Tax Deduction For Medical Expenses In Canada Allowable amount of medical expenses will be 1500 1000 3 x 60 000 700 Ineligible Deductions There are numerous ineligible deductions for the medical expense tax credit that appears on

What is the Medical Expense Tax Credit METC The deductible medical expenses are considered a non refundable tax credit meaning they can help lower how much taxes you d have to pay To February 7 2022 Medical expenses are one of the most if not the most overlooked non refundable tax deductions Most Canadians know that they can claim some of their medical expenses but many are unsure of what

Tax Deduction For Medical Expenses In Canada

Tax Deduction For Medical Expenses In Canada

https://media.freshbooks.com/wp-content/uploads/2023/09/17-Medical-Expenses-Tax-Deductions-in-Canada-1-scaled.jpg

Inflation Increased Tax Deductions For Teachers The Washington Post

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/VWQJAWAIPQI63AFWIPZL7TDGMI.jpg&w=1440

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Last update 2024 01 23 Date modified 2024 01 23 Contact the CRA About the CRA Compliance and enforcement This guide is for people with medical expenses It Income Tax Act s 118 2 2 The federal 2022 budget proposes to include as medical expenses those expenses related to a surrogate mother or sperm ova or embryo donor for the 2022 and subsequent taxation years For

Income Tax Act s 118 2 1 Who Can Claim Medical Expenses What Medical Expenses Can Be Claimed Medical Expenses for Former Spouse or Common Law Partner Your 2021 expenses need to exceed the lesser of your net income on line 23600 of your tax return or 2 241 The tax savings is 15 federally and ranges based

Download Tax Deduction For Medical Expenses In Canada

More picture related to Tax Deduction For Medical Expenses In Canada

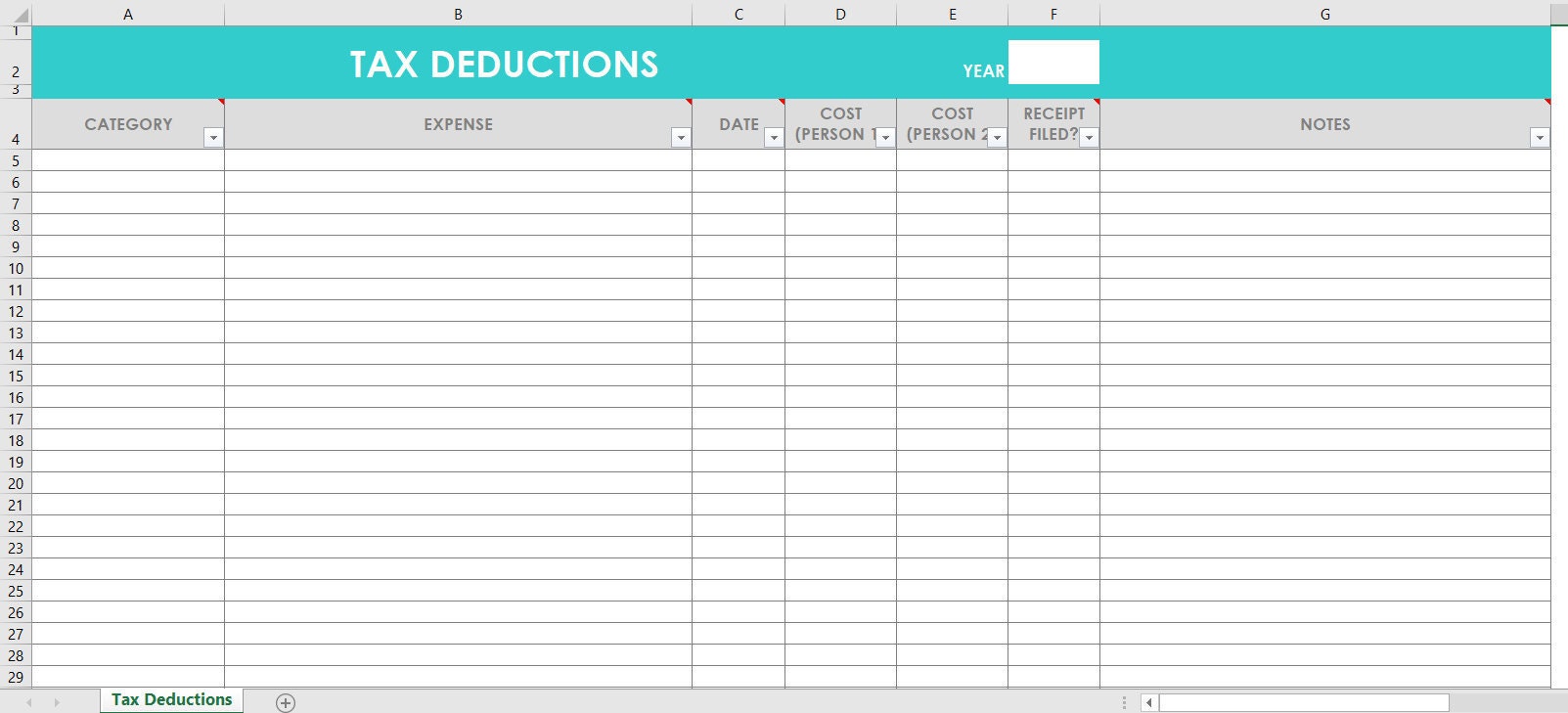

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

https://i.etsystatic.com/7329950/r/il/0a4d8c/1935516758/il_fullxfull.1935516758_mwfz.jpg

Medical Expenses Eligible For Deduction On Your 2019 Tax Return Think

https://thinkaccounting.ca/wp-content/uploads/medical-expenses-eligible-for-deduction-1.jpg

Section 80GGA Deduction For Donation For Research Development

https://www.charteredclub.com/wp-content/uploads/2020/08/tax-deductions-1536x1153.png

You can claim medical expenses for any 12 month period ending in 2023 and which have not already been claimed in 2022 For example for the 2023 tax year you could claim Understanding health insurance February 28 2022 Are Medical Expenses Tax Deductible In Canada By Brenda Spiering and Sun Life Staff Did you know you

Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels Some medical expenses unfortunately are not tax deductions and should not be included as such with possible exceptions These include Birth control Membership in a fitness

The Deductions You Can Claim Hra Tax Vrogue

https://i.pinimg.com/originals/b7/f8/b4/b7f8b4bbd77f32ff39051e43daaba655.jpg

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

https://turbotax.intuit.ca/tips/how-to-ded…

Allowable amount of medical expenses will be 1500 1000 3 x 60 000 700 Ineligible Deductions There are numerous ineligible deductions for the medical expense tax credit that appears on

https://turbotax.intuit.ca/tips/everything-y…

What is the Medical Expense Tax Credit METC The deductible medical expenses are considered a non refundable tax credit meaning they can help lower how much taxes you d have to pay To

Printable Itemized Deductions Worksheet

The Deductions You Can Claim Hra Tax Vrogue

Income Tax Deduction For Medical Treatment IndiaFilings

Taxes How Much Is My Standard Deduction MundoNOW

Realtor Tax Deduction Worksheet

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

The Fine Print Cost A Widow A 464 000 Tax Deduction WSJ

How Can You Deduct Medical Expenses From Your Taxes Rare Career

Tax Deduction For Medical Expenses In Canada - For the 2023 tax year if you re not taking the standard deduction you can deduct qualified medical expenses that exceed 7 5 of your adjusted gross income this is your gross