Tax Deduction For Life Insurance Policies Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy Here s

You generally can t deduct your life insurance premiums on your tax returns In most cases the IRS considers your premiums a personal expense like food or clothing Life insurance is also not required by your The Union Budget 2023 includes new tax regulations for insurance policies issued post 1 April 2023 Premium deductions exemption rules and taxable scenarios

Tax Deduction For Life Insurance Policies

Tax Deduction For Life Insurance Policies

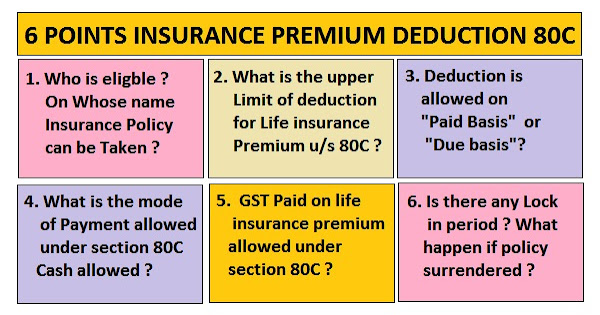

https://4.bp.blogspot.com/-BizvQ5yzwcE/Wk6EIQIdpuI/AAAAAAAAD1A/c-dEh2yYEIoa76gqycE-oOaJOcVZU941ACLcBGAs/w600-h315-p-k-no-nu/life%2Binsurance%2Bpremium%2Bdeduction%2Bunder%2B80C.jpg

New Tax Deduction For Business Angels Konieczny Wierzbicki Law Firm

https://koniecznywierzbicki.pl/wp-content/uploads/2021/12/LI_ulgi-podatkowe_06.12-scaled.jpg

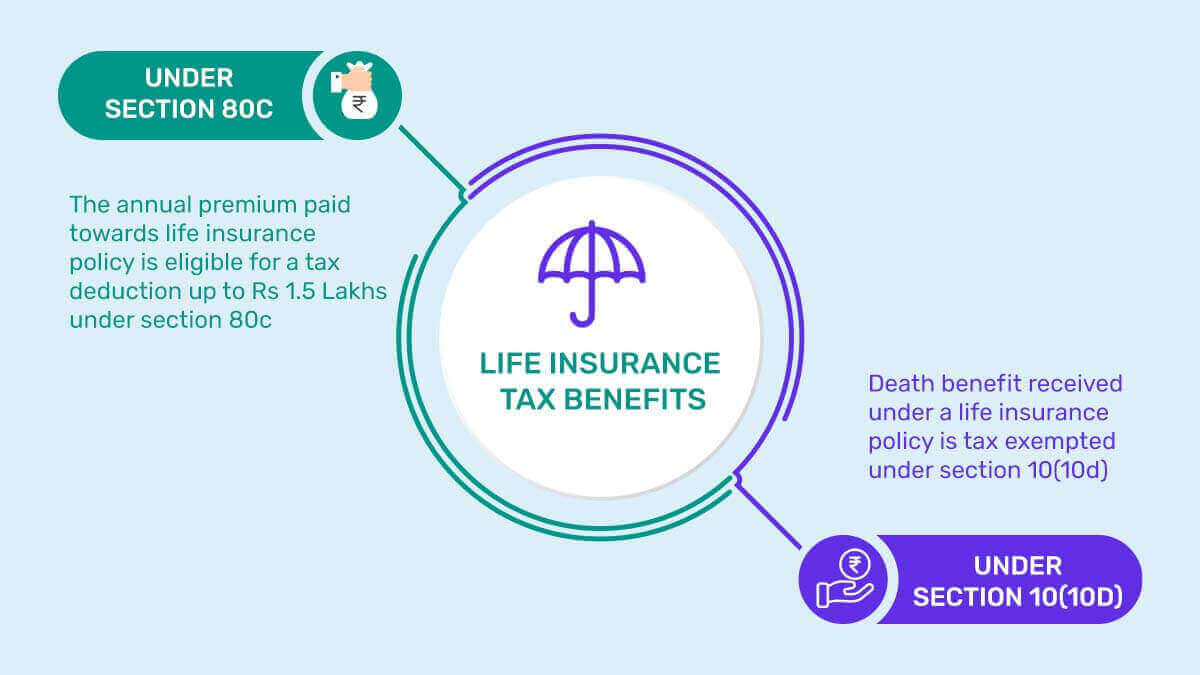

Analysing Tax Deductions In India And Exemptions On Life Insurance

https://www.hdfcsales.com/blog/wp-content/uploads/2018/04/tax-deductions-and-exemptions-on-life-insurance-policies.png

In most cases life insurance premiums aren t tax deductible even for individuals or businesses who can deduct other kinds of insurance But you might be The short answer is most often going to be no life insurance premiums are not tax deductible if you re buying a policy for yourself or another family member That s because the IRS views life insurance as a personal

Key takeaways The IRS considers life insurance a personal expense and ineligible for tax deductions Employers paying employees life insurance premiums can deduct There is no tax deduction for life insurance premiums unless the policy is used for business purposes e g employees group life insurance meeting certain criteria Tax

Download Tax Deduction For Life Insurance Policies

More picture related to Tax Deduction For Life Insurance Policies

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Life Insurance Tax Benefits In India 2023 PolicyBachat

https://www.policybachat.com/ArticlesImages/1165.jpg

5 Powerful Tax Deduction Tips Every Insurance Agency Owner Must Know

https://blog.club.capital/hubfs/CC_Social 5 Tax-Saving Strategies for Insurance Agents-png-1.png

