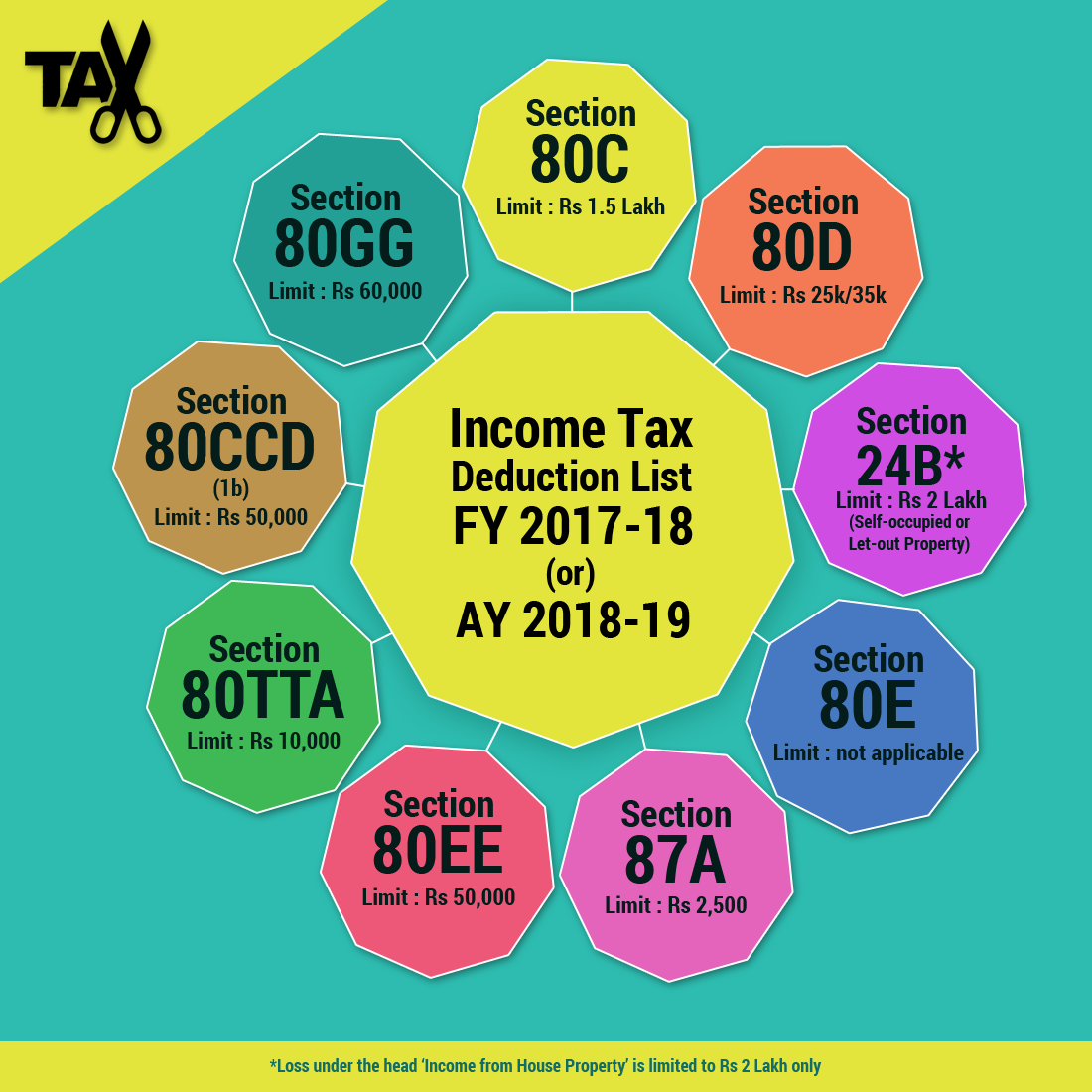

Tax Deduction For Housing Loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article Tax Advantages of Purchasing Property in Finland First time Homebuyers Exemption From Transfer Tax Tax Deduction Credit for Housing Loan Interest Capital Gains on Property Tax Exemption Tax Credit for Renovations Household Expenses Primary sources of information for this page Finnish Tax Administration Verohallinto Finnish

Tax Deduction For Housing Loan

Tax Deduction For Housing Loan

https://www.thepinnaclelist.com/wp-content/uploads/2022/10/Can-You-Receive-A-Tax-Deduction-For-Your-Home-Loan-Interest-Guidance-From-A-Mortgage-Broker-In-Hobart-Australia.jpg

