Tax Deduction For Health Care Premiums You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

Tax Deduction For Health Care Premiums

Tax Deduction For Health Care Premiums

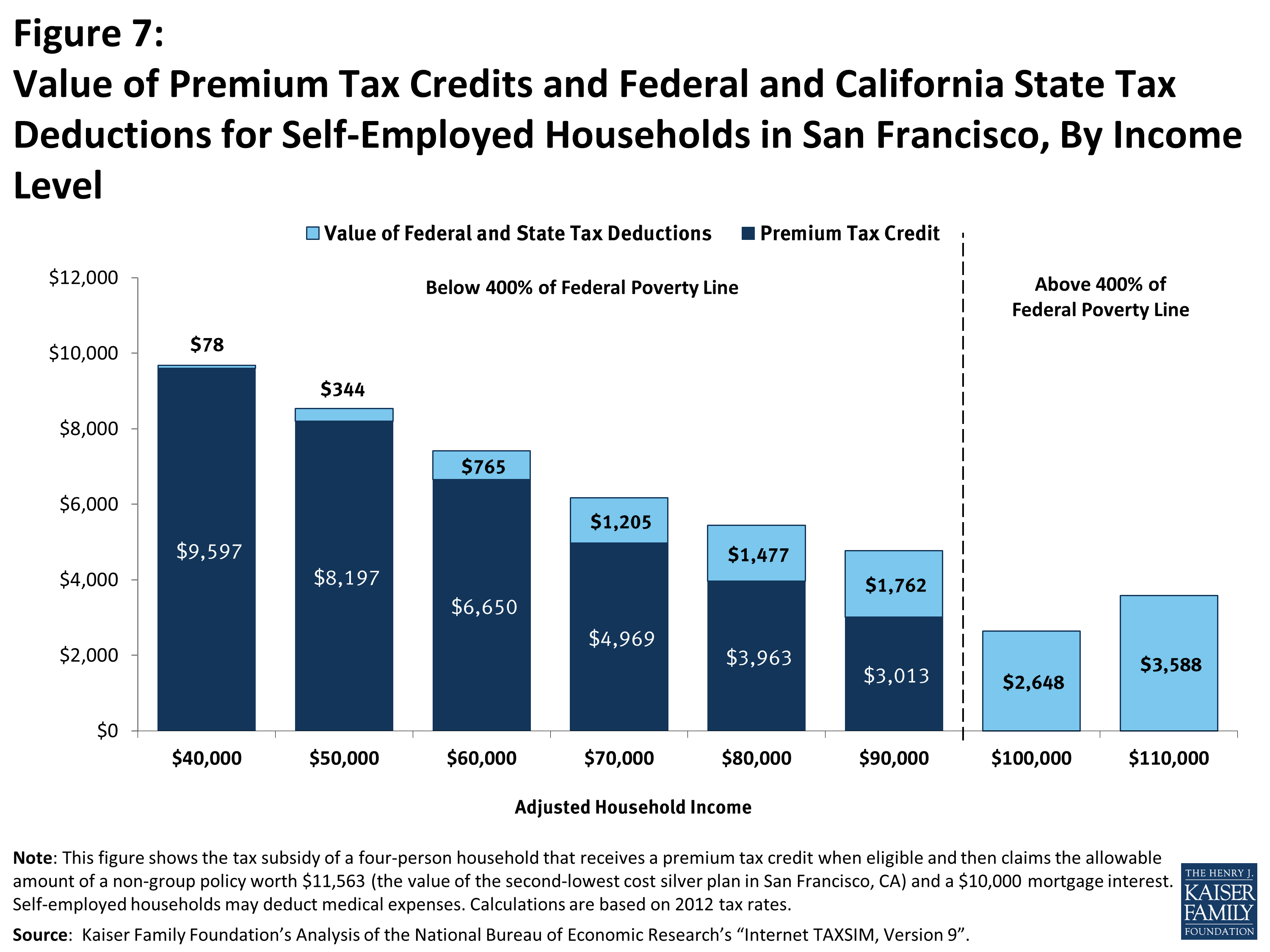

https://www.kff.org/wp-content/uploads/2014/10/7779-02-figure-7.png?resize=698

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Tax Deduction For Health Insurance When Can You Claim It Business News

https://i3.wp.com/ic-cdn.flipboard.com/thestreet.com/68fad7457e0ef3ddf6a0f261418e485cb5d16e9c/_xlarge.jpeg

Amounts paid for insurance premiums to cover medical care or qualified long term care Certain costs related to nutrition wellness and general health are considered medical expenses More information about qualifications can be found in the Frequently asked questions about medical expenses related to nutrition wellness and This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

Updated on April 15 2024 Key takeaways Your health insurance premiums may be tax deductible depending on whether you itemize deductions your total medical costs employment status and other factors Since there s no double dipping allowed you can t deduct your health insurance premiums on your tax return if they were already paid with pre tax money throughout the year i e deducted from your paycheck before your

Download Tax Deduction For Health Care Premiums

More picture related to Tax Deduction For Health Care Premiums

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

When Can You Claim A Tax Deduction For Health Insurance

https://static.wixstatic.com/media/b63c6f_c74351e3d6604e8bb40e4866f25fafe8~mv2.png/v1/fill/w_940,h_788,al_c,q_90/b63c6f_c74351e3d6604e8bb40e4866f25fafe8~mv2.png

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

https://onecargroup.com.au/wp-content/uploads/2018/08/Files-1200x938.jpg

The Bottom Line Health insurance premiums may be deductible expenses on the tax returns of self employed people as well as other taxpayers who itemize deductions Itemized deductions are limited to the amount including other out of pocket medical expenses exceeding 7 5 of the taxpayer s adjusted gross income Updated May 22 2024 You can claim your health insurance premiums on your federal taxes if you buy your own health insurance itemize deductions and spent more than 7 5 of your income on medical expenses

OVERVIEW Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

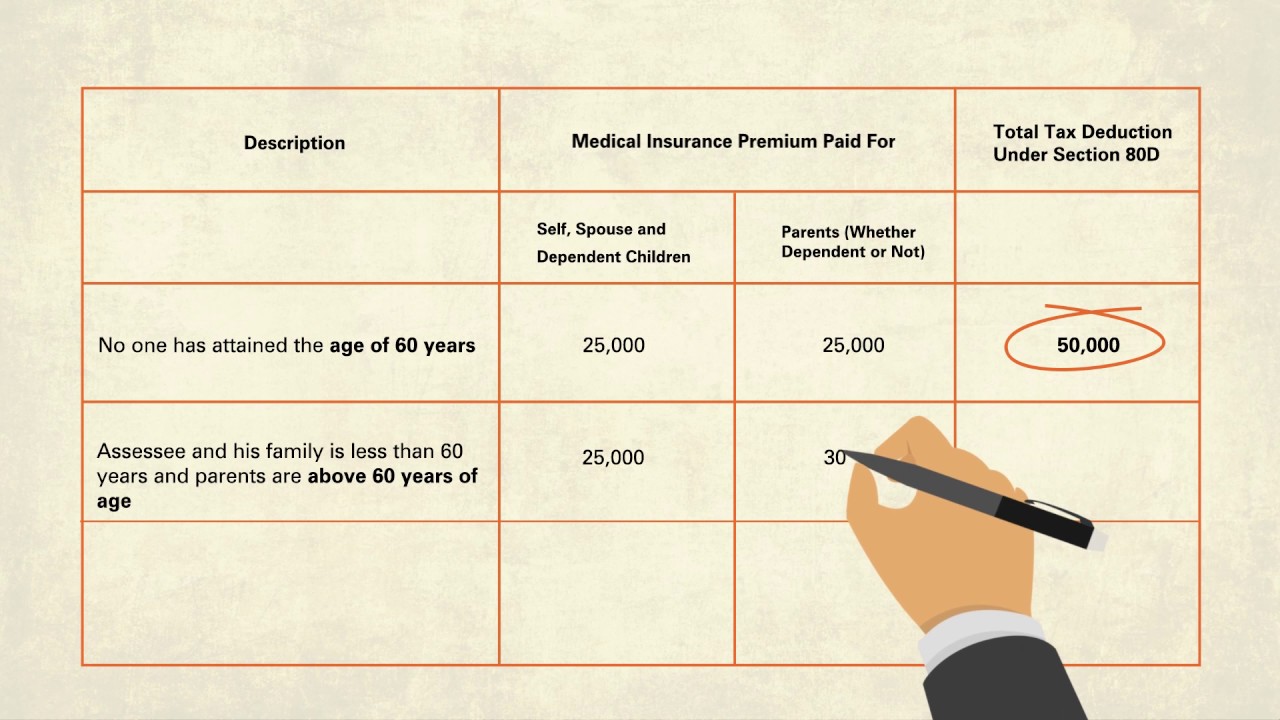

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/Deduction-for-Health-Insurance-us-80D-of-Income-Tax-.png

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

https://www. forbes.com /advisor/health-insurance/is...

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April

https:// money.usnews.com /money/personal-finance/...

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Tax Deduction Template

Tax Deduction Of Health Insurance Premium YouTube

Employee Deductions For Health Insurance Financial Report

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

Medicare Costs 2023 Chart Hot Sex Picture

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

Are Health Insurance Premiums Tax Deductions In Canada

Tax Deduction For Health Care Premiums - Since there s no double dipping allowed you can t deduct your health insurance premiums on your tax return if they were already paid with pre tax money throughout the year i e deducted from your paycheck before your