Tax Deduction Home Loan Principal Repayment Web 18 Dez 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Web 9 Feb 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax Act You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000 Web 1 Feb 2021 nbsp 0183 32 Tax Deduction on Home Loan Principal Repayment under Section 80C 2023 The principal portion of your EMIs repaid during a year are allowed to be taken as deduction under the Section 80C of the Income tax act Under Section 80C you can claim a deduction of Rs 1 5 lakh against the principal repaid during the year

Tax Deduction Home Loan Principal Repayment

Tax Deduction Home Loan Principal Repayment

https://i.ytimg.com/vi/9RdN8XnLIes/maxresdefault.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Web 20 Okt 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the Web 10 Mai 2021 nbsp 0183 32 The deduction of up to Rs 50 000 under section 80EE is over and above the deduction of up to Rs 2 00 000 available under section 24 for interest paid in respect of loan borrowed for acquisition of a self occupied property Section 80EEA

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan amount repayment you may claim tax benefit on stamp duty and Web 25 M 228 rz 2016 nbsp 0183 32 Under section 80C of the Income Tax Act the maximum deduction allowed for the repayment of the principal amount of a home loan is Rs 1 5 lakh Deduction under section 80C also includes investments done in the PPF Account Equity Oriented Mutual funds Tax Saving Fixed Deposits National Savings Certificate etc subject to a

Download Tax Deduction Home Loan Principal Repayment

More picture related to Tax Deduction Home Loan Principal Repayment

5 Smart Things To Know About Repayment Of Home Loan Principal 5 Smart

https://img.etimg.com/thumb/msid-48313022,width-640,resizemode-4,imgsize-115366/deduction-allowed-after-construction-is-complete.jpg

5 Smart Things To Know About Repayment Of Home Loan Principal 5 Smart

https://img.etimg.com/thumb/msid-48313019,width-640,resizemode-4,imgsize-163975/section-80c-of-the-income-tax-act.jpg

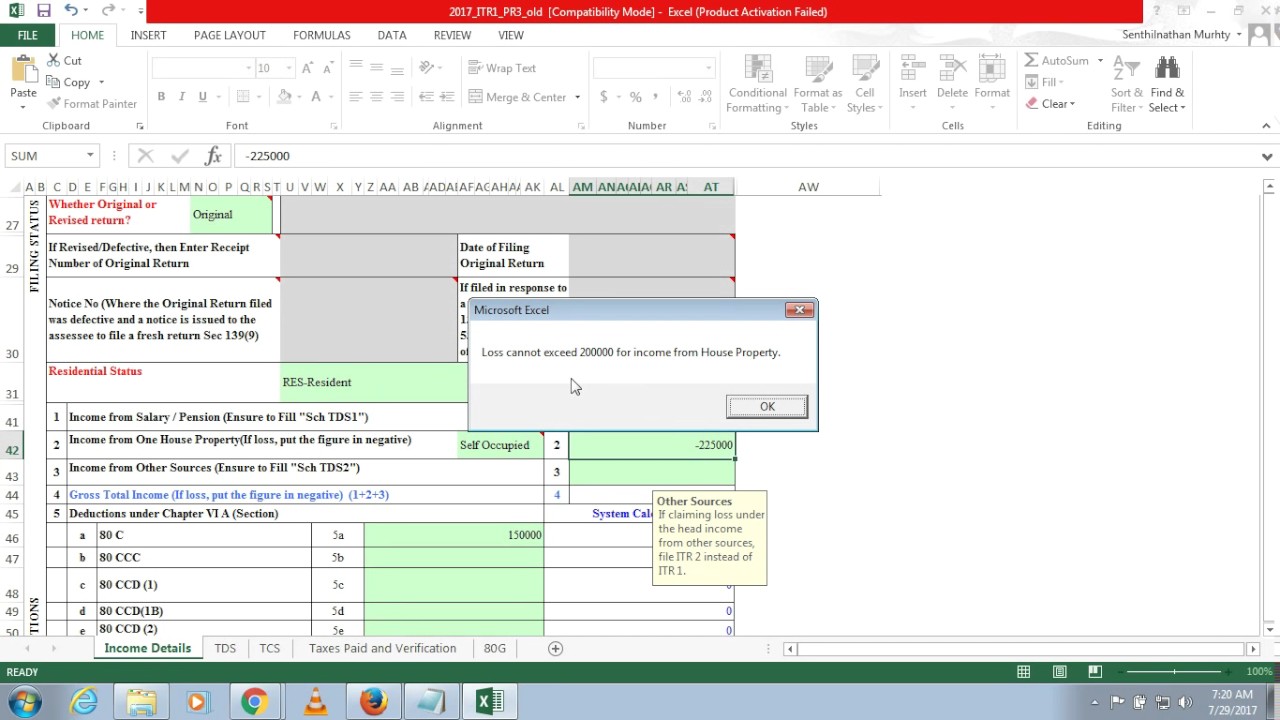

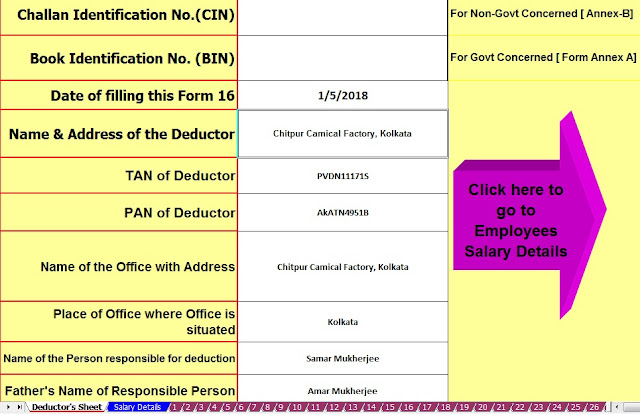

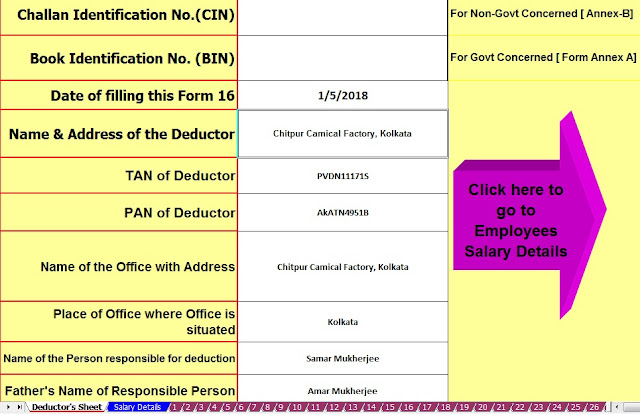

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

https://i.ytimg.com/vi/akRZ2-EPOE8/maxresdefault.jpg

Web 14 Dez 2022 nbsp 0183 32 For home loan principal amount payment the borrower can claim tax deductions under Section 80C of the Income Tax I T act See also 11 key facts about home loans in India Deduction amount is capped at Rs 1 5 Lakh Web 10 Jan 2022 nbsp 0183 32 The principal of a home loan is the loan amount that gets sanctioned and disbursed whether in the form of a lump sum or in installments You can claim a tax deduction to the tune of 1 5 lakhs per annum for the portion of your home loan EMI that accounts for the repayment of the principal amount

Web 11 Jan 2022 nbsp 0183 32 Section 80C of the Income Tax Act allows for a deduction of payment of principal component and it is allowed on the basis of actual payment made in the financial year and not on the basis of amount due in the respective financial year Further deduction under Section 80C is maximum up to the limit of INR 1 50 000 Web 4 Okt 2022 nbsp 0183 32 Key Takeaways The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction The limit decreased to 750 000 from 1 million

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

https://1.bp.blogspot.com/-JEikAPP-8mg/WhrmzgzoLYI/AAAAAAAAF6s/_b6piZ2zxgY7oNEK5gMAptqIz0TB5xV4QCLcBGAs/s640/100%2Bemployees%2BMaster%2Bof%2BForm%2B16%2BPart%2BA%2526B%2BPage%2B1.jpg

Income Tax Benefits On Home Loan Overall Accounting

http://www.overallaccounting.com/wp-content/uploads/2020/09/Income-Tax-Benefits-scaled.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

https://blog.bankbazaar.com/home-loan-tax-benefits-section-24-80…

Web 9 Feb 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Loan is eligible for a deduction under Section 80C of the Income Tax Act You can claim a maximum of Rs 1 50 000 under this section Earlier this was Rs 1 00 000

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

What Are The Tax Benefits On Top Up Loan HomeFirst

Income Tax Returns ITR Home Loan From Bank Employer Zee Business

Kisan Own Two Houses Here s How To Claim Tax Deduction On HRA And

Kisan Own Two Houses Here s How To Claim Tax Deduction On HRA And

Can I Claim Both Home Loan And HRA Tax Benefits

Avail The Benefits For Home Loans Under Section 80 C And Section 24 Of

Deduction Of Principal Component And Interest Paid On Housing Loan

Tax Deduction Home Loan Principal Repayment - Web 25 M 228 rz 2016 nbsp 0183 32 Under section 80C of the Income Tax Act the maximum deduction allowed for the repayment of the principal amount of a home loan is Rs 1 5 lakh Deduction under section 80C also includes investments done in the PPF Account Equity Oriented Mutual funds Tax Saving Fixed Deposits National Savings Certificate etc subject to a