Tax Deduction For Non Working Spouse To claim Spouse Relief for the Year of Assessment 2024 you must satisfy all these conditions in 2023 1 Your spouse was living with supported by you and 2 Your

For individuals earning under 66 000 with a non working spouse can claim a tax offset Harry007 Newbie 6 Dec 2023 In the TFN withholding declaration Taxation If you gift money to your wife who isn t employed and that is invested the taxman will club the earning with your income for

Tax Deduction For Non Working Spouse

Tax Deduction For Non Working Spouse

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Tax Deduction For A Non Working Spouse Finance Zacks

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/getty/article/154/104/89793648.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Key Takeaways If one spouse has eligible compensation that spouse can fund an IRA for the non employed spouse and their own IRA Traditional and Roth Under the spousal IRA rules for 2023 a couple where only one spouse works can contribute up to 13 000 per year or 15 000 if both are 50 or older If both spouses are 50 or older that cap

Tax deductibility is another issue Contributions to a traditional IRA may be fully tax deductible However if you participate in a 401 k or pension plan at work and earn Each IRA is set up in the name of an individual spouse A spousal IRA strategy allows couples who are married filing jointly to contribute to two IRAs per year For tax year 2023 they could

Download Tax Deduction For Non Working Spouse

More picture related to Tax Deduction For Non Working Spouse

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

If your contributions are tax deductible you ll pay ordinary income taxes on withdrawals come retirement If you re not concerned about tax deductibility you might want to consider opening a spousal Can I reduce my tax if my spouse doesn t work I own a rental property and pay tax on the rental income at the higher rate My spouse doesn t pay tax and I was

The Social Security Administration permanently reduces retirement benefits to nonworking spouses by 25 36 of one percent for every month up to 36 months Standard deduction amount increased For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 13 850

About That Property Tax Deduction For Vets NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2017/08/kconnors-1024x685.jpg

Joint Tax Deduction Brookline Food Rescue

https://i0.wp.com/brooklinefoodrescue.org/wp-content/uploads/2021/02/VoucherJoint.png?fit=1280%2C780&ssl=1

https://www.iras.gov.sg/taxes/individual-income...

To claim Spouse Relief for the Year of Assessment 2024 you must satisfy all these conditions in 2023 1 Your spouse was living with supported by you and 2 Your

https://community.ato.gov.au/s/question/a0JRF000000bI9J

For individuals earning under 66 000 with a non working spouse can claim a tax offset Harry007 Newbie 6 Dec 2023 In the TFN withholding declaration

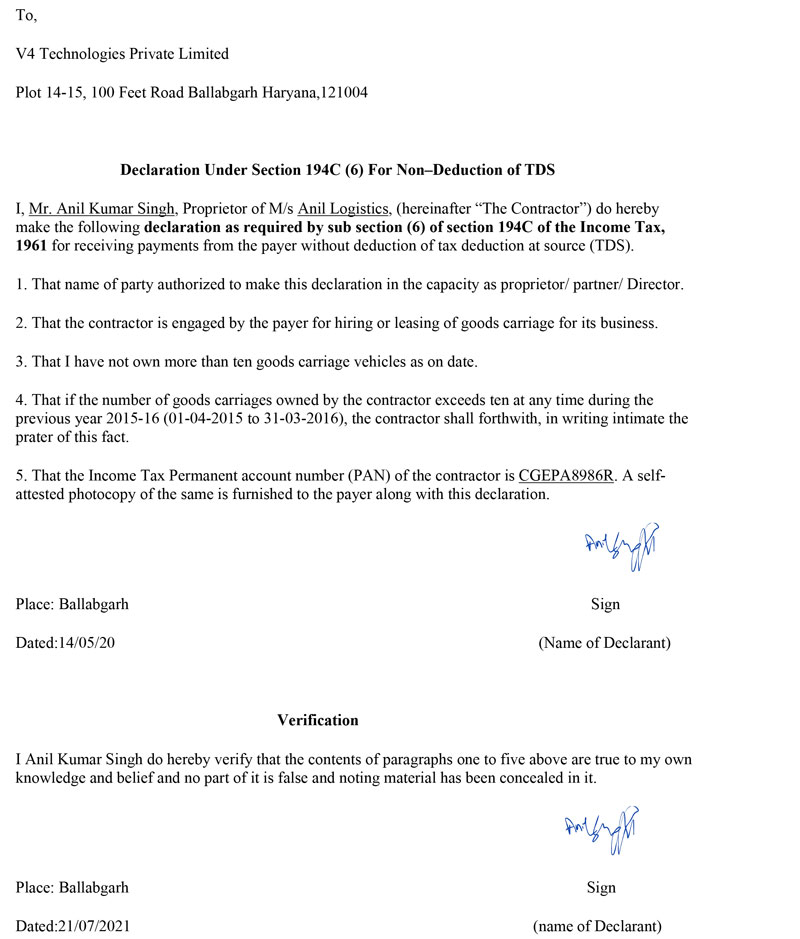

Transporter s Declaration For Non Deduction Of TDS U s 194C Drafting

About That Property Tax Deduction For Vets NJMoneyHelp

How Do Tax Deductions For Donating A Car Actually Work

Tax Deductions For Businesses BUCHBINDER TUNICK CO

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

QBI Rules Is Determining The QBI Deduction Which Depends On A Taxpayer

Tax Deduction Thailand 2022 Pay Less With Health Insurance

8 Tax Itemized Deduction Worksheet Worksheeto

Tax Deduction For Non Working Spouse - Key Takeaways If one spouse has eligible compensation that spouse can fund an IRA for the non employed spouse and their own IRA Traditional and Roth