Tax Deduction For Home Health Care Page Reviewed Updated Feb 29 2024 Home care can be expensive nearly 5 000 per month on average but there are ways to help make it more

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you For long term home care to be tax deductible care needs to be performed by a home healthcare worker and three requirements generally need to be met The

Tax Deduction For Home Health Care

Tax Deduction For Home Health Care

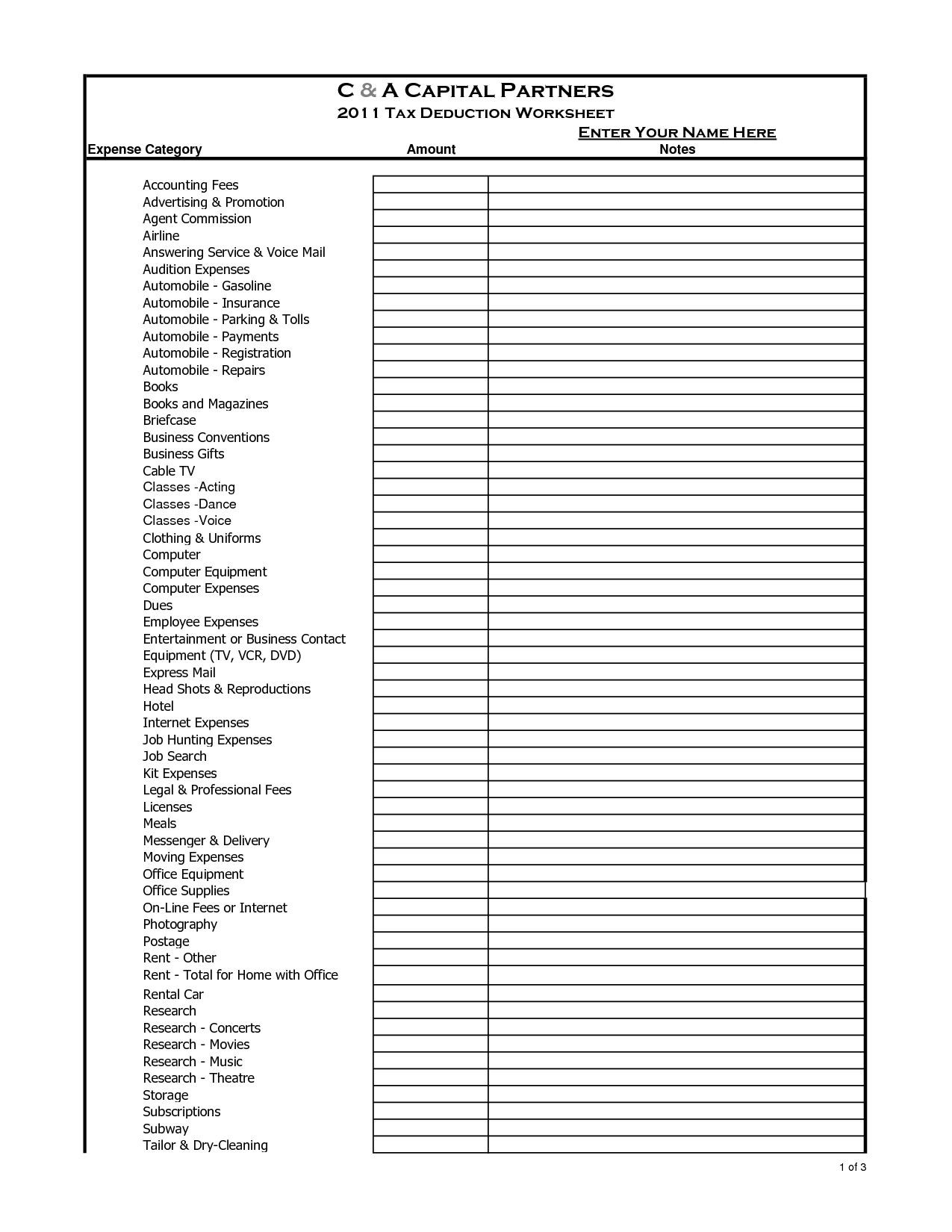

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

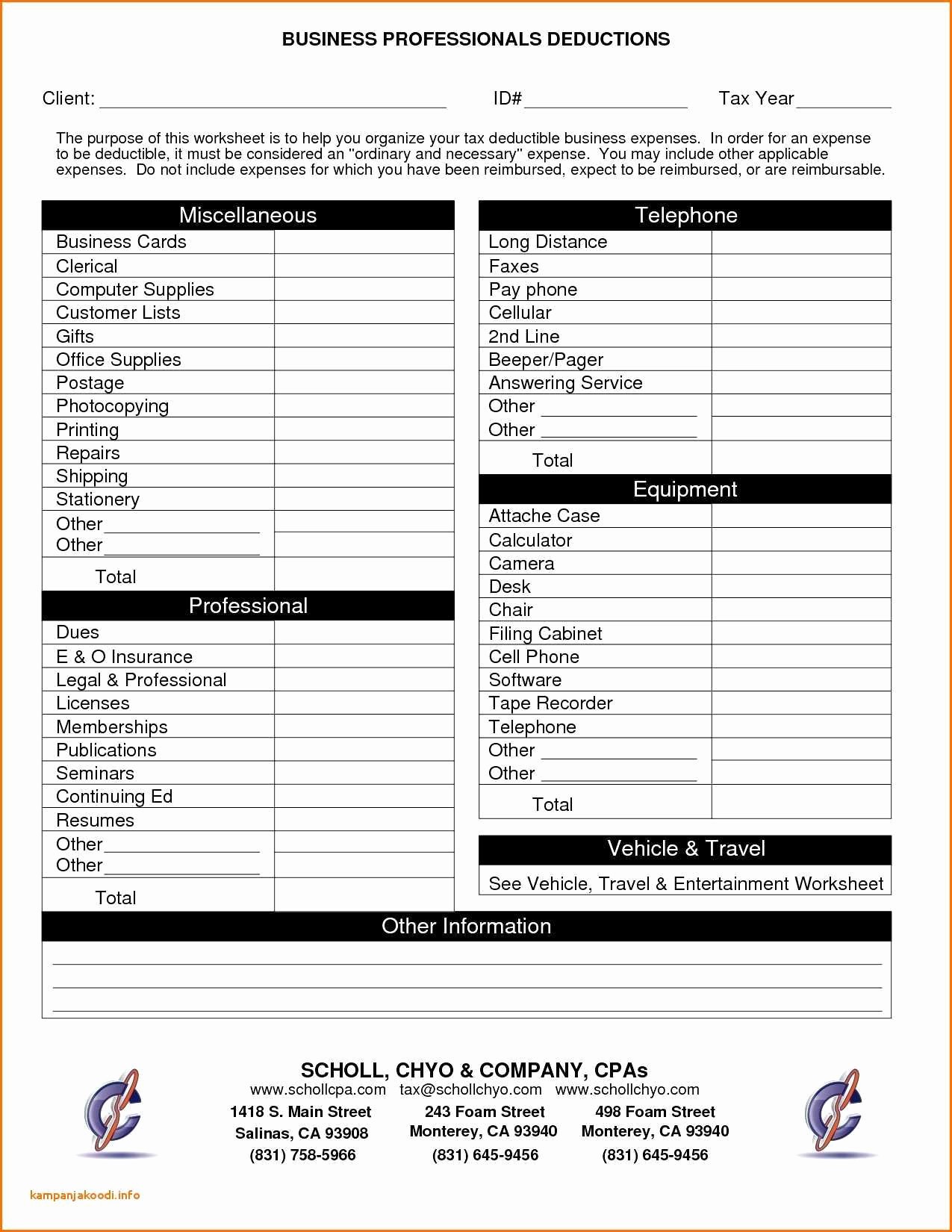

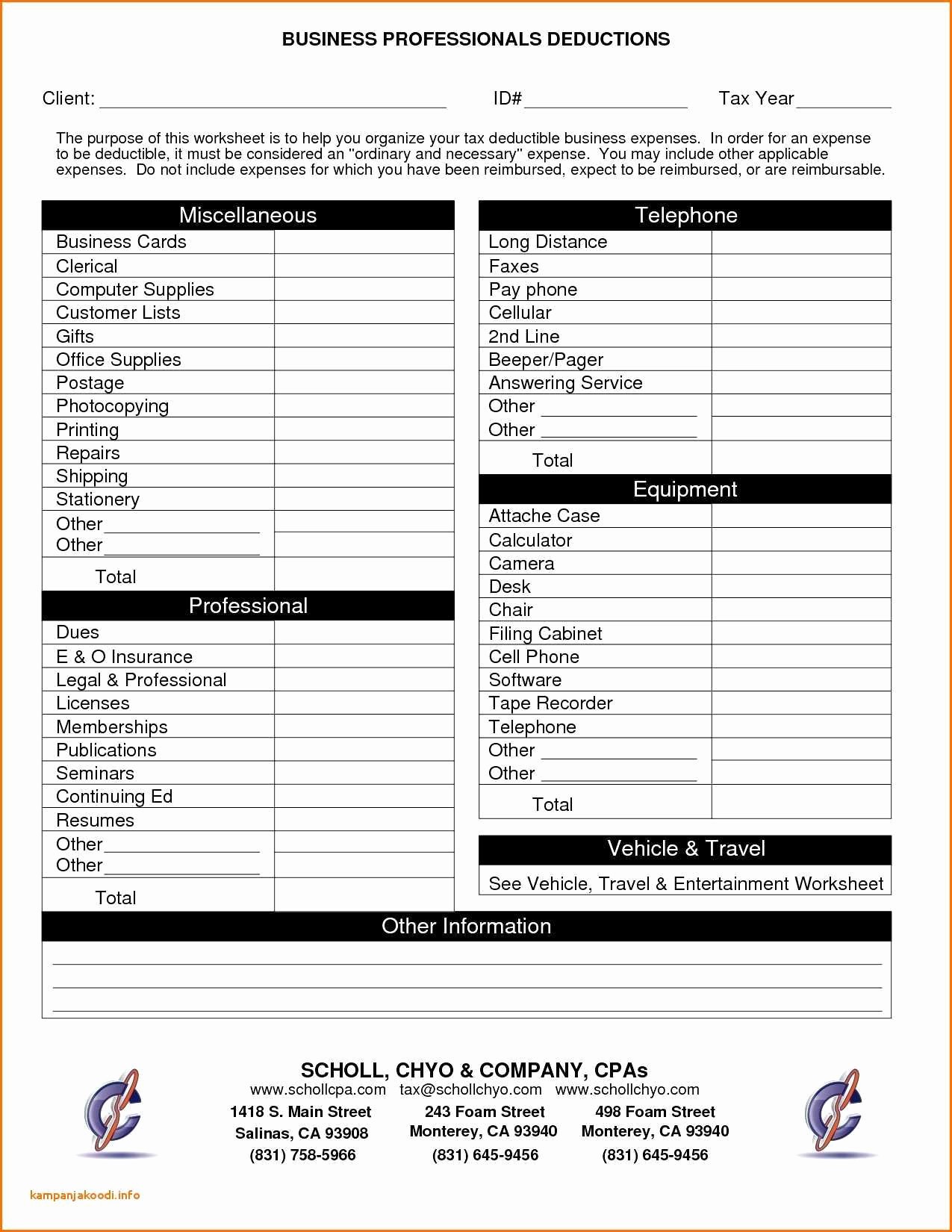

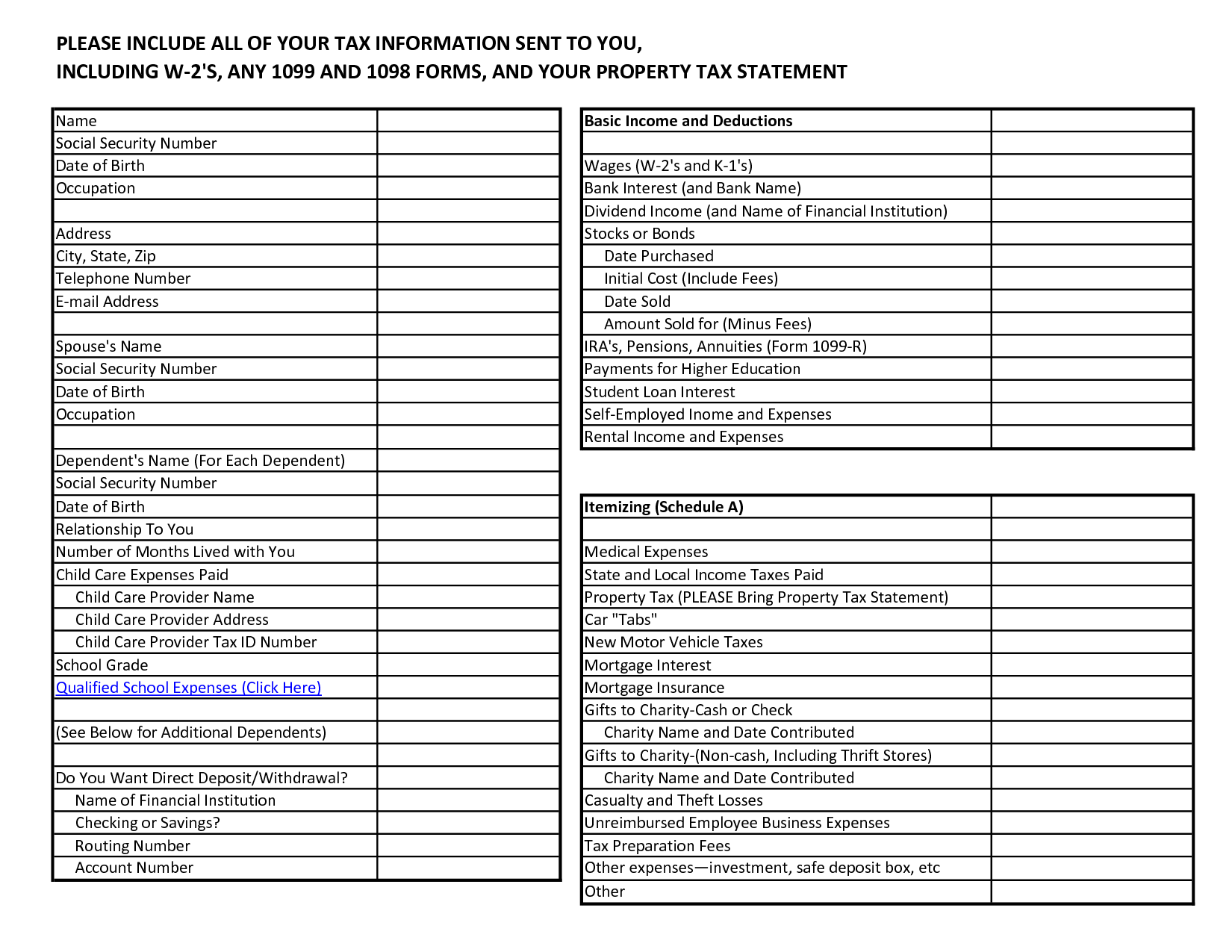

Itemized Deductions Worksheet Template

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet.jpg

Small Business Tax Deductions Worksheets

https://www.housview.com/wp-content/uploads/2018/08/small_business_tax_deductions_worksheet_the_best_worksheets_image_7.jpg

When an in home caregiver is considered an employee a variety of federal and state laws require the family to 1 collect and Is home health care tax deductible Yes out of pocket costs for nursing services including home health care are tax deductible It s important to keep in mind

To claim expenses for home health care and other allowable medical expenses you must itemize deductions on Form 1040 Schedule A Under IRS guidelines you can only You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Download Tax Deduction For Home Health Care

