Tax Deduction For New Boiler Verkko 13 huhtik 2022 nbsp 0183 32 The cost of the boiler was 3 500 and the labor was 3 000 a total cost of 6 500 I can only deduct 50 of the cost because I live on the property Can the

Verkko It depends You may be able to claim for a new boiler by offsetting what you spend as an allowable expense You can learn more about allowable expenses and how to claim them in our advice centre If Verkko 11 jouluk 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit

Tax Deduction For New Boiler

Tax Deduction For New Boiler

https://cdn11.bigcommerce.com/s-f2blb58h/product_images/uploaded_images/section-179-tax-deduction-thumbnail.jpg

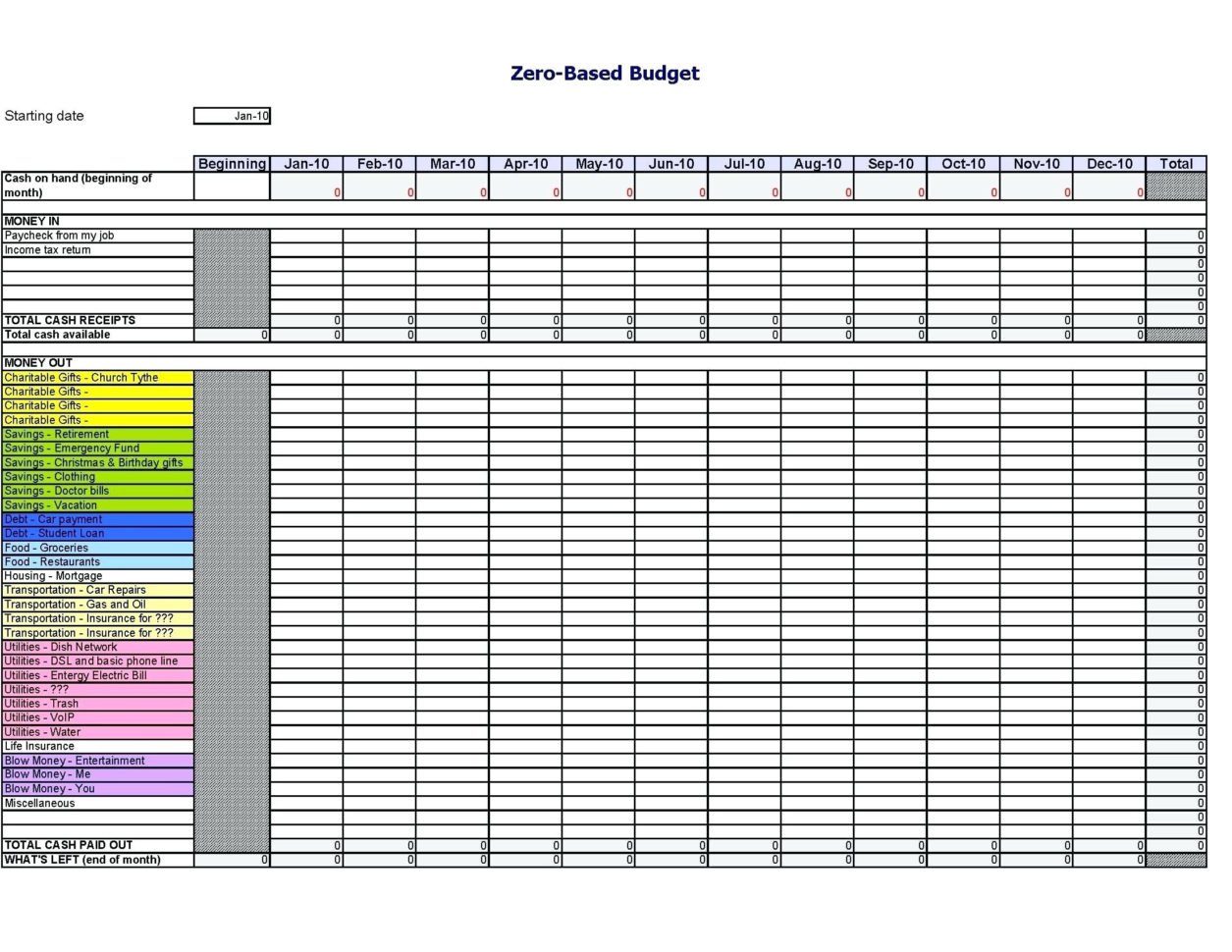

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Compulsory Super Get Your Deduction Lister Mason

https://listermason.com.au/wp-content/uploads/2017/06/tax-deductions-589b582955427.jpg

