Tax Deduction In Business Meaning For tax purposes a deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI while completing a tax form

A tax deduction refers to an item that is subtracted from revenue in order to determine a company s taxable income Tax deductions are considered a form of tax relief for the A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can

Tax Deduction In Business Meaning

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Tax Deduction In Business Meaning

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

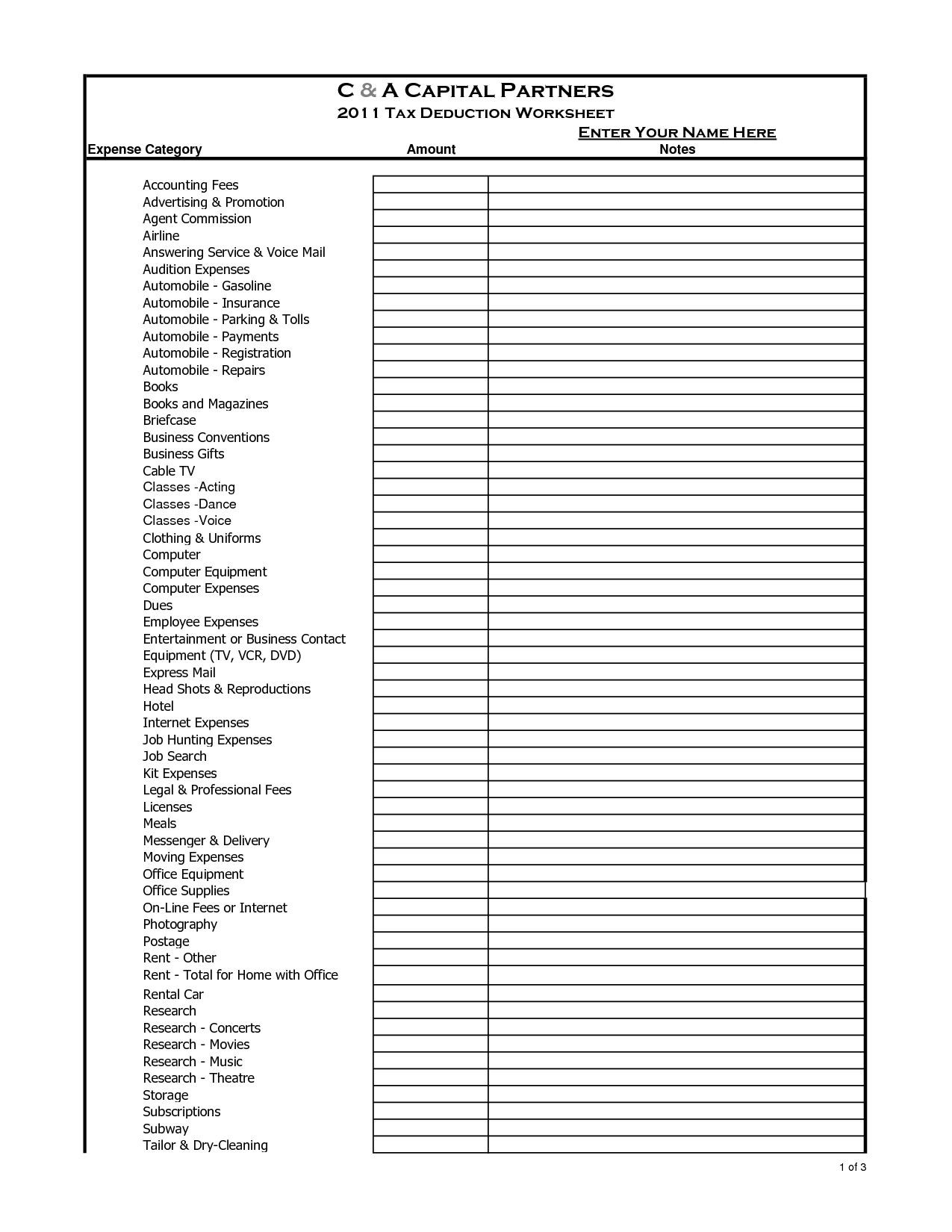

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Small Business Tax Deductions Deductible Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1-1024x846.png

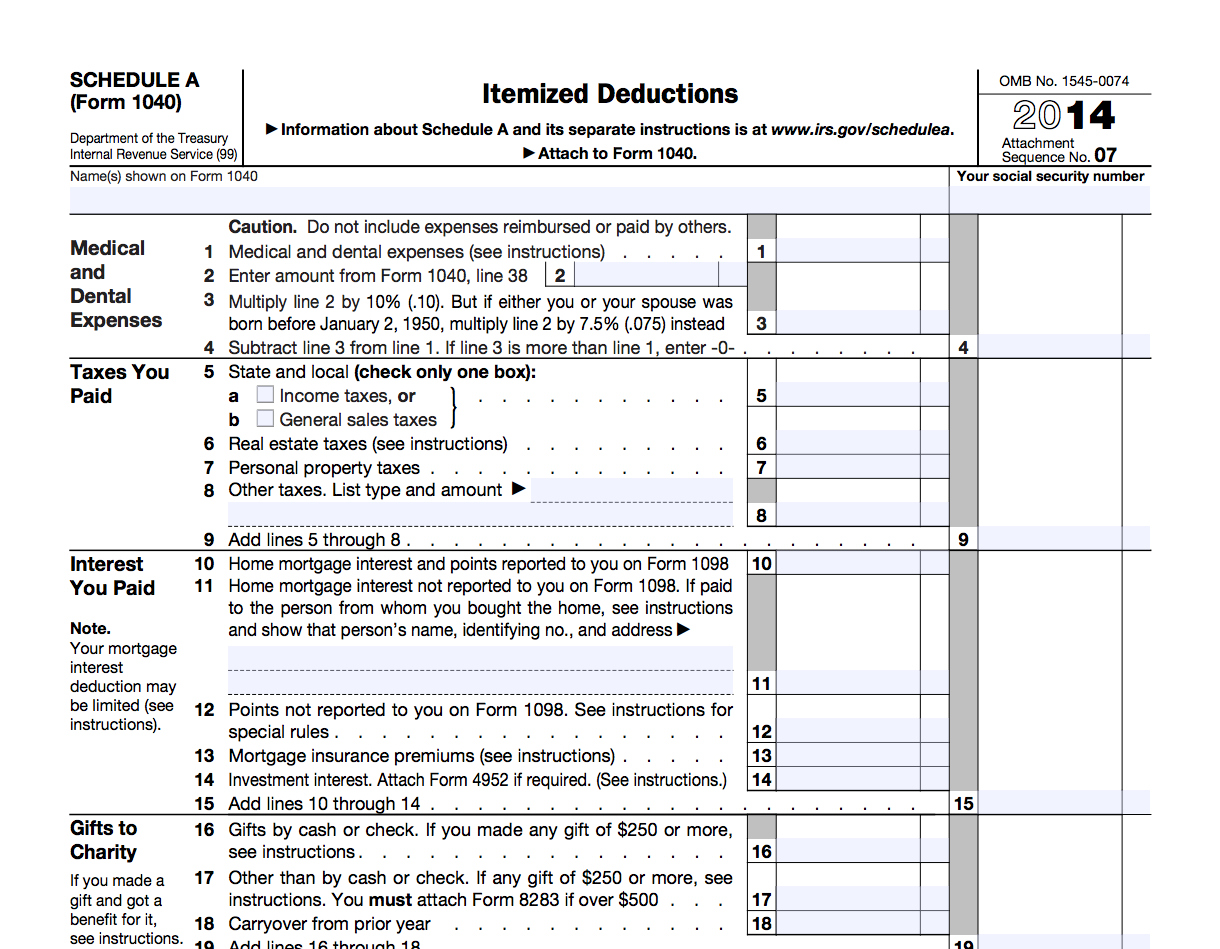

A tax deduction is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of tax incentives along with exemptions and tax credits The difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable income while credits reduce tax To claim small business tax deductions as a sole proprietorship you must fill out a Schedule C tax form The Schedule C form is used to determine the taxable profit in your business during

Percentage deductible Company wide party 100 deductible Your own meals as part of doing business 100 deductible Office snacks and meals 50 deductible Business meals with clients A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher

Download Tax Deduction In Business Meaning

More picture related to Tax Deduction In Business Meaning

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

What is the qualified business income deduction The qualified business income deduction QBI is a tax deduction that allows eligible self employed and small business owners to deduct up to 20 A tax deduction is a business expense that can lower the amount of tax you have to pay It s deducted from your gross income to arrive at your taxable income She made

A tax deduction or tax write off is an expense that you can deduct from your taxable income You take the amount of the expense and subtract that from your taxable income Essentially tax write offs allow What Is a Tax Deduction Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax

What Are Payroll Deductions Mandatory Voluntary Defined QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/payroll-deductions-examples-infographic-us.png

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.investopedia.com/terms/d/deductible.asp

For tax purposes a deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI while completing a tax form

https://corporatefinanceinstitute.com/resources/accounting/tax-deduction

A tax deduction refers to an item that is subtracted from revenue in order to determine a company s taxable income Tax deductions are considered a form of tax relief for the

Business Tax List Of Business Tax Deductions

What Are Payroll Deductions Mandatory Voluntary Defined QuickBooks

How To Find Average Income Tax Rate Parks Anderem66

Income Tax Tables In The Philippines 2022 187 Pinoy Money Talk Riset

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Tax Deductions For Businesses BUCHBINDER TUNICK CO

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

Tax Deduction In Business Meaning - To claim small business tax deductions as a sole proprietorship you must fill out a Schedule C tax form The Schedule C form is used to determine the taxable profit in your business during