Tax Deduction For Mileage 2022 If you drive your own car the deduction to claim is 0 30 per kilometre in 2023 When you complete your tax return for the year enter this deduction under the

If you use the standard mileage rate for a year you can t deduct your actual car expenses for that year You can t deduct depreciation lease payments maintenance and repairs Beginning on Jan 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 58 5 cents per mile driven for business use

Tax Deduction For Mileage 2022

Tax Deduction For Mileage 2022

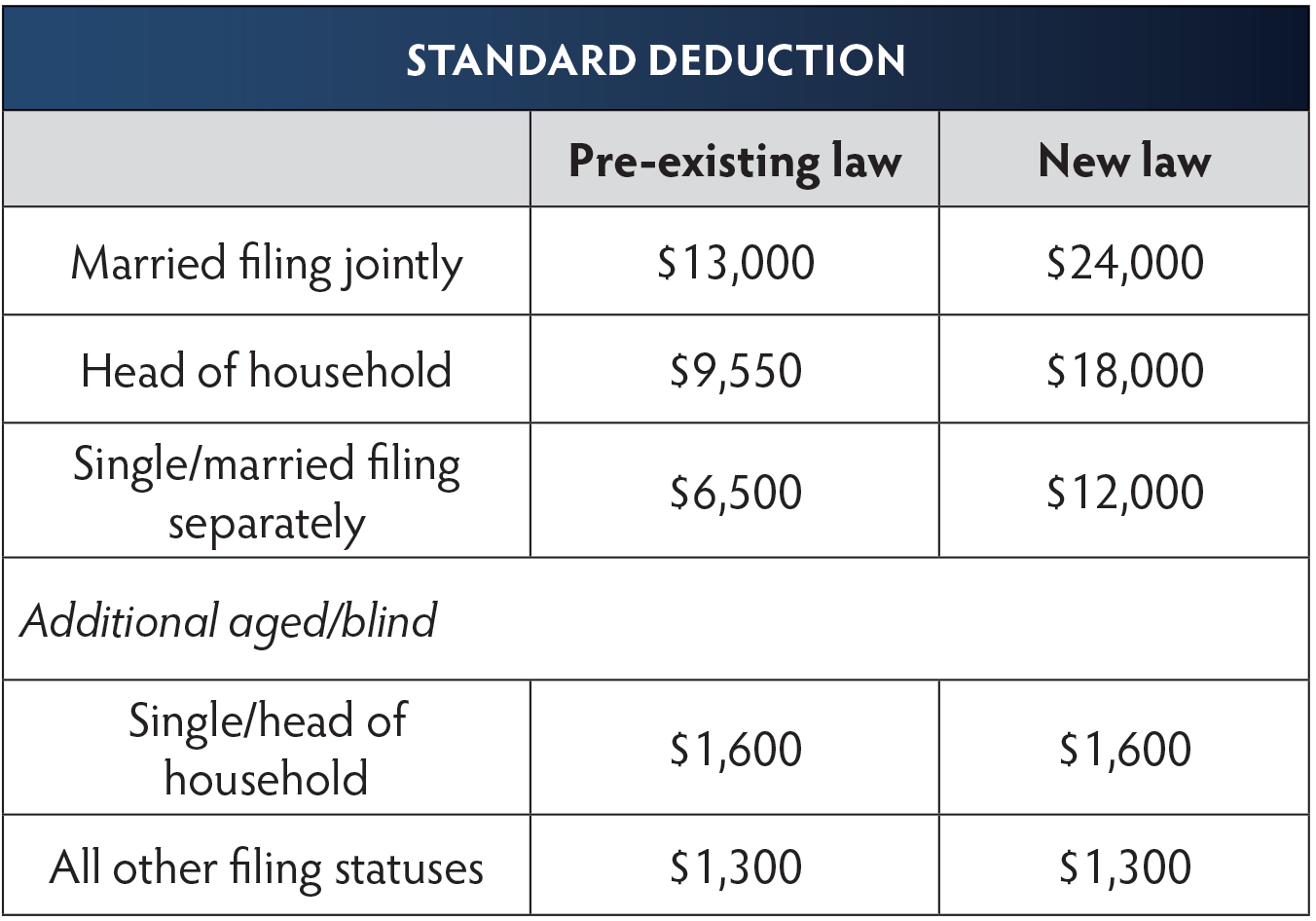

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

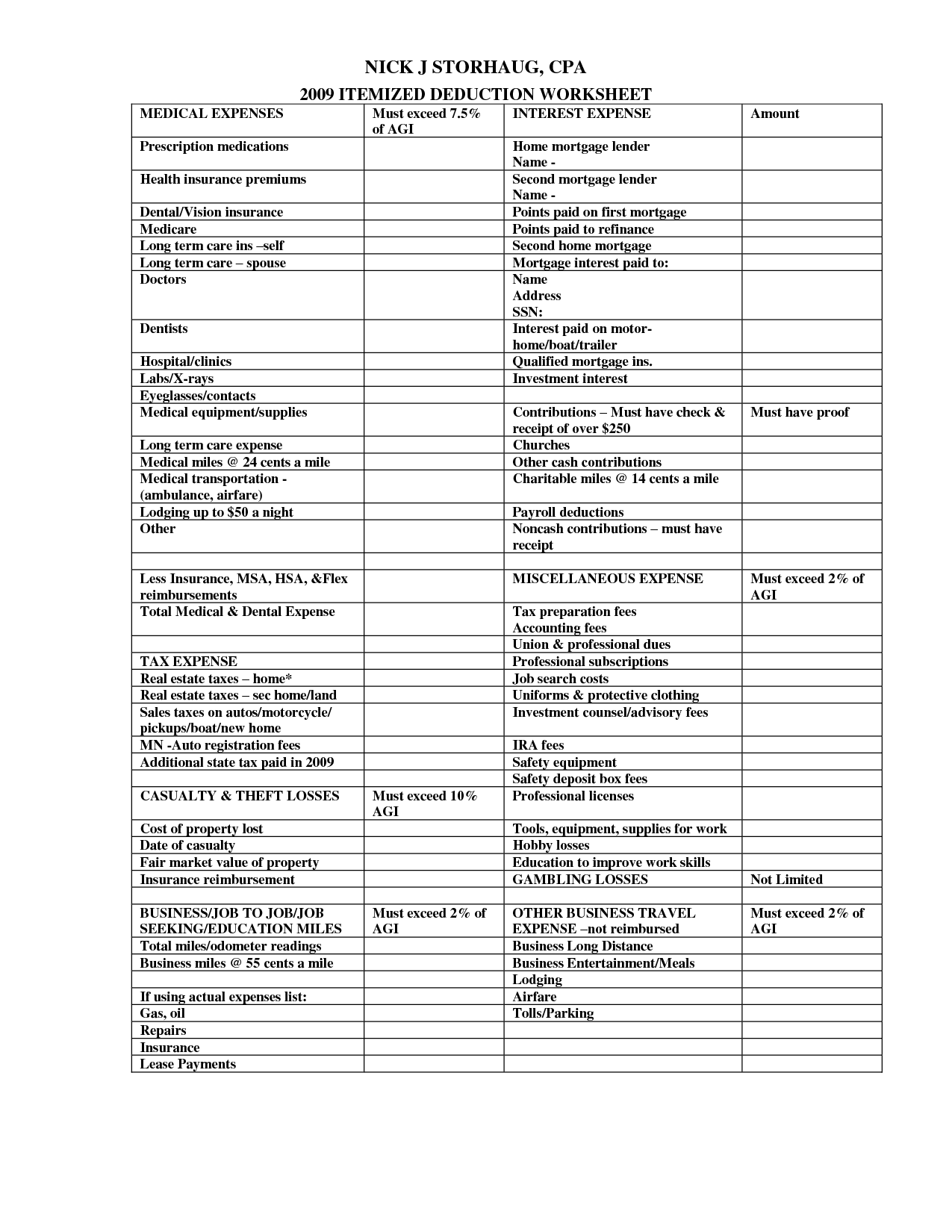

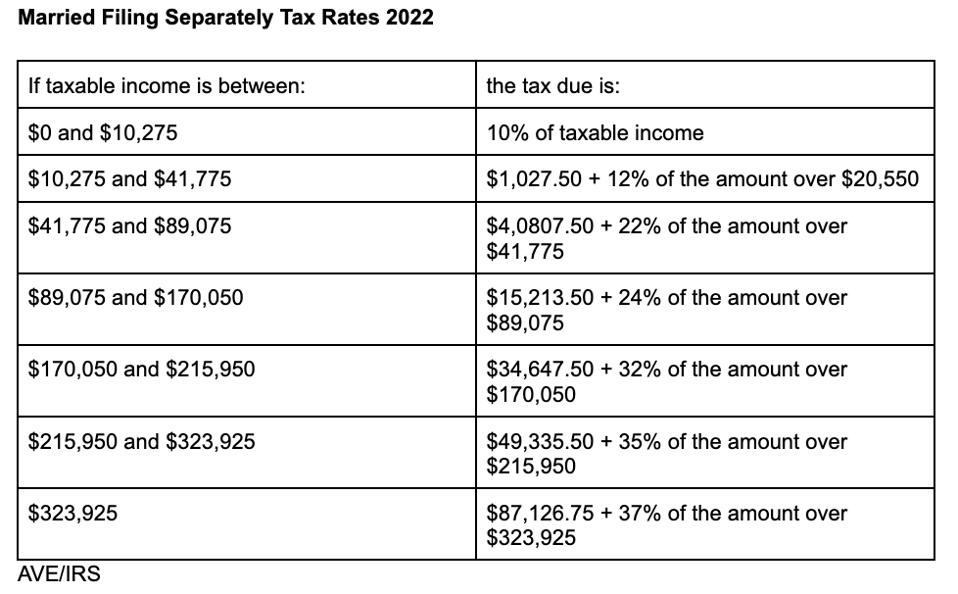

IRS Announces Inflation Adjustments To 2022 Tax Brackets Foundation

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

The 2022 rate for charitable use of an automobile is 14 cents per mile the same as in 2021 Standard mileage rates can be used instead of calculating the actual The Internal Revenue Service announced standard mileage rates for 2022 today for taxpayers to use in calculating the deductible costs of using a car for business

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2022 taxation shall be as prescribed in this decision below 2 Travel Effective for miles traveled on or after July 1 2022 the standard mileage rate for purposes of deductible business expenses is 62 5 cents per mile an increase of 4 cents from the

Download Tax Deduction For Mileage 2022

More picture related to Tax Deduction For Mileage 2022

Standard Deduction 2020 Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies.jpg

IRS Mileage Rate How To Claim Mileage Deductions On 2022 Tax Returns

https://www.gannett-cdn.com/presto/2022/06/02/PDTF/ef3b525a-997e-4cc2-98e8-1fc4c489d3f7-06022022_gasprice-6.jpg?crop=2399,1350,x0,y0&width=2399&height=1350&format=pjpg&auto=webp

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also For the 2022 tax year you re looking at two mileage rates for business use A rate of 58 5 cents a mile applies to travel from January through June last year and it s

IR 2021 251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an Standard mileage rates for 2022 released December 17 The rate for computing the deductible costs of automobiles operated for a business expense purpose

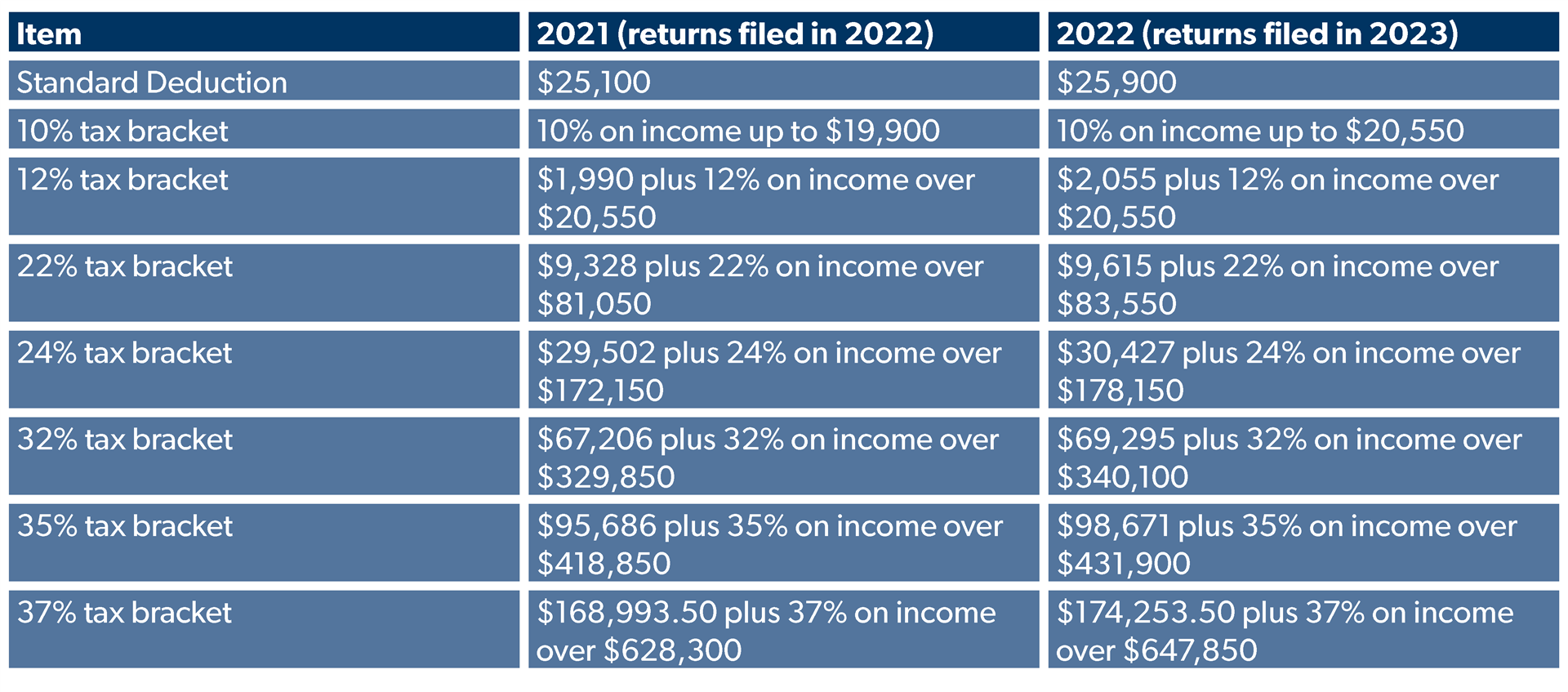

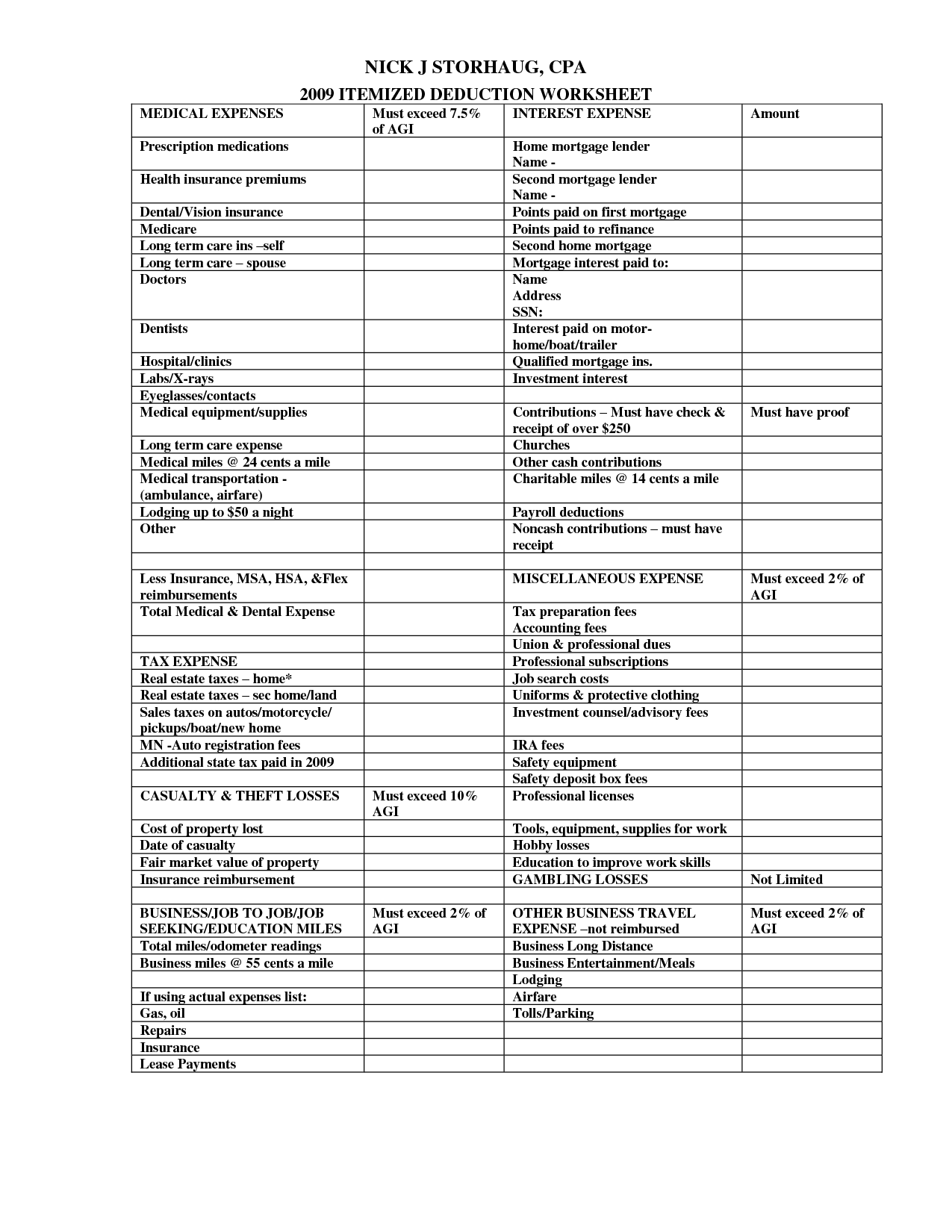

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

https://www.vero.fi/en/individuals/deductions/...

If you drive your own car the deduction to claim is 0 30 per kilometre in 2023 When you complete your tax return for the year enter this deduction under the

https://www.irs.gov/publications/p463

If you use the standard mileage rate for a year you can t deduct your actual car expenses for that year You can t deduct depreciation lease payments maintenance and repairs

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

10 Business Tax Deductions Worksheet Worksheeto

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

13 Car Expenses Worksheet Worksheeto

Standard Mileage Rates For 2022 New York Society Of Tax Accountants

2021 Taxes For Retirees Explained Cardinal Guide

2021 Taxes For Retirees Explained Cardinal Guide

Irs Compliant Mileage Log Template

IRS Announces 2022 Tax Rates Standard Deduction

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

Tax Deduction For Mileage 2022 - The Internal Revenue Service announced standard mileage rates for 2022 today for taxpayers to use in calculating the deductible costs of using a car for business