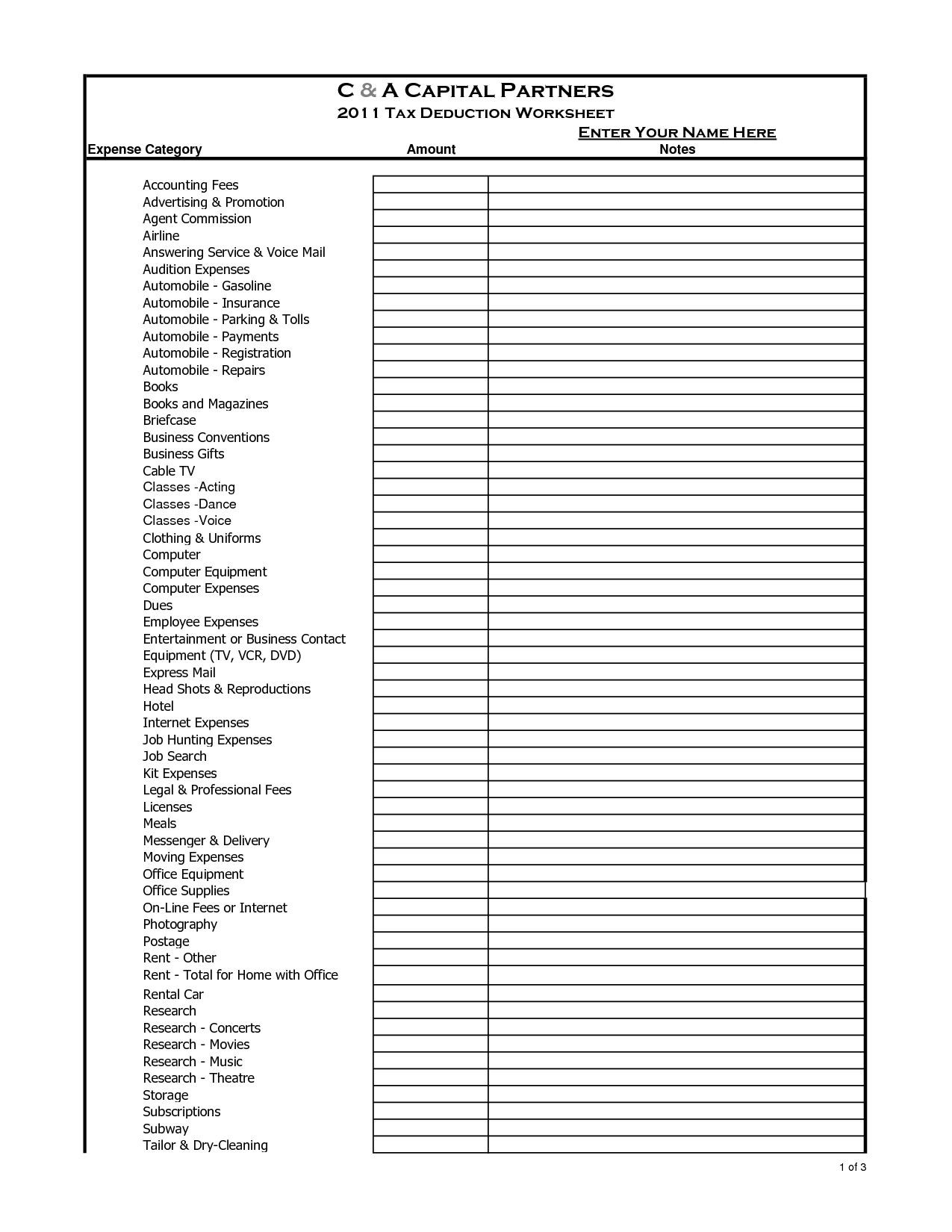

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

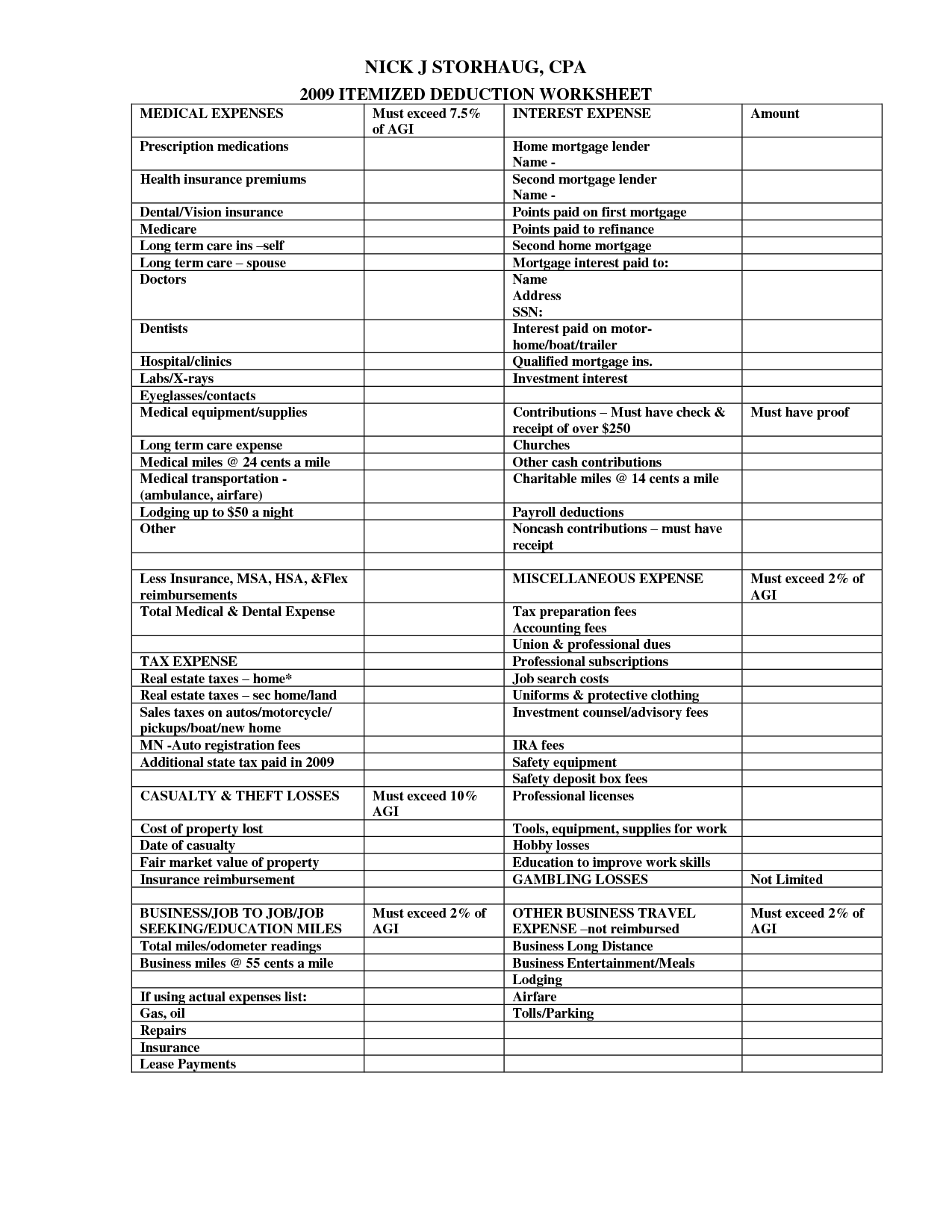

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Section 179 of the IRS tax code allows businesses to deduct the purchase price up to 1 160 000 for qualifying assets such as construction equipment Did You For 2020 you can deduct up to 1 040 000 in equipment with a spending cap of 2 590 000 Bonus depreciation is 100 Essentially Section 179 is more beneficial to small businesses than ever It is one of

If you buy qualifying equipment Section 179 allows you to deduct the total purchase price from your gross income from this tax year This deduction is an incentive from the U S government to invest in equipment This allowance is taken after any allowable Section 179 deduction and before any other depreciation is allowed There are also special rules and limits for depreciation of listed

Download Tax Deduction For Equipment Purchase

More picture related to Tax Deduction For Equipment Purchase

Section 194Q Deduction Of Tax At Source On Payment Of Doc Template

https://www.pdffiller.com/preview/575/646/575646055/large.png

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

Section 179 Tax Deductions Infographic GreenStar Solutions

https://greenstar-us.com/wp-content/uploads/2021/04/Section-179-Tax-Deductions-Infographic-768x1920.png

If you purchase equipment with a combination of cash and a trade in you can only claim the section 179 deduction for the cash you paid If the cost of your section 179 In order to use the Section 179 deduction for 2023 you will need to have the purchased or leased the qualifying equipment this year for your business This means you have until December 31 2023 to purchase or

The Section 179 deduction for 2024 is 1 220 000 an 60 000 increase from the previous year This allows businesses to deduct the full purchase price of qualifying equipment To take the deduction for tax year 2024 the equipment must be financed or purchased and put into service between January 1 2024 and the end of the day on December 31

Joint Tax Deduction Brookline Food Rescue

https://i0.wp.com/brooklinefoodrescue.org/wp-content/uploads/2021/02/VoucherJoint.png?fit=1280%2C780&ssl=1

How Do Tax Deductions For Donating A Car Actually Work

https://i0.wp.com/automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png?w=1000&ssl=1

https://www.thebalancemoney.com/business-equipment...

Deduct Supplies Expense Since supplies are supposedly used up within the year of purchase the cost of supplies as current assets is listed as an expense on your

https://www.smbsales.com/2021-tax-deductions-for...

2021 Spending Cap on equipment purchases 2 620 000 This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Joint Tax Deduction Brookline Food Rescue

Tax Deductions You Can Deduct What Napkin Finance

16 Insurance Comparison Worksheet Worksheeto

A Tax Liability Super Deduction Means Now Is A Great Time To Purchase

Section 179 Radiology Equipment Tax Deduction For 2020 Everything Rad

Section 179 Radiology Equipment Tax Deduction For 2020 Everything Rad

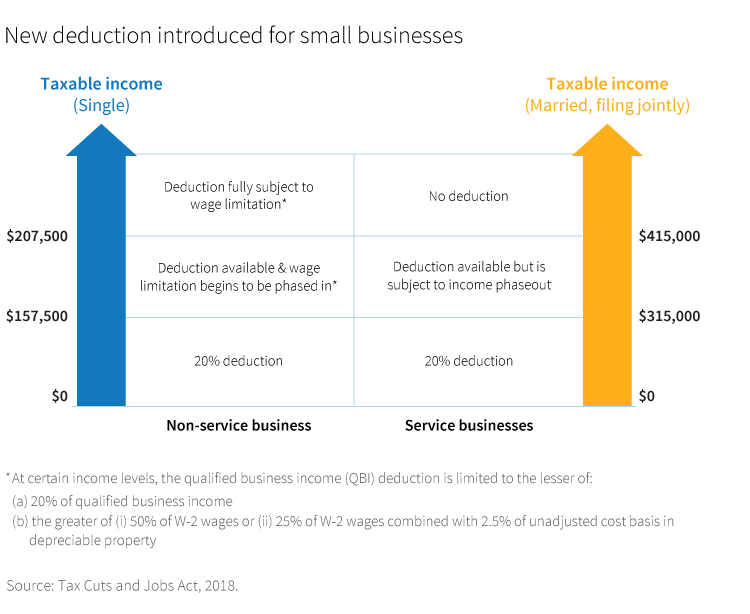

Understanding The New Small Business Tax Deduction Putnam Investments

Section 179 Tax Deduction For Wedling Machines 2020 Bancroft Engineer

Self Employed Business Tax Deduction Sheet A Success Of Your Business

Tax Deduction For Equipment Purchase - For 2020 you can deduct up to 1 040 000 in equipment with a spending cap of 2 590 000 Bonus depreciation is 100 Essentially Section 179 is more beneficial to small businesses than ever It is one of