Generally life insurance premiums are not tax deductible However there are some exceptions to this rule For instance some businesses may deduct premiums they pay Key takeaways Life insurance payouts are usually tax free If your policy s payout causes your estate s worth to exceed 13 61 million your heirs might be charged estate taxes Your

This interview will help you determine if the life insurance proceeds received are taxable or nontaxable Information you ll need If you are the policy holder who surrendered the life Tax code 7702 ensures a life insurance policy is used primarily for a death benefit and not as an investment vehicle Find out what 7702 means for your policy

CBDT New Rules On Taxation Of Life Insurance Maturity Amount

https://myinvestmentideas.com/wp-content/uploads/2023/08/CBDT-New-Rules-on-Taxation-of-Life-Insurance-Maturity-Amount.jpg

Personal Income Tax Deduction Numerise

https://numerise.com.cy/wp-content/uploads/2020/03/News_1-1200x630.jpg

https://www.forbes.com/advisor/life-ins…

Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy Here s

https://fidelitylife.com/life-insurance-basics…

You generally can t deduct your life insurance premiums on your tax returns In most cases the IRS considers your premiums a personal expense like food or clothing Life insurance is also not required by your

Qualified Business Income Deduction And The Self Employed The CPA Journal

CBDT New Rules On Taxation Of Life Insurance Maturity Amount

16 Insurance Comparison Worksheet Worksheeto

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Tax Deductions You Can Deduct What Napkin Finance

How Covid Is Changing The Indian Life Insurance Industry LaptrinhX

How Covid Is Changing The Indian Life Insurance Industry LaptrinhX

The 6 Best Tax Deductions For 2020 The Motley Fool

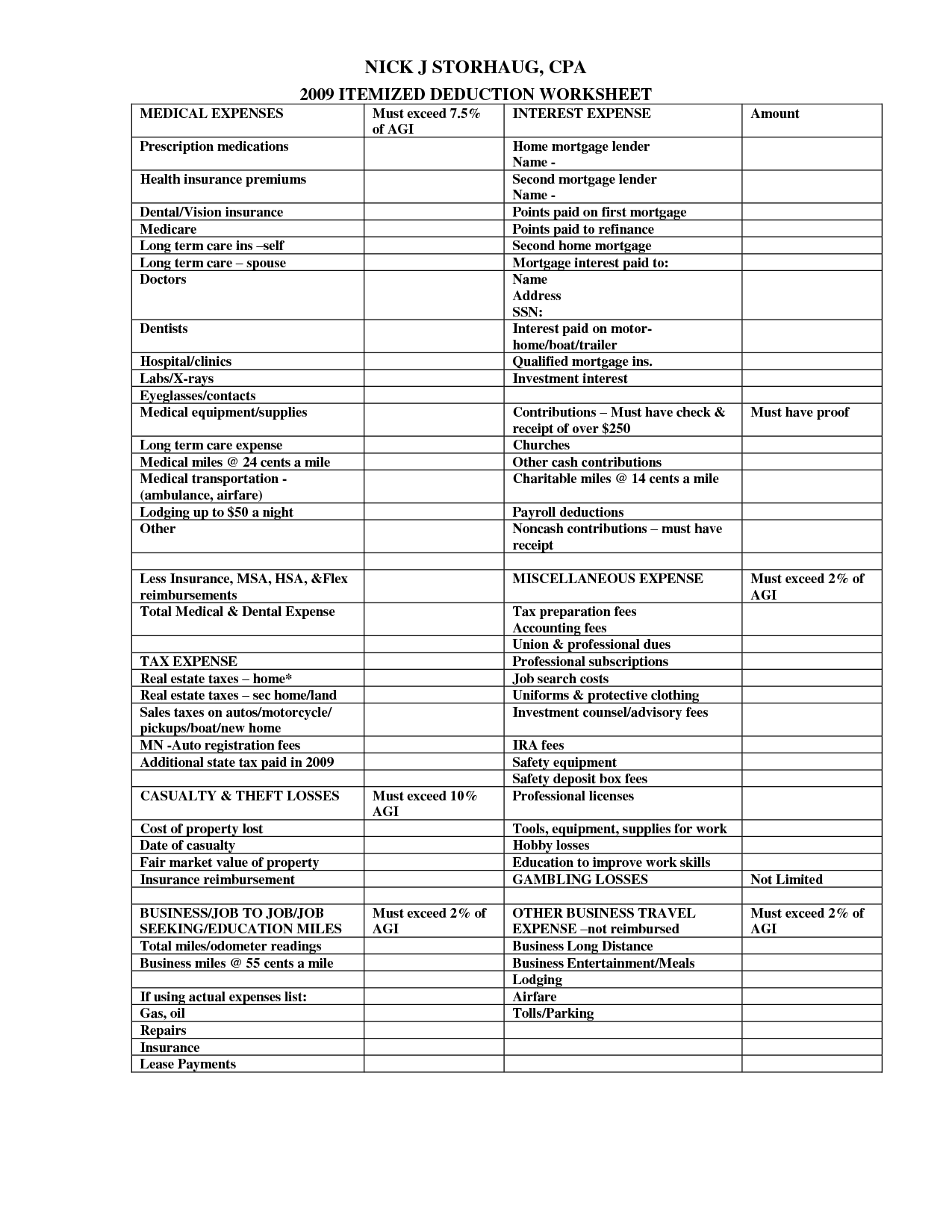

8 Tax Itemized Deduction Worksheet Worksheeto

How To Donate Real estate And Get A Tax Deduction By I Believe World

Tax Deduction For Life Insurance Policies - Key Takeaways In most cases money paid out from a life insurance policy is not taxable Life insurance payouts can sometimes be subject to taxation such as when the contract