Tax Deduction For Healthcare Expenses This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and

Here s a look at how the medical expense deduction works and how you can make the most of it Are medical expenses tax deductible Taxpayers can deduct The IRS allows you to deduct expenses for many medically necessary products and services including surgeries prescription medications and dental and vision care You can t deduct medical expenses that are for

Tax Deduction For Healthcare Expenses

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Tax Deduction For Healthcare Expenses

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

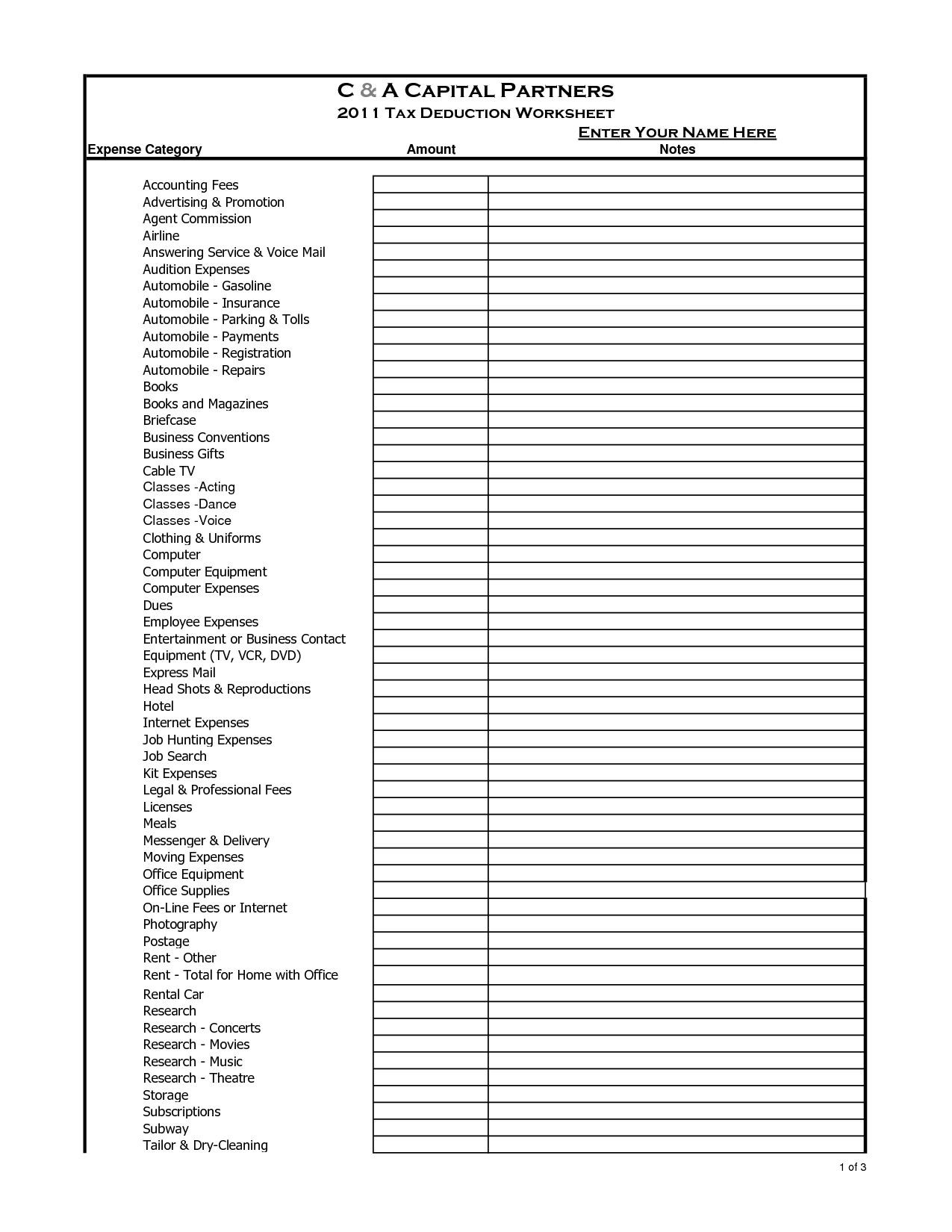

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Healthcare Insurance Deduction In Ireland Insurance Hacks To Write Off

https://irelandaccountant.ie/wp-content/uploads/healthcare-insurance-tax-deduction-final.jpg

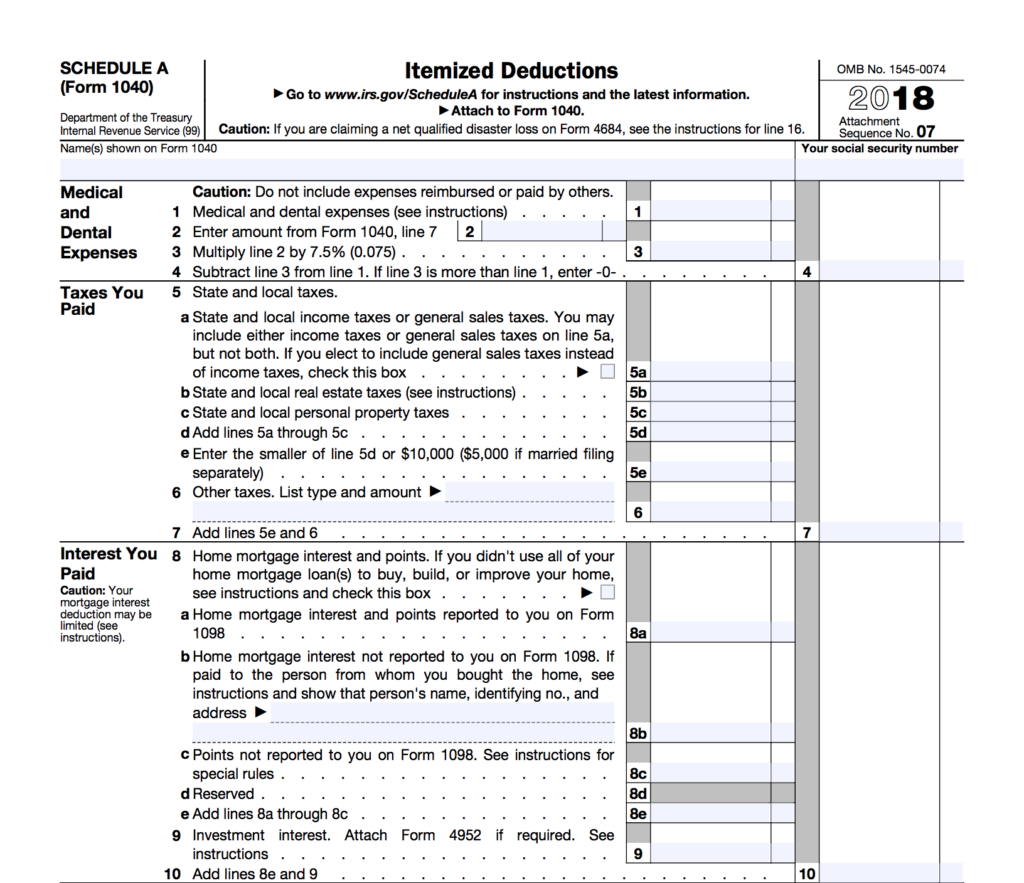

Deduct medical expenses on Schedule A Form 1040 Itemized Deductions The total amount of all allowable medical expenses is the amount of such expenses that exceeds 7 5 of adjusted They offer tax deductible contributions tax free earnings and tax free withdrawals for qualified expenses For 2023 HSA contributions are capped at 3 850 for individuals and

Learn the IRS approved expenses and why you must itemize your deductions to reduce your tax bill You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on You can also only deduct the portion of your medical expenses that exceed 7 5 of your adjusted gross income AGI Another way to claim medical expenses on your taxes is by using a Health Savings Account HSA With an

Download Tax Deduction For Healthcare Expenses

More picture related to Tax Deduction For Healthcare Expenses

Petition A Tax Deduction For Healthcare Workers Change

https://assets.change.org/photos/2/ra/zr/BjrAzrRIMPGNILZ-1600x900-noPad.jpg?1611292551

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Which Medical Expenses Are Tax Deductible You can deduct unreimbursed medical care expenses paid for yourself your spouse and your dependents You can deduct medical expenses that exceed 7 5 of your adjusted gross income AGI For example if you have an AGI of 50 000 and 10 000 in total deductible

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath To deduct medical expenses from your taxes you ll need to choose itemized deductions instead of a standardized deduction You ll file a 1040 Schedule A Form that lists

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

https://onecargroup.com.au/wp-content/uploads/2018/08/Files-1200x938.jpg

Can You Claim A Tax Deduction For Medical Expenses OVLG

https://www.ovlg.com/sites/files/uploaded_files/Can-you-claim-a-tax-deduction-for-medical-expenses.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.irs.gov › publications

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and

https://www.nerdwallet.com › article › taxe…

Here s a look at how the medical expense deduction works and how you can make the most of it Are medical expenses tax deductible Taxpayers can deduct

8 Tax Itemized Deduction Worksheet Worksheeto

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Health Reimbursement Arrangement Employers Are Allowed To Say A Tax

Income Tax Deductions For The FY 2019 20 ComparePolicy

Printable Itemized Deductions Worksheet

2020 Standard Deduction Over 65 Standard Deduction 2021

2020 Standard Deduction Over 65 Standard Deduction 2021

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

How To Find Average Income Tax Rate Parks Anderem66

Claim Income Tax Deduction For Medical Treatment Of Specified Diseases

Tax Deduction For Healthcare Expenses - They offer tax deductible contributions tax free earnings and tax free withdrawals for qualified expenses For 2023 HSA contributions are capped at 3 850 for individuals and