Tax Deduction Formula In Ethiopia Calculate your income tax in Ethiopia and salary deduction in Ethiopia to calculate and compare salary after tax for income in Ethiopia in the 2024 tax year

Income Tax Calculator mor Income Tax Calculator Input Gross Salary ETB Tax Breakdown Accountable Institutions Customs Commission Our Partners Prime Minister Office Ministry of Finance Investment Commission Address Location Addis Ababa Ethiopia Tel Email info mor mor gov et Po Box 2559 Useful Links The Ethiopia Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Ethiopia This includes calculations for Employees in Ethiopia to calculate their annual salary after tax

Tax Deduction Formula In Ethiopia

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Tax Deduction Formula In Ethiopia

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Amazon Ethiopian Tax Calculator Apps Games

https://images-na.ssl-images-amazon.com/images/I/61lqVuLV-ZL.png

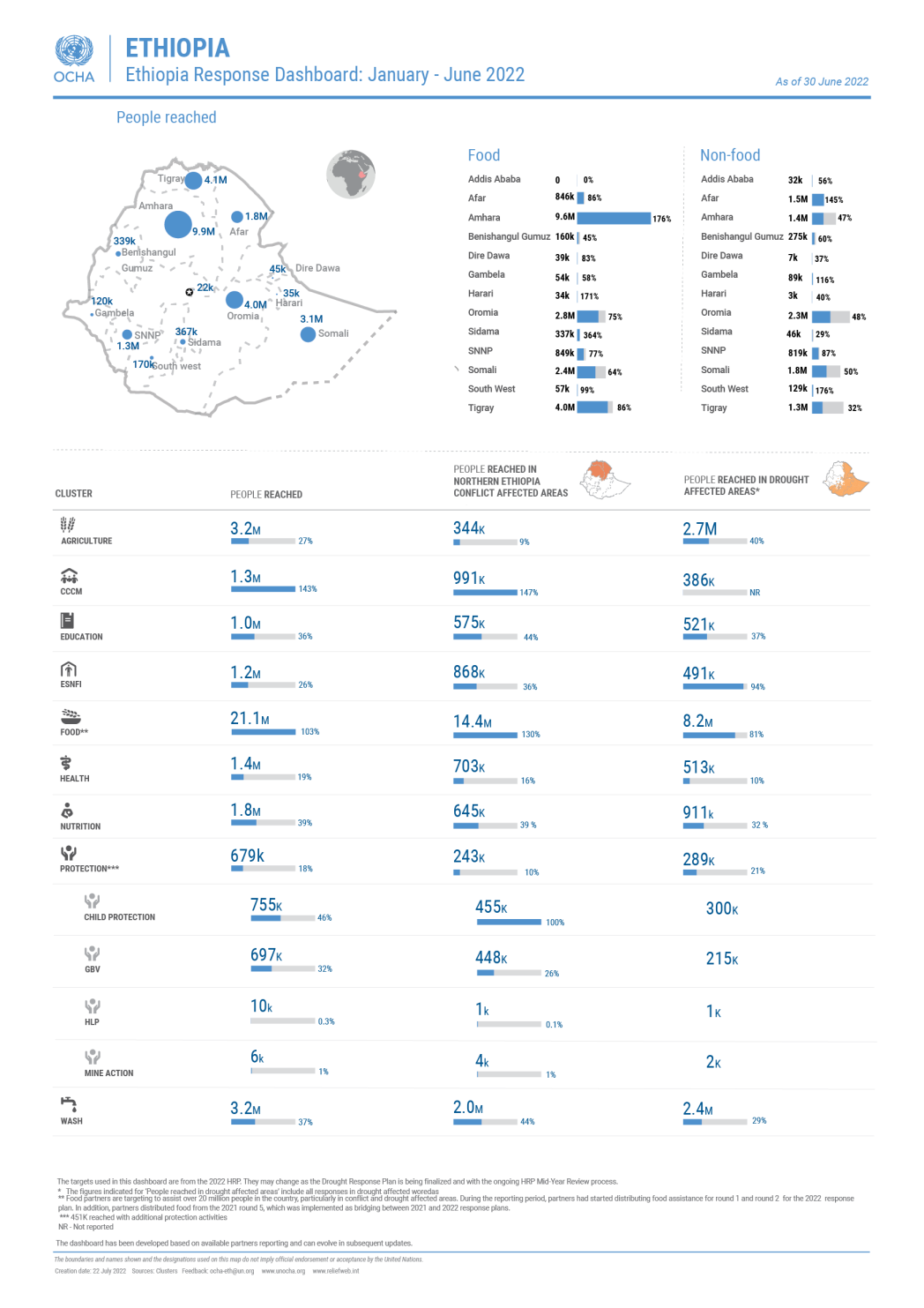

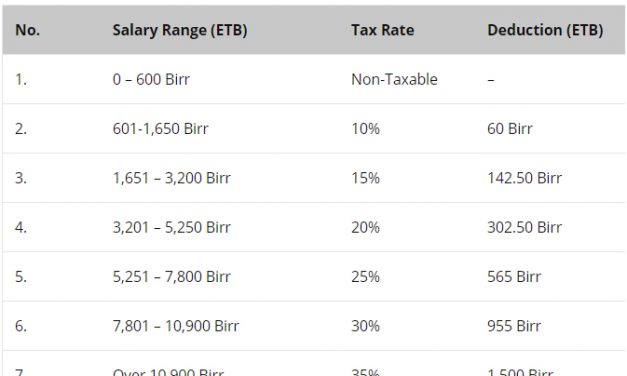

Taxable income comprises the following employment income business profits and investment income Summary of monthly employment income tax brackets Ethiopian birr The deductible fee is a tax relief applied to the Pay As You Earn PAYE system and the amount depends on the salary bands Contacts News Print Search It indicates the tax percentage you would pay on an additional amount of income reflecting the progressive nature of tax systems like Ethiopia s These rates offer valuable insights into financial planning and tax strategies

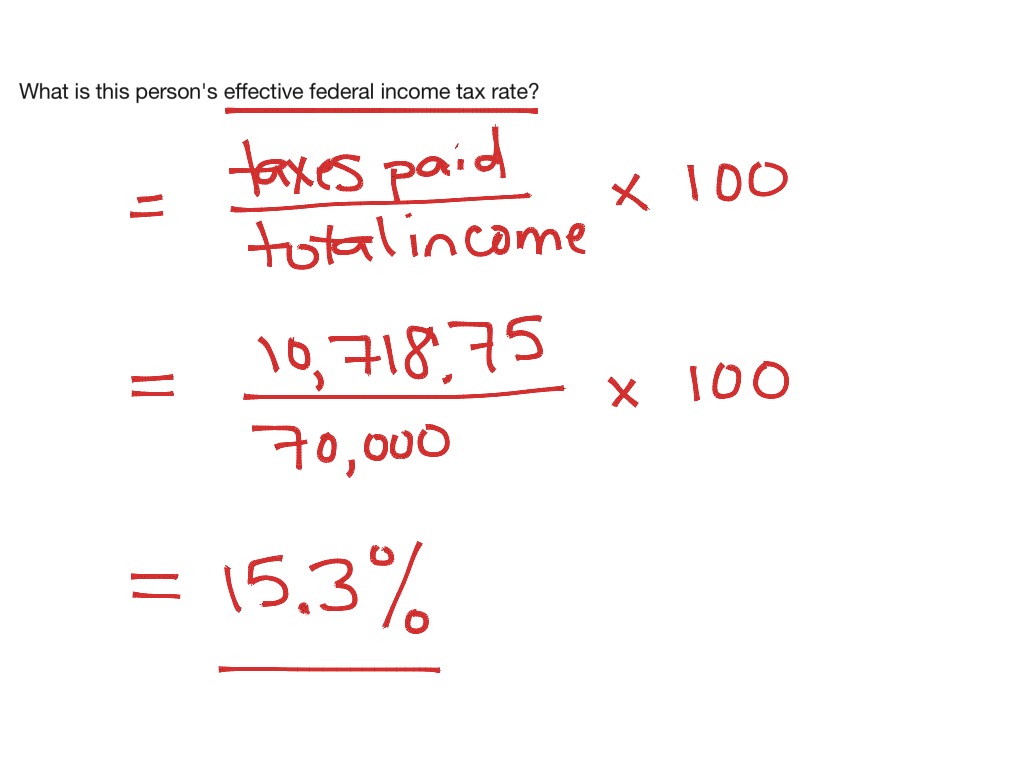

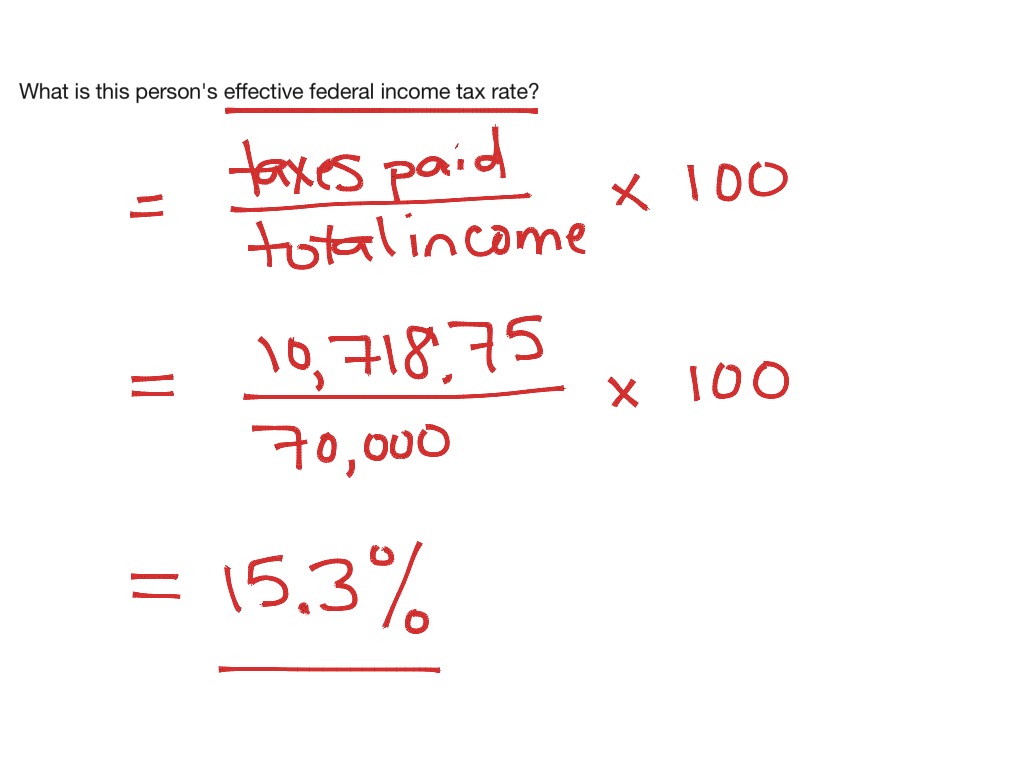

Find out how much money you will receive after taxes and tax deductions from your salary including pension contributions and tax free allowances Easily calculate your Ethiopian salary by inputting your gross salary into the designated field labeled Gross Amount and clicking the calculate button To calculate their salary tax we would use the following formula Salary Tax Tax Rate x Income Previous Range Maximum Cumulative Tax Using the above formula and the tax rates provided in the table we can calculate the salary tax for an income of 8 000 Ethiopian Birr Case Study Calculating Salary Tax Income 8 000 Birr

Download Tax Deduction Formula In Ethiopia

More picture related to Tax Deduction Formula In Ethiopia

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

Brief History Of Income Taxes In Ethiopia PDF Tax Deduction Value

https://imgv2-1-f.scribdassets.com/img/document/489057023/original/c7273b1de0/1656301733?v=1

Ethiopia Ethiopia Response Dashboard January June 2022 Digital

https://images.ctfassets.net/ejsx83ka8ylz/7lVt9bLOLwLw0Lnt7sFY56/bde052bbaebea1533658569b490c1cb5/V.4_Final_draft_Ethiopia_Response_dashboard_27_July_2022-01.png?w=1048&h=1483

December 24 2020 5 00 AM UTC Ethiopia Tax Agency Explains Income Tax Calculation From Salary Wages The Ethiopian Ministry of Revenues Dec 21 explained the calculation of individual income taxes from salary and wages Dividends declared by Ethiopian resident companies are subject to a 10 dividend withholding tax WHT for individual shareholders which is the final tax Interest income Interest income is subject to WHT at a rate of 15 which is the final tax Rental income Rental income is taxed under FITP No 979 2016

Income tax rate Deduction Tax computation I Employment income EIT Employment income tax 0 600 0 0 601 1 650 10 60 00 EIT I x 10 60 1 651 3 200 15 142 50 EIT I x 15 142 50 3 201 5 250 20 302 50 EIT I x 20 302 50 5 251 7 800 25 565 00 EIT I x 25 565 Ethiopian Personal Income TAX Caclulator This free tax calculator helps you determine your personal employment income taxes in Ethiopia This calculator will provide you detailed information about your income tax pension and net salary

Ethiopia Procures Fuel In Case Of Emergency

https://addisfortune.news/wp-content/uploads/2020/05/tadesse-hailemariam.jpg

Ethiopia How To Calculate Bonus Tax Ethiopia Taxation System salary

https://i.ytimg.com/vi/PidM2U0_ir0/maxresdefault.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https:// et.icalculator.com /salary-calculator.html

Calculate your income tax in Ethiopia and salary deduction in Ethiopia to calculate and compare salary after tax for income in Ethiopia in the 2024 tax year

http://www. mor.gov.et /web/mor/income-tax-calculator

Income Tax Calculator mor Income Tax Calculator Input Gross Salary ETB Tax Breakdown Accountable Institutions Customs Commission Our Partners Prime Minister Office Ministry of Finance Investment Commission Address Location Addis Ababa Ethiopia Tel Email info mor mor gov et Po Box 2559 Useful Links

Mar 2024 Gross Net Salary Calculation In Ethiopia Latest Ethiopian

Ethiopia Procures Fuel In Case Of Emergency

Things You Should Know About Insurance In Ethiopia Ahadu Vacancy

How To Fully Maximize Your 1099 Tax Deductions Steady

Ethiopia s Election Hints At New Possibilities Throws Up Fresh

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

Standard Deduction 2020 Self Employed Standard Deduction 2021

Tax Deduction Tracker Printable Tax Sheet Business Decduction Log

Taxation In Ethiopia 1 Value Added Tax Tax Deduction Free 30 day

Tax Deduction Formula In Ethiopia - Find out how much money you will receive after taxes and tax deductions from your salary including pension contributions and tax free allowances Easily calculate your Ethiopian salary by inputting your gross salary into the designated field labeled Gross Amount and clicking the calculate button