Tax Deduction Formula The formula for tax shield is Tax Shield Value of Tax Deductible Expense x Tax Rate Is Tax Shield the Same As Tax Savings Tax shields result in tax savings

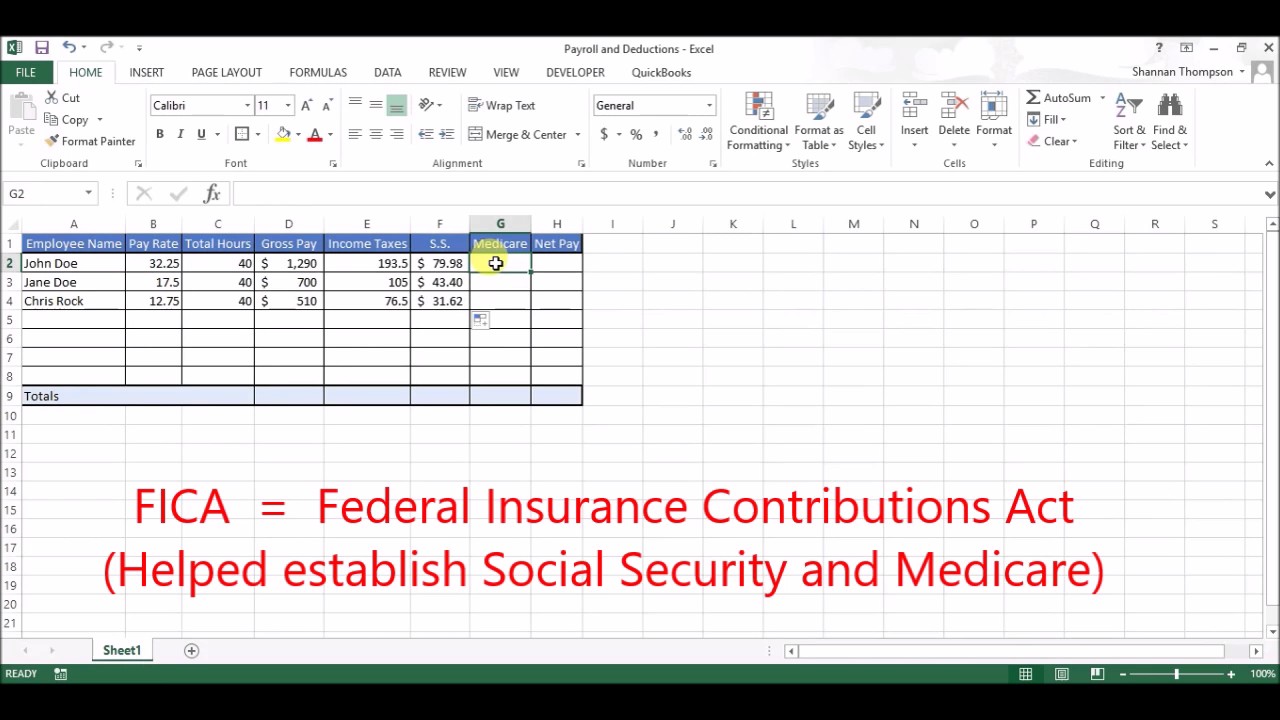

Get step by step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax A tax deduction is an expense you can subtract from your taxable income This lowers the amount of money you pay taxes on and reduces your tax bill A standard deduction is a single fixed amount of money you can

Tax Deduction Formula

Tax Deduction Formula

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture351.png?fit=693%2C345&ssl=1