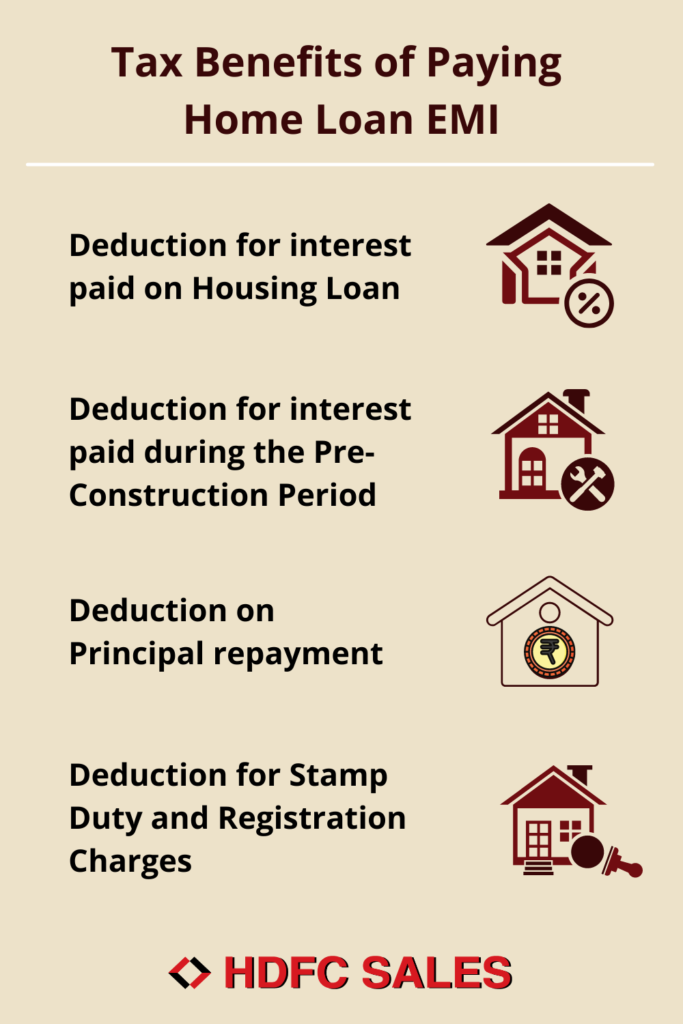

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income through this itemized deduction of mortgage interest The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct interest on

If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately The standard deduction for the 2022 tax year is 25 900 for married couples filing jointly 12 950 for single filers and married individuals filing separately 19 400 for heads of households

Download Tax Deduction For Housing Loan

More picture related to Tax Deduction For Housing Loan

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

https://freefincal.com/wp-content/uploads/2023/02/Home-Loan-interest-double-tax-deduction-benefit-removed-in-budget-2023.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Deduction limitations To prevent taxpayers from claiming a deduction for luxurious homes the law limits the deduction to the interest that you pay on up to 750 000 in total mortgage balances This 750 000 limitation applies to the total of both mortgages For example if you owe 600 000 on your main home and 800 000 on a vacation home If your yearly salary is 120 000 you can use the mortgage interest you paid to reduce your taxable income to 100 000 This means you ll only pay taxes on 100 000 of your income not 120 000

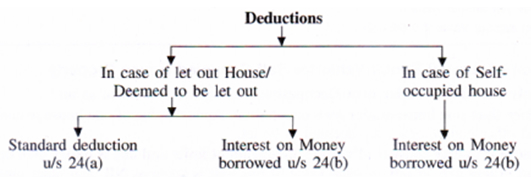

For 2023 the standard deduction is 13 850 for married filing separately and single filers Head of household filers have a standard deduction of 20 800 for the 2023 tax year If you are married Deduction on interest paid on a housing loan A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Declaration For Housing Loan PDF Loans Government

https://imgv2-1-f.scribdassets.com/img/document/547858339/original/f8497bb72e/1659337439?v=1

https://cleartax.in/s/home-loan-tax-benefits

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

https://cleartax.in/s/home-loan-tax-benefit

Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

About That Property Tax Deduction For Vets NJMoneyHelp

Tax Deductions You Can Deduct What Napkin Finance

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Deductions For The FY 2019 20 ComparePolicy

How To Donate Real estate And Get A Tax Deduction By I Believe World

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Tax Deduction For Housing Loan - If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately