Tax Deduction For Self Education Expenses India Under Section 80C of the Income Tax Act 1961 individuals can claim deductions of up to Rs 1 5 lakh for various investments and expenditures including tuition fees These tax

Deduction under Section 80 C for expenses on full time education in India You can claim a deduction upto Rs 1 50 lakh every year for tuition fee paid for maximum of two children in respect of full Explore Section 80C Deduction for tuition fees in India Learn eligibility criteria maximum limits and FAQs to optimize tax benefits for

Tax Deduction For Self Education Expenses India

Tax Deduction For Self Education Expenses India

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

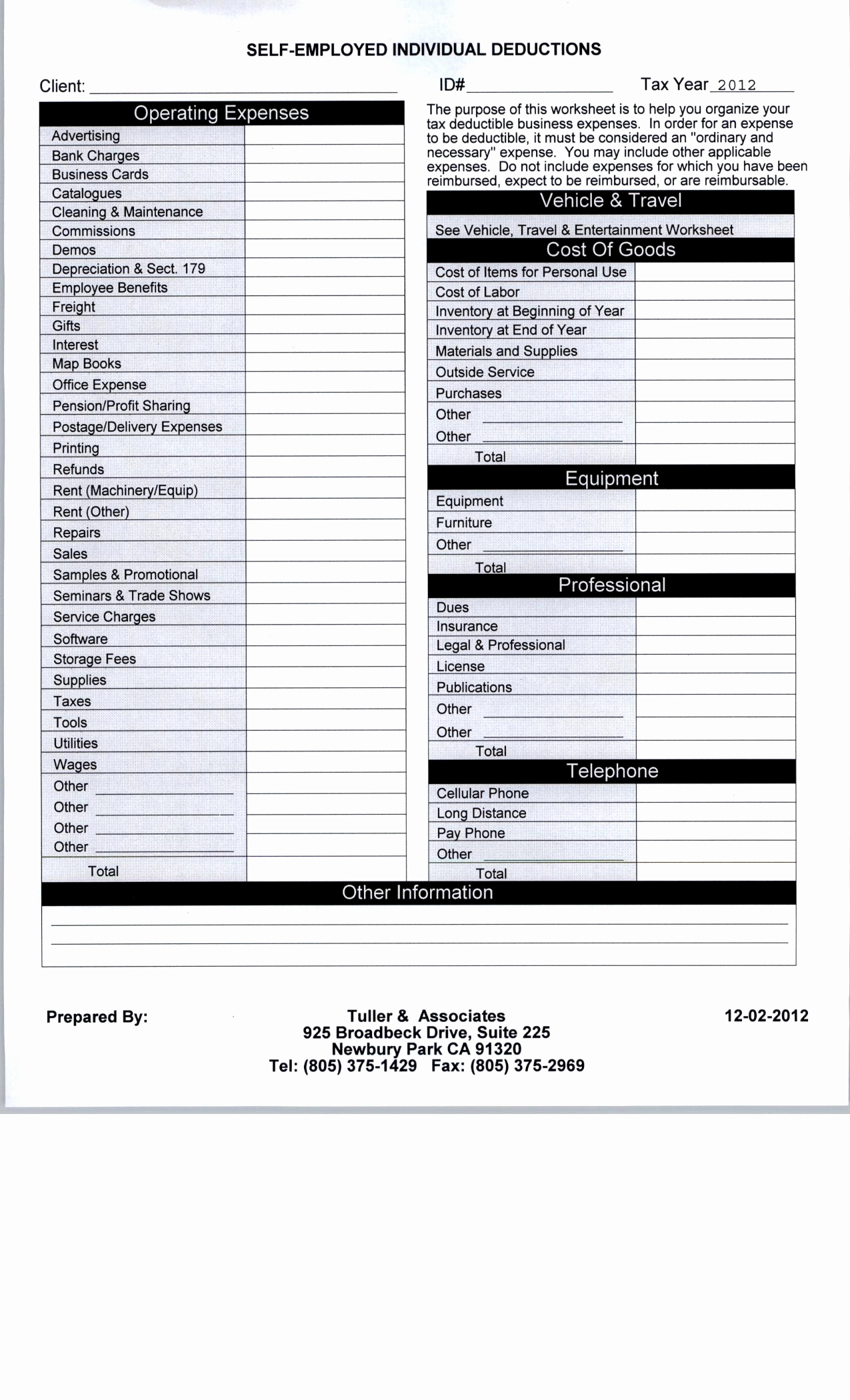

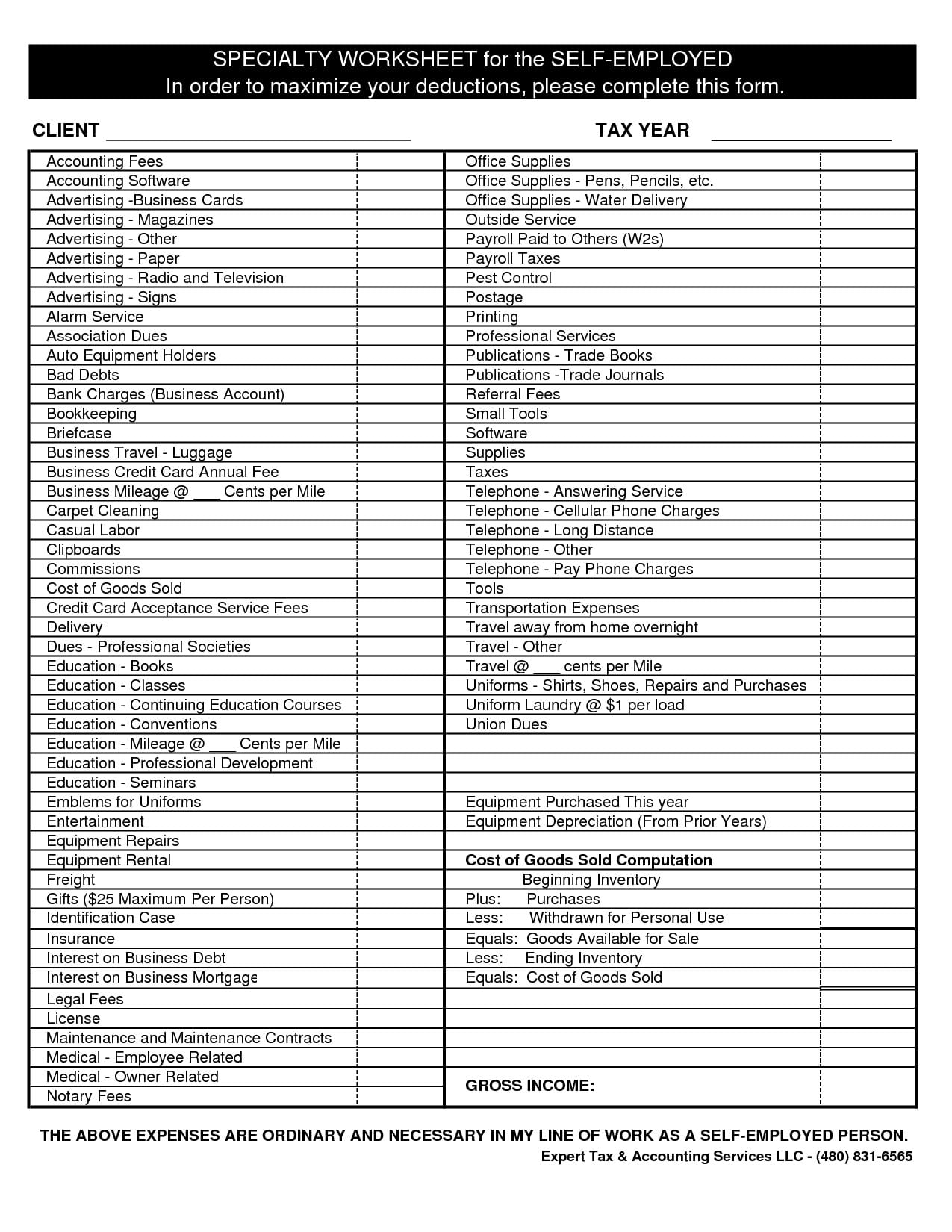

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/04/self-employed-tax-deductions-worksheet.jpg

Business Expense Spreadsheet For Taxes New Self Employed Tax And

https://db-excel.com/wp-content/uploads/2018/11/business-expense-spreadsheet-for-taxes-new-self-employed-tax-and-business-expense-deductions-spreadsheet.jpg

Tax benefits on Tuition fee for children You can claim deduction upto Rs 1 50 lakh every year for tuition fee paid for full time education of your children in India This deduction When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under

If your employer provides you children education allowance as a part of your salary structure for the payment of education or tuition fee expenses of your children Section 10 of the Income Tax Act offers an Education Tax benefit on the tuition fees of up to Rs 1200 paid to a registered school college or university in India per year That said expenses of up to 1 5

Download Tax Deduction For Self Education Expenses India

More picture related to Tax Deduction For Self Education Expenses India

Resources

http://tax29.com/wp-content/uploads/2016/11/Tax29-Self-Employed-Deduction-List.png

Pin By Tonya Spangler On Book Keeping Business Tax Deductions Small

https://i.pinimg.com/736x/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.jpg

Hassan Measure Would Restore Mortgage Insurance Deduction For

https://wpcdn.us-east-1.vip.tn-cloud.net/www.nhbr.com/content/uploads/2023/06/m/y/taxes-home-2048x1410.jpg

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize An individual is eligible to claim a tax deduction for tuition fees paid to any university college or other educational institution in India for two children It is important to note that

In India tax incentives are available for tuition and other educational costs Based on this deductions of up to Rs 1 5 lakh may be requested Section 80C Tax Deduction for Section 80C of the Income Tax Act in India provides tax deduction benefits for tuition fees paid by parents for their children s education The maximum limit for income tax

Small Business Tax Small Business Tax Deductions Business Tax Deductions

https://i.pinimg.com/originals/80/f5/2d/80f52dac2182daa554539d9580ab22d3.png

Itemized Deductions List Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/302/100302714/large.png

https://www.bankbazaar.com/tax/tax-benefits-on...

Under Section 80C of the Income Tax Act 1961 individuals can claim deductions of up to Rs 1 5 lakh for various investments and expenditures including tuition fees These tax

https://taxguru.in/income-tax/income-tax-b…

Deduction under Section 80 C for expenses on full time education in India You can claim a deduction upto Rs 1 50 lakh every year for tuition fee paid for maximum of two children in respect of full

Self Employed Tax Deductions Worksheet Db excel

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Tax Deduction Cheat Sheet

2017 Self Employment Tax And Deduction Worksheet Db excel

Qualified Business Income Deduction And The Self Employed The CPA Journal

Claim Self Education Expenses In Tax Deductions

Claim Self Education Expenses In Tax Deductions

Hassan Measure Would Restore Mortgage Insurance Deduction For

Daily Life In Your Day Care Business Expense Business Tax Deductions

Business Expense Spreadsheet For Taxes

Tax Deduction For Self Education Expenses India - To promote education in India the govt allows for Income Tax Deduction under Section 80C Section 80E Deduction under Section 80C is allowed for payments made by self