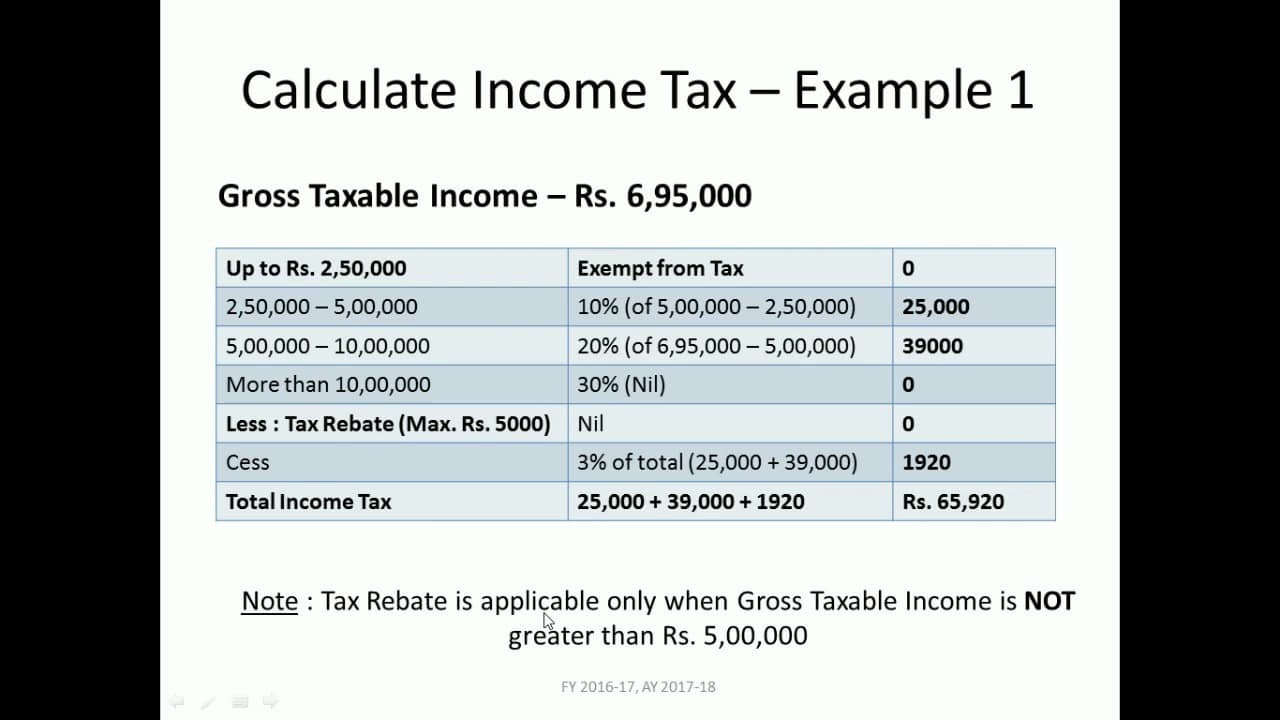

How To Calculate Income Tax Formula

https://www.trickyfinance.com/wp-content/uploads/2018/10/income-tax-calculate-min.jpg

PPT Taxable Income Formula For Individuals PowerPoint Presentation

https://image2.slideserve.com/3840453/taxable-income-formula-for-individuals-l.jpg

A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower your taxable income which also reduces your

Tax deductions reduce your taxable income by allowing you to write off certain expenses Learn more about this tax incentive and how you can leverage it The AMT exemption rate is also adjusted for inflation The AMT exemption amount for tax year 2025 for single filers is 88 100 and begins to phase out at 626 350 in 2024 the

Download Tax Deduction Formula

More picture related to Tax Deduction Formula

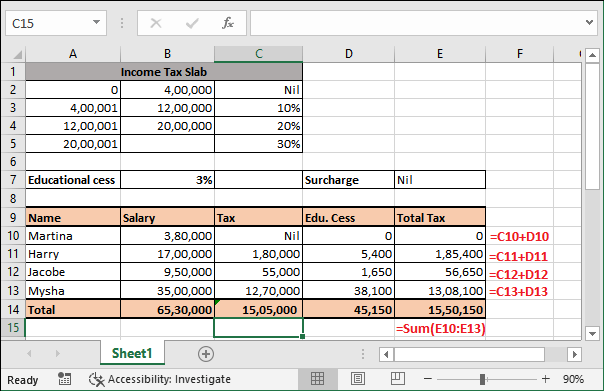

Calculate Taxes In Excel

https://static.javatpoint.com/ms/excel/images/income-tax-calculating-formula-in-excel30.png

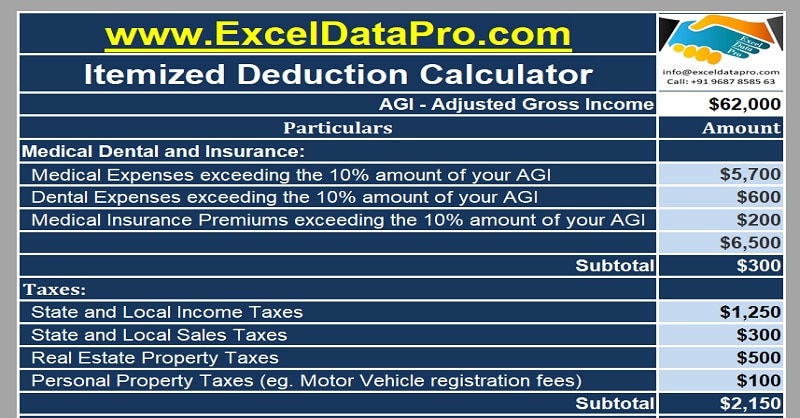

Download Itemized Deductions Calculator Excel Template ExcelDataPro

https://exceldatapro.com/wp-content/uploads/2017/12/Itemized-Deduction-Calculator.jpg

Taxable Income Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes Tax deductions are a way to decrease your taxable income which decreases the amount of taxes you owe the government Learn all about tax deductions

Changes to U S tax policy could make the dream of homeownership more affordable to many Americans according to a new study by researchers at the Johns Hopkins NerdWallet s tax calculator can help you estimate your federal income tax bill based on your earnings age deductions and credits

Tax Deduction Definition TaxEDU Tax Foundation

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

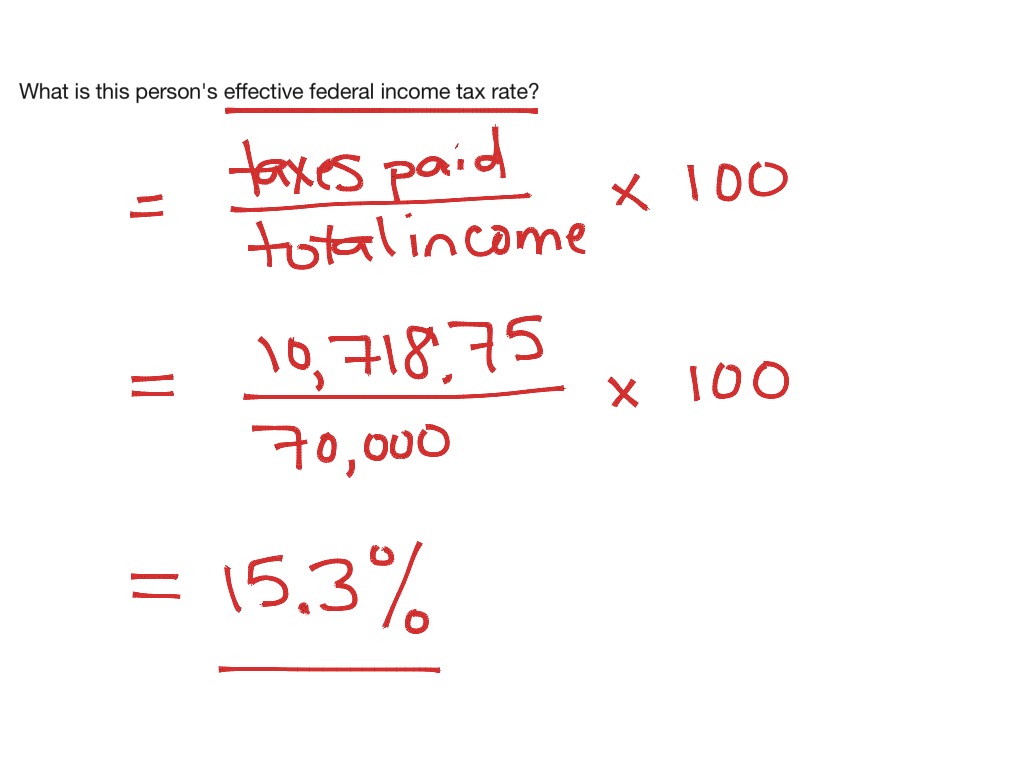

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

https://showme0-9071.kxcdn.com/files/1000093366/pictures/thumbs/2302829/last_thumb1456332448.jpg

https://www.investopedia.com › terms …

The formula for tax shield is Tax Shield Value of Tax Deductible Expense x Tax Rate Is Tax Shield the Same As Tax Savings Tax shields result in tax savings

https://www.thebalancemoney.com

Get step by step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax

Standard Deduction Tax Exemption And Deduction TaxAct Blog

Tax Deduction Definition TaxEDU Tax Foundation

TX301 Income Tax Basics

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

Setting Up Payroll Deductions In Excel YouTube

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

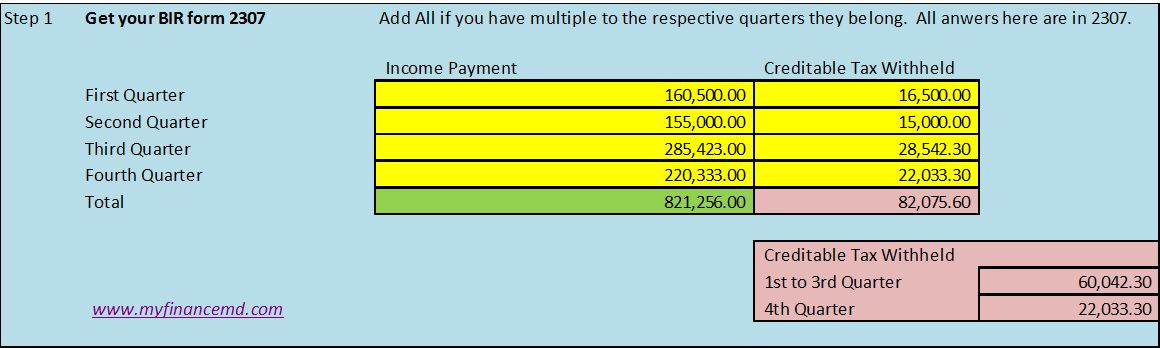

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

Mortgage Interest Tax Deduction What Is It How Is It Used

Income Tax Deductions Income Tax Deductions Student Loan Interest

Tax Deduction Formula - This formula splits the income into the seven brackets in column E in one step After that simple formulas can be used to compute the tax per bracket and total tax As explained below it is