Verkko 13 jouluk 2023 nbsp 0183 32 In the evolving landscape of home heating a new challenge has emerged for homeowners the so called Boiler Tax This financial burden stems Verkko 30 jouluk 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Verkko 22 jouluk 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs Verkko 13 huhtik 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home

Download Tax Deduction For New Boiler

More picture related to Tax Deduction For New Boiler

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Inflation Increased Tax Deductions For Teachers The Washington Post

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/VWQJAWAIPQI63AFWIPZL7TDGMI.jpg&w=1440

About That Property Tax Deduction For Vets NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2017/08/kconnors-1024x685.jpg

Verkko 12 jouluk 2023 nbsp 0183 32 Beginning this year 2023 they will be 150 for home energy audits 250 for an exterior door 500 total for all exterior doors 600 for exterior windows and skylights central air Verkko 27 hein 228 k 2017 nbsp 0183 32 Deduct the cost of your new boiler on Form 5695 Residential Energy Credits For 2009 and 2010 you may deduct 30 percent of the total cost of qualifying

Verkko 27 huhtik 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of Verkko 10 jouluk 2023 nbsp 0183 32 The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and

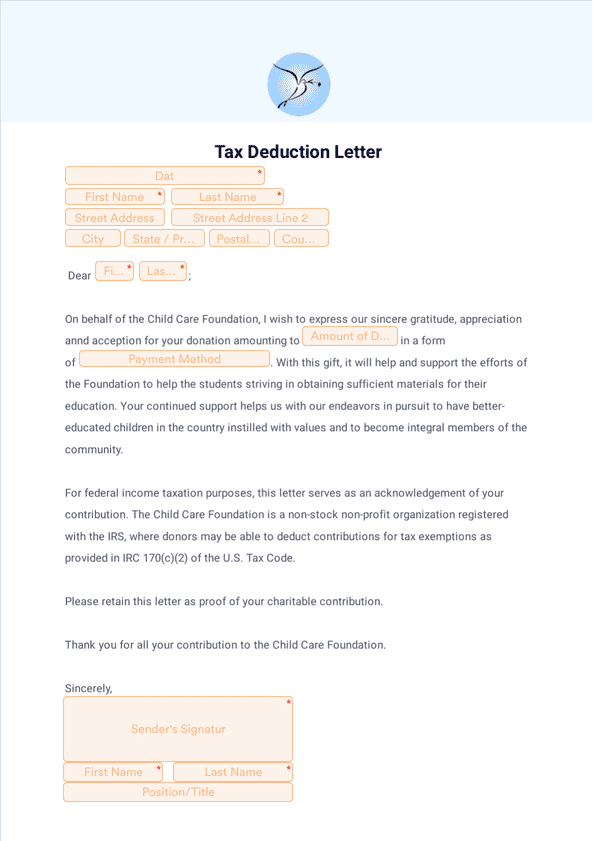

Tax Deduction Excel Template

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-excel-for-tax-deduction-spreadsheet-excel-lovely-awesome-template-examples-1255x970.jpg

Explained The New 20 Tax Deduction For Real Estate Tech Digital

https://cdn.stepps.com.au/wp-content/uploads/2022/06/14173902/Explained-The-New-20-Tax-Deduction-For-Real-Estate-Tech-Digital-Investments.jpg

https://ttlc.intuit.com/community/investments-and-rental-properties/...

Verkko 13 huhtik 2022 nbsp 0183 32 The cost of the boiler was 3 500 and the labor was 3 000 a total cost of 6 500 I can only deduct 50 of the cost because I live on the property Can the

https://www.cia-landlords.co.uk/.../can-a-landl…

Verkko It depends You may be able to claim for a new boiler by offsetting what you spend as an allowable expense You can learn more about allowable expenses and how to claim them in our advice centre If

Tax Deductions Tax Next Gen

Tax Deduction Excel Template

Tax Rates Absolute Accounting Services

How To Get A Tax Deduction For Supporting Your Child s School

2 Easy Steps To Get Tax Deduction For Your Personal Vehicle Blue Rock

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Section 80GGA Deduction For Donation For Research Development

The Deductions You Can Claim Hra Tax Vrogue

Guide To TAX Deduction For 2024 Exam Commercial Law Publishers

Tax Deduction For New Boiler - Verkko 30 jouluk 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope