Tax Deduction Home Office The formula based home office deduction covers workspace rent furniture illumination electricity heat and cleaning The deduction can also be granted on the basis of actual

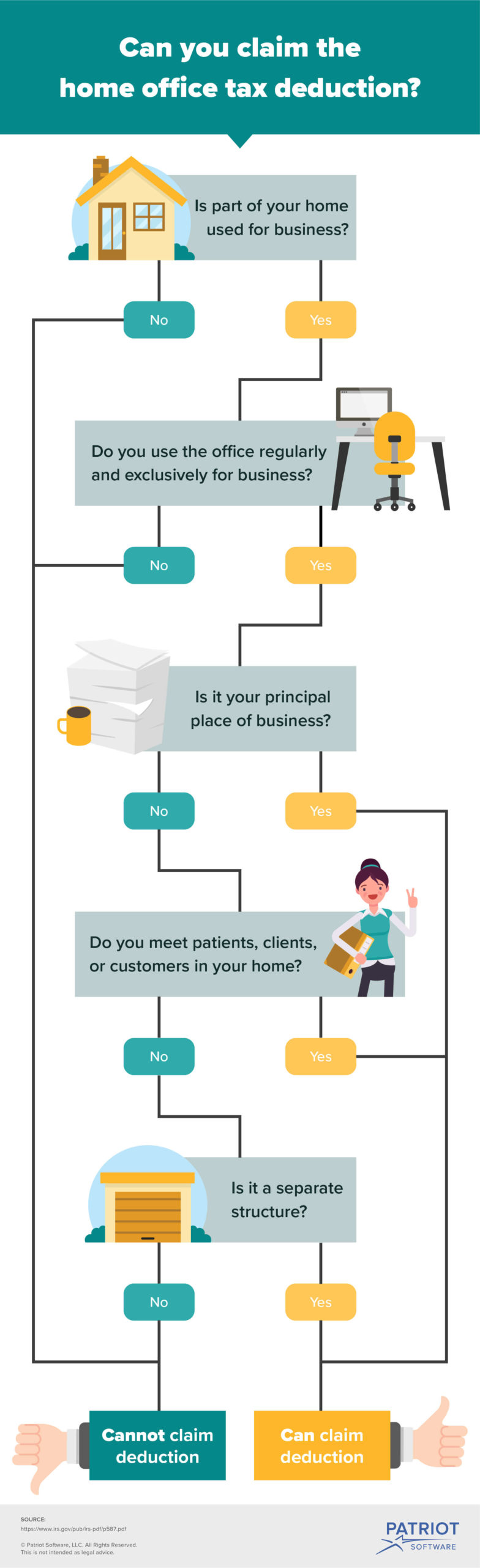

Home Office Tax Deduction 2023 2024 Rules Who Qualifies The home office deduction is a tax break for self employed people who use part of their home for business activities Home Office Deduction Tax Topic 509 Business Use of Home Form 8829 PDF Publication 587 If you use part of your home exclusively and regularly for

Tax Deduction Home Office

Tax Deduction Home Office

https://sandiegotaxpreparation.com/wp-content/uploads/2020/10/tax-deduction-home-office-1200x900.jpg

Home Office Tax Deduction For Landlords American Landlord

http://americanlandlord.com/wordpress/wp-content/uploads/2017/11/home-office-tax-deduction.jpg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

The home office tax deduction is an often overlooked tax break for the self employed that covers expenses for the business use of your home including mortgage interest rent insurance To qualify for the home office deduction you must use part of your home regularly and exclusively for business You can take the simplified or the standard option for calculating the deduction

Calculating the home office deduction using the standard method involves completing IRS Form 8829 to compute the actual amount of the deductible home office expenses 10 rowsBeginning in tax year 2013 returns filed in 2014 taxpayers may use a simplified option when figuring the deduction for business use of their home Note This simplified

Download Tax Deduction Home Office

More picture related to Tax Deduction Home Office

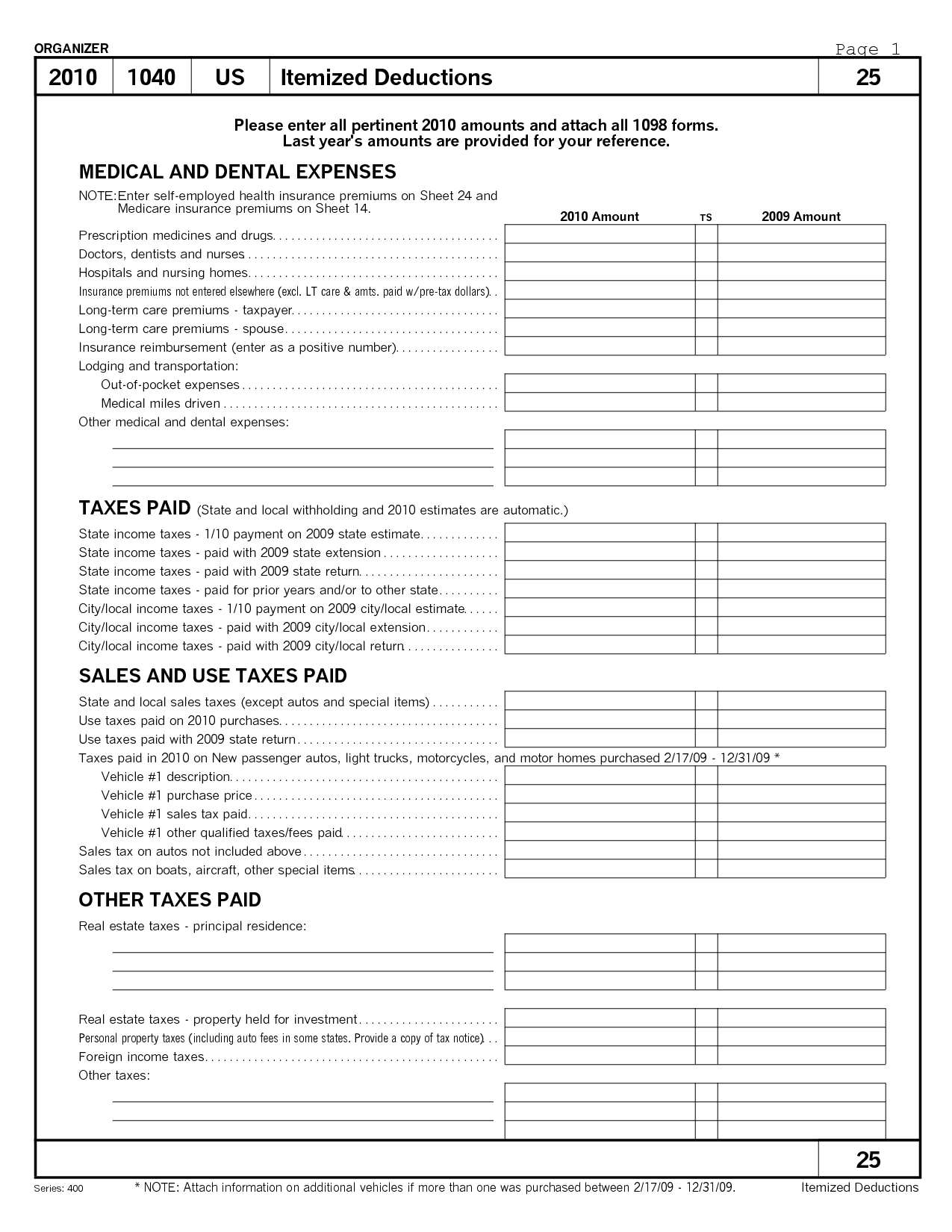

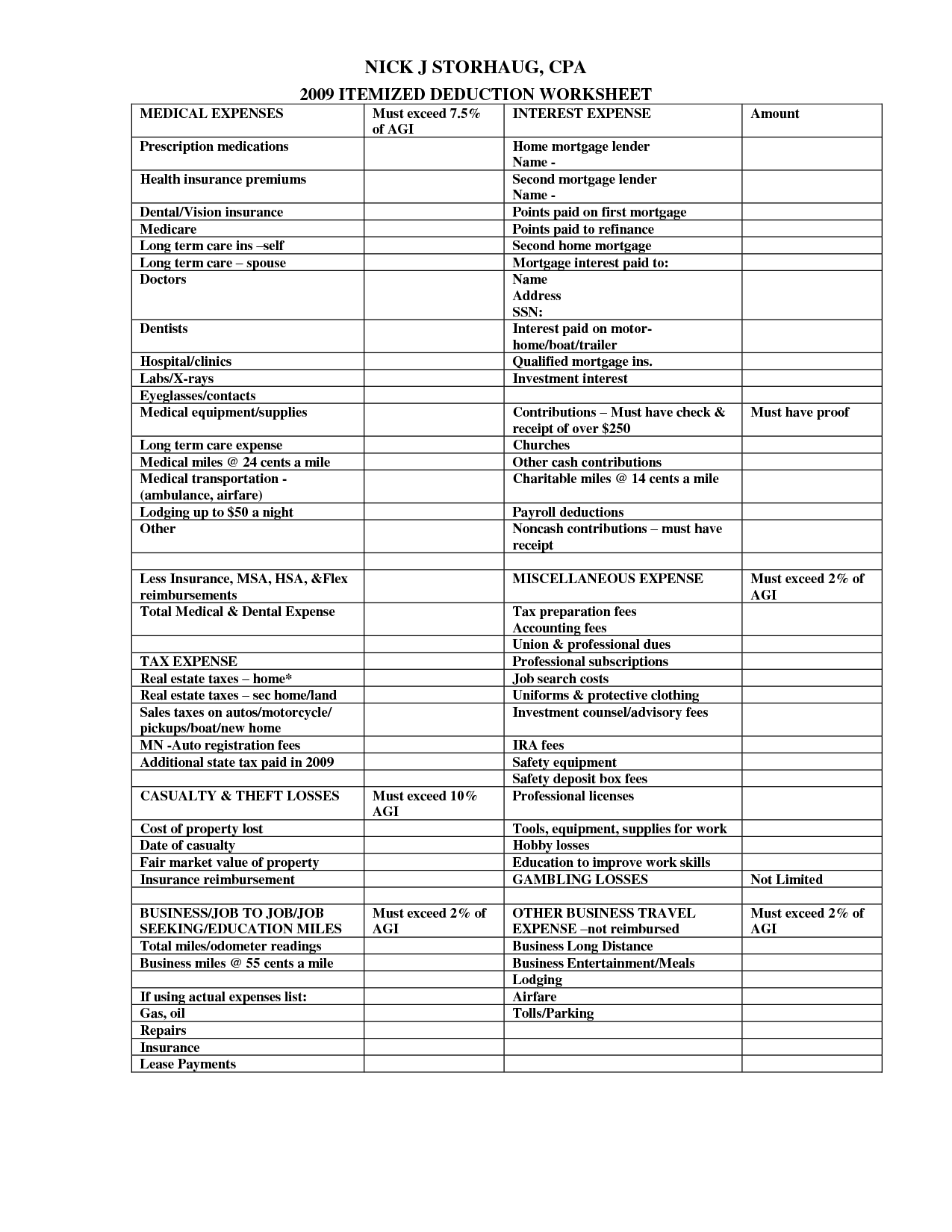

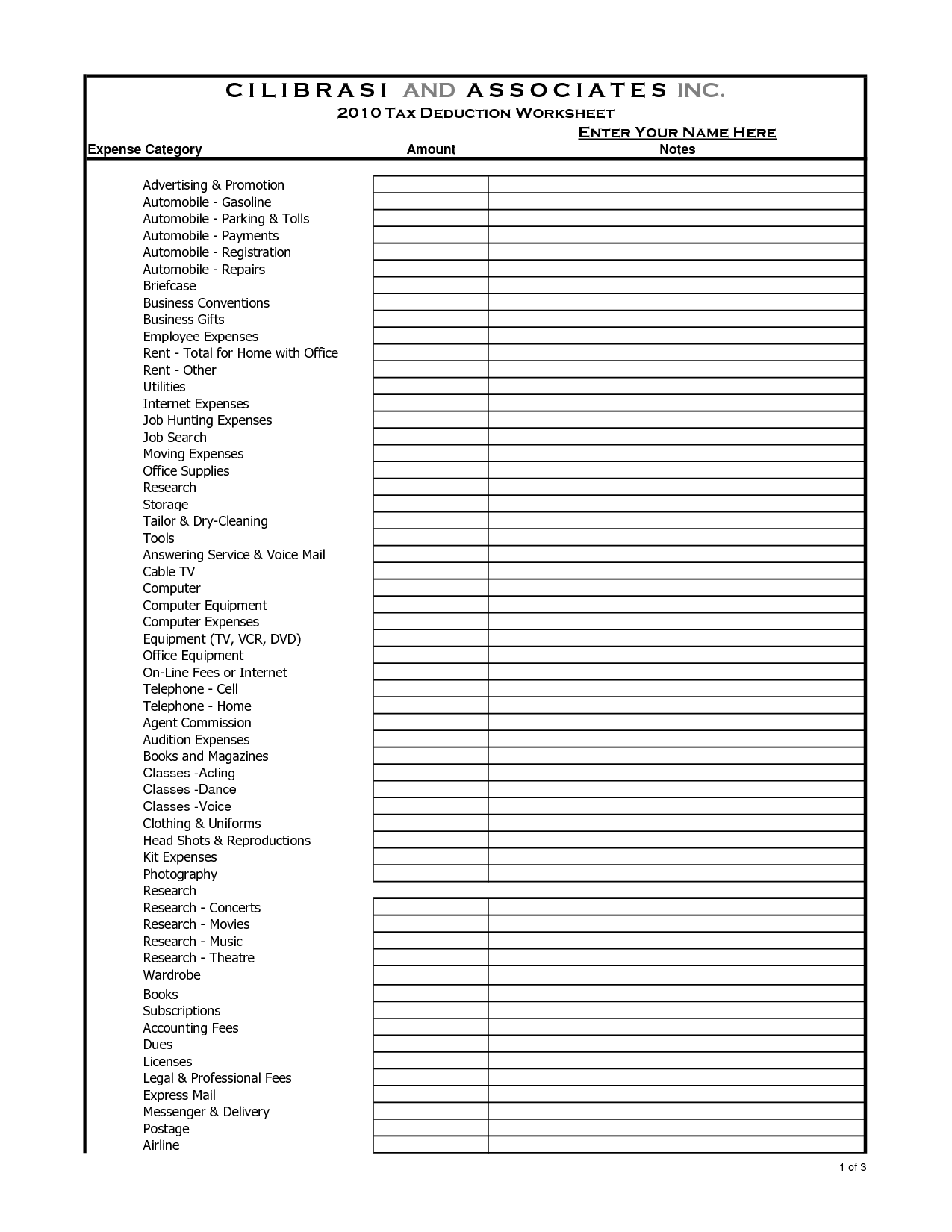

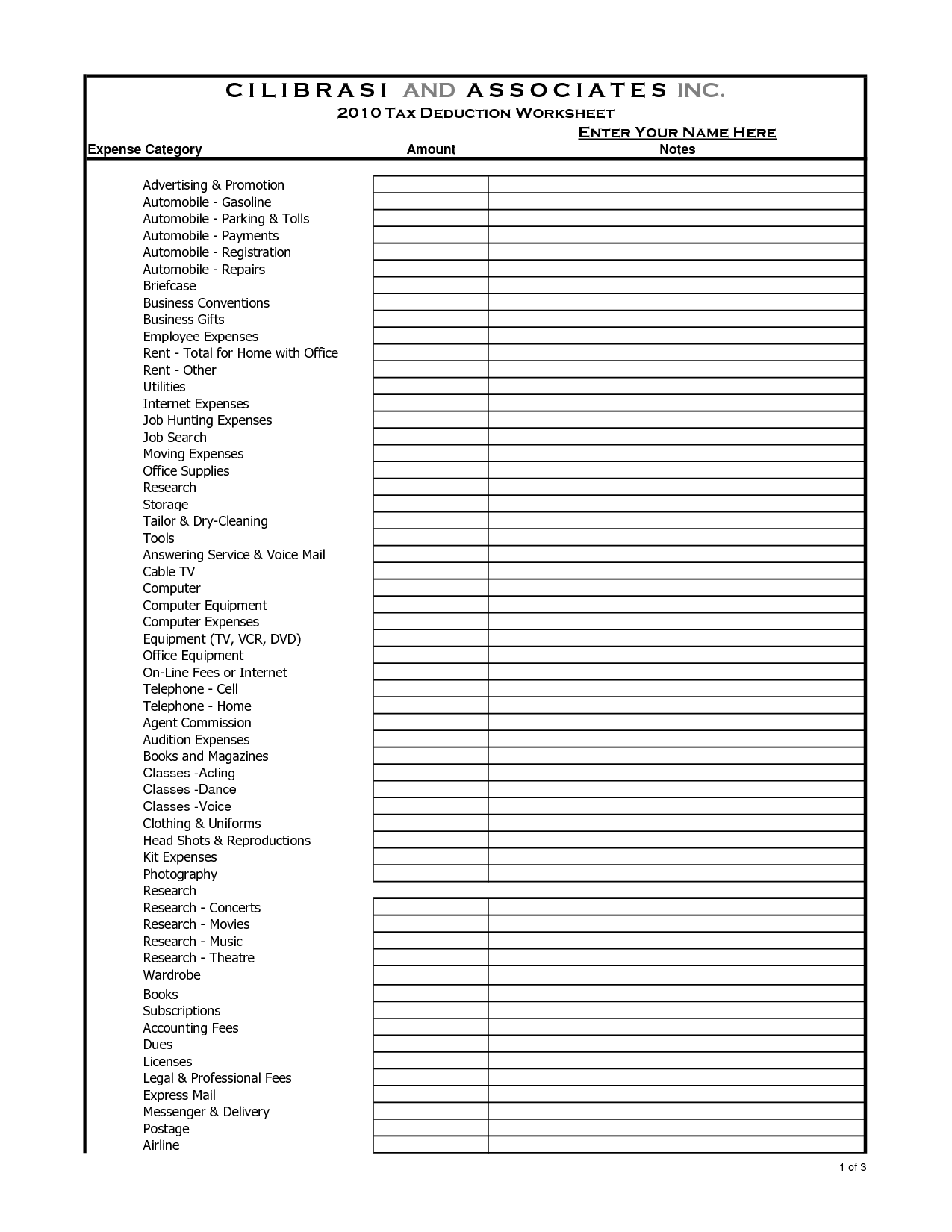

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

Tax Reform Home Office Deduction Business Accounting Springfield MO

https://swrmissouricpa.com/wp-content/uploads/2019/09/Impact-of-Tax-Reform-on-Home-Office-Deduction-Business-Accounting-Springfield-MO.jpg

Home Office Deduction Worksheet Excel Osakiroegner 99

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

The home office deduction is a tax incentive that allows small business owners and self employed individuals to deduct some home expenses from their taxes If the business is rarely run from home it may be more convenient to claim a fixed rate deduction instead of actual costs The amounts that can be tax deducted are very

You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis a home can include a house apartment The home office deduction is a way for self employed business owners including sole proprietors limited liability company LLC owners or partners in

Tax Deductions For Pet Sitters Paws Pet Care At Home Pet Sitting

https://static1.squarespace.com/static/562f959fe4b022e56e74eb49/t/57bca05720099ebd6ed818f3/1471982043268/Tax+Deduction:+Home+Office?format=750w

Tax Tips For Remote Workers Can You Claim The Home Office Deduction On

https://1.bp.blogspot.com/-5HGEk7cNoAg/XwIankE3ikI/AAAAAAAAAck/6QyxSlaWgrgWrFsdy3k3vSMebbQXT80OQCK4BGAsYHg/s1500/Home%2Boffice%2Btax%2Bdeduction.png

https://www.vero.fi/.../home-office-deduction

The formula based home office deduction covers workspace rent furniture illumination electricity heat and cleaning The deduction can also be granted on the basis of actual

https://www.nerdwallet.com/article/taxes/…

Home Office Tax Deduction 2023 2024 Rules Who Qualifies The home office deduction is a tax break for self employed people who use part of their home for business activities

13 Tax Deduction Worksheet 2014 Worksheeto

Tax Deductions For Pet Sitters Paws Pet Care At Home Pet Sitting

5 Itemized Tax Deduction Worksheet Worksheeto

Is Your Home Office Eligible For Tax Deductions Brigade Bookkeeping

Claiming A Home Office Deduction Is About To Get Easier

16 Tax Organizer Worksheet Worksheeto

16 Tax Organizer Worksheet Worksheeto

13 Car Expenses Worksheet Worksheeto

Home Office Tax Deduction What Is It And How Can It Help You

Deduction Vs Tax Exemption Vs Tax Rebate 2021 What Is Tax Deduction

Tax Deduction Home Office - There are two ways that eligible taxpayers can calculate the home office deduction In the simplified version you can take 5 per square foot of your home