Tax Deduction For Insurance Premiums Updated on April 15 2024 Key takeaways Your health insurance premiums may be tax deductible depending on whether you itemize deductions your total medical costs employment status and other factors

In some instances you might be able to deduct your insurance premiums medical expenses and other health related costs on your taxes Here s what to know As a general guideline the ATO will allow a deduction for certain insurance premiums if it can be shown that the insurance cover relates to earning assessable income In other

Tax Deduction For Insurance Premiums

Tax Deduction For Insurance Premiums

https://www.thefriendlyaccountants.co.uk/wp-content/uploads/2018/04/paper-3224639_640.jpg

Mortgage Insurance Premiums Tax Deduction The Oasis Firm Credit

https://www.theoasisfirm.com/wp-content/uploads/2022/03/Mortgage-Insurance-Premiums-Tax-Deduction-3.png

Why Do My Health Insurance Premiums Keep Going Up Each Year Part 2

https://www.trustedunion.com/wp-content/uploads/2019/01/shutterstock_premium-increases-part-2-875x410.jpg

If you pay for health insurance premiums pre tax you cannot deduct the cost on your tax return However if you pay for premiums after taxes are taken out of Here s what you need to know Tax deductions for insurance premiums allow you to lower your taxable income when you file your tax return These deductions

You can claim your health insurance premiums on your federal taxes if you buy your own health insurance itemize deductions and spent more than 7 5 of your income on medical expenses But if you have As a general rule corporate expenses that are necessary to operate a trade or business are tax deductible under guidelines published by the Internal Revenue

Download Tax Deduction For Insurance Premiums

More picture related to Tax Deduction For Insurance Premiums

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Accessed Feb 29 2024 You may be able to deduct various types of insurance premiums from your taxes including the amount you pay for car insurance home 1 Disability Insurance Disability insurance is probably the most commonly overlooked insurance premium tax deduction This type of insurance can provide supplemental income if you re disabled

Claiming a tax deduction for insurance premiums generally Whether claiming a tax deduction for insurance premiums will be considered allowable depends on the You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

https://www.goodrx.com/insurance/taxes/d…

Updated on April 15 2024 Key takeaways Your health insurance premiums may be tax deductible depending on whether you itemize deductions your total medical costs employment status and other factors

https://smartasset.com/taxes/guide-to-tax-deductions-related-to-insurance

In some instances you might be able to deduct your insurance premiums medical expenses and other health related costs on your taxes Here s what to know

Tax Deduction Thailand 2022 Pay Less With Health Insurance

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

About That Property Tax Deduction For Vets NJMoneyHelp

Qualified Business Income Deduction And The Self Employed The CPA Journal

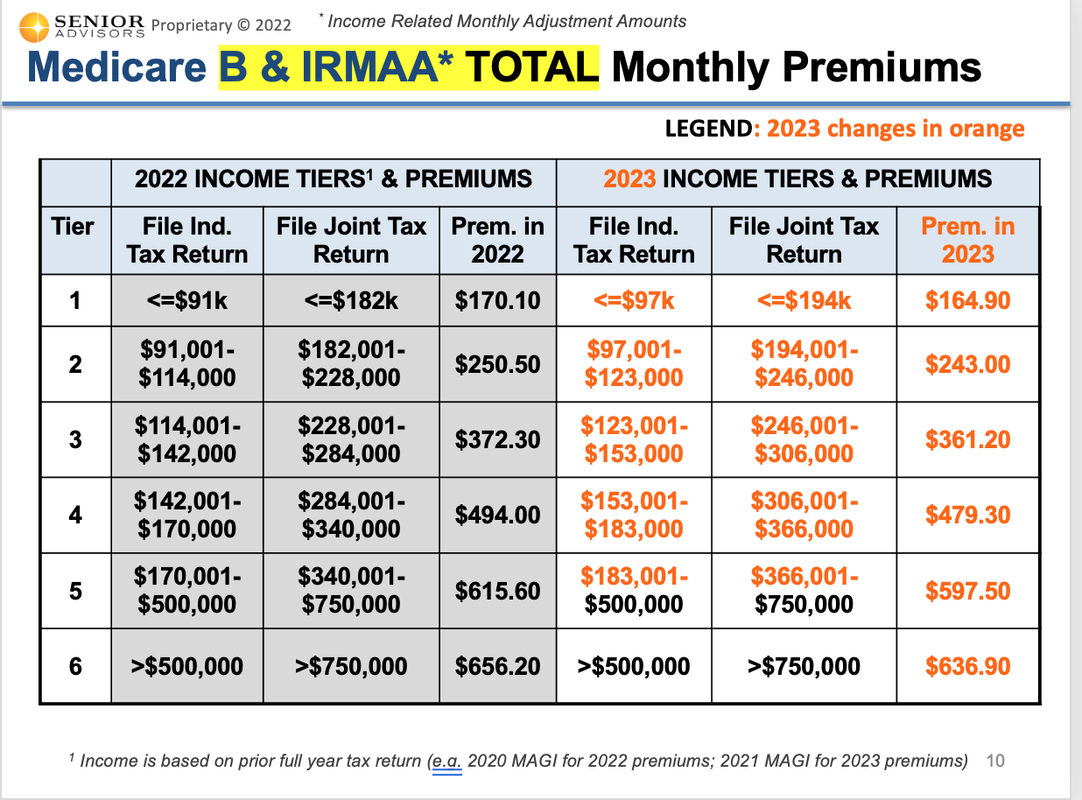

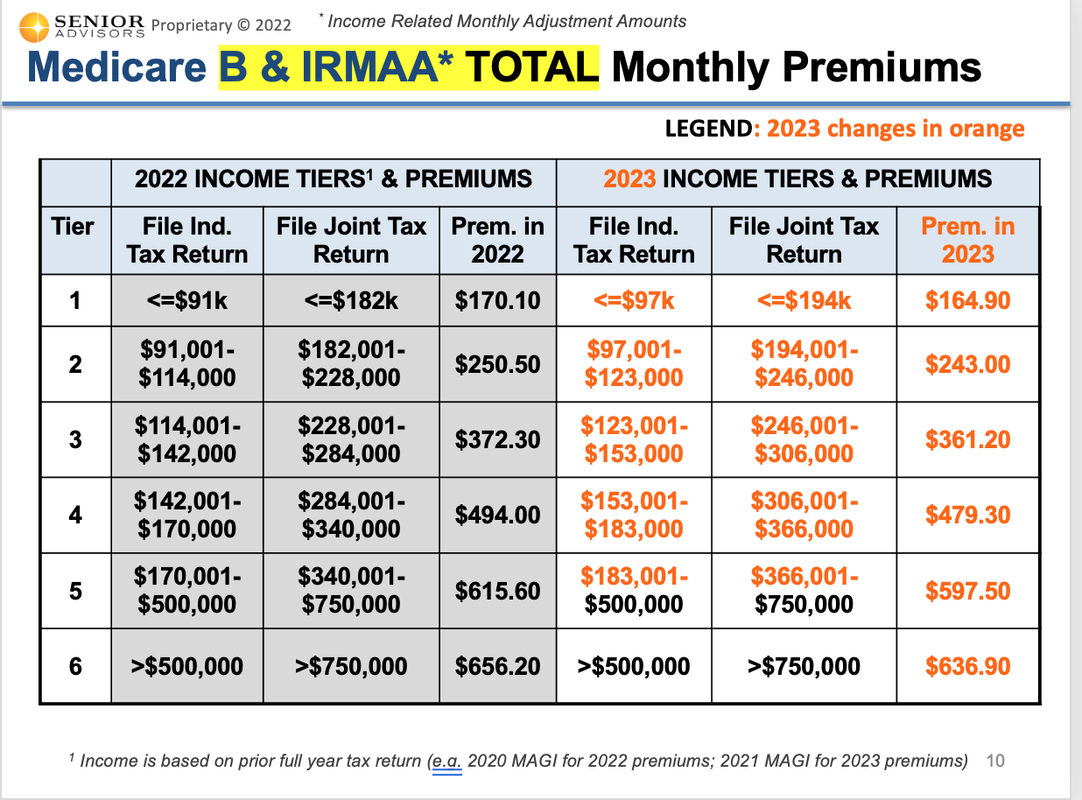

Medicare Blog Moorestown Cranford NJ

Medicare Blog Moorestown Cranford NJ

Tax Deductions You Can Deduct What Napkin Finance

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

Can Your Client Claim A Tax Deduction For Insurance Premiums Cruz And Co

Tax Deduction For Insurance Premiums - The total premium paid is divided by the number of years covered by the plan and you can claim a portion of the premium as a tax deduction annually For example