More picture related to Tax Deduction For Home Health Care

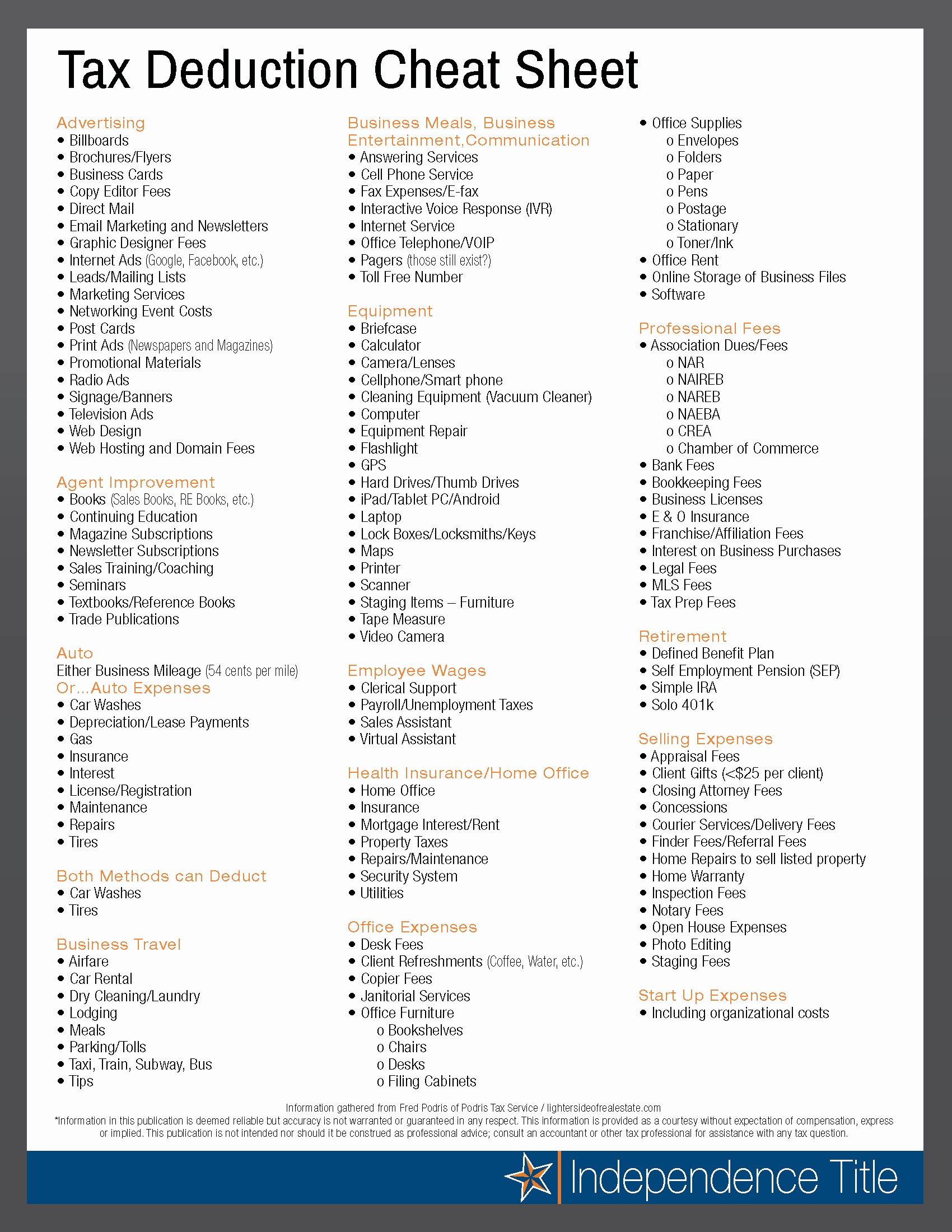

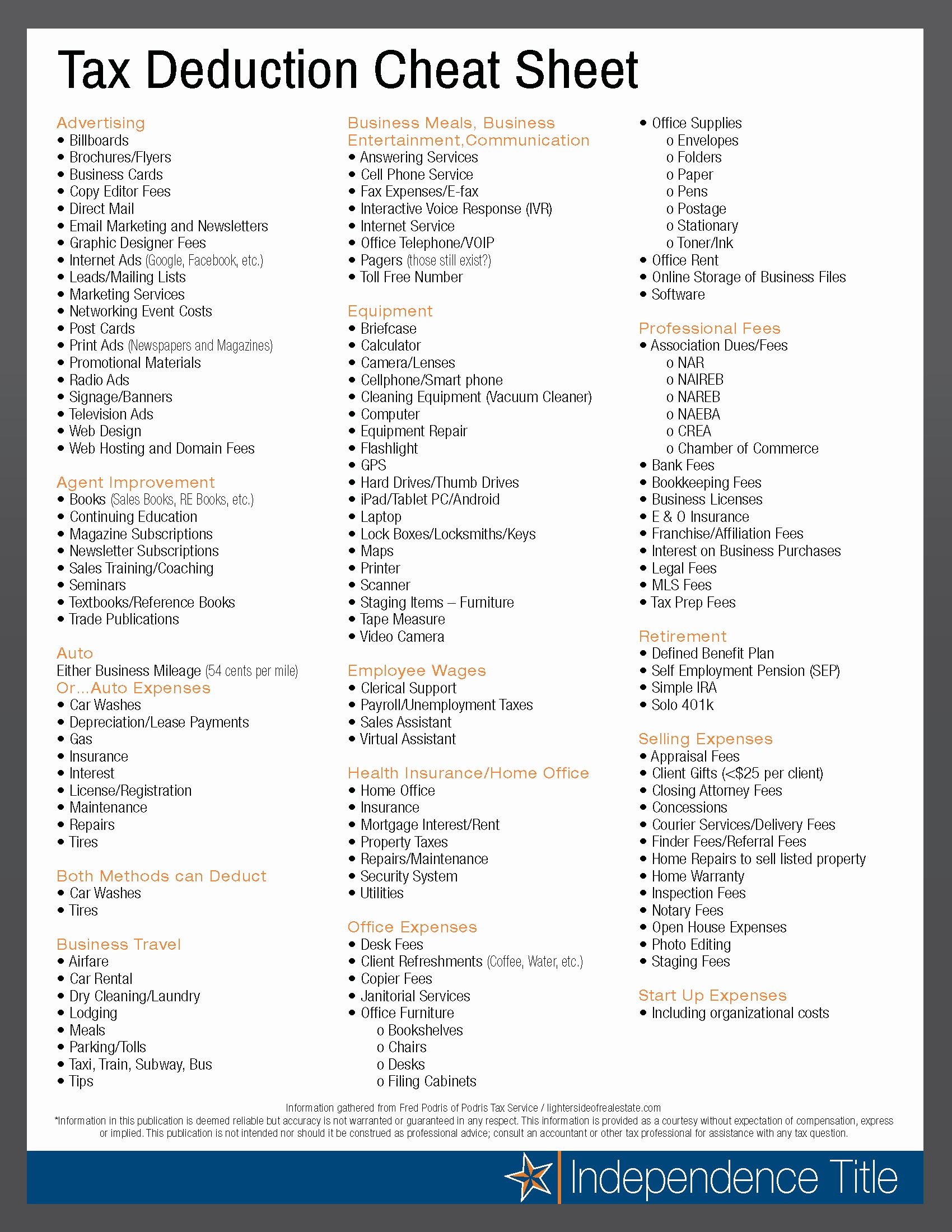

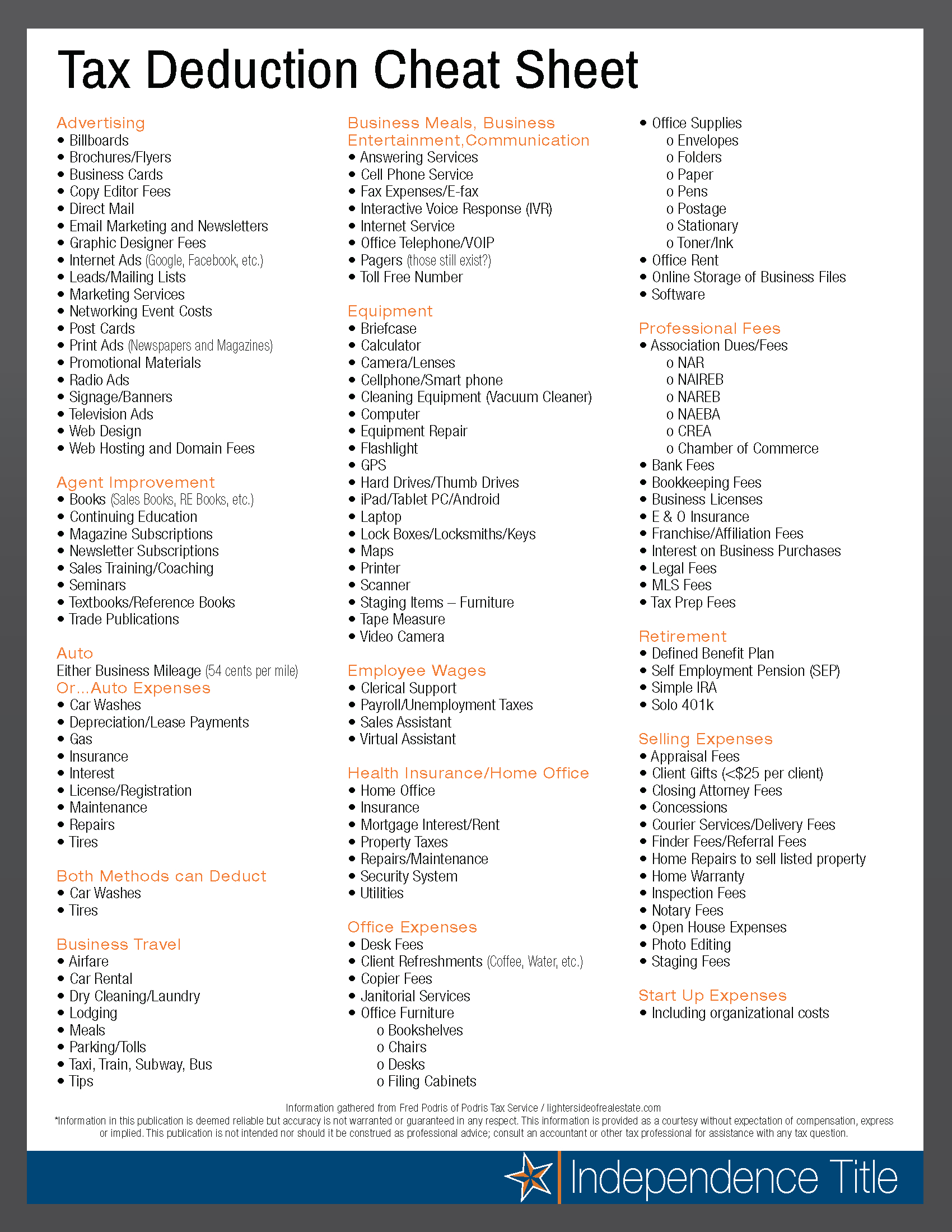

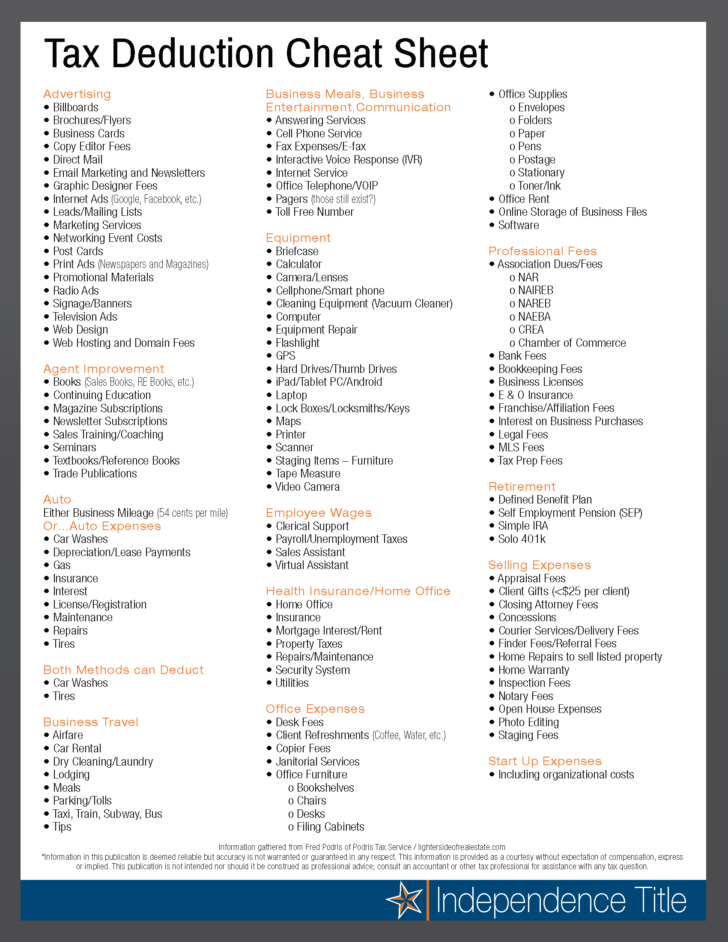

Printable Tax Deduction Cheat Sheet

https://i.pinimg.com/originals/c6/6c/36/c66c36ac209edd0f430465859899061c.png

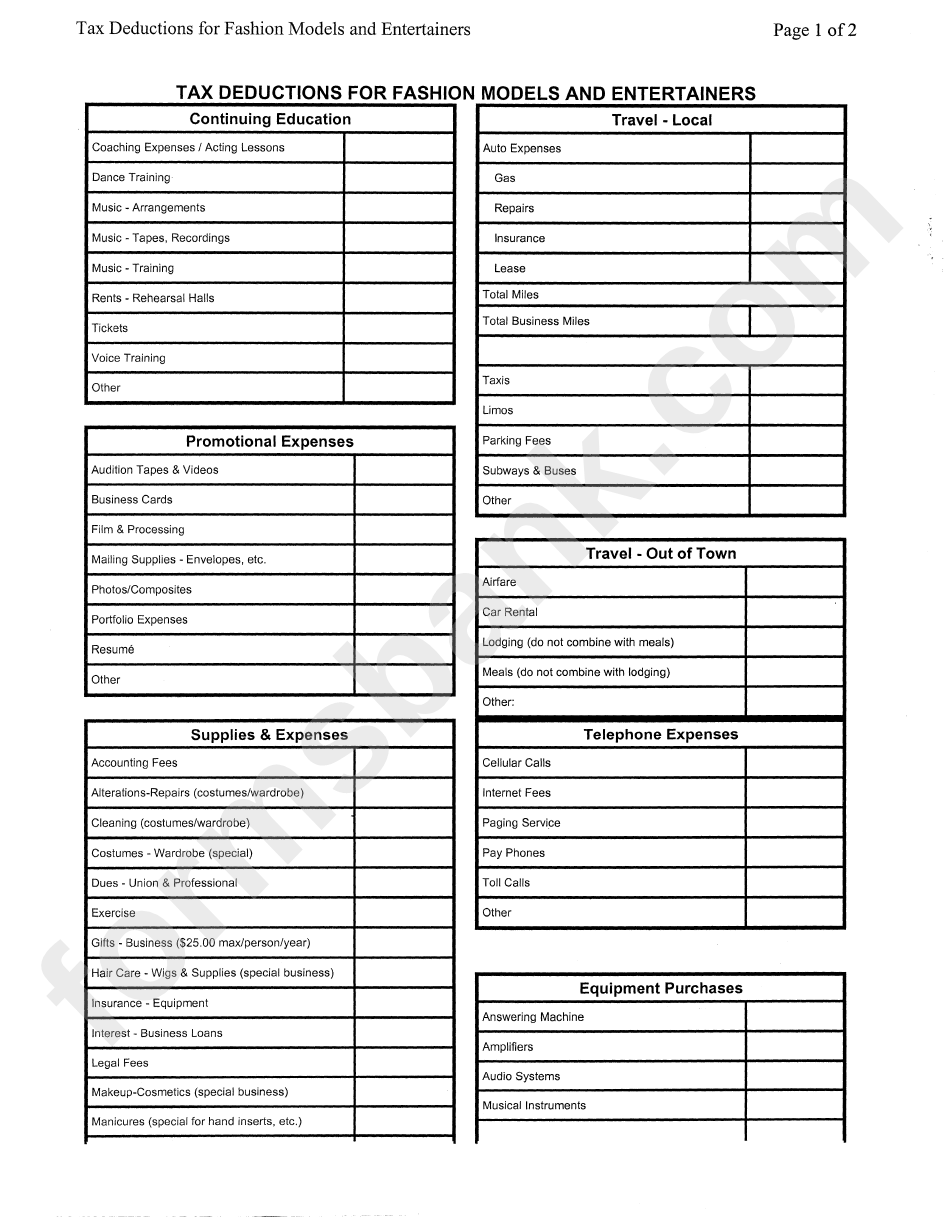

39 Airline Pilot Tax Deduction Worksheet Worksheet Live

https://data.formsbank.com/pdf_docs_html/304/3047/304716/page_1_bg.png

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable Topic no 502 Medical and dental expenses If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to

Answer Yes in certain instances nursing home expenses are deductible medical expenses If you your spouse or your dependent is in a nursing home primarily 1 Medical care tax deduction IRS Publication 502 Employers may take an itemized deduction for qualifying medical expenses that are more than 7 5 of their

Small Business Tax Worksheet Excel

https://petermcfarland.us/wp-content/uploads/2018/12/itemized-deductions-worksheet-for-small-business-awesome-tax-document-5c07da7c4121e.jpg

Nurse Tax Deduction Worksheet Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/391/382/391382225/large.png

https://www. payingforseniorcare.com /.../tax-deductions

Page Reviewed Updated Feb 29 2024 Home care can be expensive nearly 5 000 per month on average but there are ways to help make it more

https://www. cpapracticeadvisor.com /2022/11/09/home...

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

Small Business Tax Worksheet Excel

Anchor Tax Service Nurses Medical Professionals

Home Improvement Deductions 2024 Form Bird Kassie

10 Home Based Business Tax Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Realtor Tax Deduction Worksheet Worksheet List

Printable Real Estate Agent Tax Deductions Worksheet Printable Word

Tax Deduction For Home Health Care - Is home health care tax deductible Yes out of pocket costs for nursing services including home health care are tax deductible It s important to keep in mind