Tax Deduction For Rebates Web Tax Tax Accounting EXECUTIVE SUMMARY The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 167

Web 24 avr 2023 nbsp 0183 32 Deductions can reduce the amount of your income before you calculate the tax you owe Credits can reduce the amount of tax you owe or increase your tax refund Web De tr 232 s nombreux exemples de phrases traduites contenant quot tax rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Tax Deduction For Rebates

Tax Deduction For Rebates

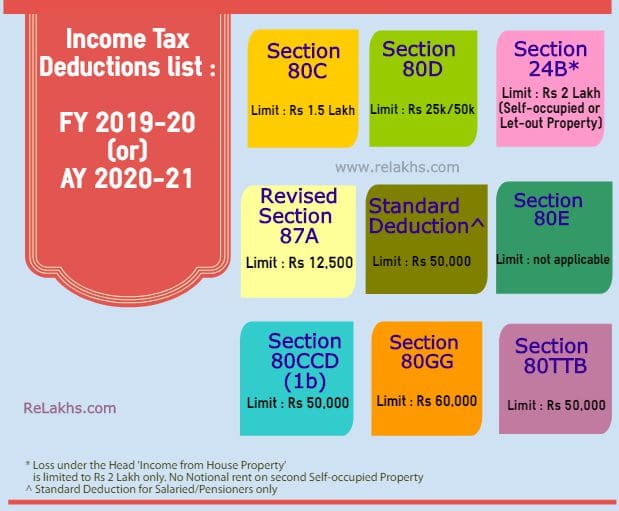

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amounts of the first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and must file a

Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have Web 10 f 233 vr 2023 nbsp 0183 32 Under the new tax regime the rebate is available if the taxable income is less than 7 lakhs Therefore tax exemption and tax deductions help in saving money by

Download Tax Deduction For Rebates

More picture related to Tax Deduction For Rebates

Pin On Realtor Tips

https://i.pinimg.com/originals/ed/f6/a7/edf6a7946c3357a19520ba4732a2effc.jpg

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

https://i.pinimg.com/564x/b6/70/c4/b670c47f275a63df1ef5550404fec2b1.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median Web Personal tax rebates will be automatically granted for the relevant years Parenthood Tax Rebate PTR You and your spouse may share the rebate based on an apportionment

Web 26 juil 2023 nbsp 0183 32 Home Energy Tax Credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

Pin On Tax Credits Vs Tax Deductions

https://i.pinimg.com/originals/9f/13/5e/9f135e8d89955e3dea41d76cd0ff4d6b.jpg

https://www.journalofaccountancy.com/issues/2008/oct/tax_treatment_of...

Web Tax Tax Accounting EXECUTIVE SUMMARY The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 167

https://www.irs.gov/credits

Web 24 avr 2023 nbsp 0183 32 Deductions can reduce the amount of your income before you calculate the tax you owe Credits can reduce the amount of tax you owe or increase your tax refund

Business Tax Credit Vs Tax Deduction What s The Difference

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

FREE 10 Personal Tax Deduction Samples In PDF MS Word

Custom Essay Order How To Write Off Bad Debt Expense 2017 10 11

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Travelling Expenses Tax Deductible Malaysia Paul Springer

Travelling Expenses Tax Deductible Malaysia Paul Springer

Printable Itemized Deductions Worksheet

2012 Tax Rebates Taxes History Tax Deduction

2022 Deductions List Name List 2022

Tax Deduction For Rebates - Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed